BROKSTOCK Exposed: Traders Report Login Errors, Withdrawal Issues & Incompetent Customer Support

Abstract:Is your BROKSTOCK trading account full of inefficiencies? Do the recurrent BROKSTOCK login errors prevent you from opening and shorting positions at a favorable price? Has the broker failed to honor your withdrawal requests? Do you face order execution price issues? Has the customer support service failed to resolve your queries? You are not alone! In this BROKSTOCK review article, we have shared some complaints that need a close introspection. Read on to explore them.

Is your BROKSTOCK trading account full of inefficiencies? Do the recurrent BROKSTOCK login errors prevent you from opening and shorting positions at a favorable price? Has the broker failed to honor your withdrawal requests? Do you face order execution price issues? Has the customer support service failed to resolve your queries? You are not alone! In this BROKSTOCK review article, we have shared some complaints that need a close introspection. Read on to explore them.

Top Trading Complaints Against BROKSTOCK

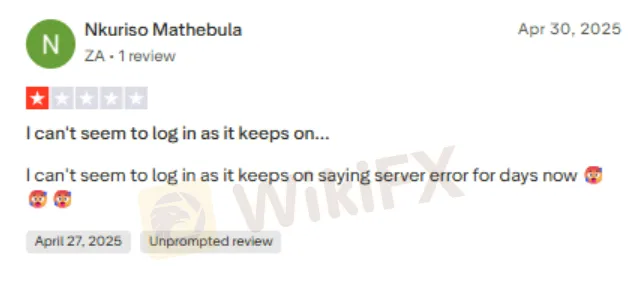

Frequent BROKSTOCK Login Issues Disturb Traders

Several traders have reported constant login errors while trading through the BROKSTOCK platform. These errors are an absolute NO amid a thick and fast trading environment where every second counts. Here are some login error complaints we found in our BROKSTOCK review.

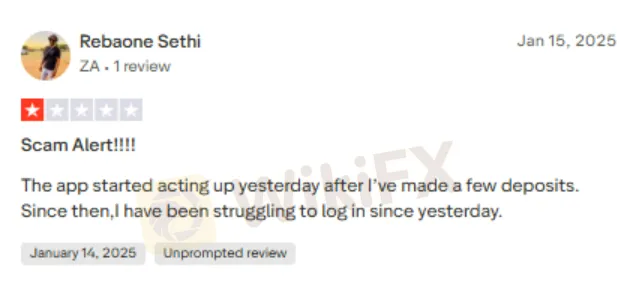

Withdrawal Denial Issues Further Plague Traders

Typical of a scam forex broker, BROKSTOCK allegedly denies traders access to their funds. There have been cases of pending withdrawal requests. Traders have had to follow up a lot with broker officials, but to no avail. Here is the BROKSTOCK withdrawal complaint screenshot.

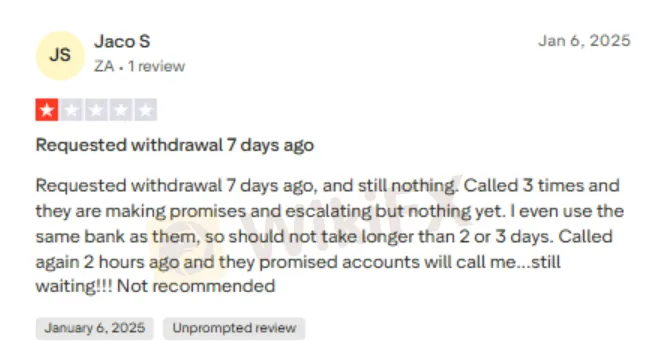

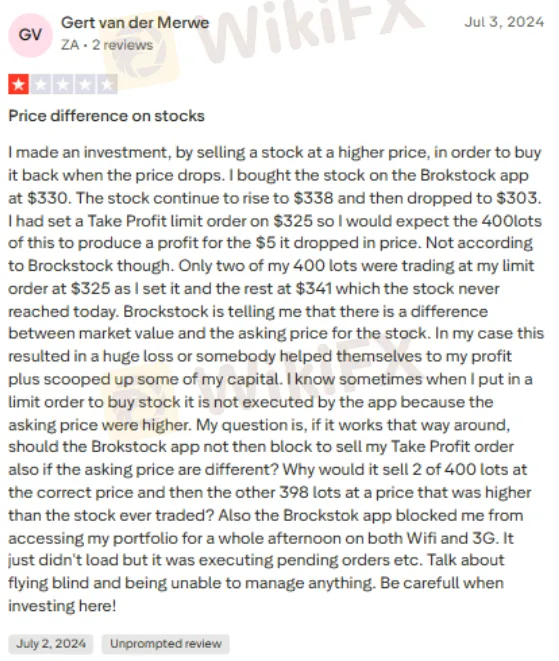

The Price Manipulation Tactic

A trader reports significant losses on the Brokstock app due to discrepancies in trade execution and platform performance. The user claims to have set a Take Profit limit order at $325 after buying the stock at $330. While the stock price later rose to $338 and dropped to $303, only 2 out of 400 lots were sold at the correct $325 price, with the remaining 398 lots allegedly executed at $341, a price the stock never reached. Check the screenshot below to know the full story.

