Stonefort Securities Review — MT5 Broker Overview, Regulation, and Trader Experience

Abstract:Stonefort Securities is a relatively new brokerage firm that provides trading services through the MetaTrader 5 (MT5) platform. Founded in Saint Lucia and operating for about one to two years, the company presents itself as a multi-asset broker offering forex and CFD trading with professional-grade technology. Although it advertises a regulatory license from the United Arab Emirates, independent assessments suggest that the license may only cover investment advisory services rather than a full foreign-exchange dealing authorization. Because of this, traders should carefully evaluate the firm’s regulatory protection and transparency before committing significant funds.

Stonefort Securities is a relatively new brokerage firm that provides trading services through the MetaTrader 5 (MT5) platform. Founded in Saint Lucia and operating for about one to two years, the company presents itself as a multi-asset broker offering forex and CFD trading with professional-grade technology. Although it advertises a regulatory license from the United Arab Emirates, independent assessments suggest that the license may only cover investment advisory services rather than a full foreign-exchange dealing authorization. Because of this, traders should carefully evaluate the firms regulatory protection and transparency before committing significant funds.

Company Background and Regulation

Stonefort Securities operates under the name Stonefort Securities Limited, registered in Saint Lucia, with an affiliated entity in Mauritius. Public information also lists a related company—Stonefort Securities LLC—registered in the United Arab Emirates and holding license number 20200000226 issued by the SCA (Securities and Commodities Authority). The stated license type is “Investment Advisory License,” which allows advisory activity but does not necessarily authorize full brokerage operations in leveraged products such as forex or CFDs.

This regulatory gap has led some independent reviewers to flag Stonefort Securities as operating “beyond its authorized business scope.” In plain terms, this means that while the company may have a legal registration and an advisory license, it might not possess the complete permissions normally required to provide leveraged trading services. Therefore, potential clients should recognize that the firms investor-protection framework could differ substantially from brokers regulated in jurisdictions such as the United Kingdom, Australia, or the European Union.

Platform and Technology — MetaTrader 5

Stonefort Securities advertises itself as an MT5-based broker. MT5, the successor to MetaTrader 4, is one of the most widely used platforms in global forex trading, known for its fast execution, integrated charting, automated trading support, and multi-asset flexibility. The broker reportedly maintains two MT5 servers—StonefortSecurities-Server and StonefortSecurities-Demo—with hosting locations in Mauritius and Singapore. Average ping latency is around 2 milliseconds, indicating a technically efficient connection for most users in Asia or the Middle East.

Traders can access currency pairs, commodities, indices, and possibly digital assets through the MT5 platform, though the full instrument list has not been publicly confirmed. The company markets itself toward experienced traders and introducing brokers who require fast execution and stable connectivity.

Trading Conditions

According to its own disclosures and user feedback, Stonefort offers the following indicative conditions:

Minimum deposit: approximately 10,000 USD

Maximum leverage: up to 1:200

Spreads: starting from 0.1 pips on major pairs

Commission: around 7 USD per lot round turn

Platform: MetaTrader 5 desktop, mobile, and web

Account types: Starter, Advanced, and Elite (as named in some listings)

The relatively high minimum deposit suggests that Stonefort targets semi-professional clients rather than casual retail traders. High leverage and low spreads may be appealing, but they also amplify risk, especially when regulatory oversight is limited.

User Feedback and Service Quality

Despite questions about its license scope, Stonefort Securities has received a notable number of positive reviews from clients, particularly from traders in India and the UAE. Many users praise its account managers—often mentioning representatives like Hassan Abdulla—for providing personal guidance, regular market updates, and prompt communication. Several clients highlight smooth and fast withdrawal processing, which is often a critical test of a brokers reliability.

For example, traders report that Stoneforts platform execution is fast and that withdrawals are completed without unexpected delays. Others appreciate the clarity of the Partner Portal, which allows introducing brokers (IBs) to monitor commissions and payouts in real time. Users describe the partner system as transparent and punctual, giving them confidence in ongoing performance tracking.

However, not all feedback is positive. Some reviews from external sites raise concerns about inconsistent withdrawal approvals or account verification delays. A few comments note that profit-withdrawal requests may take longer than expected when larger sums are involved. These mixed experiences underline the importance of testing the brokers systems with small deposits before scaling up.

Business Model and Regional Presence

Stonefort appears to position itself as a regional broker focusing on clients in the Middle East and South Asia, particularly the UAE and India. The company maintains a contact number in Dubai (+971 43656600) and an email for support at support@stonefortsecurities.com. Their main office address—11th floor, Bramer House, Hotel Avenue, Ebene, Cybercity, Mauritius—suggests a growing operational presence beyond Saint Lucia.

The firm markets itself as offering both retail and partnership programs, including MAM (PAMM) accounts for fund managers and an IB network for referral partners. These programs reportedly include instant tracking dashboards, real-time data on conversions, and transparent revenue reporting. The marketing tone of these services indicates an effort to attract professionals and affiliates rather than purely retail clients.

Strengths and Advantages

One of Stoneforts main strengths is its consistent branding around reliability and client support. The broker emphasizes human interaction—clients often mention their account managers by name—which differentiates it from large automated brokers. The company also invests in maintaining responsive communication via email and phone, something that smaller brokers often overlook.

Its use of the MT5 platform provides a robust technological foundation. MT5 supports advanced charting, multiple order types, algorithmic trading, and faster back-end architecture compared to its predecessor. With two global server locations, Stonefort seems technically prepared to deliver low-latency trading to its primary user regions.

Another advantage is transparency in the IB program. Many affiliates appreciate having immediate visibility over commissions, payouts, and client activity. For traders who operate as introducing brokers or manage client groups, this can be a significant operational benefit.

