ALPEX TRADING: The "Money Printer" Trap? Unmasking a Web of Withdrawal Blocks and Silent Support

Abstract:Can a broker turn your trading profits into a digital mirage? With a WikiFX score of just 1.33/10, ALPEX TRADING has triggered a red alert in our risk monitoring system. In recent months, we have received a surge of over 15 complaints involving inability to withdraw funds, alleged "copy trade" entrapment, and phantom customer service. While the broker markets itself with promises of easy bonuses and advanced tools, the reality reported by traders suggests a far more precarious environment.

Abstract

Can a broker turn your trading profits into a digital mirage? With a WikiFX score of just 1.33/10, ALPEX TRADING has triggered a red alert in our risk monitoring system. In recent months, we have received a surge of over 15 complaints involving inability to withdraw funds, alleged “copy trade” entrapment, and phantom customer service. While the broker markets itself with promises of easy bonuses and advanced tools, the reality reported by traders suggests a far more precarious environment.

> Anonymity Disclaimer: The following report is based on actual complaints and regulatory data filed with WikiFX. To protect the privacy of the victims, the identities of all traders mentioned have been anonymized.

The “Free Money” Mirage: Bonuses and Unexpected Fees

For many traders, the journey with ALPEX TRADING reportedly begins with an offer that seems too good to refuse. Our investigation into user feedback reveals a pattern of aggressive promotion, often involving third-party agents or “friends” on social media who lure victims with promises of “100% bonuses” and simplified verification processes.

One trader from Hong Kong described a classic “bait and switch” scenario. Induced by a promoter promising significant deposit bonuses, the user deposited $500. Not only did the bonus never arrive, but the promoter allegedly stalled for time before disappearing completely. When the user attempted to withdraw their own principal, the request was blocked. Even a subsequent test deposit of $30 via the official website was reportedly trapped.

However, the situation escalates when users attempt to retrieve larger sums. A distressing report from June 2025 details a scenario often associated with advance-fee fraud. After a user requested a withdrawal, they were accused of having an account “associated with other accounts”—a vague violation often cited by high-risk platforms. The broker allegedly demanded a $2,000 “handling fee” to unfreeze the funds.

When a broker asks for more money to release existing money, it is historically one of the strongest indicators of severe operational irregularity.

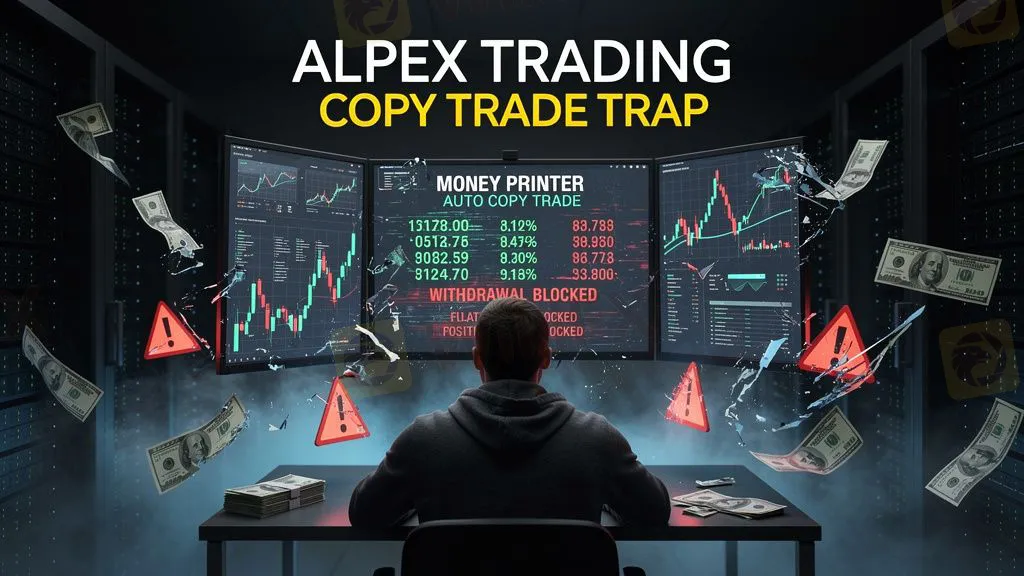

The “Infinite Float”: The Copy Trade Trap

Perhaps the most sophisticated and disturbing pattern emerging from the data involves ALPEX TRADINGs “Copy Trade” or “Money Printer” services. Multiple complaints, particularly from Malaysia, outline a technical mechanism that effectively locks investor capital indefinitely.

Here is how the alleged trap works:

Investors deposit funds (e.g., $3,000) into a copy trading account managed by a group (often referred to as “Money Printer”). When the investor attempts to withdraw, the system rejects the request because there are “floating positions” (open trades).

Traders report that the master trader deliberately keeps a micro-position (often just 0.01 lots) open or in a floating loss state. This minor open position is used as a pretext to claim “equity is tied up in margin,” making withdrawal impossible. Users report being unable to close these positions themselves and unable to opt-out of the copy trade service.

As one frustrated trader noted: “I can't withdraw if there's a floating position. I can't close my own account too.” This leaves the funds in a state of limbo—technically present, but practically inaccessible.

The Wall of Silence: When Support Disappears

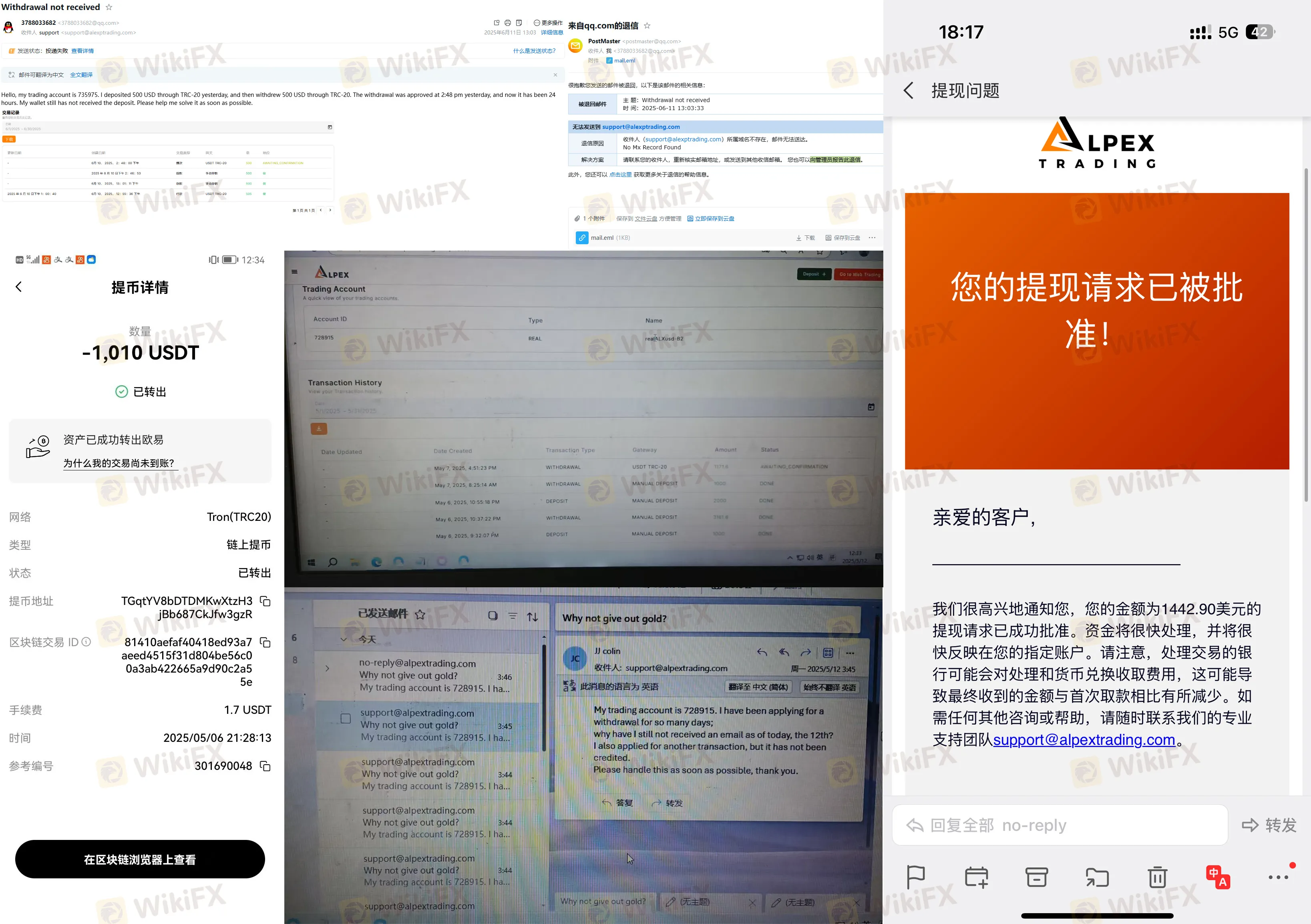

A recurring theme across all 15 analyzed cases is the sudden breakdown of communication. While ALPEX TRADING claims to offer online customer support and email assistance via support@alpextrading.com, the reality experienced by traders shows a stark disconnect.

