MY MAA MARKETS Review 2025: Institutional Audit & Risk Assessment

Abstract:MY MAA MARKETS presents a risk profile characteristic of a newly established, offshore entity operating without recognized financial oversight. Despite offering the industry-standard MT5 platform and aggressive spread structures, the broker's low WikiFX score of 1.81 reflects significant deficiencies in compliance and safety. The entity, established in 2024 with a nexus in Mauritius, failing to hold a valid financial license, combined with emerging reports of withdrawal failures, categorizes this platform as a high-risk investment vehicle. Traders are advised that the lack of regulatory supervision exposes capital to substantial counterparty risk.

Executive Summary

WikiFX Score: 1.81/10

Regulatory Status:Unregulated

MY MAA MARKETS presents a risk profile characteristic of a newly established, offshore entity operating without recognized financial oversight. Despite offering the industry-standard MT5 platform and aggressive spread structures, the broker's low WikiFX score of 1.81 reflects significant deficiencies in compliance and safety. The entity, established in 2024 with a nexus in Mauritius, failing to hold a valid financial license, combined with emerging reports of withdrawal failures, categorizes this platform as a high-risk investment vehicle. Traders are advised that the lack of regulatory supervision exposes capital to substantial counterparty risk.

Quick Take: Pros and Cons

Pros

- ✅ Platform Standard: Utilizes the MetaTrader 5 (MT5) White Label solution, offering advanced charting and EA support.

- ✅ Account Diversity: Offers five tiered account types (General to VIP) catering to various deposit levels from $50.

- ✅ High Leverage: Provides accessibility to significant leverage (up to 1:500), appealing to aggressive speculative strategies.

Cons

- ❌ Regulatory Vacuum: Operates without authorization from any Tier-1 or Tier-2 financial regulator (Unregulated).

- ❌ Critical WikiFX Score: A score of 1.81 indicates a failure to meet basic safety and operational standards.

- ❌ Withdrawal Risks: Verified user reports identify severe friction in fund repatriation and non-responsive support.

- ❌ Operational Opacity: Lacks transparency regarding segregated accounts and liquidity providers.

- ❌ Short Operating History: Established in 2024, lacking a proven track record of solvency.

Regulatory Compliance & Safety Profile

Regulatory Status: Unauthorized

Upon auditing the corporate structure of MY MAA MARKETS, data indicates the firm is headquartered in Mauritius but does not appear to hold a valid Global Business License or Investment Dealer License from the Mauritius Financial Services Commission (FSC) or any other recognized body. The WikiFX database explicitly confirms: “No valid regulation found.”

Risk Warning: The Unregulated Implication

The absence of a regulatory framework has severe implications for retail and institutional clients:

- Capital Security: There is no legal mandate for MY MAA MARKETS to maintain client funds in segregated tier-1 bank accounts. In the event of corporate insolvency, client assets may be treated as general company funds, recoverable only through complex or non-existent liquidation processes.

- Censorship Resistance: Clients have no recourse to an external ombudsman or a Financial Services Compensation Scheme (FSCS) in the event of disputes.

- Operational Conduct: Unregulated entities are not subject to periodic capital adequacy audits, allowing potential mismanagement of operational leverage without detection.

Trading Infrastructure & Costs

Leverage Policy: High-Risk Allocation

MY MAA MARKETS offers a uniform maximum leverage of 1:500 across all account types, from strict “General” accounts to high-volume “VIP” tiers.

- Analyst Note: While attractive for high-frequency traders seeking capital efficiency, a 1:500 ratio significantly exceeds the safety caps enforced by top-tier regulators like the FCA or ASIC (typically capped at 1:30). This suggests the broker operates with an offshore mandate, prioritizing aggressive volume over client capital preservation.

Cost Structure: Aggressive Pricing

The broker markets a competitive spread structure:

- General Account ($50 Deposit): Spreads from 0.35 pips.

- Premium Account ($5000 Deposit): Spreads from 0.10 pips.

- VIP Account ($10,000 Deposit): Raw spreads.

Audit of Costs: A starting spread of 0.35 pips on a Standard/General account is atypically low for the industry, where 1.0–1.2 pips is the norm for commission-free accounts. Traders should exercise due diligence to verify if these low spreads are offset by hidden commissions or high slippage, as such pricing models can sometimes indicate a “loss-leader” strategy to attract deposits quickly.

Software: White Label MT5

The firm utilizes a White Label MetaTrader 5 (MT5) configuration.

- Evaluation: MT5 is the gold standard for multi-asset trading. However, a “White Label” setup implies the broker does not own the server infrastructure but leases it. This lowers the barrier to entry for the broker but grants them significant control over trade execution settings, including potential friction in execution speed or slippage parameters. The platform reportedly lacks biometric authentication, presenting a minor security gap.

