XS Review: The Disconnect Between Global Ambition and Client Reality

Abstract:In the complex architecture of modern forex brokerage, there exists a specific category of firm that presents a particular challenge to the analytical observer: the "Janus-faced" broker. On one side, there is the facade of institutional solidity—licenses from reputable jurisdictions like Australia and Malaysia, a high "Influence Rank," and a sophisticated digital presence. On the other side lies a darker operational reality characterized by profit reversals, opaque execution policies, and friction-heavy withdrawal processes.

By WikiFX Special Editorial

In the complex architecture of modern forex brokerage, there exists a specific category of firm that presents a particular challenge to the analytical observer: the “Janus-faced” broker. On one side, there is the facade of institutional solidity—licenses from reputable jurisdictions like Australia and Malaysia, a high “Influence Rank,” and a sophisticated digital presence. On the other side lies a darker operational reality characterized by profit reversals, opaque execution policies, and friction-heavy withdrawal processes.

Our deep-dive analysis of XS (XS.com) reveals a platform exhibiting exactly this duality. While holding a decent WikiFX Score of 6.09, suggesting a mid-tier level of reliability, the underlying data conveys a different narrative. The discrepancy between XSs marketing posture and the experiences of its most profitable traders suggests a structural conflict of interest that warrants immediate attention from the global trading community.

The Profitability Paradox

The most alarming indicator in the recent XS data stream does not concern technical failures or platform outages, but rather a deliberate administrative response to client profitability. In the retail trading sector, a brokers integrity is best tested not when a client loses, but when they win significantly.

