Trive Review 2025: Is This Broker Safe or a Scam Warning?

Abstract:Trive (formerly known or associated with Trive International Ltd) is a Virgin Islands-based brokerage established in 2013. With over a decade of history, the broker markets itself as a multi-asset trading provider offering global access to financial markets. The platform holds a corporate score of 7.91, suggesting a relatively established market presence.

Trive (formerly known or associated with Trive International Ltd) is a Virgin Islands-based brokerage established in 2013. With over a decade of history, the broker markets itself as a multi-asset trading provider offering global access to financial markets. The platform holds a corporate score of 7.91, suggesting a relatively established market presence.

However, despite holding licenses from several reputable regulatory bodies, Trive faces a challenging reputation due to a mix of regulatory statuses and a significant volume of recent user complaints regarding fund withdrawals. This review analyzes Trives safety, fees, and client feedback to help you determine if they are a legit trading partner.

Is Trive Legit? Regulatory Status and Safety Analysis

When determining if a broker is safe, the first step is verifying their regulatory licenses. Trive operates under a complex structure with multiple entities, some of which are highly regulated while others are offshore or unverified.

Regulatory License Table

| Regulator | Country | License Details | Status |

|---|---|---|---|

| ASIC | Australia | TRIVE FINANCIAL SERVICES AUSTRALIA PTY LTD | Regulated (Tier-1) |

| MFSA | Malta | TRIVE FINANCIAL SERVICES EUROPE LTD. | Regulated |

| FSCA | South Africa | TRIVE SOUTH AFRICA (PTY) LTD | Regulated |

| FSC | Virgin Islands | Trive International Ltd. | Offshore Regulation |

| FCA | United Kingdom | Trive Financial Services UK Limited | Unverified |

| BAPPEBTI | Indonesia | PT Trive Invest Futures | Unverified |

Regulatory Verdict

Trive demonstrates legitimacy through its Tier-1 authorization from ASIC (Australia) and regulation by the MFSA (Malta) and FSCA (South Africa). These licenses generally ensure specific standards regarding capital requirements and operational transparency.

However, traders should be cautious regarding the specific entity they contract with. The global entity is regulated by the Virgin Islands FSC, which is considered an offshore regulator with less stringent oversight than European or Australian authorities. Furthermore, the provided data indicates that licenses claimed for the UK (FCA) and Indonesia (BAPPEBTI) are currently listed as “Unverified,” which is a significant red flag for traders in those regions.

Scam Warnings and User Complaints

Despite a high system score, the user feedback paints a concerning picture. In the last three months alone, there have been multiple complaints registered against Trive. The primary allegations revolve around withdrawal refusals and the deduction of profits.

Recent Exposure Cases (2024-2025)

