ACY SECURITIES Review: Do Traders Face Withdrawal Discrepancies, Forced Liquidation and Poor Support

Abstract:Does ACY SECURITIES wipe out your trading gains in the name of scalping arbitrage? Do you find their demand for inventory fees illegitimate? Do you sense a Ponzi scam-like investment when trading through the broker? Have you faced a forced liquidation of your forex positions by ACY SECURITIES? There have been a plethora of forex trading complaints against the broker. Read on as we share the ACY SECURITIES review in this article.

Does ACY SECURITIES wipe out your trading gains in the name of scalping arbitrage? Do you find their demand for inventory fees illegitimate? Do you sense a Ponzi scam-like investment when trading through the broker? Have you faced a forced liquidation of your forex positions by ACY SECURITIES? There have been a plethora of forex trading complaints against the broker. Read on as we share the ACY SECURITIES review in this article.

Check Out the Top Complaints Against ACY SECURITIES

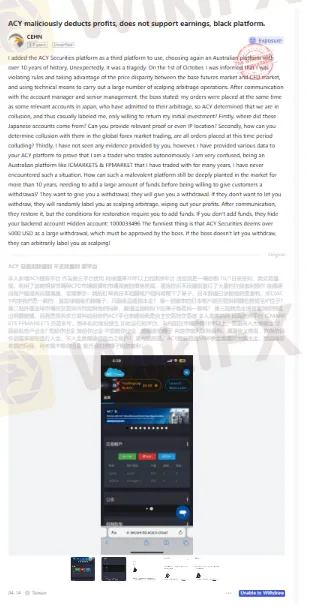

The Illegitimate Profit Withdrawal Denial Accusation

A trader exploded when denied profit withdrawals by ACY SECURITIES on the grounds of breaking rules and leveraging the price disparity between CFD and base futures market, and carrying out large-scale scalping arbitrage transactions. The trader responded to it by saying all these were done by the broker to deny him profit withdrawals. Read out this explosive ACY SECURITIES review.

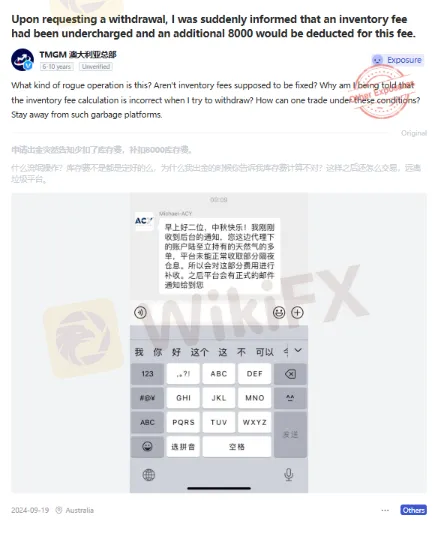

The ‘Inventory Fee’ Miscalculation Upon Withdrawal

A trader claimed that, as he looked to withdraw funds from ACY SECURITIES, the broker informed him of an inventory fee undercharge. Due to this, the broker demanded an extra fee from the trader. Sharing an ACY SECURITIES review where the trader alleged the broker of this unfair charge.

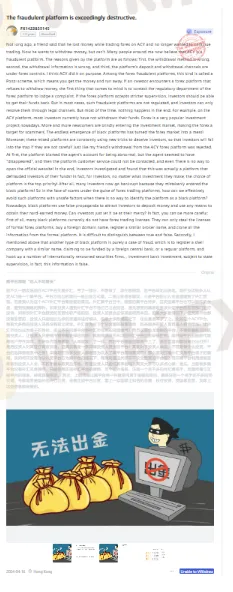

Traders Allege Ponzi Scam by ACY SECURITIES

ACY SECURITIES is accused of running a Ponzi scheme, collecting funds from a wide range of traders. As per traders‘ admission, the broker refuses withdrawals by unnecessarily questioning the withdrawal process and information, trapping the hard-earned capital of many clients. Many traders question whether the broker is under a strict regulatory framework. This complaint, shared by a trader, if true, only mounts suspicion over the broker’s operation.