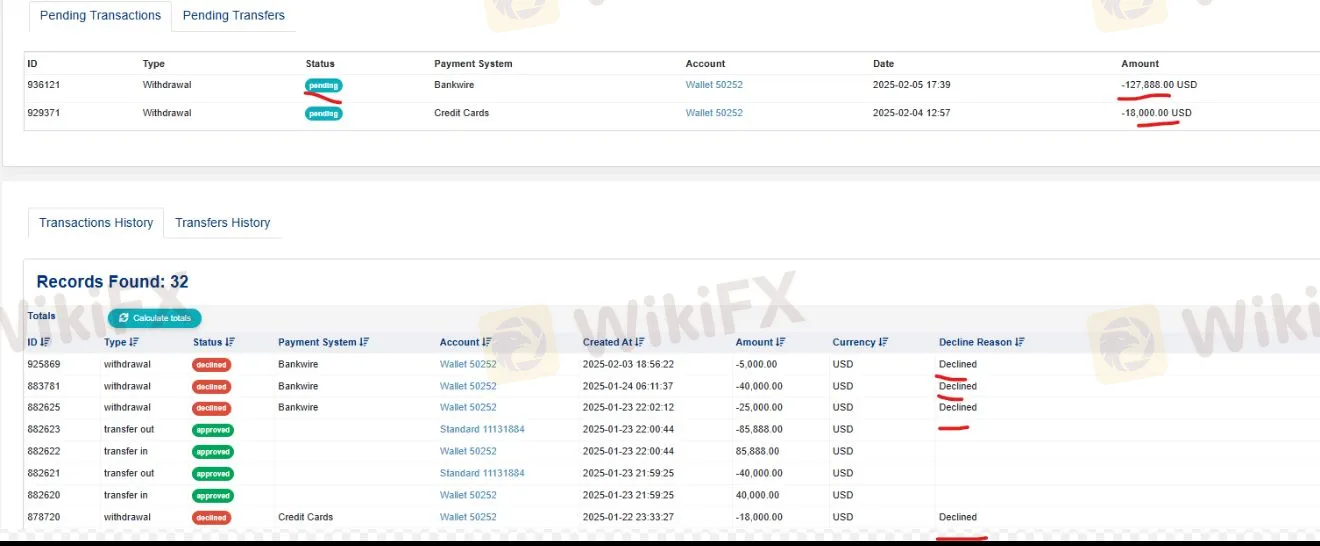

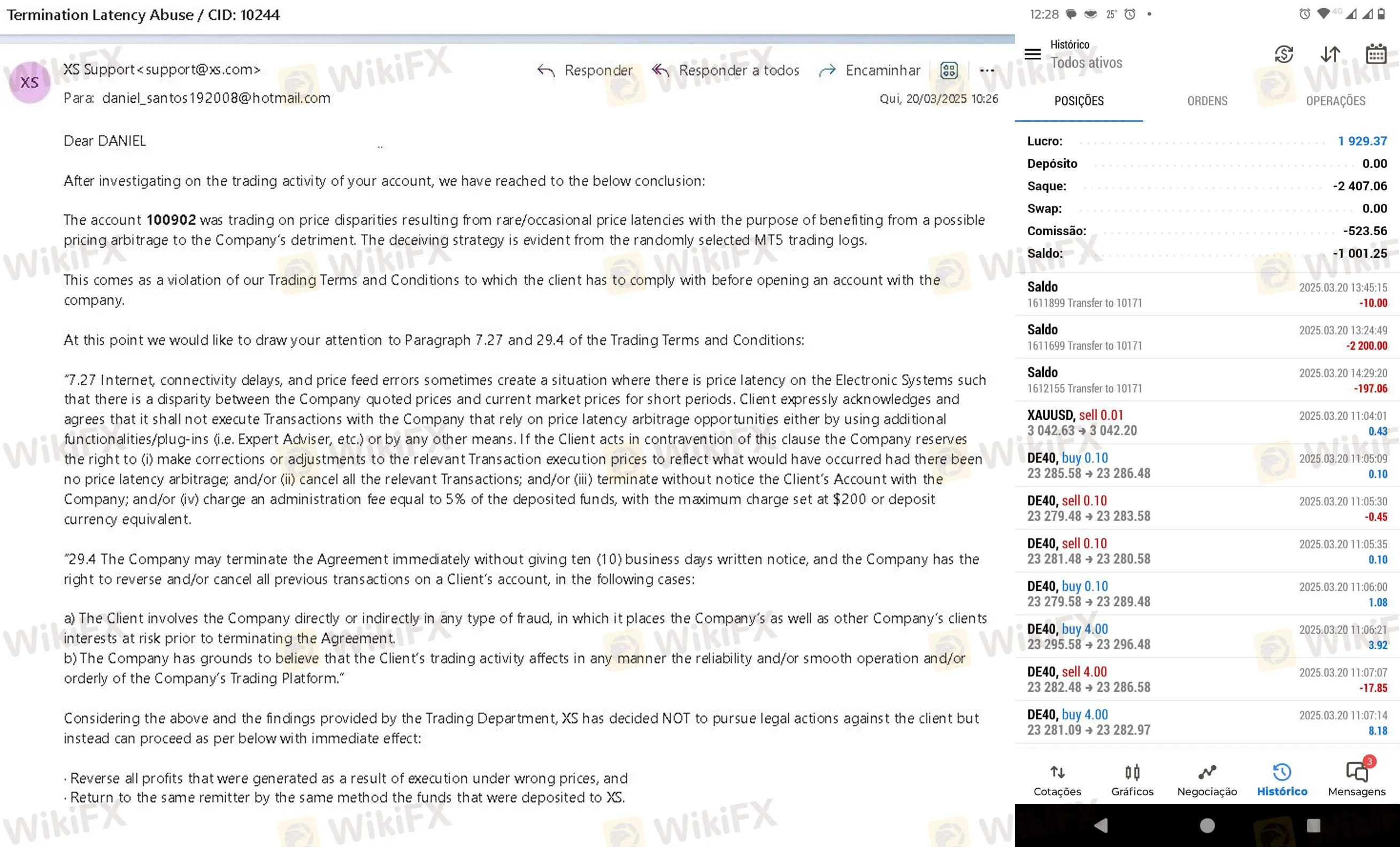

In early 2025, a particularly illustrative case emerged from the United Arab Emirates. A trader, anticipating market volatility following the U.S. elections, deposited $38,000 and subsequently generated profits totaling $127,888 via an MT5 account. According to the complaint lodged with WikiFX, XS did not facilitate the withdrawal of these funds. Instead, the brokerage terminated the account, citing “abuse of trading conditions” and “swap arbitrage strategies”—despite the traders assertion that no futures contracts were traded, rendering swap arbitrage technically impossible in that context. The outcome was a forced reversal of all profits, leaving the trader with only their principal deposit.

(Evidence: A Notification of Profit Reversal cited in the UAE case review, February 2025)

This is not an isolated incident of friction. A similar narrative surfaced from Brazil in March 2025, where a trader generating a modest $1,400 profit faced accusations of “negotiation abuse.” Much like the UAE case, management threatened to debit the account, placing the client in an indefinite administrative limbo.

When a brokerage systematically applies vaguely defined “abuse” clauses to nullify legitimate market gains, it suggests the firm may be operating a “B-Book” model (acting as the counterparty to trades) without adequate risk management. In such a setup, client profit equals broker loss, creating a perverse incentive to invalidate successful trades retroactively.