Weaknesses and Risks

Nevertheless, there are serious factors to consider. The most prominent is the uncertain regulatory scope. Holding an “Investment Advisory License” under the UAE SCA does not automatically mean the company is authorized to offer leveraged trading services or act as a counterparty in forex transactions. Without clear proof of client-fund segregation, negative-balance protection, or an investor-compensation mechanism, clients may face higher counterparty risk compared to trading under tier-1 regulators such as the FCA (U.K.), ASIC (Australia), or CySEC (E.U.).

Second, the companys limited public history means there is minimal long-term data on its financial stability, execution quality, or compliance track record. A broker operating for only one or two years may still be developing its internal controls. Additionally, the relatively high minimum deposit could be a barrier for beginners who wish to test the platform safely with small amounts.

Finally, while many user reviews are positive, it is impossible to verify all testimonials, and unverified reviews can sometimes paint an overly optimistic picture. Prospective clients should always validate their own experience through demo trading and small-scale live testing.

Read this Important Article- www.wikifx.com/en/newsdetail/202511106764907234.html

Overall Assessment

Stonefort Securities represents a new generation of offshore or semi-offshore brokers that blend modern technology with personal support. The companys MT5 infrastructure, fast execution, and active client communication have earned it loyal followers, particularly in emerging markets such as the UAE and India. Yet, the lack of a clearly defined, comprehensive regulatory license covering forex operations remains the central risk factor.

Traders who value personal service and high leverage may find Stonefort Securities appealing, provided they understand and accept the elevated risk associated with limited regulation. Cautious traders, however, may prefer to work with brokers supervised by well-known financial authorities that enforce strict capital requirements and client-fund safeguards.

In summary, Stonefort Securities offers a capable MT5 environment, responsive support, and competitive spreads, but its regulatory ambiguity and short operational history require careful scrutiny. Those who choose to engage with this broker should start small, verify withdrawal reliability firsthand, and treat the account as a higher-risk exposure rather than a fully protected investment relationship. With prudent testing and disciplined money management, traders can determine whether Stonefort Securities truly meets their standards for transparency, stability, and trustworthiness in the evolving world of forex trading.

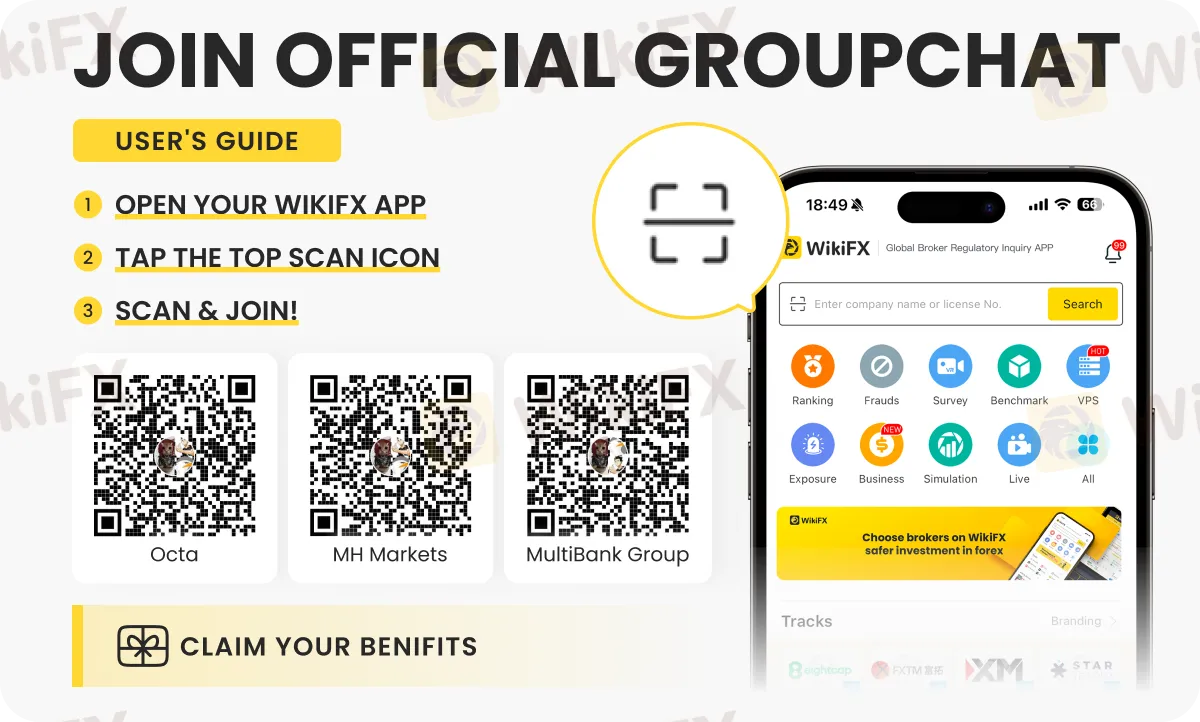

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

US Dollar on Edge: Fed Minutes and Trump Attacks Rattling Central Bank Independence

Gold and Silver Plummet from Record Highs as Profit-Taking Sweeps the Market

WM Markets Review (2025): Is this Broker Safe or a Scam?

It’s a Scam, Not Romance: How This Woman Lost US$1 Million

Crude Oil Surges as US Strikes Venezuela Facility and Ukraine Talks Stall

He Thought He Was Investing BUT US$500,000 Disappeared!

Forex Daily: USD/JPY and AUD/USD Falter as Year-End Liquidity Thins

Fed Watch: Powell Sounds Alarm on "Excessive" Valuations

Rate Calc