BROKSTOCK Review by WikiFX: Score & Regulation Inquiry

The trading complaints discussed above made us introspect BROKSTOCK thoroughly. Upon a thorough investigation, we found that the South Africa-regulated BROKSTOCK is marked as exceeded, meaning the broker has breached rules, which could potentially cause fines and penalties for it. Traders engaging through trading platforms like BROKSTOCK may also be subject to legal action. Keeping all these issues in mind, the WikiFX team handed BROKSTOCK a score of 4.61 out of 10.

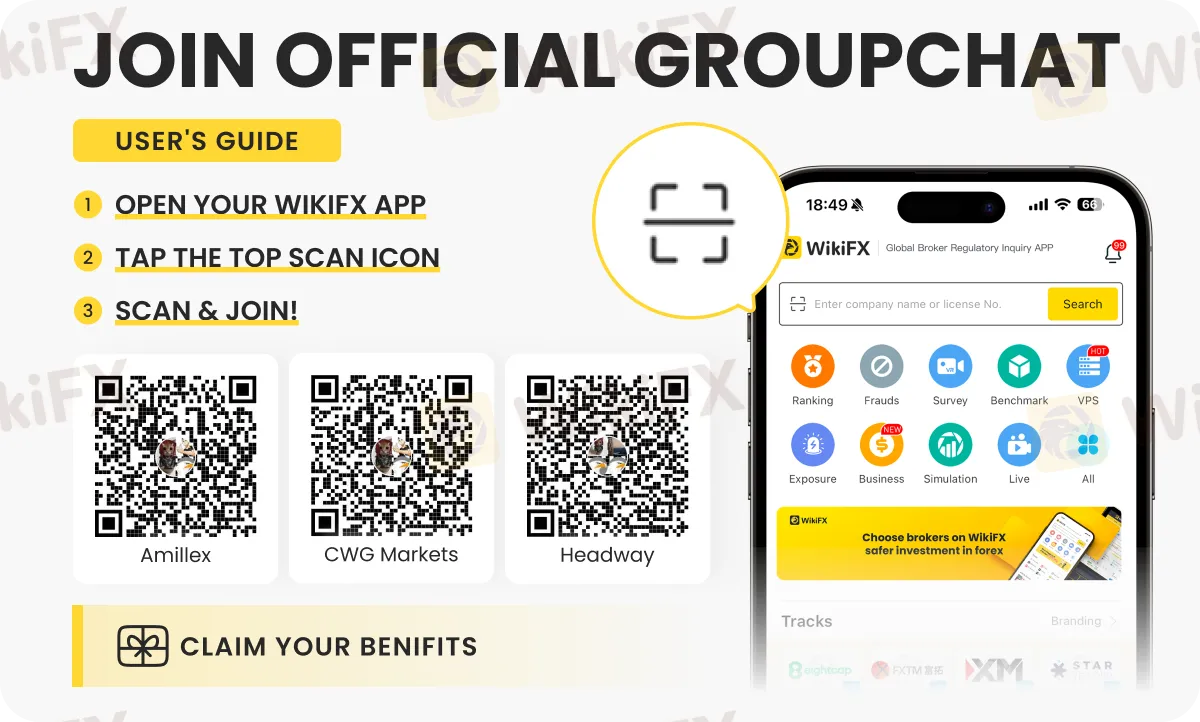

For latest news and trends in the forex landscape, be part of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). All you need to do is follow the simple instructions shown in the image below.

Read more

Biggest Scams In Malaysia In 2025

Malaysia is facing a sharp escalation in online scam activities, with reported losses reaching RM2.7 billion between January and November, driven by increasingly sophisticated and well-organised fraud schemes. Official data shows a significant rise in cases compared to the previous year, while experts warn that the true economic impact may be far greater due to widespread underreporting.

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

9Cents Review 2025: Institutional Audit & Risk Assessment

9Cents (established 2024) presents the risk profile of a newly formed, unsupervised financial entity. Despite utilizing the reputable MT5 trading infrastructure, the broker operates without effective regulatory oversight and has already accrued serious allegations regarding fund safety. 9Cents is classified as a High-Risk Platform, primarily due to the discord between its high minimum deposit requirements for competitive accounts and its lack of legal accountability or capital protection schemes.

Is PRCBroker Legit or a Scam? 5 Key Questions Answered (2025)

You are likely looking at PRCBroker because you’ve seen their ads or heard about their platform, but you have doubts about whether your funds will be safe. You are right to be cautious.

WikiFX Broker

Latest News

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Ringgit hits five-year high against US dollar in holiday trade

Commodities: Gold Targets $5,000 as Central Banks Buying Spree Meet Geopolitical Shocks

Forex vs. Stocks vs. Futures: Which Market Fits Your Wallet?

Transatlantic Rift: Visa Wars and Tech Tariffs Threaten EUR/USD

JPY Alert: Bond Yields Hit 29-Year High as Market Challenges BOJ

Is Finalto Legit or a Scam? 5 Key Questions Answered (2025)

US Banking Giants Add $600B in Value as Deregulation Widens Gap with Europe

Markets Wrap: Gold and Equities Surge to Records as Holiday Liquidity Thinness Rattles Speculative A

Stop Chasing Headlines: The Truth About "News Trading" for Beginners

Rate Calc