The Regulatory Fragment: A Safety Net with Holes

To the casual observer, XS appears heavily regulated. However, a forensic audit of their regulatory status reveals a “patchwork” framework. While they possess top-tier licensing, clients must be acutely aware of which specific entity they are contracting with. A license in Australia does not protect a client onboarded under a Seychelles entity.

Current WikiFX regulatory data highlights significant discrepancies in their compliance standing. While the Australian (ASIC) and Malaysian (LFSA) licenses appear active, the status of their operations in South Africa and Cyprus raises flags regarding their commitment to global compliance standards.

WikiFX Regulatory Audit: XS Group

| Regulator | Regulator Jurisdiction | License Type | Current Status |

|---|---|---|---|

| Seychelles FSA | Seychelles | Retail Forex License | Offshore Regulated |

| Australia ASIC | Australia | MM (Market Maker) | Regulated |

| Malaysia LFSA | Malaysia (Labuan) | Money Broking | Regulated |

| South Africa FSCA | South Africa | Financial Service Provider | Exceeded Business Scope |

| Cyprus CYSEC | Cyprus | STP/MM | Unverified |

The “Exceeded Business Scope” status in South Africa is particularly concerning for a broker expanding its global footprint. It implies the firm may be offering services or products that go beyond what their local license permits, operating in a regulatory gray zone. Furthermore, the “Unverified” status with CySEC (one of Europes primary watchdogs) leaves a significant gap in their European safety credentials.

The “Grade D” Trading Environment

While marketing materials often tout “raw spreads” and “lightning execution,” WikiFX‘s quantitative assessment of XS’s trading environment paints a starkly different picture. The platform received an overall Trade Environment Grade of D—a rating that technically contradicts its acceptable overall score.

The data reveals a “Fast but Slippery” execution model.

- Speed: Rated AA. The execution speed is objectively fast, with average speeds clocking around 305ms.

- Slippage: Rated D. This is the critical failure point.

High speed combined with poor slippage control is a hallmark of asymmetric execution. In layman's terms, orders allow for instant entry, but often at a price inferior to what was clicked, or profitable positions are closed with negative slippage that erodes gains. While the Cost Grade is AAA (indicating low spreads on paper), the hidden cost of slippage likely negates this benefit for high-frequency or news traders.