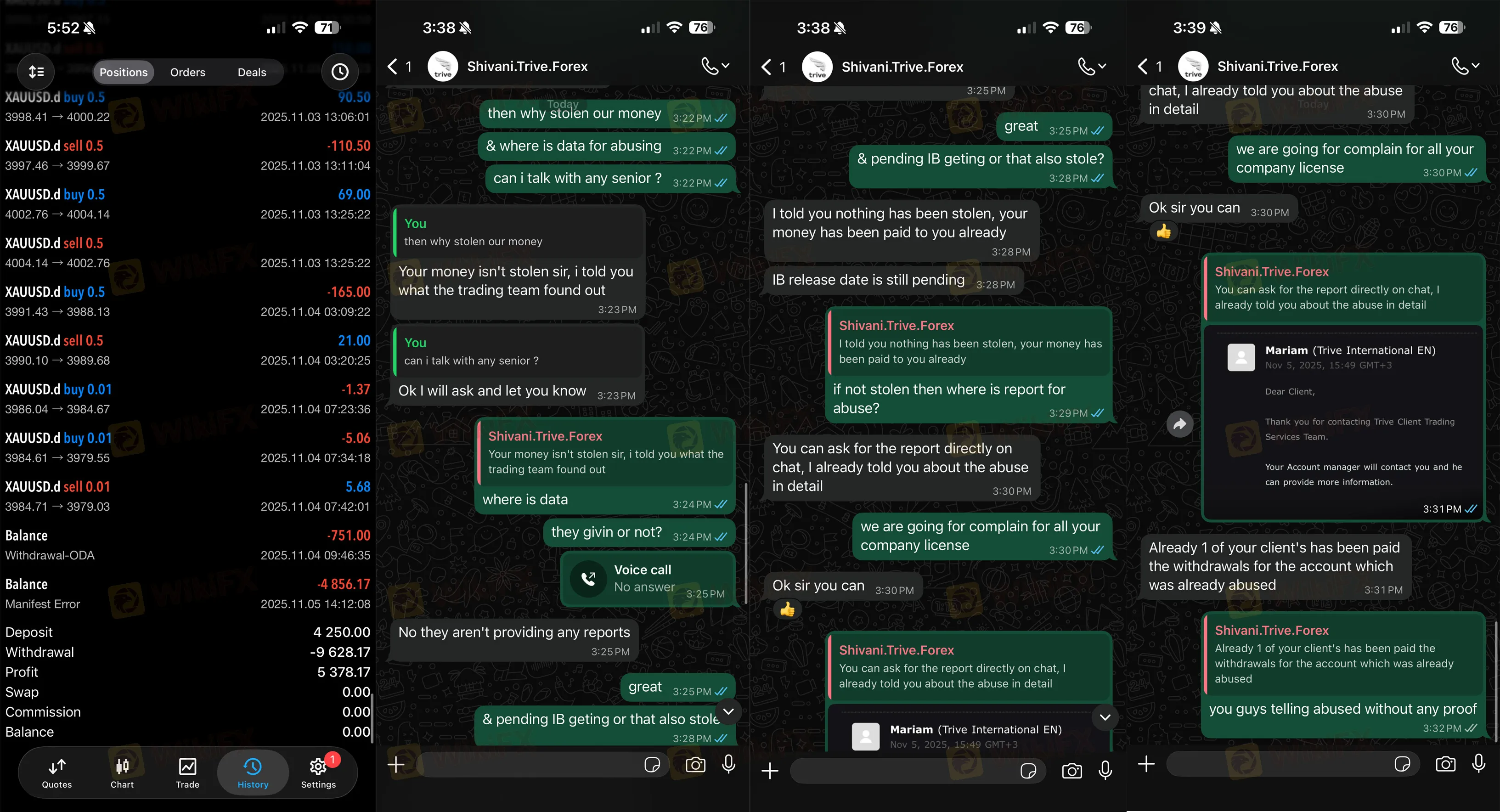

Data collected from traders in India, China, Hong Kong, and Syria highlights a pattern of disputes:

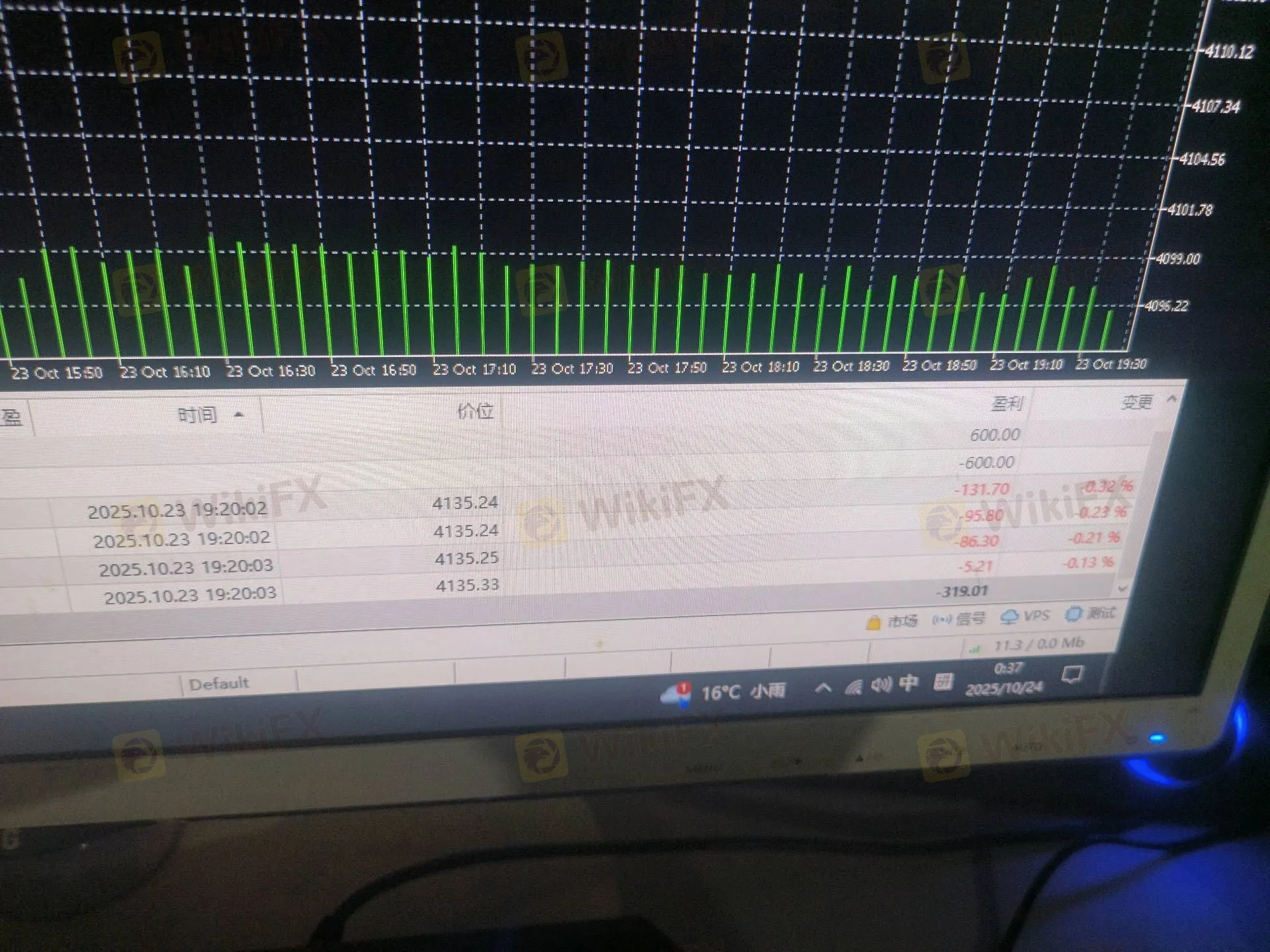

- Profit Deductions: Multiple traders (e.g., from Hong Kong and China) reported that after generating profits, Trive allegedly deducted significant sums (ranging from $5,951 to over $18,000) from their accounts. The broker reportedly cited “abuse” of trading methods or invalid trading strategies as the reason for these deductions, despite verifyng the users' accounts initially.

