XTB Review 2025: Pros, Cons and Legit Broker?

Abstract:XTB limited has 6,898 instruments, low spreads from 0.5 pips, no min deposit and it is FCA & CySEC regulated. Pros: commission-free CFDs. Cons: withdrawal fees under 50 USD. Read full review.

XTB Broker Overview

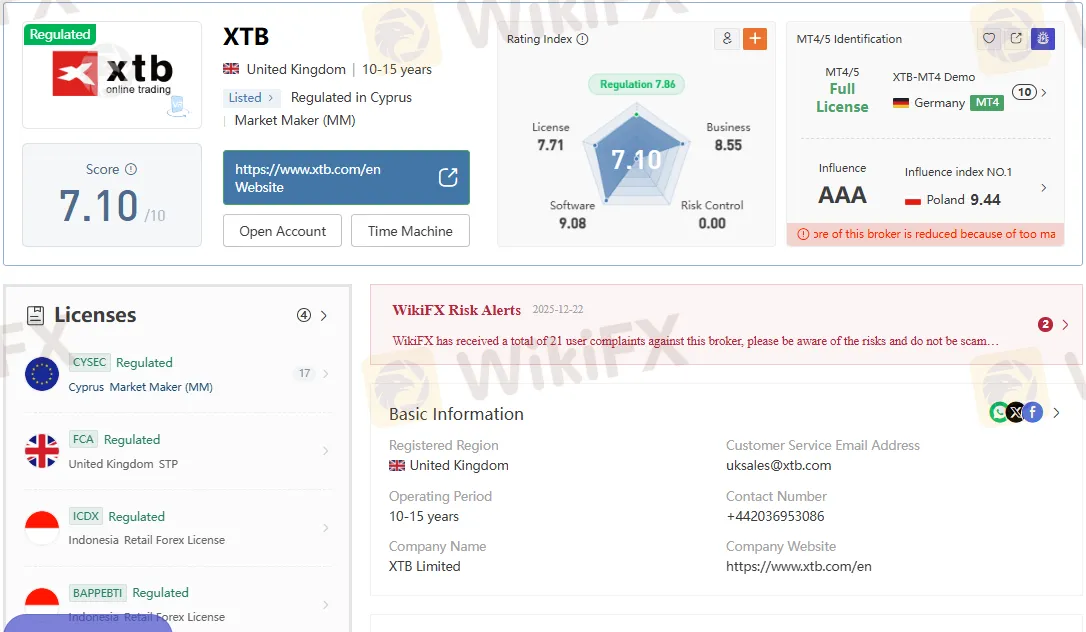

XTB Limited, operating under the brand XTB Broker, is a UK-registered entity founded in 1995. The firm has grown into one of Europes most recognized online trading providers, offering access to 6,898 financial instruments across forex, stocks, ETFs, indices, and commodities. According to the attached regulatory documents, XTB holds multiple licenses:

- CySEC (Cyprus Securities and Exchange Commission) – License No. 169/12, Market Maker (MM), effective since 2012.

- FCA (Financial Conduct Authority, UK) – License No. 522157, Straight Through Processing (STP), effective since 2011.

- Indonesia Commodity and Derivatives Exchange (ICDX) – License No. 196/SPKB/ICDX/DIR/III/2020.

- BAPPEBTI (Indonesia) – License No. 003/BAPPEBTI/SI/08/2020.

This multi-jurisdictional regulation underscores XTBs legitimacy, positioning it as a broker with strong compliance credentials compared to less-regulated competitors.

Trading Instruments and Market Access

XTB Broker provides one of the broadest product ranges among retail brokers:

- Forex: Major, minor, and exotic pairs with leverage up to 1:500.

- CFDs: Commission-free trading on indices, commodities, and currencies.

- Stocks & ETFs: Over 6,000 listed instruments, with commissions applied beyond €100,000 monthly turnover.

- Cryptocurrencies, Bonds, Options: Available through CFDs, expanding diversification opportunities.

Competitor comparison: While brokers like IG and Saxo Bank also offer multi-asset coverage, XTBs zero minimum deposit and commission-free CFD structure provide a more accessible entry point for retail traders.

Platforms and Technology

The brokers proprietary xStation5 platform is available on mobile, desktop, and tablet. It integrates advanced charting, sentiment analysis, and risk management tools. Unlike many rivals, XTB does not rely solely on MetaTrader 4/5, though demo servers for MT4 are being acquired by the XTB.

Execution speed averages 160 ms, which is competitive but not industry-leading compared to brokers like Pepperstone, known for sub-100 ms latency.

Account Types and Fees

XTB offers a single standard account type:

- Minimum Deposit: £0.

- Spreads: Floating, starting from 0.5 pips; EUR/USD averages around 1.0 pips.

- Commissions:

- CFDs: Commission-free.

- Stocks/ETFs: 0.2% after €100,000 turnover, minimum £10.

- Withdrawal Fees: Free above 50 USD/EUR/GBP; £5 fee below this threshold.

- Inactivity Fee: £10 monthly after 365 days of inactivity.

Compared to competitors, XTBs fee structure is transparent but less forgiving for small withdrawals. Brokers like eToro waive withdrawal fees entirely, giving them an edge for micro-investors.

Regulatory Standing and Transparency

The XTB confirmed FCA and CySEC regulation, alongside Indonesian oversight. This multi-layered compliance framework is a significant advantage over offshore brokers.

However, investigative notes highlight discrepancies:

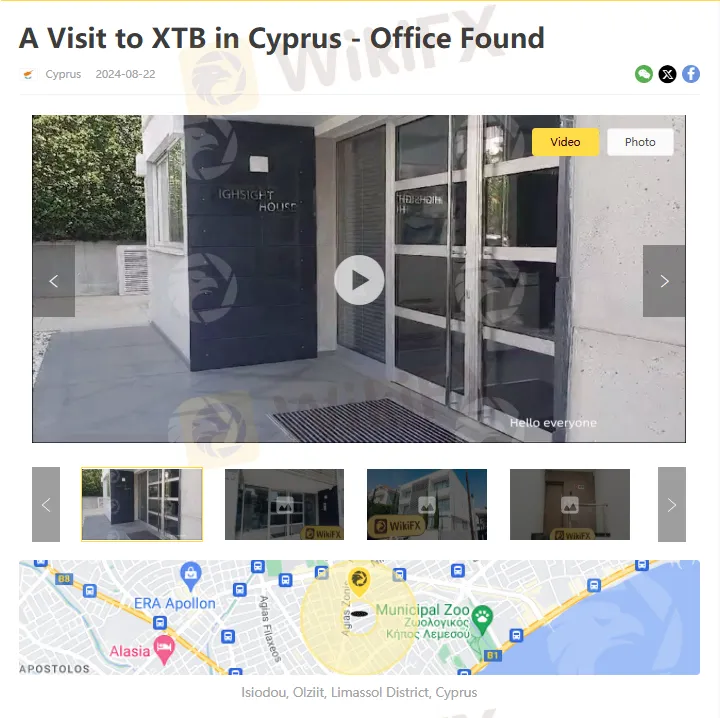

- Cyprus Office: Verified presence in Limassol.

- UK Office: A 2021 inspection reported “no office found” at Canary Wharf, raising questions about operational transparency in the UK.

Domain registration: The official site xtb.com/en is consistent with licensed entities, but traders should remain cautious about clone sites.

Reported Cases and User Complaints

The reported cases includes 43 user reviews, with mixed sentiment:

- Positive: Many users praised the platforms clean interface, fast deposits, and educational resources.

- Neutral: Some noted the brokers heavy reliance on CFDs, limiting long-term investment appeal.

- Exposure Cases: Multiple reports of withdrawal issues, including funds withheld, delays exceeding one month, and unresponsive customer support.