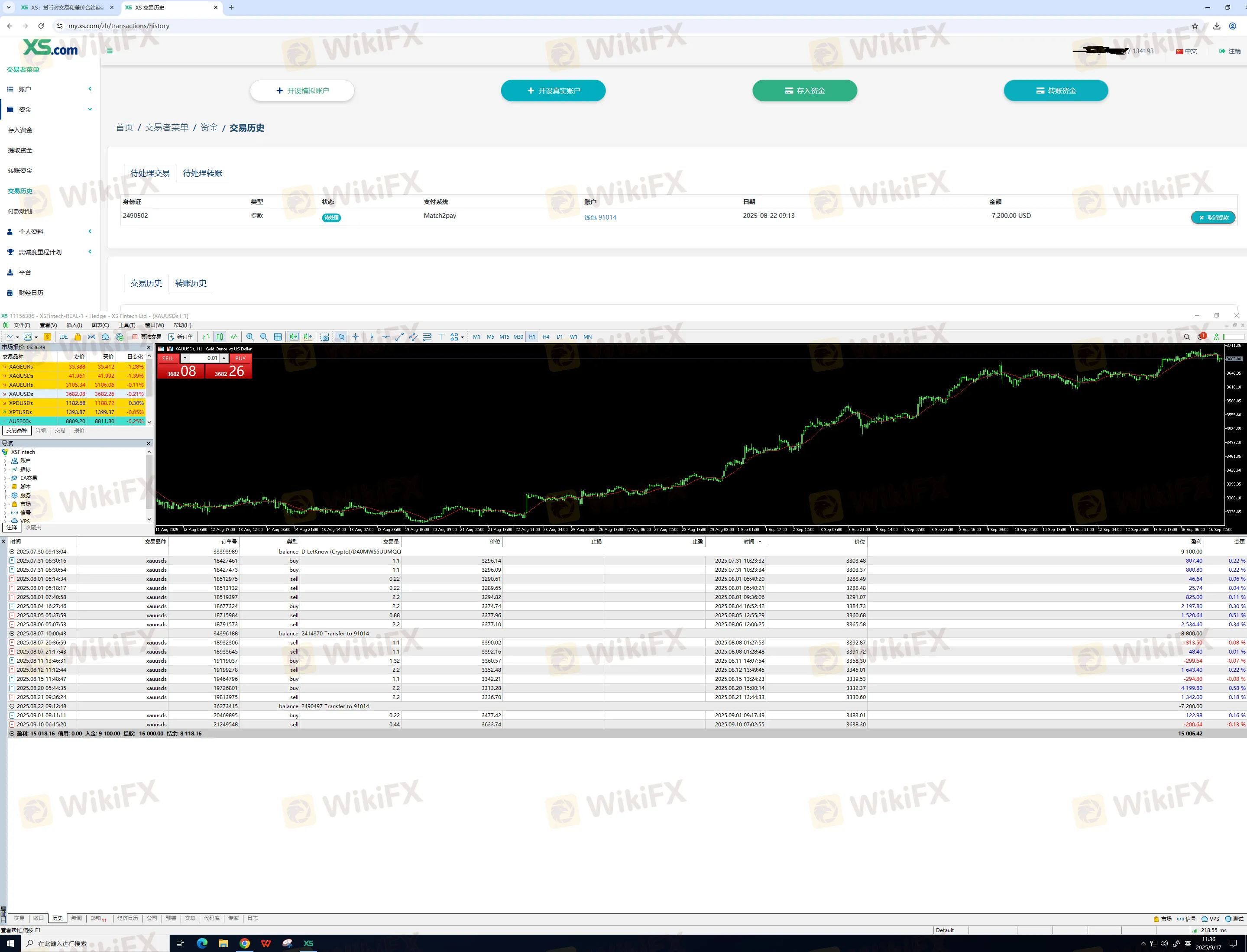

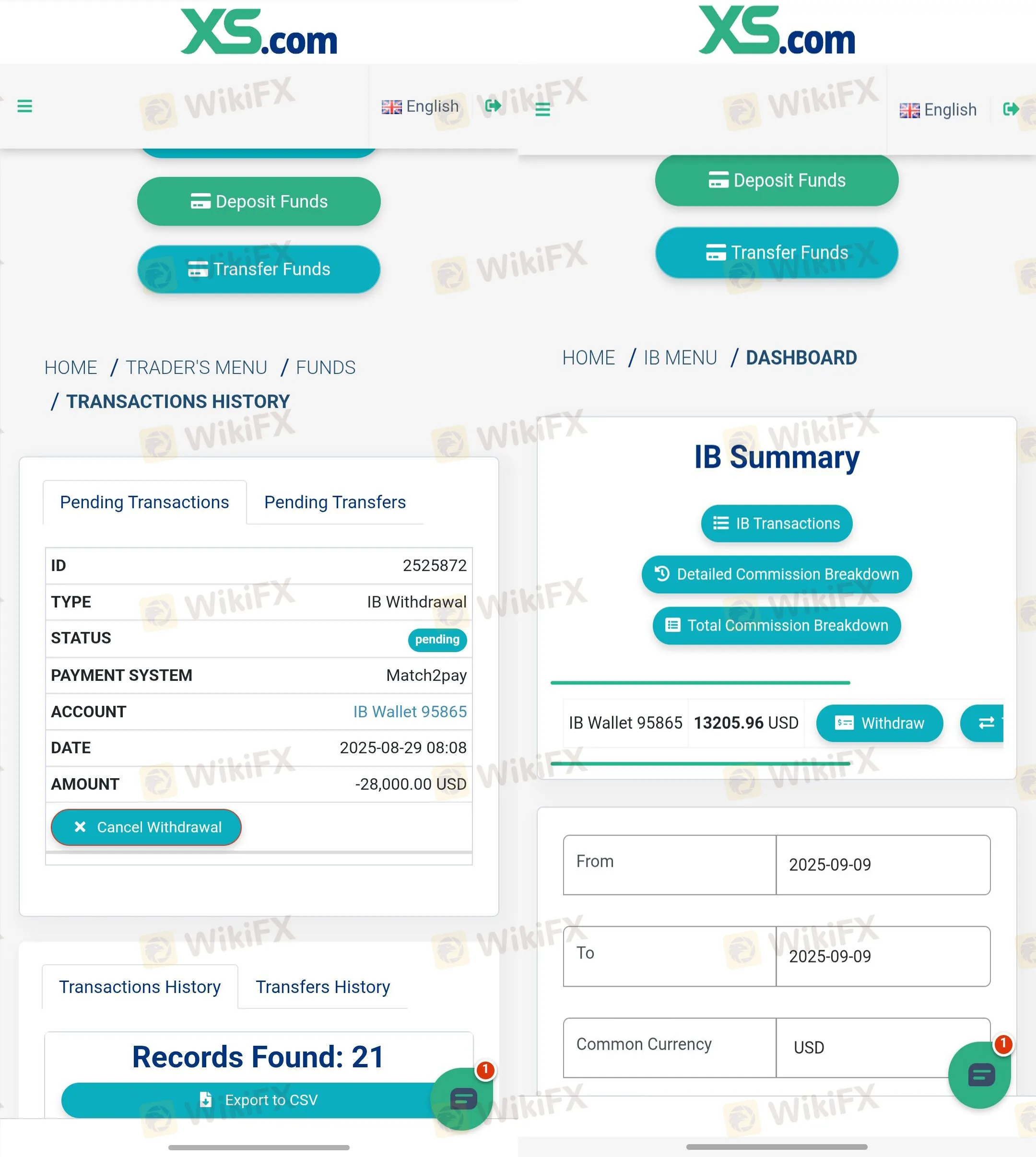

(Evidence: Correspondence regarding delayed commission withdrawals, September 2025)

The Withdrawal Bottleneck

Liquidity looks different from the inside than it does from the outside. For XS, the inflow of deposits appears seamless (fully digital, instant), but the outflow mechanism shows signs of severe friction.

Reports from late 2024 through September 2025 indicate a pattern where withdrawals—particularly those involving commissions or substantial principal—trigger exhaustive “compliance reviews.”

- In Hong Kong (September 2025), a client reported a withdrawal pending for over a month, sparking fears of insolvency among local user groups.

In China (September 2025), a partner attempted to withdraw $28,000 in accumulated commissions. The request was met with a 14-day review loop and repetitive demands for “selfie verification,” which, even after submission, did not result in fund release.

(Evidence: User report citing month-long delays, September 2025)

This behavior—stalling large withdrawals under the guise of security checks—is a classic liquidity management tactic often utilized by brokers facing capital crunch issues or those attempting to discourage partners from leaving the platform.

Verdict: The Gap Between Influence and Integrity

The tragedy of XS is that on the surface, it possesses the infrastructure of a Tier-1 brokerage. With an Influence Rank of A and a modern MT5 stack, it has the tools to be a market leader. However, market leadership requires an alignment of interest with the client—something currently missing from the XS equation.

The prevailing evidence suggests that XS operates comfortably only when clients are losing or trading small volumes. When faced with professional profitability or large withdrawal requests, the “institutional” facade cracks, revealing an aggressive risk-mitigation strategy that treats client profits as operational threats.

For the global investor, the presence of an ASIC license is reassuring, but it is not a shield against the behavior observed in the Offshore and Asian branches of the firm. Until XS resolves the “Exceeded Business Scope” issues in South Africa and eliminates the predatory use of “abuse clauses” to retake client profits, WikiFX advises extreme caution. The platform currently presents a high-risk environment for profitable traders, despite its glossy exterior.