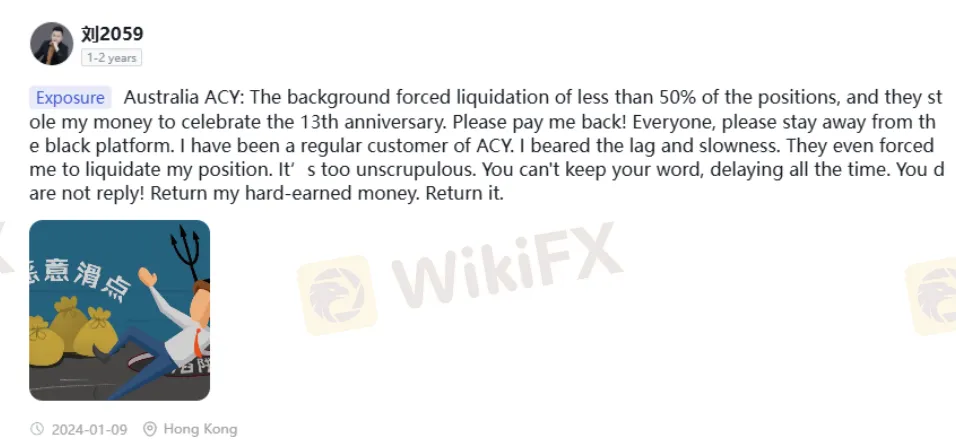

The Forced Liquidation Claim Against ACY SECURITIES

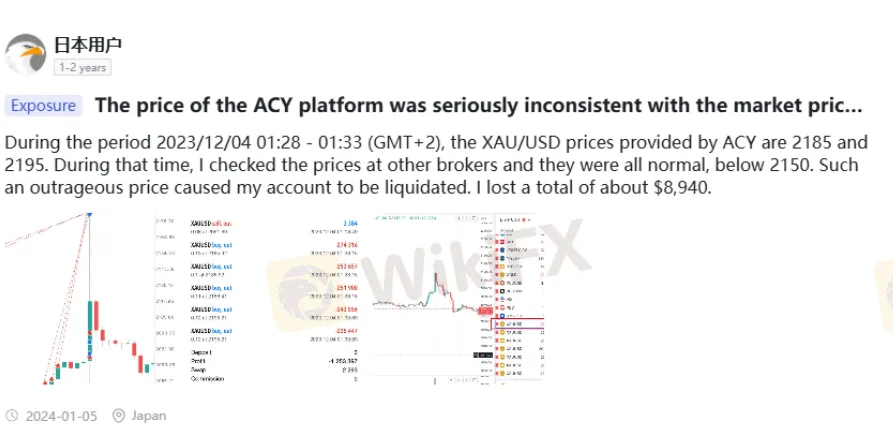

Several traders have questioned how manipulatively ACY SECURITIES liquidates their forex positions, causing them losses. Some argue that the prices shown on the ACY SECURITIES login are not consistent with the market price, which is one of the reasons why traders face forced liquidations. Here are multiple ACY SECURITIES reviews on this complaint.

The Scam Hidden within ACY SECURITIES Bonus Offerings, Traders Allege

Several traders have alleged that ACY Securities scams them and comes up with deposit bonus offers. They reckon that it is just a ploy to attract more funds from them. Here are multiple screenshots supporting this complaint.

So Many Deposit Requirements for Withdrawals

A trader argued that withdrawal requirements are too sceptical at ACY SECURITIES. The very prominent one is the numerous deposits they need to make. As per the traders words, he needs to make hundreds of deposits for fund withdrawals. Check the complaint screenshot below.

The Stop-Loss and Slippage Complaint Against ACY SECURITIES

A trader claimed to have faced a slippage of 1,200 pips after setting the stop-loss order. Seeing this, the trader contacted the ACY SECURITIES customer service representative. The representative responded by saying that it happened because of market fluctuations. This left the trader questioning the stop-loss application process by the broker. Check this explosive ACY SECURITIES review.

ACY SECURITIES Review: Whats the Score & Regulation Status?

The complaints speak large about the trading flaws in ACY SECURITIES, an Australia-based forex broker. Seeing the complaints, the WikiFX team investigated the broker on several aspects, including its regulatory status. While the broker was found to be a regulated entity in Australia, the complaints mentioned above did demand a thorough review of the operations by the broker management. The score for the broker stands at 7.55 out of 10.

