GLOBAL GOLD & CURRENCY CORPORATION Exposure: User Complaints on Heavy Slippage & Spreads

Abstract:Did you face massive slippage on the GLOBAL GOLD & CURRENCY CORPORATION trading platform and the subsequent reduction in profits? Did the broker apply a stop-loss when you were in profit? Does the high spread only add to your trading losses? Has the broker blocked your trading account and run away with your funds? You are not alone! Many traders have highlighted their painful trading experiences with the Saint Lucia-based forex broker. In this GLOBAL GOLD & CURRENCY CORPORATION review article, we have explained some of them. Read on!

Did you face massive slippage on the GLOBAL GOLD & CURRENCY CORPORATION trading platform and the subsequent reduction in profits? Did the broker apply a stop-loss when you were in profit? Does the high spread only add to your trading losses? Has the broker blocked your trading account and run away with your funds? You are not alone! Many traders have highlighted their painful trading experiences with the Saint Lucia-based forex broker. In this GLOBAL GOLD & CURRENCY CORPORATION review article, we have explained some of them. Read on!

Top Forex Trading Complaints Against GLOBAL GOLD & CURRENCY CORPORATION

Investigating a Series of Slippage Complaints Against GLOBAL GOLD & CURRENCY CORPORATION

The GGCC, abbreviated for GLOBAL GOLD & CURRENCY CORPORATION, is accused of causing heavy losses to traders through slippage on the trading platform. According to traders, orders are executed way below the target price. Some traders also complain about the triggering of stop-loss orders even when profits were visible on the GLOBAL GOLD & CURRENCY CORPORATION login. Due to slippage quickly eroding their gains, multiple traders have shared their bad trading experiences online. Take a look at them.

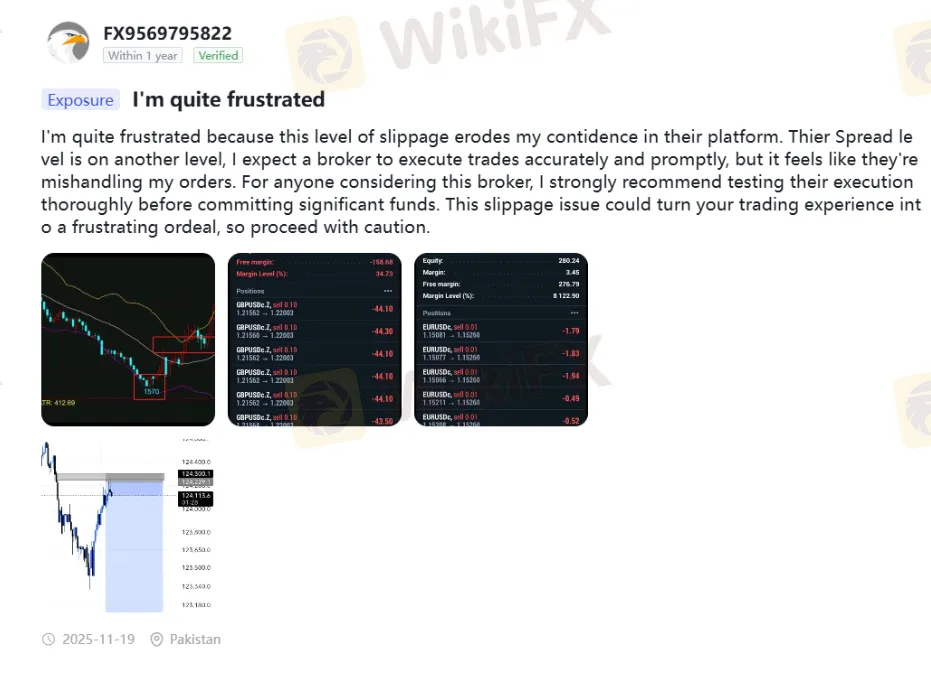

The High Spread Allegation Highlighted in GGCCFX Reviews

While slippage is an issue affecting traders regularly at GGCC, the high spread charged by the broker does not help them either. Trading costs are alleged to be blown out of proportion, leaving traders with significant losses or a massive reduction in profits. The screenshot below captures the essence of a trader who has almost given up on GLOBAL GOLD & CURRENCY CORPORATION. Take a look!