Identities of the traders involved in the case studies have been withheld for privacy.

Disclaimer: The information provided in this review is based on data and user complaints available in the WikiFX database as of the current reporting period. Forex trading involves significant financial risk and may not be suitable for all investors. Regulatory statuses can change; traders are advised to verify real-time data on the WikiFX app before depositing funds.

Read more

LONG ASIA Exposure: Traders Report Fund Losses & Long Withdrawal Blocks

Long Asia Group, a Saint Vincent and the Grenadines-based forex broker, has come under increasing scrutiny as a growing number of traders report troubling experiences with the broker’s operations. User feedback highlights recurring issues such as delayed or blocked withdrawals, sudden communication breakdowns, and a lack of clear accountability once funds are deposited. Several traders claim that while small withdrawals may initially go through, larger payout requests often face unexplained obstacles. More concerning are allegations suggesting that the broker may no longer be operating transparently, with users reporting prolonged silence, unresolved complaints and suspected fund mishandling. These patterns have raised serious questions about Long Asia Group’s reliability and overall legitimacy, prompting traders to exercise extreme caution before engaging with the broker. For more details, keep reading this LONG ASIA review article, where we have elaborated on the traders’ pain wit

MY MAA MARKETS Review: Are Withdrawal Blocks and Regulation Gaps Real?

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

20 Arrested as Selangor Police Smash Online Scam Rings

Selangor police arrested 20 suspects after dismantling three online scam syndicates operating fake job and investment scams across Kajang, Seri Kembangan and Puchong, with multiple devices seized and investigations ongoing.

Sarikei Online Scams Exposed: Police Trace Bank Account Owners

Police in Sarikei identify four bank account owners linked to online scams, with victims losing over RM475,000 in investment and tender frauds.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

Warning: VexPro Withdrawal Complaints

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

FXPN Review 2026: Is This Forex Broker Safe?

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

Rate Calc