Market Sentiment: User Complaints

Risk Factors Analysis

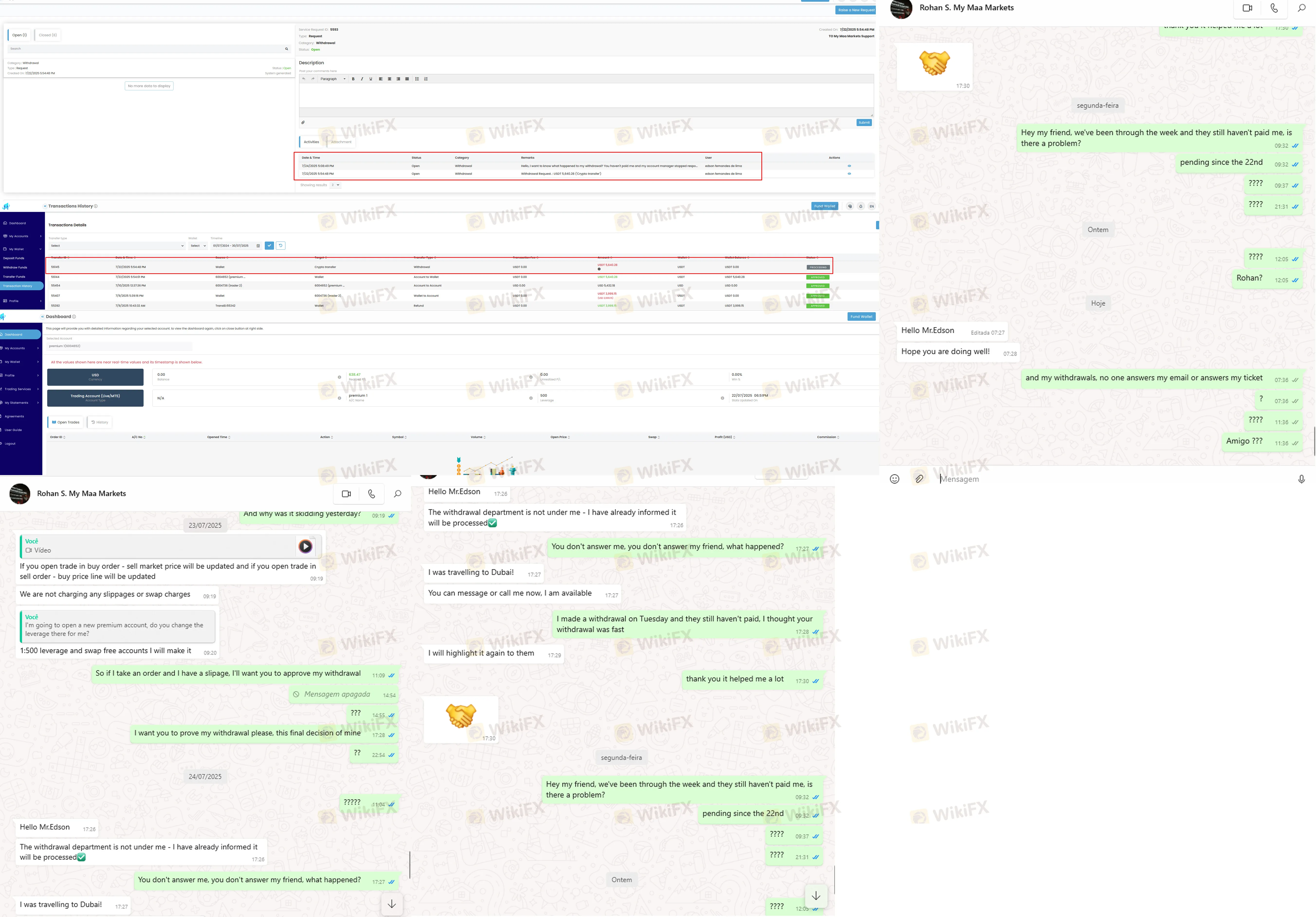

Information sourced from user reports highlights critical operational failures. A specific case filed in July 2025 details a severe breach of trust.

- Case Details: A user from Brazil reported a “Stuck Withdrawal” dating back to July 22, 2025.

- Nature of Dispute: The client requested a withdrawal of 5,640.28 (currency unspecified, likely USD or BRL). The request remained “pending” while communication channels were severed.

- Communication Breakdown: The user provided evidence of being ignored by their assigned account manager despite repeated email inquiries.

- Evidence:

Analyst Assessment: This pattern—withdrawal delays coupled with the cessation of support communication (“ghosting”)—is a primary red flag for liquidity distress or fraudulent operational practices. It suggests the broker may be utilizing delay tactics to retain capital, a common characteristic of unregulated entities facing solvency issues.

Final Verdict

Based on the 2025 institutional audit, MY MAA MARKETS is classified as a High-Risk brokerage. The combination of its unregulated status, a critically low WikiFX score of 1.81, and documented evidence of withdrawal failures outweighs the benefits of its MT5 platform and low spread capabilities.

The entity's short operational history (est. 2024) and lack of regulatory oversight create an environment where capital safety cannot be guaranteed. The reported inability of clients to repatriate funds suggests potential operational instability. Investors are strongly advised to avoid depositing capital with unregulated entities where legal recourse is absent.

For the most current regulatory certificates and real-time blocklisting status, verify MY MAA MARKETS on the WikiFX App.

WikiFX Broker

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

What Is a Forex Expert Advisor and How Does It Work?

Rate Calc