Plus500 Allegations Exposed in Real Trader Cases

Abstract:Plus500 allegations revealed: trader complaints, withdrawal delays, and regulatory oversight explained in detail.

Plus500 allegations center on persistent trader complaints about withdrawal delays, deposit discrepancies, and evasive customer support, as documented in multiple real-user accounts. Despite its regulated status across several jurisdictions, these issues raise serious questions about operational reliability for everyday traders. This exposure draws directly from verified trader reports and regulatory filings to uncover patterns that demand scrutiny.

Plus500 Allegations: Withdrawal Nightmares

Traders report endless hurdles pulling funds from Plus500 accounts, often stretching over months with shifting document demands. One user detailed submitting salary statements and address proofs, only to face an indefinite “under review” status without timelines. Such Plus500 allegations highlight a pattern where verification checks pass, but payouts stall, eroding trust.

- Case 1: Promised $200 bonus deposit arrived short at $120; support dodged inquiries repeatedly.

- Case 2: $280 balance locked despite verification; zero response to multiple statements.

- Case 3: Over 30 days waiting for post-documents, no resolution or communication.

These stories fuel broader Plus500 Exposed discussions on forums, pointing to systemic delays.

Plus500 Exposed: Regulatory Facade Cracks

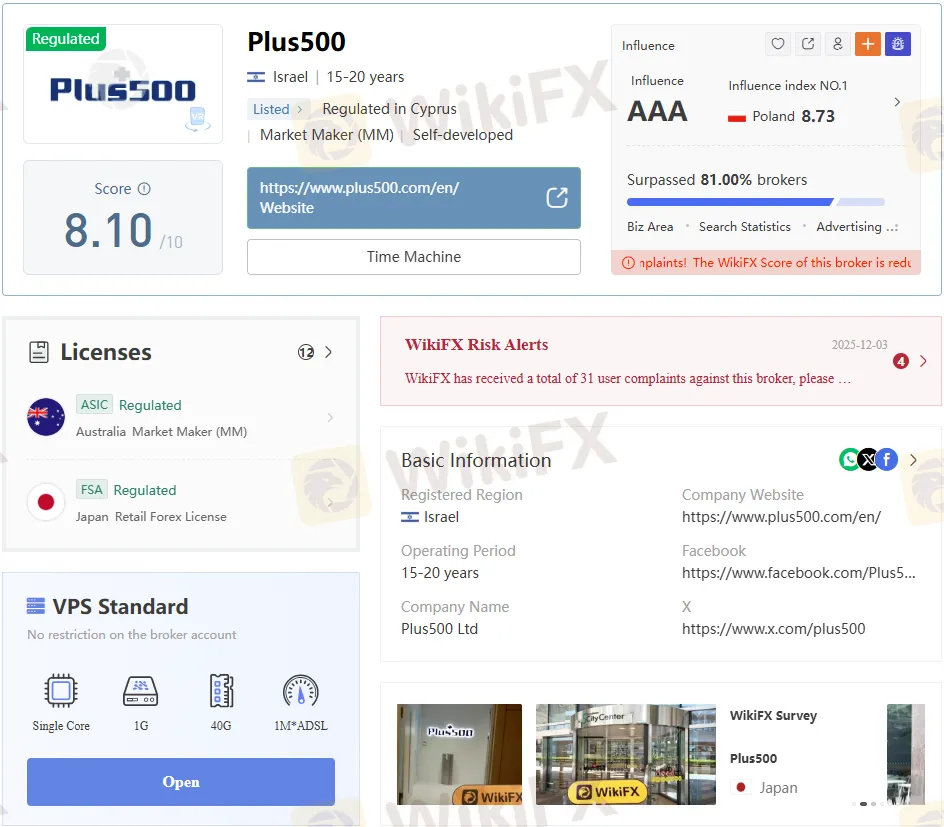

Plus500 holds licenses from top bodies like FCA (UK, #509909), ASIC (Australia, #417727), and CySEC (Cyprus, #25014), yet offshore entities in Seychelles (#SD039) and the Bahamas draw warnings for weaker oversight. Israeli origins via PLUS500IL LTD add scrutiny, with traders citing “sketchy” bonus tactics tied to its roots. Client funds stay segregated under FCA rules, but complaint volumes question enforcement.

| Regulator | License # | Type | Key Risk |

| FCA (UK) | 509909 | STP | Strong, but complaints persist |

| ASIC (AU) | 417727 | MM | Solid; bonus issues flagged |

| CySEC (CY) | 25014 | MM | Multi-country; delays reported |

| FSA (Seychelles) | SD039 | Offshore | High risk, limited recourse |

Offshore arms amplify Plus500's allegations of inadequate protection.

Plus500 Trading: Instruments and Hidden Fees

Plus500 offers 1000+ CFDs on forex, shares, indices, plus futures and share dealing via its proprietary platform. No traditional commissions, but spreads on majors like EUR/USD can widen during volatility, squeezing profits. Leverage hits 1:30 under EU rules, dropping lower elsewhere—risky for novices amid reported platform glitches.

Account types include standard retail with $100 minimum, premium perks for high-volume traders, and demo modes. Fees hit on inactivity ($10/month after 3 months) and overnight financing, often undisclosed upfront. Mobile apps rate high on stores, yet traders blast lag during key sessions.

Pros and Cons: Plus500 Exposed Risks

Pros:

- Regulated by tier-1 authorities like the FCA and ASIC.

- Vast 1000+ instruments; intuitive app for quick trades.

- Segregated funds and negative balance protection.

Cons:

- Rampant withdrawal delays per trader cases.

- Offshore licenses invite higher scam exposure.

- Bonus deposit shortfalls and poor support.

Risks dominate, especially for withdrawals.

Safer Alternatives to Plus500 Allegations

Opt for IG Group (FCA-regulated, transparent withdrawals) or CMC Markets (ASIC/FCA, fixed spreads) over Plus500 exposed to pitfalls. eToro adds social copying with stronger US oversight, dodging offshore woes. These peers boast faster payouts and fewer complaints, per recent reviews.

| Broker | Regulation | Withdrawal Speed | Spreads |

| IG | FCA/ASIC | 1-2 days | Tight |

| CMC | FCA/ASIC | Same day | Fixed |

| eToro | FCA/CySEC | 1-3 days | Variable |

| Plus500 | Mixed | Weeks+ |

Switching cuts Plus500 allegations risks.

Bottom Line on Plus500 Legitimacy

Plus500 maintains legitimacy through major licenses, but trader cases expose withdrawal chaos and bonus tricks that undermine it. Regulatory standing shines in the UK/Australia yet falters offshore, amplifying exposure risks for global users. Approach with caution—prioritize brokers providing payout reliability over app hype.

Read more

AssetsFX Review – What Traders Are Saying & Red Flags to Watch

Has AssetsFX stolen your deposits when seeking withdrawals from the trading platform? Did the broker fail to give any reason for initiating this? Did you notice fake trades in your forex trading account? Does the Mauritius-based forex broker deny you withdrawals by claiming trading abuse on your part? Did you also receive assistance from the AssetsFX customer support team? Firstly, these are not unusual here. Many traders have shared negative AssetsFX reviews online. In this article, we have highlighted such reviews so that you can make the right investment call. Take a look!

ROCK-WEST Complete Review: A Simple Guide to Its Trading Platforms, Costs, and Dangers

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

LTI Review 2026: Safe Broker or a High-Risk Scam? User Complaints Analyzed

When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

LTI Regulatory Status: Understanding Its Licenses and Company Registration Details

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Rate Calc