- Withdrawal Refusals: Complaints from India and Syria specifically mention that withdrawal requests are ignored or delayed indefinitely. One user reported a loss of nearly $5,000, claiming the broker refused to provide details on the alleged “abuse.”

“Bonus” Traps: A report indicates that bonus funds offered by the platform may be used as a lever to close client positions unexpectedly.

- Fee Disputes: One trader noted that an “interest-free” account was retroactively charged over $30,000 in overnight fees (swap fees) after profitable trading, which the user described as fraudulent behavior.

Risk Warning: The recurrence of “profit deduction” complaints suggests aggressive risk management practices by the broker. Traders relying on specific strategies (scalping or news trading) should proceed with extreme caution.

Trading Conditions and Fees

For traders who choose to proceed, Trive offers flexible trading conditions. The broker uses a mix of proprietary technology and industry-standard third-party platforms.

Account Types and Spreads

Trive offers four distinct account types designed for different capital levels:

- ECN Zero Account: Spreads start from 0.0 pips. Requires a commission but offers the tightest spreads.

- VIP Account: Requires a $2,000 deposit. Spreads start from 0.6 pips.

- Standard Account: No deposit limit. Spreads start from 1.2 pips.

- Pro Leveraged Account: High leverage options with spreads from 1.2 pips.

Leverage and Margins

Trive offers extremely high leverage, reaching up to 1:500 for standard accounts and an aggressive 1:2000 for the “Pro Leveraged” account. While high leverage can amplify gains, it significantly increases the risk of rapid capital loss, especially for inexperienced traders.

Trading Platforms

- MT4 & MT5: The broker supports the industry-standard MetaTrader 4 and 5, known for their charting capabilities and automated trading support (EAs are allowed).

- Trive Trader: A proprietary mobile app available for iOS and Android.

Pros and Cons of Trive

Pros:

- Regulated by reputable authorities (ASIC, MFSA, FSCA).

- Offers popular MT4 and MT5 platforms plus a proprietary app.

- Wide range of funding methods including Crypto, Skrill, Neteller, and Bank Transfer.

- Cost Grade is rated “AA” with competitive spreads on ECN accounts.

Cons:

- High Complaint Volume: Numerous reports of denied withdrawals and retroactively cancelled profits.

- Regulatory Gaps: UK FCA and Indonesia BAPPEBTI statuses are “Unverified.”

- Offshore Entity: Global clients are likely onboarded under the BVI entity, offering less protection than ASIC/MFSA entities.

- Execution Quality: Speed grade is rated “D” (Poor) in trading environment tests, with average slippage noted.

Final Review Verdict: Can You Trust Trive?

Trive presents a conflicting profile. On paper, it appears to be a robust, multi-regulated broker with a good history since 2013 and access to top-tier trading platforms. The regulation by ASIC and MFSA adds a layer of credibility that many offshore brokers lack.

However, the recent surge in complaints regarding profit confiscation and withdrawal blocks cannot be ignored. The pattern of accusing profitable traders of “abuse” to void earnings is a severe warning sign. While the platform score is decent (7.91), the “Unverified” status of its UK license and the user exposure stories suggest that your capital may be at risk if you fall under their offshore jurisdiction.

Recommendation: If you trade with Trive, ensure you are contracted under their ASIC or MFSA entity. If you are dealing with their offshore branch, exercise extreme caution.

Read more

FP Markets Marks 20 Years of Global Trading

FP Markets celebrates 20 years of innovation, global expansion, and award-winning service, reinforcing its role as a trusted multi-asset broker.

GivTrade Secures UAE SCA Category 5 Licence

GivTrade gains UAE SCA Category 5 licence, enabling advisory, arrangement, and consulting services under strict regulatory oversight.

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

You are likely here because you are considering trading with 9X markets, but their very recent launch date has you worried about the safety of your funds. You are right to be cautious.

MYFX Markets Review (2025): Is it Safe or a Scam?

If you are considering depositing funds with MYFX Markets, you need to pause and read this safety review immediately. While many brokers operate with high standards of transparency, our analysis of the data suggests MYFX Markets poses significant risks to retail investors.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

What Is a Forex Expert Advisor and How Does It Work?

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

“Elites’ View in Arab Region” Event Successfully Concludes

Commodities Wrap: Copper Surges on ‘Green Squeeze’ Fears; Oil Dips on Peace Hopes

GivTrade Secures UAE SCA Category 5 Licence

Rate Calc