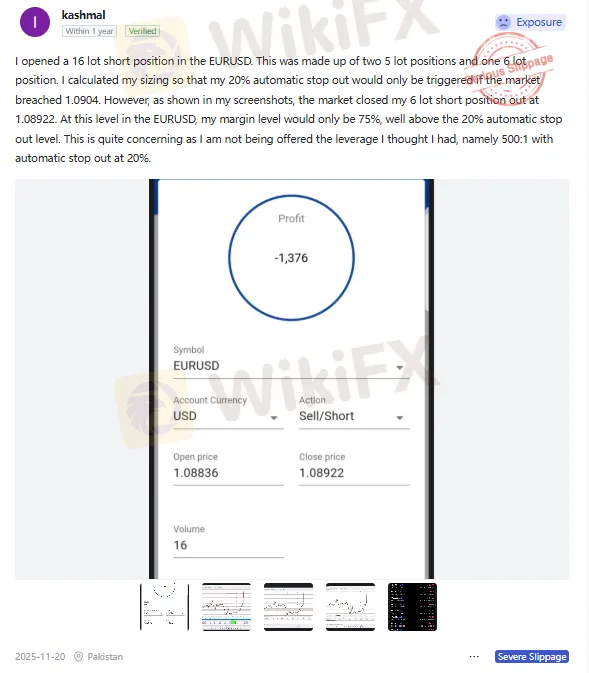

Premature Stop Out Despite Margin Level Well Past Threshold

A trader stated to have opened a 16-lot short position on EUR/USD into two 5-lot trades and a single 6-lot trade. Along with that, the position size was made to ensure the triggering of the stop-out order only when the price reached 1.0904. However, as per the attached screenshots below, GLOBAL GOLD & CURRENCY CORPORATION seems to have closed the position early at 1.08922. The trader claimed to have the margin at 75% at this level, which was way above the 20% stop-out threshold. Viewed this as a suspicious trading activity, the trader shared a sharp GLOBAL GOLD & CURRENCY CORPORATION review online. Check below to know more.

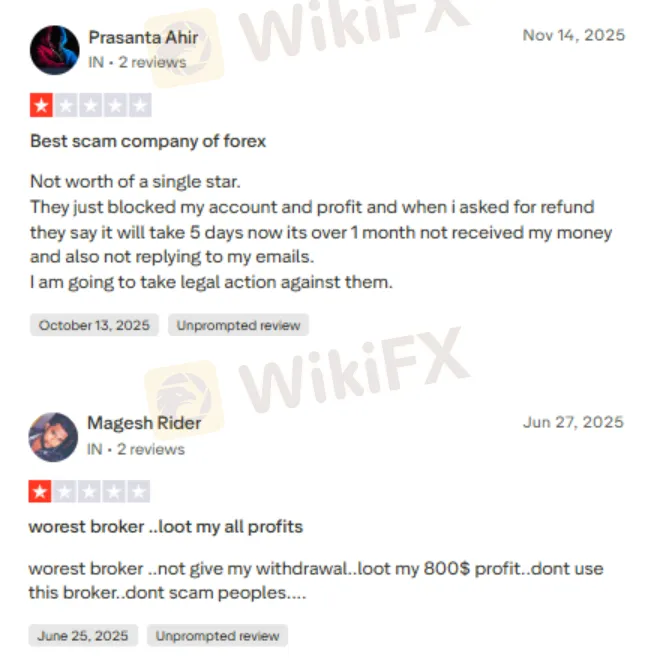

The Expected Profit Withdrawal Issue at GLOBAL GOLD & CURRENCY CORPORATION

Yes, a broker with severe allegations of slippage and spread, discussed above, will likely make it more difficult for traders by blocking their fund withdrawal access. Multiple traders have raised this complaint online. Let us share some GLOBAL GOLD & CURRENCY CORPORATION reviews on poor withdrawals.

GLOBAL GOLD & CURRENCY CORPORATION Review by WikiFX: Check the Broker‘s Regulatory Status

Traders were visibly frustrated after witnessing several instances of trading chaos at GLOBAL GOLD & CURRENCY CORPORATION. After carefully examining the complaints, the WikiFX team investigated the broker’s regulatory status to find out that it was an unregulated entity despite operating for more than two years. With no license, the broker could only merit a score of 1.91 out of 10 from WikiFX.

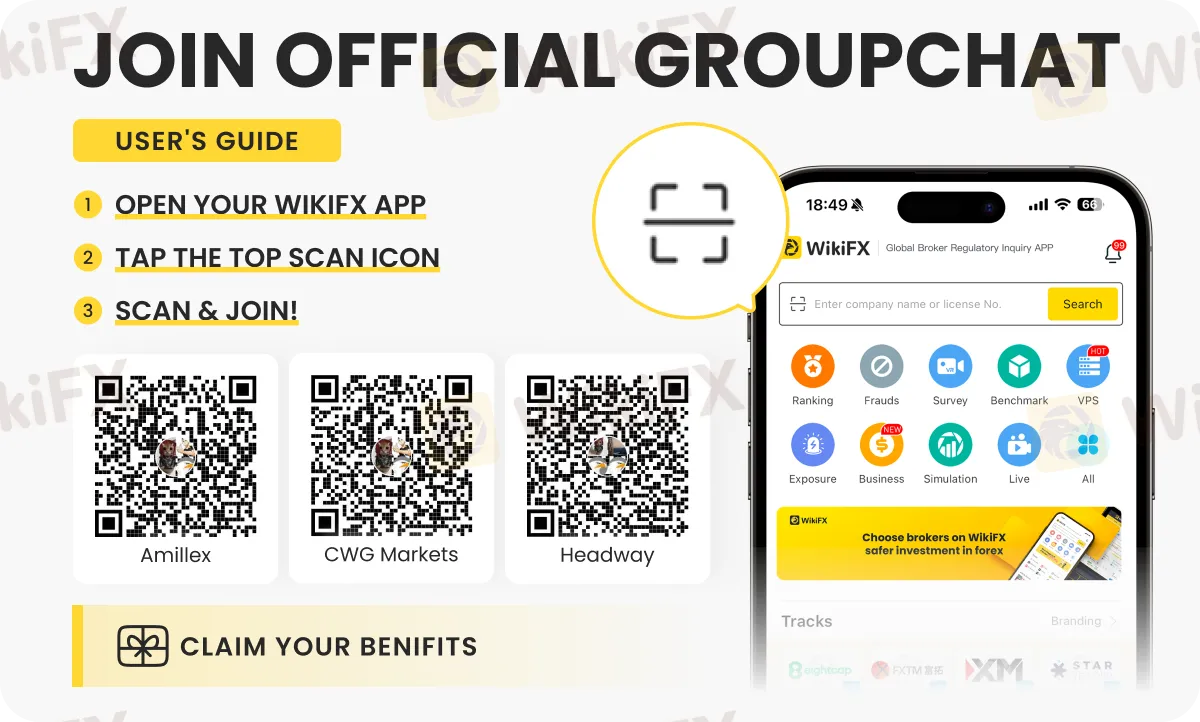

Start exploring forex updates, insights and strategies on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Read more

Mazi Finance Comprehensive Review: A Deep Look into Trader Warnings and Risks

Mazi Finance is a trading company registered in Saint Lucia, an offshore location. Recently, it has received a lot of attention in the trading world. The company shows off many modern trading features, but when we look closer, we find many potential dangers. Before any trader thinks about opening an account, they need to understand the most important finding from our research: Mazi Finance does not have proper regulation. This single fact creates major warning signs about whether client capital is safe.

Pemaxx User Reputation: Looking at Real User Reviews to Check If It's Trustworthy

When you look for information about a forex broker, you often find a confusing mix of great reviews and serious warnings. This is especially true for Pemaxx, where traders have one main question: Is Pemaxx Safe or Scam? The internet has many different user experiences, making it hard to know what's true. This article won't give you a simple yes or no answer. Instead, we'll do an objective, fact-based study to help you make a smart choice. We'll look at the available information, focusing on real user reviews, common Pemaxx Complaints, and whether it follows proper regulations. By looking at patterns in both good and bad reports, we want to give you a clear picture of the risks and warning signs with this broker, helping you protect your capital.

Pemaxx Regulatory Status: A Complete Guide to Licenses and Trading Risks

The regulatory status of Pemaxx is a major concern for traders. When you search online, you can find the broker claiming to be regulated, but financial watchdog sites show serious warnings and user complaints. This creates a confusing and potentially risky situation for anyone considering an investment. The goal of this analysis is to clear up the confusion. We will examine the available information, explain the facts about the Pemaxx License status, and look at the risks for traders.

HFM Scam Warning: Withdrawal Complaints Surge

HFM users report withdrawal delays and missing funds. Read verified scam complaints, check regulatory info, and report your HFM case now.

WikiFX Broker

Latest News

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Gold Defends $5,000 Level as Geopolitical Tension Disrupts Risk Appetite

'Takaichi Trade' Propels Nikkei to 57,000; Yuan Surges to Multi-Year High

GLOBAL GOLD & CURRENCY CORPORATION Review (2026): Serious User Problems and Warnings

GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

Accountant Loses RM460,888 to PFOU Syndicate’s UVKXE App Crypto Scheme

Global Capital Rotation Batters Greenback; USD/JPY Pierces 156

Rate Calc