'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

Abstract:This morning's survey data on the US manufacturing economy comes as the post-shutdown slump in 'soft

This morning's survey data on the US manufacturing economy comes as the post-shutdown slump in 'soft' data has dominated desk conversations amid the vacuum of hard macro data...

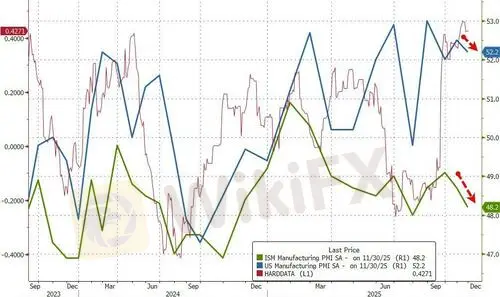

But the picture remains mixed:

- S&P Global's US Manufacturing PMI BEAT expectations in November but dippedon a MoM basis from 52.5 to 52.2 (still in expansion territory and up from the 51.9 flash print).

- ISM's Manufacturing PMI MISSED expectations, dropping from 48.7 to 48.2 (well below the 49.0 expectation) and in contraction for the ninth month in a row.

Although the headline PMI signalled a further expansion of factory activity in November, “the health of the US manufacturing sector gets more worrying the more you scratch under the surface,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Under the hood, ISM shows Price Paid higher, and new orders and employment worsening...

For two successive months now, warehouses have filled with unsold stock to a degree not previously seen since comparable data were available in 2007. This unplanned accumulation of stock is usually a precursor to reduced production in the coming months.

Profit margins are meanwhile coming under pressure from a combination of disappointing sales, stiff competition and rising input costs,the latter widely linked to tariffs.

In short, Williamson notes that manufacturers are making more goods but often not finding buyers for these products.

“This combination of sustained robust production growth alongside weaker than expected sales led to a worryingly steep rise in unsold inventories.”

ISM Respondents were pretty clear with blame for weakness being placed at Trump's feet in Washington:

- “New order entries are within the forecast. We have increased requests from customers to get their orders sooner. Transit time on imports seems to be longer.” (Machinery)

- “We are starting to institute more permanent changes due to the tariff environment.This includes reduction of staff, new guidance to shareholders, and development of additional offshore manufacturing that would have otherwise been for U.S. export.” (Transportation Equipment)

- “Tariffs and economic uncertainty continue to weigh on demand for adhesives and sealants, which are primarily used in building construction.” (Chemical Products)

- “No major changes at this time, but going into 2026, we expect to see big changes with cash flow and employee head count. The company has sold off a big part of the business that generated free cash while offering voluntary severance packages to anyone.” (Petroleum & Coal Products)

- “Business conditions remain soft as a result of higher costs from tariffs, the government shutdown, and increased global uncertainty.” (Miscellaneous Manufacturing)

- “The unstable market has made pricing fluctuate in a very volatile way; I have had to reduce suppliers for raw materials to maintain a better direct cost structure. Reducing my suppliers has reduced the availability of some items and created longer lead times.” (Fabricated Metal Products)

- “Business continues to be a struggle regarding long-term sourcing decisions based on tariffs and landing costs. External (or international) sourcing remains the lowest-cost solution compared to U.S. production/manufacturing. The delta is smaller now, reducing margins.” (Computer & Electronic Products)

- “The government shutdown has impacted our access to agricultural data,impacting agricultural markets and, as a result, decisions we make. Optimism for a tariff exemption on palm oil percolated but hasnt come to fruition at this time.” (Food, Beverage & Tobacco Products)

- “Trade confusion.At any given point, trade with our international partners is clouded and difficult. Suppliers are finding more and more errors when attempting to export to the U.S. — before I even have the opportunity to import. Freight organizations are also having difficulties overseas, contending with changing regulations and uncertainty. Conditions are more trying than during the coronavirus pandemic in terms of supply chain uncertainty.” (Electrical Equipment, Appliances & Components)

- “Domestic and export business have been lackluster. Our customers are taking prompt orders only and still don‘t have confidence to build inventory, much less make expansion plans.In fact, most of any kind of ’planning has been undermined by unpredictability due to inconsistent messaging from Washington.Artificial intelligence is in its infancy stages, producing confusing and most often inaccurate information. This also causes apprehensive consumer buying patterns, contributing to the challenge of forecasting demand.” (Wood Products)

However, there is hope, as manufacturers have grown more optimistic about the year ahead, with the ending of the government shutdown helping lift confidence from the sharp drop suffered in October.

Optimism is being fueled by hopes of improved policy support, including lower interest rates, as well as greater political stability, though it is clear that uncertainty remains elevated and a drag on business growth in many firms, holding confidence well below levels seen at the start of the year.

WikiFX Broker

Latest News

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

What Is a Forex Expert Advisor and How Does It Work?

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

“Elites’ View in Arab Region” Event Successfully Concludes

Commodities Wrap: Copper Surges on ‘Green Squeeze’ Fears; Oil Dips on Peace Hopes

GivTrade Secures UAE SCA Category 5 Licence

FP Markets Marks 20 Years of Global Trading

Rate Calc