Gold Turns Bullish Only If It Breaks Above $4,150; Otherwise Expect Sideways Consolidation

Abstract:With no major bearish catalysts in sight, current market risk appetite does not fundamentally support a sustained rally in precious metals. However, short-term trading still requires close attention t

With no major bearish catalysts in sight, current market risk appetite does not fundamentally support a sustained rally in precious metals. However, short-term trading still requires close attention to technical signals. Both the U.S. Dollar Index and the 10-year Treasury yield declined simultaneously, providing support for equities, non-USD currencies, and precious metals.

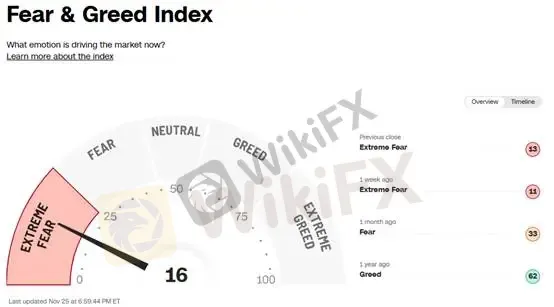

Sentiment indicators also remain favorable. The CNN Fear & Greed Index is still sitting at “Extreme Fear,” reporting 16%. This keeps us comfortable with the ongoing rebound in risk assets and leaves room for the rally to extend into the Christmas season.

(Figure 1. CNN Fear & Greed Index; Source: CNN)

The U.S. 10-year Treasury yield briefly broke below 4.00% during yesterdays U.S. session. Beyond the September Producer Price Index (PPI) cooling in line with expectations, retail sales data came in weaker-than-expected, prompting renewed market expectations for a December Fed rate cut.

Additionally, San Francisco Fed President Mary Daly stated on the 24th that the risk of a sudden deterioration in the labor market is higher—and more difficult to control—than the risk of inflation flaring up again. She argued that a rate cut in December would be appropriate. Daly emphasized that nonlinear risks exist in today‘s labor market but expressed confidence that inflation can return to the Fed’s 2% target without causing a meaningful rise in unemployment.

(Figure 2. U.S. 10-Year Treasury Yield; Source: CNBC)

From our perspective, the 10-year yield falling below 4.00% carries symbolic importance: it signals optimism regarding future borrowing costs and suggests investors are regaining confidence in U.S. Treasuries. This should benefit small-to-medium-sized businesses and households by lowering financing costs. It also reflects a degree of market self-reinforcement, supporting stronger terminal demand and consumption in the months ahead.

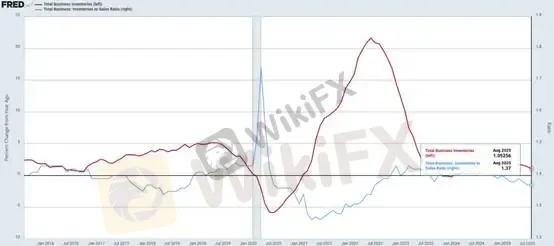

Following the release of September retail sales, overall business inventories continued to decline in August. The inventory-to-sales ratio held steady at 1.37, consistent with July. With inventories as the numerator and sales as the denominator, this indicates that terminal demand in the U.S. was indeed softer than July. However, these figures represent lagging data. The U.S. is now entering the traditional fourth-quarter shopping season, and we expect firms to actively rebuild inventories, potentially lifting manufacturing momentum.

(Figure 3. Business Inventories & Inventory-to-Sales Ratio; Source: FRED)

As U.S. earnings season winds down, Novembers healthy pullback in equities combined with upward earnings revisions has led to a constructive reset in market valuations. This prevents excessive P/E expansion and currently forms an ideal setup for a continued U.S. equity bull cycle.

(Figure 4. Forward 12-Month P/E Ratio; Source: FactSet)

Gold Technical Outlook

Gold has reached a critical resistance zone, encountering selling pressure at the upper boundary of its ascending channel and the 61.8% Fibonacci retracement at $4,150. The trend is becoming clearer:

A breakout above $4,150 opens the door for long opportunities, with the potential to retest prior highs.

Failure to break $4,150 suggests a return to range-bound trading, where short-term short positions may be considered.

Key support lies at $4,121, with secondary support at $3,997.

Stop-loss recommendation: $15

Support: 4,121 / 3,997

Resistance: 4,150

Risk Disclaimer

The views, analysis, research, pricing, or other information presented above constitute general market commentary and do not represent the official position of this platform. All readers should exercise independent judgment and assume full responsibility for their trading decisions.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc