DBG Markets: Market Report for Nov 20, 2025

Abstract:Market Rebound Amid AI Optimism, Dollar Eyes 100 Ahead of NFPGlobal equities saw a strong reversal on Wednesday, halting a four-day losing streak. Supported by Nvidias robust earnings, the three major

Market Rebound Amid AI Optimism, Dollar Eyes 100 Ahead of NFP

Global equities saw a strong reversal on Wednesday, halting a four-day losing streak. Supported by Nvidia's robust earnings, the three major U.S. indices closed higher collectively, with the Nasdaq rising 0.6% and the S&P 500 up 0.4%.

Key summary for today market insights:

· Policy Hawkishness Confirmed: The U.S. Dollar Index strengthened significantly after the FOMC minutes, challenging the 100-handle.

· Yen Under Pressure: The Yen faced renewed pressure due to Dollar strength and the return of risk appetite.

· Commodities: Gold prices faced pressure from the strengthening Dollar but the overall trend remains stable, consolidating above $4,000.

Macro Outlook: AI Concerns Eases, FOMC Minutes on Hawkish

Market volatility today is expected to be extremely high, driven by the massive injection of multi-month delayed data and the mixed outlook of the tech earnings and FOMC minutes.

Over the Nvidia earnings, Q3 revenue and EPS both significantly exceeded expectations, with Data Center revenue showing a strong 66% YoY increase. The company forecast next quarter's revenue to exceed $60 billion.

· CEO Commentary: CEO Jensen Huang stated that the AI market is growing at an exponential rate, with “Blackwell sales absolutely through the roof.”

· Market Impact: The earnings report effectively cleared valuation concerns that had been plaguing the technology sector, providing strong immediate support for global tech stocks and risk sentiment.

On the other hand, the FOMC minutes released earlier today, confirmed the market's assessment: most officials favor staying put in December, with only a minority pushing for a continued cut.

Following the minutes, the market's implied probability for a December rate cut plummeted from 46.6% to 32.8%, reinforcing the policy-driven strength of the Dollar.

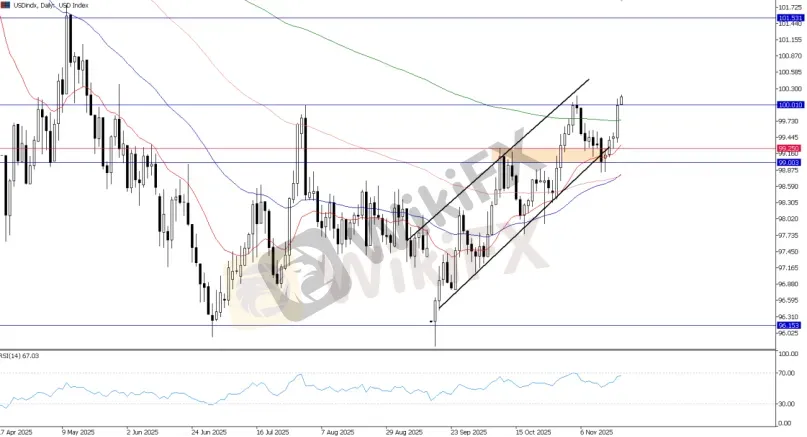

Dollar Index: Regain 100-Mark

The combined pressure of the policy-hawkish FOMC minutes and the expectation for strong data provides a solid foundation for the Dollar.

USD Index, Daily Chart

The Dollar is now operating with a clear upside bias, with the 100-mark serving as a key handle, now are likely to test the dollar momentum.

Today's NFP data is key to determining if the Dollar can challenge the 100.00 psychological handle. A momentum sustained above the 100-key level may send the dollar higher up.

Nonfarm Payroll Report: Todays Decisive Event

The previously delayed September Nonfarm Payrolls report is confirmed for release today, set to drive the global market, particularly the Dollar. The market generally anticipates net job additions of around 50,000 and the unemployment rate holding near 4.3%.

This report is considered the “gold standard” for assessing labor market health.

· A strong NFP figure would decisively undermine remaining expectations for a December rate cut, propelling the Dollar higher.

· Conversely, a weak figure would force the Fed to adopt a more dovish stance, potentially weakening the U.S. Dollar.

Key Asset Outlook: EURUSD, GBPUSD

EURUSD Outlook: 1.1600 Lose Ground

EUR/USD, H4 Chart

Despite attempts to move higher, EURUSD failed to sustain momentum as the Dollar strengthened. EURUSD has now broken below the 1.1600–1.1550 decisive zone again, suggesting the downside remains likely.

GBPUSD Outlook: Bearish Reversal Intact

GBP/USD, Daily Chart

Meanwhile, the GBPUSD outlook remains the same as previously mentioned. A double top pattern on the broader trend has formed, confirming a bearish trend after the 1.3200 neckline breakout.

Key Outlook: While both currency pairs remain weak against the Dollar from a technical perspective, the macro-outlook could further support Dollar momentum. If the Nonfarm Payrolls report comes in higher than expected—or higher than the previous reading, which is the more likely scenario—this would further strengthen the Dollar.

Gold: Moves Poised After NFP

Gold continues to face dual pressure from the strong U.S. Dollar and elevated interest rate expectations. The recent shift in market sentiment following Nvidia‘s earnings has also slightly tempered gold’s safe-haven appeal.

XAU/USD, H4 Chart

From a technical perspective, gold is likely to remain capped ahead of the NFP release within the $4,000–$4,100 range, showing little change recently. A breakout in either direction would likely trigger more significant movement, especially after the nonfarm payroll data.

Key Risk: A strong NFP report could accelerate the Dollar rally, putting immediate pressure on golds $4,000 support and potentially pushing it lower. Conversely, if gold regains momentum above $4,100, further upside remains possible.

Bottom Line:

Global markets have seen a sharp rebound following Nvidias strong earnings, which have eased AI-related valuation concerns and supported risk sentiment. However, the U.S. Dollar remains firmly underpinned by hawkish signals from the FOMC minutes and the upcoming NFP report, which could drive further Dollar strength.

WikiFX Broker

Latest News

WikiFX's New Evaluation of ATM Capital LTD: Does its License Protect the Arab Investor?

Bessent believes there won't be a recession in 2026 but says some sectors are challenged

Rate Calc