Examples:

- A trader in Ecuador reported receiving only $140 from a $200 withdrawal.

- An Indian client claimed withdrawals were blocked for over a month.

- A Colombian user feared funds were lost after no bank transfer was recorded.

These cases highlight operational risks that prospective clients should weigh against regulatory assurances.

Pros and Cons of XTB Broker

Pros:

- FCA & CySEC regulated.

- Commission-free CFD trading.

- No minimum deposit requirement.

- Broad product range (6,898 instruments).

- Rich educational resources.

Cons:

- Withdrawal fees under 50 USD/EUR/GBP.

- An inactivity fee after 12 months.

- Limited account types (only standard).

- Reports of delayed or failed withdrawals.

- Proprietary platform only; limited MT4/MT5 support.

Bottom Line: Is XTB Legit?

Yes, XTB Broker is legitimate, backed by FCA and CySEC regulation, alongside Indonesian oversight. Its broad instrument coverage, commission-free CFDs, and zero minimum deposit make it attractive for retail traders.

However, investigative found serious withdrawal complaints and inconsistencies in office verification. While XTB remains a regulated broker, traders should approach it with caution, particularly regarding fund withdrawals and long-term reliability.

For those seeking a regulated, commission-free CFD provider, XTB offers value. Yet, competitors like IG or Pepperstone may provide stronger execution speeds and fewer withdrawal concerns.

Read more

BaFin Flags Multiple Suspicious Platforms Over Unlicensed Financial and Crypto Services

Germany’s BaFin has issued a fresh wave of warnings against several websites suspected of offering unauthorised financial, investment, lending, and crypto-related services, with some cases also involving identity fraud.

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

Did your good trading experience with TAG MARKETS reverse when applied for fund withdrawals at the Mauritius-based forex broker? Besides withdrawal denials, did you also witness account blocks or deletions by the broker? Did the broker’s customer support team fail to provide you a proper reason for these trading activities? Have you also witnessed glitches on deposit bonus? These allegations have only grown further in 2026. Read on as we share these allegations in this TAG MARKETS review article.

MYFX Markets: Is it Legit or a Scam? This Review Will Tell You the Answer!

Is your trading experience with MYFX markets full of fund withdrawal denials despite repeated communications with its customer support team? Has the broker deleted all your profits? Did the broker accuse you of false trading strategy implementation while deleting your profits? There have been many such instances reported by traders against these activities online. In this MYFX Markets review article, we have shared some complaints. Take a look!

Exfor Exposure: Investigating Alleged Withdrawal Denials, Illegitimate Account Closure & More

Exfor, a Malaysia-based forex broker, has allegedly been the centre of attention for all the wrong reasons. These include long-pending withdrawal denials, no communication or assistance from the broker’s customer support team, manipulated pricing upon a withdrawal request by the trader, and account blowups due to bonus-related issues. It’s the traders who allegedly bear the brunt of all these suspicious trading activities. A lot of them have criticized it on broker review platforms. We have highlighted some of their complaints in this Exfor review article. Take a look!

WikiFX Broker

Latest News

TAG MARKETS Review 2026: Allegations of Withdrawal Denials & Trading Glitches

WikiFX Wishes You a Happy International Women's Day

Canadian Regulators Say More Than 7,500 Fraudulent Investment and Crypto Websites Were Taken Down

Oil prices jump above $100 for first time in four years

Retiree’s Tabung Haji Savings Gone: Elderly Retiree Loses RM277,000 After One Whatsapp Message

Crude Oil Rallies to $85 on Escalating Middle East Geopolitical Risks

Forex Brief: Dollar Dips Ahead of NFP; RBA Bets Lift AUD

Global Risk Spike: Gulf SWFs Review US Assets as Strait of Hormuz Fears Mount

Doctor Loses RM3.8 Million in Alleged Fake IPO Investment Scheme

“Guaranteed Profits” in Volatile Markets? New Financial Traps Trend Malaysia May Soon Face

Rate Calc