TD Markets Exposed: Price Manipulation, Withdrawal Issues & False Promises Hurt Traders

Abstract:Is your winning trade converted into a loss upon closing it at TD Markets due to heavy price manipulation? Is withdrawing funds too much of a hassle at this South Africa-based forex broker? Does even the customer support fail to respond to your withdrawal requests? Have you been defrauded on the promise of zero commission upon withdrawal? Have you failed to close the trade due to the systemic issue at TD Markets? You are not alone! Many traders have commented while sharing the negative TD Markets review. We have shared some of them in this article. Take a look!

Is your winning trade converted into a loss upon closing it at TD Markets due to heavy price manipulation? Is withdrawing funds too much of a hassle at this South Africa-based forex broker? Does even the customer support fail to respond to your withdrawal requests? Have you been defrauded on the promise of zero commission upon withdrawal? Have you failed to close the trade due to the systemic issue at TD Markets? You are not alone! Many traders have commented while sharing the negative TD Markets review. We have shared some of them in this article. Take a look!

Top Complaints Against TD Markets

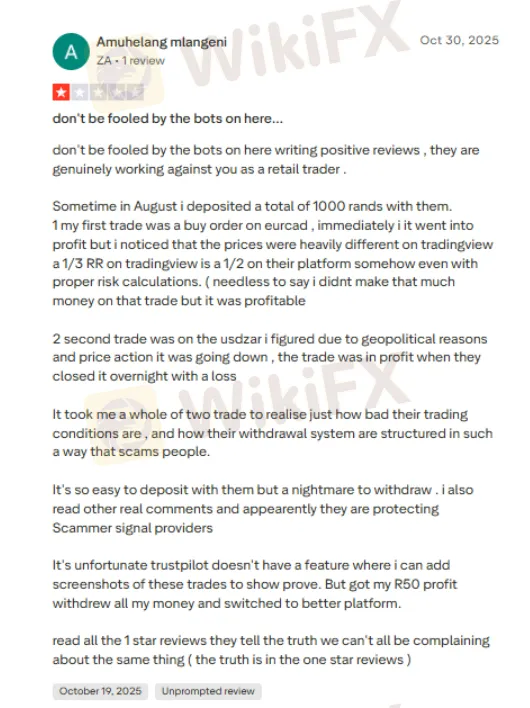

Winning Trades Converted Into Losses

The technical charts offered by TD Markets and the ones shown on third-party but credible platforms vary. As a result, traders suffer. In one case, the trader admitted that the price difference made it look ultra profitable for traders. However, practically speaking, that was unreal. Factoring in some risks, trades were profitable even then. However, as the trades closed, it led to losses for the trader. The screenshot below contains an elaborate complaint on how the trader suffered because of the price difference or manipulation, whatever you would like to call it.