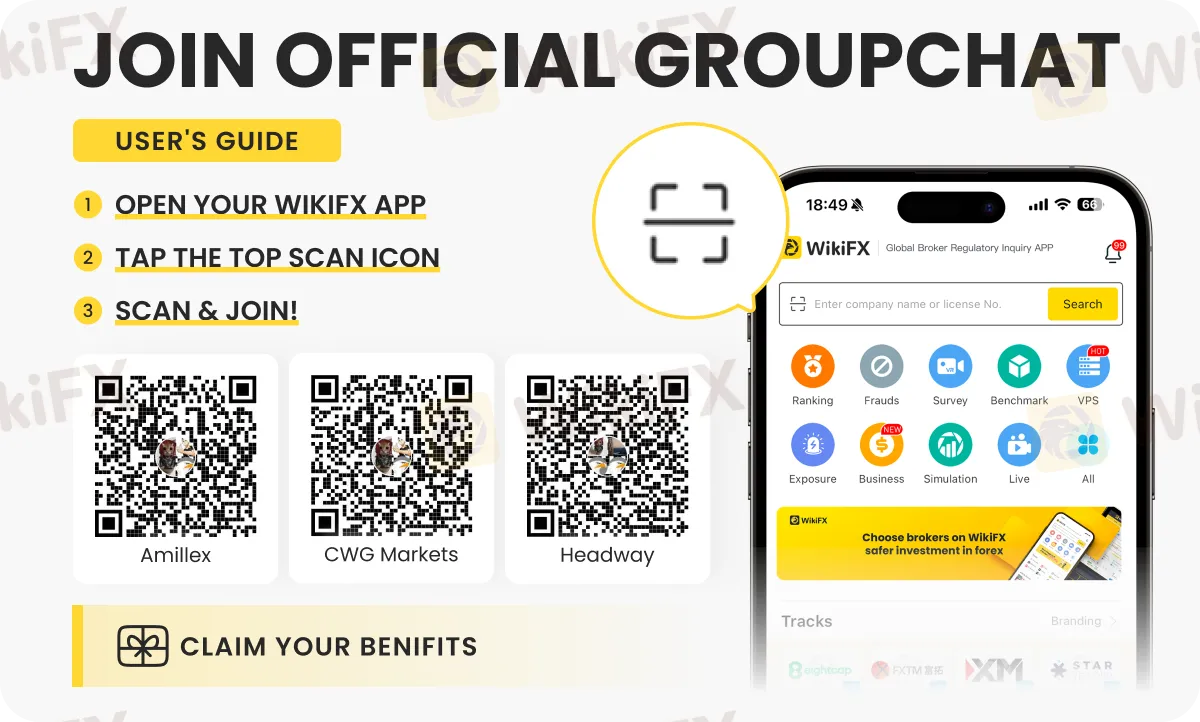

Find the latest forex news, updates, trading tips and insights on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Details on how to join these groups are shared below.

Read more

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Become a Broker Reviewer: Your Experience is Worth Its Weight in Gold

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.

Fed Minutes in Focus as USD Stabilizes, Gold Slips from Record Highs

Markets turn cautious as investors await the Fed’s December meeting minutes. The US Dollar stabilizes near 98.10, gold drops sharply from record highs, while GBP/USD, EUR/USD, and USD/JPY react to central bank signals.

Star-Studded Jury Panel Unveiled as WikiFX Golden Insight Award’s Expert Judging Commences

Following the successful conclusion of the global public voting phase, the WikiFX Golden Insight Award has now officially entered its final evaluation stage—the expert judging. This marks a critical juncture in the 2025 Golden Insight Award selection process, ushering in the most authoritative and rigorous phase of professional assessment and industry consensus-building.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

What Is a Forex Expert Advisor and How Does It Work?

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

“Elites’ View in Arab Region” Event Successfully Concludes

Commodities Wrap: Copper Surges on ‘Green Squeeze’ Fears; Oil Dips on Peace Hopes

GivTrade Secures UAE SCA Category 5 Licence

Rate Calc