Fidelity Exposed: Traders Complain About Withdrawal Denials, Frozen Accounts & Platform Glitches

Abstract:Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

Detailing the Trading Problems Faced by Traders at Fidelity Investments

The Usual Fund Withdrawal Access Denial

Traders accuse Fidelity of constantly playing with their patience by repeatedly denying withdrawals. While the broker constantly assures them of access, nothing turns out in real time. Here is a screenshot expressing the traders helplessness.

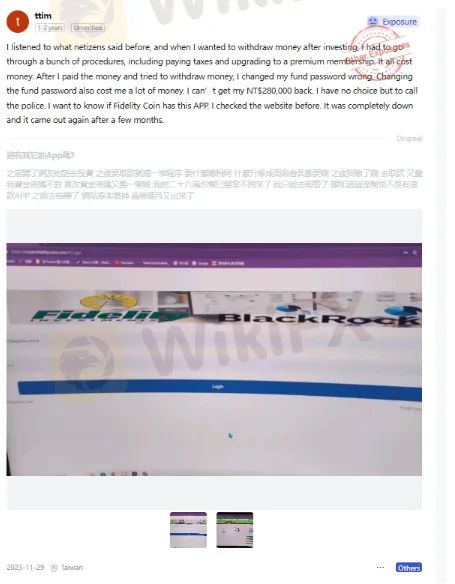

Too Many Procedures & Expenses, But No Withdrawal, Claims Traders

Fidelity Investments also draws flak for making the withdrawal process lengthy and costly. In one case, the trader, in order to receive withdrawal access approval from the broker, followed lengthy processes and paid the required cost. At one point, the trader typed the fund password wrong. Fixing it made him pay further. At the end, the trader could not withdraw the capital amount. Sharing a screenshot explaining a painful journey for the trader.

Bad Customer Support Service, Forced Liquidation

Recently, a case emerged where the trader feared that the market downturn could lead to a margin call and a forced liquidation. Out of this sheer anxiety, the trader connected with the customer support service. However, the long wait time resulted in a partial position liquidation. Here is what the trader said while sharing the Fidelity review online.

The Poor Trading System Claim

The trading system, as claimed by the trader, is not smooth, leading to trading delays and the frustration that comes later. Sharing a screenshot where the trader has expressed this issue.

The Review of Fidelity by WikiFX: Score & Regulatory Status

Considering the grave nature of trading complaints, as mentioned above, the WikiFX team conducted a thorough inquiry into the broker, aimed at detecting the root cause of the trading mess. Our investigation found Fidelity Investments to be an unregulated broker, answering the question - is Fidelity a scam or legit? Trading with an unregulated broker is the path to non-stop losses and scams. Considering the prevailing investment risks, the WikiFX team handed Fidelity a score of 1.57 out of 10.

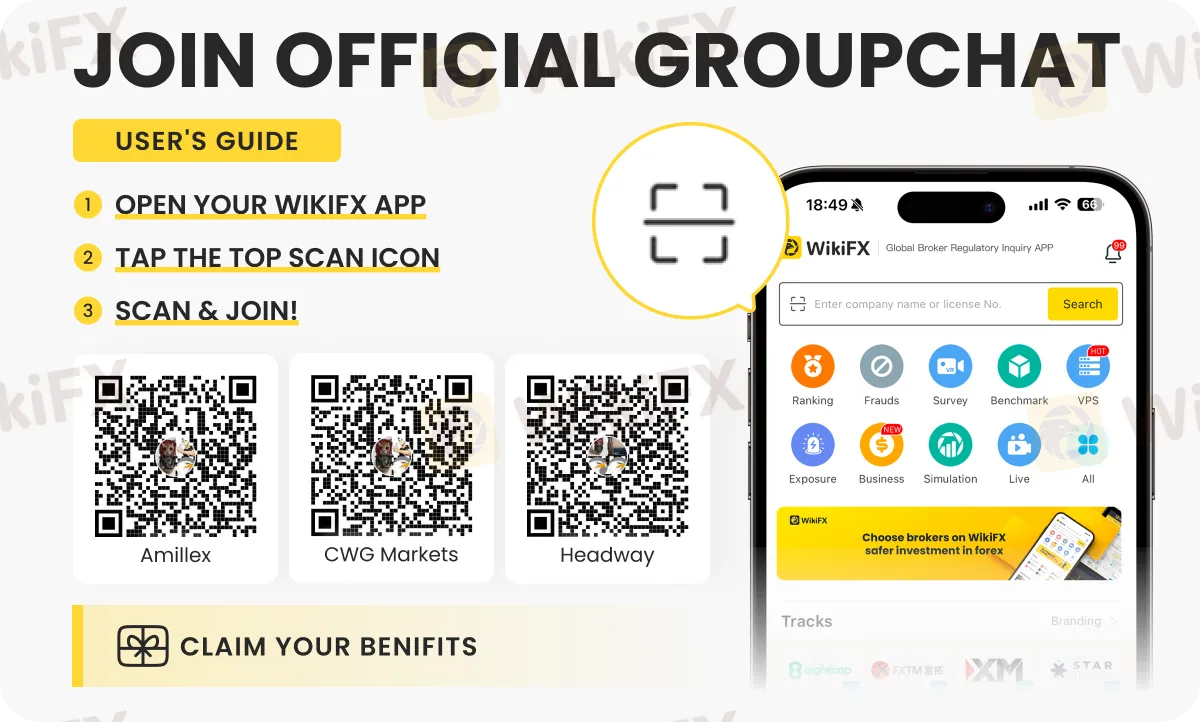

Knowing the latest forex updates becomes easier with these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Just follow the simple instructions below to be part of these.

Read more

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Multibank Group Scam Alert: Recent Fraud Cases Exposed (Nov–Present)

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

ZarVista User Reputation: Looking at Real User Reviews to Check if it's Trustworthy

When traders think about choosing a new broker, two main questions come up: Is ZarVista safe or a scam? And what are the common ZarVista complaints? These questions get to the heart of what matters most—keeping your capital safe. This article gives you a detailed look at ZarVista's reputation using public information, government records, and real experiences from people who used their services. Our research starts with an important fact that shapes this whole review. WikiFX, a website that checks brokers independently, gives ZarVista a trust score of only 2.07 out of 10. This very low rating comes with a clear warning: "Low score, please stay away!" The main reason for this low score is the large number of user complaints. This finding shows that ZarVista might be risky to use. To get the complete picture, we will look at the broker's government approval status, examine the specific complaints from users, check any positive reviews to be fair, and give you a final answer based on fact

ACY Securities Review: $40k Profits Withheld in Singapore

ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

WikiFX Broker

Latest News

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Rate Calc