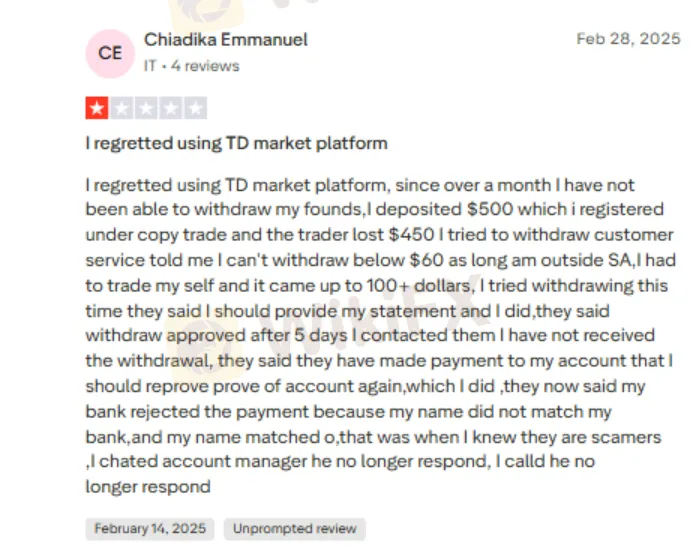

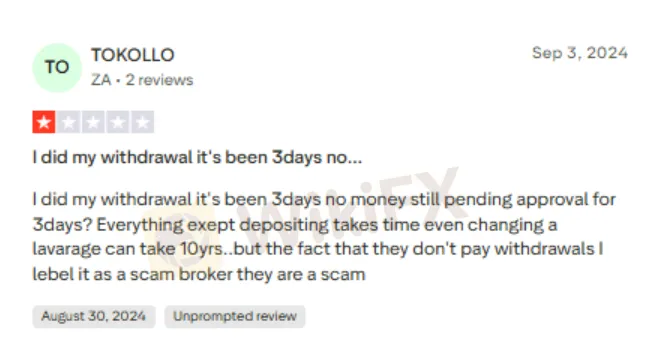

The Painful Withdrawal Complaints

Traders increasingly report withdrawal denials by TD Markets, with some pointing out that it is long and problematic. In one case, a trader commented on having initiated a copy trade, which resulted in a loss of $450 from his deposit of $500. The trader was denied on the ground that withdrawal below $60 cannot be allowed for those outside of South Africa. He traded on his own, and it resulted in profit. However, the broker kept denying withdrawals despite the trader complying with the requirements. Here are multiple screenshots, including the painful recount briefed above.

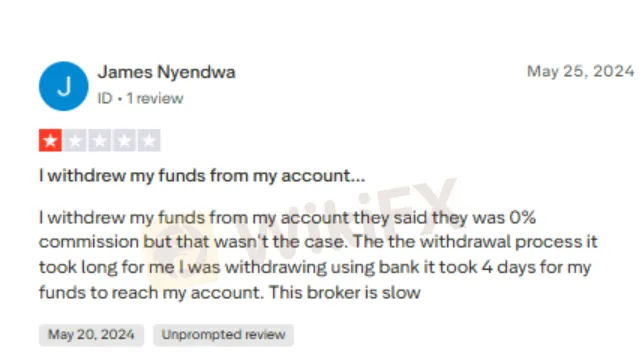

The False 0% Commission Promise

Commission is a charge levied by the broker for helping traders execute trades. However, the broker falsely told the trader 0% commission; however, there was nothing of that, as per the latter‘s admission. Even the withdrawal process turned out to be long for the trader. Let’s check out the screenshot below, explaining the problem encountered by the trader.

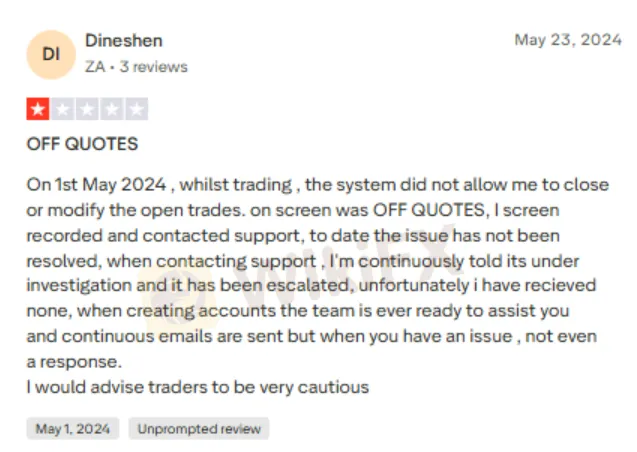

Failure to Close or Modify Trades

Failure to close or modify trades due to a systemic issue can result in losses. A trader recounted such an incident and admitted that the problem could not have been resolved despite repeated requests. Upon TD Markets login, it showed OFF Quotes. The trader recorded and shared with the support team. However, nothing happened. For more details, check the screenshot below.

TD Markets Review by WikiFX - Score & Regulation Status

TD Markets WikiFX reviews have been sharp from traders, as indicated above. Looking at the traders complaints, the WikiFX team investigated the broker and found it to be not so desirable for traders despite being regulated in South Africa. It also found its FSCA license to have exceeded. It thus led to a score of just 4.53 out of 10 for TD Markets.

Knowing about the forex trading landscape is made easy with these chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join any of these by following the instructions shown in the image below.

Read more

Man loses RM728,800 in fake share investment scam

A Kuching man lost RM728,800 after being lured by a fake share investment advertised on social media, later discovering the scheme was non-existent when he was unable to withdraw the promised returns.

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

WikiFX Broker

Latest News

Gold and Silver Buckle Under BCOM Rebalancing Weight Ahead of Critical NFP

Why Southeast Asia Can’t Stop Online Scams

Trump Triggers Fiscal Jitters with $1.5tn Defense Ambition Funded by Tariffs

Is GMG Safe or a Scam? A 2026 Deep Dive

Pocket Broker Review: Why Traders Should Avoid It

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Is Assexmarkets Legit or a Scam? 5 Key Questions Answered (2025)

TibiGlobe Review 2025: Institutional Audit & Risk Assessment

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Rate Calc