XS Review 2025: Safety, Features, and Reliability

Abstract:XS is a brokerage firm established in 2022 with its headquarters in Mauritius. It is currently regulated by multiple financial authorities, including the Seychelles FSA and Malaysia LFSA, though its regulatory status across different regions shows mixed results. With a WikiFX Score of 6.09, XS holds a mid-range rating, reflecting a balance between its regulatory framework and recent feedback regarding its trading environment.

XS is a brokerage firm established in 2022 with its headquarters in Mauritius. It is currently regulated by multiple financial authorities, including the Seychelles FSA and Malaysia LFSA, though its regulatory status across different regions shows mixed results. With a WikiFX Score of 6.09, XS holds a mid-range rating, reflecting a balance between its regulatory framework and recent feedback regarding its trading environment.

Pros and Cons of XS

Based on the available data, here is a breakdown of the broker's strengths and weaknesses:

- ✅ High Leverage: Offers maximum leverage up to 1:2000.

- ✅ Platform Variety: Supports industry-standard MT4 and MT5 trading platforms.

- ✅ Account Options: Features multiple account types including Standard, Micro, and Cent accounts.

- ❌ Regulatory Warnings: Some licenses are flagged as “Exceeded Business Scope” or “Unverified.”

- ❌ Poor Trading Environment: Rated “D” for trading environment, with poor slippage and swap grades.

- ❌ User Complaints: Significant recent complaints regarding withdrawal refusals and profit cancellations.

Is XS Safe? Regulatory Analysis

XS operates under a multi-regulatory framework, but the specific status of each license varies significantly.

Regulated Entities

- Seychelles FSA: XS Ltd is regulated by the Financial Services Authority (FSA) with license number SD089. This is considered an offshore regulation.

- Malaysia LFSA: XS Finance Limited is regulated by the Labuan Financial Services Authority (License MB/21/0081). The status is noted as “Regulation in Progress.”

- Australia ASIC: XS PRIME LTD holds a license (374409) from the Australian Securities & Investments Commission. However, the data also categorizes this under a “Regulation in Progress” status in the safety analysis.

Risk Warning

The regulatory analysis flags several concerns regarding other licenses:

- South Africa (FSCA): The license held by XS ZA (Pty) Ltd (53199) is flagged as “Exceeded Business Scope.”

- Cyprus (CySEC): The status for XS Markets Ltd (412/22) is listed as “Unverified.”

Real User Feedback and Complaints

In the last three months, WikiFX has received 5 complaints. The feedback highlights severe issues regarding fund management and trade execution.

Withdrawal Issues

Multiple users reported significant delays or inability to withdraw funds.

- Case 1 (Hong Kong): A user reported that withdrawals have been pending for a month with no resolution.

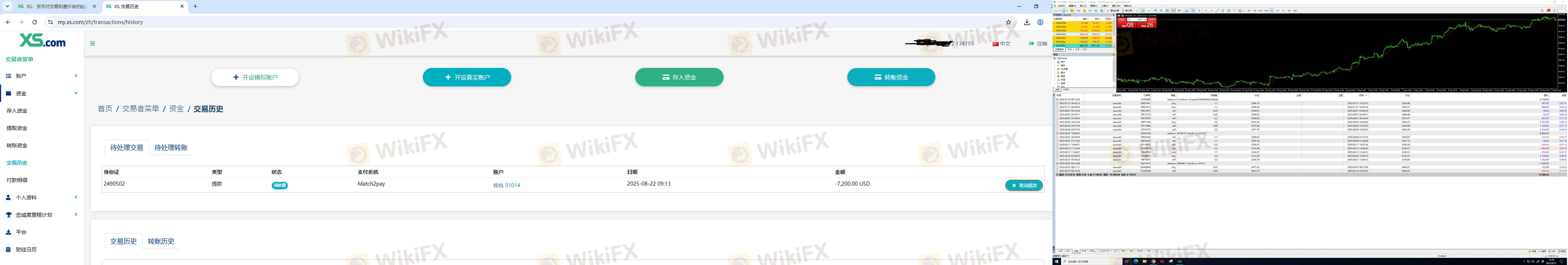

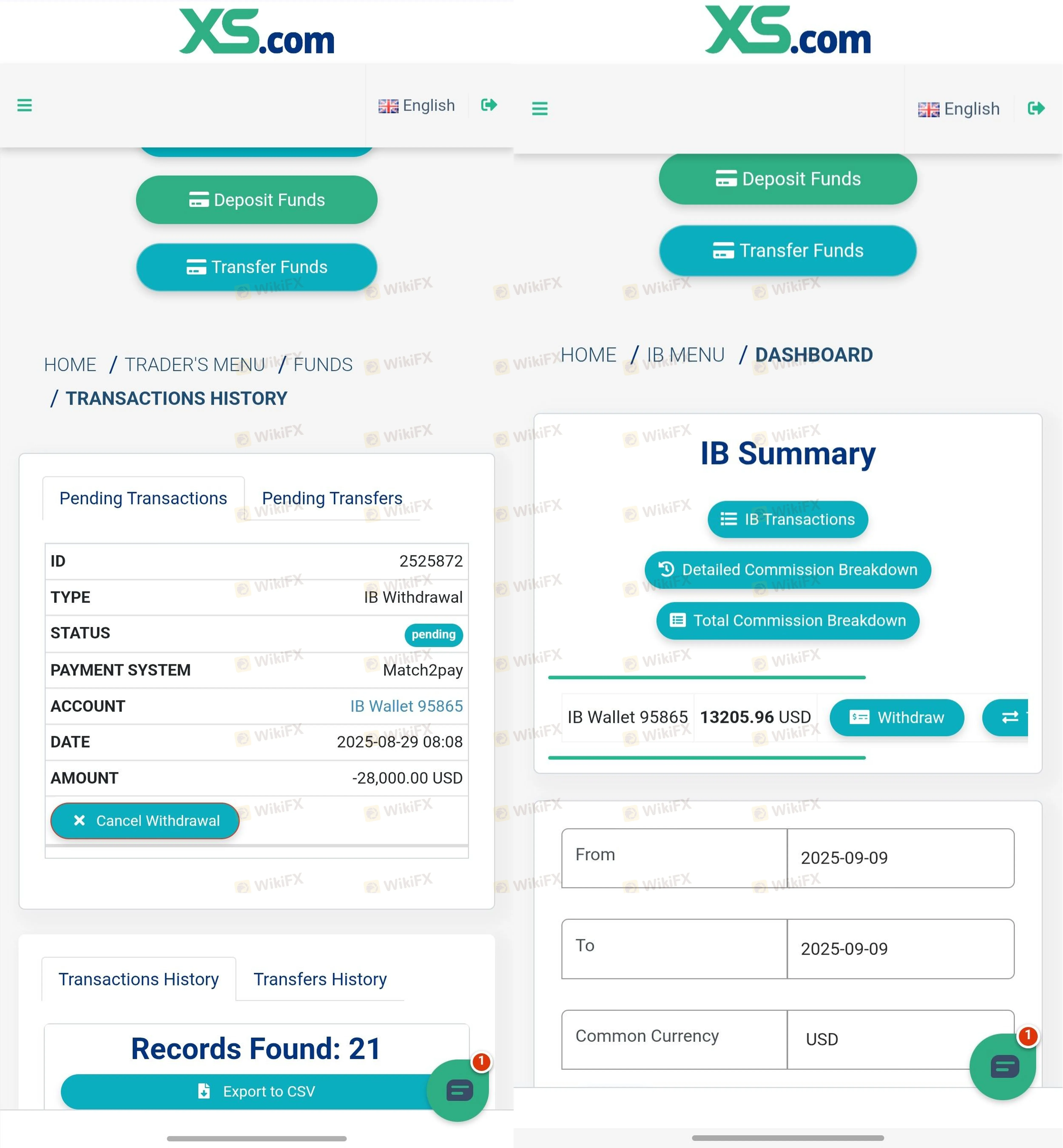

Case 2 (China) & Case 5 (Brazil): Users faced hurdles withdrawing larger amounts ($28,000 and $24,000 respectively). One user noted that while small commissions were processed, large amounts were stuck in “review” for weeks.

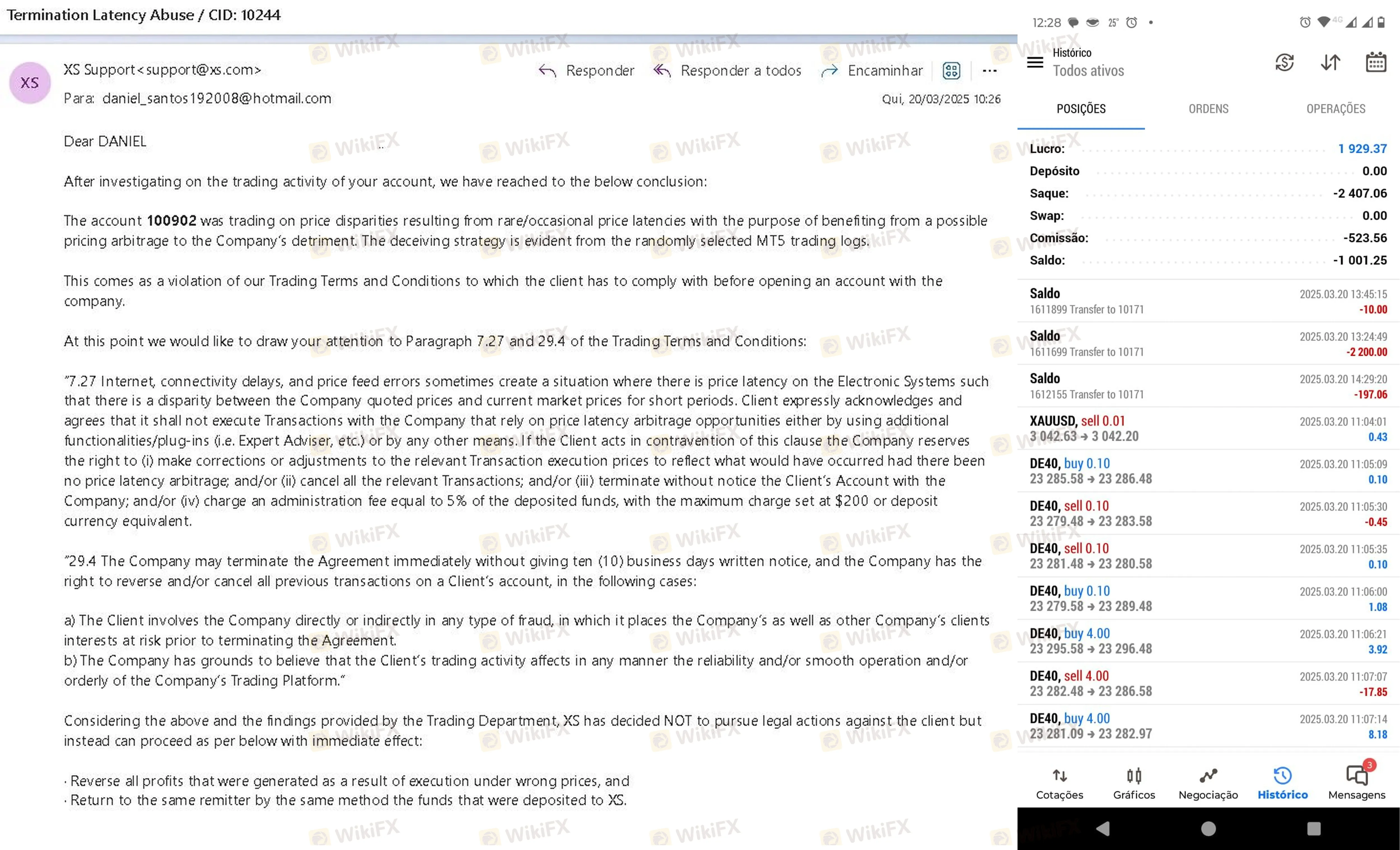

Profit Cancellation and “Abuse” Accusations

Several traders reported that their profits were removed by the broker under the accusation of “trading abuse.”

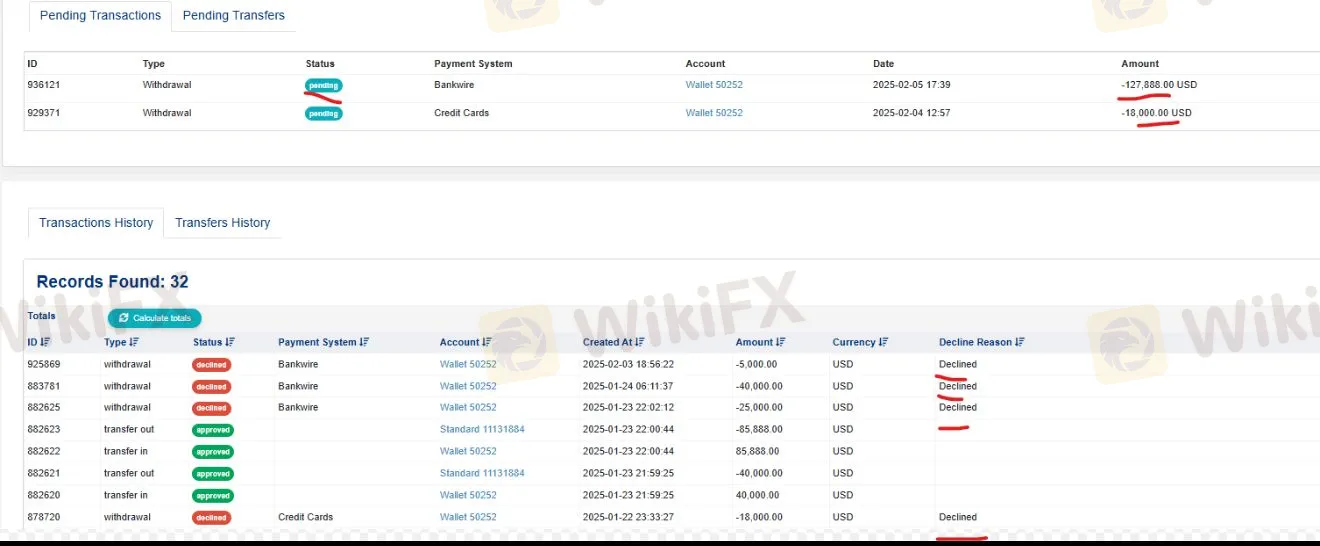

- Case 4 (UAE): A user claimed to make $127,888 in profits from gold and equity markets. XS allegedly terminated the account citing “swap arbitrage,” reversed the profits, and only allowed the withdrawal of the initial deposit.

Case 3 (Brazil): A trader with $1,400 in profit received an email claiming “abuse in negotiations” and faced potential penalties.

System Errors

- Case 6 (China): A user reported forced liquidation of BTC, Gold, and Oil positions due to a recognized system error, but claimed the broker refused compensation.

Trading Conditions and Fees

Leverage

XS offers extremely high leverage, reaching up to 1:2000 for Standard, Cent, and MT5 accounts. While this allows for significant market exposure, it substantially increases the risk of capital loss.

Spreads and Accounts

The broker offers spreads starting from 1.1 pips on its Standard, Micro, and Cent accounts.

- Account Types: Standard MT5, Standard MT4, Micro, and Cent.

- Minimum Deposit: Starts as low as 0.01 (currency unspecified, implied USD/Base unit) for Standard/Cent accounts and 0.1 for Micro accounts.

Platforms

XS utilizes the MT4 and MT5 trading platforms. Data indicates the MT5 software used is a “Main Label” (Subject to customization), rated as “Perfect” for its features, though it lacks two-step biometric authentication.

Final Verdict

XS presents itself as a modern broker with high leverage (1:2000) and access to MetaTrader platforms. Its WikiFX Score of 6.09 suggests a legitimate foundation, yet the “Poor” trading environment rating (Grade D) and specific regulatory flags (FSCA exceeded scope, CySEC unverified) warrant caution.

Most concerning are the recent user reports detailing profit cancellations and withdrawal blockers involving substantial sums. Traders should exercise high caution regarding liquidity and internal policy enforcement.

To stay safe and view the latest regulatory certificates, check XS on the WikiFX App.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

Warning: VexPro Withdrawal Complaints

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

FXPN Review 2026: Is This Forex Broker Safe?

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

Rate Calc