- Invalid Addresses: One user reported that their emails bounced back, suggesting the support email address might not even exist or is disconnected.

- The Waiting Game: Another trader deposited over $1,000 and generated profits, bringing their total to over $2,100. Despite waiting 8 days and sending multiple inquiries, they received zero response.

- Approved yet Unpaid: In a baffling turn of events, one user received an email stating their withdrawal was approved, yet a week later, no funds had arrived, and no further explanation was given.

The lack of a responsive support team is a critical failure. For an online financial service provider, silence during a withdrawal dispute is not just poor service; it is often a tactical delay used by high-risk entities.

Regulatory Vacuum: The Root of the Risk

Why are these issues occurring with such frequency? The answer likely lies in the regulatory status of ALPEX TRADING.

According to WikiFXs database, ALPEX TRADING was established in 2023 (though interestingly, one user claims to have traded with them since 2017, highlighting a suspicious data inconsistency). The company is headquartered in Saint Vincent and the Grenadines.

It is crucial for traders to understand that the Financial Services Authority (FSA) of Saint Vincent and the Grenadines has publicly stated that it does not regulate, monitor, or license forex brokers. Registration there is merely a corporate formation, not a license to conduct financial services locally or globally.

Furthermore, our data indicates that ALPEX TRADING holds no valid regulatory license from any major tier-1 authority (such as the UK FCA or Australian ASIC). This means there is no legal oversight separating client funds from company operational funds, and no government Ombudsman to turn to when withdrawals are denied.

Regulatory Disclosure Table

| Regulator Name | License Type | Current Status |

|---|---|---|

| None | N/A | Unregulated / No License Detected |

Note: The broker claims to be registered in St. Vincent and the Grenadines, but this does not constitute a valid Forex trading license.

Conclusion

The evidence surrounding ALPEX TRADING presents a grim picture. The convergence of unregulated status, withdrawal blockers disguised as technical features (Copy Trade), and demands for “handling fees” creates a high-risk environment for capital.

While the platform boasts advantages like “low entry threshold” ($25 for Standard accounts) and high leverage (up to 1:5000), these features often serve as lures for inexperienced traders. The data suggests that once money enters the ALPEX ecosystem, retrieving it becomes exceptionally difficult.

We strongly advise investors to exercise extreme caution. Engaging with a broker that lacks varying degrees of regulatory oversight puts your principal at total risk.

WikiFX Risk Warning

High-Risk Alert:

The score of ALPEX TRADING is currently 1.33, indicating an extreme level of risk. The valid regulatory information is 0. Please be aware of the risk!

Forex trading involves significant risk to your invested capital. Please adhere to the principle of “Trust, but Verify.” Before depositing funds, always check the broker's current regulatory status and user reviews on WikiFX. If you are a victim of withdrawal issues, please retain all evidence and contact the WikiFX Rights Protection Center immediately.

Read more

97 Scams Crushed: KL Police Seize Over RM5 Million

Police busted 97 online scam cases and seized more than RM5 million, in a series of integrated operations conducted in the capital throughout last year.

AMarkets Reputation Analysis 2025: Looking Into Complaints and Withdrawal Problems

When looking at AMarkets, traders often get mixed signals. The broker has been around for a long time (since 2007) and has a very high rating on Trustpilot. These things suggest it's reliable and customers are happy. But when you search for AMarkets complaints or AMarkets withdrawal issues, you'll find some worrying information, mostly about the broker's offshore licenses and problems some users have getting their capital out. This article will take a fair, fact-based look at these issues to help you understand the real risks and benefits of trading with AMarkets.

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

A 67-year-old former civil servant in Penang has lost more than RM1 million after being lured into a fraudulent online share investment scheme promoted through social media

Biggest Scams In Malaysia In 2025

Malaysia is facing a sharp escalation in online scam activities, with reported losses reaching RM2.7 billion between January and November, driven by increasingly sophisticated and well-organised fraud schemes. Official data shows a significant rise in cases compared to the previous year, while experts warn that the true economic impact may be far greater due to widespread underreporting.

WikiFX Broker

Latest News

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

Precious Metals Surge: Central Banks and Fed Outlook Fuel 'Bare-Knuckle' Bull Market

RIFAN FINANCINDO BERJANGKA Review (2025): Is it Safe or a Scam?

Fed’s Paulson Douses Rate Cut Hopes, Strengthening 'Higher for Longer' Case

WAYONE CAPITAL Review 2025: Institutional Audit & Risk Assessment

Is BotBro Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Global Crypto Launch Tax Network to 48 Nations

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc