Morfin FX Fraud: Forex Trading Scam Alert

Abstract:Morfin FX denies withdrawals, citing fake LP issues and scalping policy violations, despite 5+ min holds. Unregulated scam broker blocks Indian accounts. Check WikiFX now and report!

Morfin FX is an unregulated forex broker accused of blocking withdrawals and using fake liquidity provider (LP) excuses, making it a high‑risk forex trading scam for Indian traders and global investors. Its weak offshore registration, low safety scores, and serious user complaints indicate that Morfin FX fits the pattern of a dangerous forex investment scam rather than a trustworthy broker.

Morfin FX Fraud: Forex Trading Scam Alert

Morfin FX presents itself as a multi‑asset trading platform offering forex, commodities, indices, shares, and cryptocurrencies via MetaTrader 5, but it operates without any credible financial regulation. The broker is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient oversight and explicit refusal to supervise forex brokers, which leaves traders funds completely exposed.

Several complaint cases show a consistent pattern: once clients deposit and start trading, Morfin FX becomes uncooperative when larger profits or withdrawals are involved, which is a classic hallmark of many forex scams. Indian investors in particular should treat this broker as a scam alert and verify all details through independent sources, such as the WikiFX App, before risking any money.

Unregulated Status and Fake SVG “License”

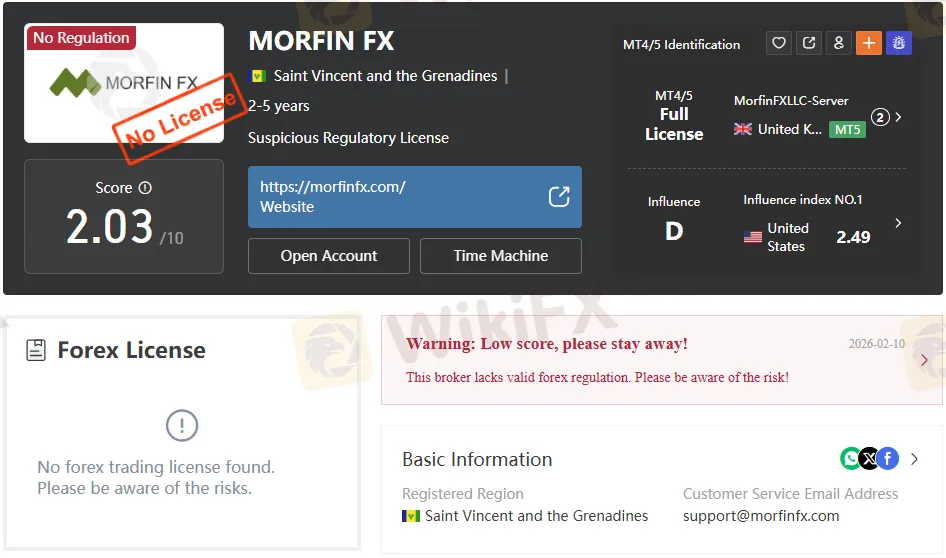

Morfin FX claims registration with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines under a company number, but this does not constitute genuine forex regulation or investor protection. The SVG regulator itself has publicly stated that it does not issue or supervise licenses for forex or CFD brokers, meaning firms like Morfin FX operate without meaningful oversight despite presenting an offshore license number.

This gap allows Morfin FX to advertise services globally while avoiding strict rules on client fund segregation, capital adequacy, and dispute resolution that top‑tier regulators (FCA, ASIC, BaFin, etc.) enforce. For retail traders, “no regulation” effectively means no legal recourse if the broker withholds withdrawals, manipulates trades, or simply disappears with client deposits, which aligns with many reported patterns of forex trading scams.

Withdrawal Denials, LP Excuses, and Account Blocking

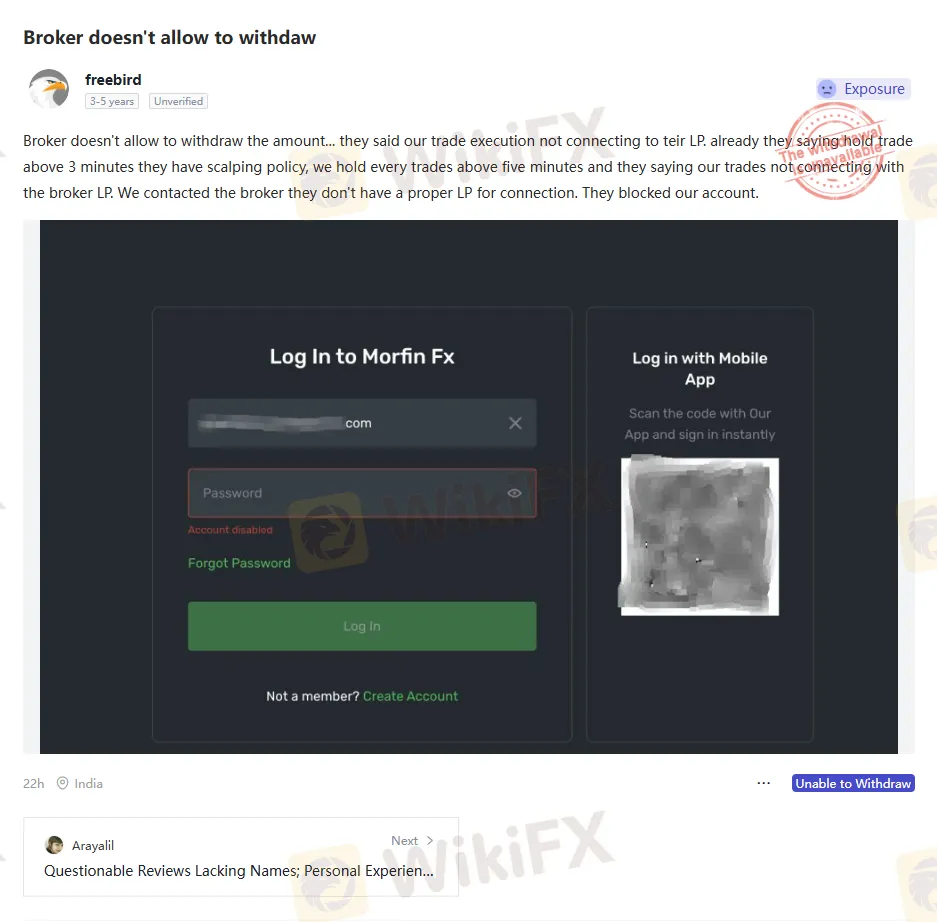

One reported case describes a trader whose withdrawals were refused even though trades were reportedly held for more than five minutes, well beyond any alleged scalping activity. Morfin FX allegedly claimed that “trade execution was not connecting to their LP” and insisted that positions violated a scalping policy, despite the trader explicitly holding each trade for more than 5 minutes.

When the client contacted the broker, they found that Morfin FX did not appear to have a proper liquidity provider connection in place. Instead of resolving the issue, the broker simply blocked the trading account and kept the funds locked. In other complaints, users report that Morfin FX initially processes small withdrawals to build trust, then rejects larger withdrawals or requests “extra deposits” under the guise of taxes or fees, a classic forex investment scam manoeuvre.

Risk Factors and Red Flags for Indian Traders

Several key red flags make Morfin FX extremely dangerous for Indian traders looking for forex or CFD exposure:

- Unregulated status: No valid license from any recognized financial authority, only an offshore registration in Saint Vincent and the Grenadines.

- Weak safety scores: Independent broker information platforms assign Morfin FX a very low safety score of around 2/10, indicating a high risk of fund loss or abuse.

- Offshore structure: SVGs FSA does not regulate forex activity, so Indian traders have no serious regulator to complain to if withdrawals are denied.

- Withdrawal abuse: Reports of blocked accounts, unprocessed withdrawals, and fabricated rule violations (such as scalping or LP connection issues) are consistent with classic forex scams.

- Transparency issues: Limited information on real ownership, management, detailed fee structures, and clear account conditions make it hard to verify who really controls client money.

For anyone in India searching for terms like “forex scams,” “forex trading scam,” or “forex investment scam,” Morfin FX should be treated as a strong red flag case study rather than a viable trading option.

Brief Broker Review: Why Morfin FX Attracts Victims

On the surface, Morfin FX tries to appear attractive by offering multiple markets (forex, commodities, indices, cryptos, shares) and access via the popular MT5 platform, sometimes promoting zero‑commission trading and flexible account options. These features can easily mislead beginners who compare only spreads and platforms while ignoring the brokers regulatory status and withdrawal reputation.

However, the lack of transparent regulation, unclear conditions on leverage, fees, and account types, and the absence of credible negative‑balance or fund‑protection mechanisms make these “benefits” meaningless in practice. A professional broker review that weighs pros and cons concludes that any advantages Morfin FX claims are overshadowed by its unregulated status and numerous scam‑like complaints, which is why it is widely categorized as unsafe.

How to Protect Yourself and Use the WikiFX App

If you are already involved with Morfin FX and are facing withdrawal issues, immediately stop depositing additional funds and document all communication, transaction receipts, and account screenshots as evidence. You should then submit a detailed complaint through tools like the WikiFX App, which aggregates broker data, user reports, and regulatory information so more traders can see the exposure and treat Morfin FX as a scam.

Before opening any new forex trading account, search the brokers name and license on the WikiFX App at least two or three times during your research process to check scores, regulatory details, and existing scam reports. For Indian traders in particular, always prioritize brokers regulated by recognized authorities and cross‑check any “license number” claims; if an offshore broker like Morfin FX is unregulated or has a very low WikiFX score, treat it as a forex scam risk and avoid depositing altogether.

Read more

Diago Finance Exposure: Examining Withdrawal Denial & Fund Scam Complaints

Did you find a contrasting difference between Diago Finance’s deposit and withdrawal processes? Were deposits seamless, but withdrawals remained difficult? Did you fail to receive your funds despite paying extra fees? Did the Saint Lucia-based forex broker scam your hard-earned capital? You are not alone! Many traders have expressed concerns over the alleged illegitimate trading activities carried out by the broker. In this Diago Finance review article, we have investigated some complaints against the broker. Take a look!

FirewoodFX Review: Investigating Complaints Concerning Bonus & Withdrawals

Thinking about investing in FirewoodFX? Attracted by its no-deposit bonus offers? Stop for a while and evaluate many of the complaints concerning FirewoodFX bonus, verification, withdrawal denials, fund scams, etc. These alleged issues have grabbed significant traction on broker review platforms. In this FirewoodFX review article, we have investigated all of these allegations, shared bonus promotions claimed by the forex broker, and explained its regulatory status. Keep reading!

Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc