SD GLOBAL

บทคัดย่อ:SD GLOBAL is an unregulated brokerage company registered in Belize. While the broker's official website has been closed, so traders cannot obtain more security information.

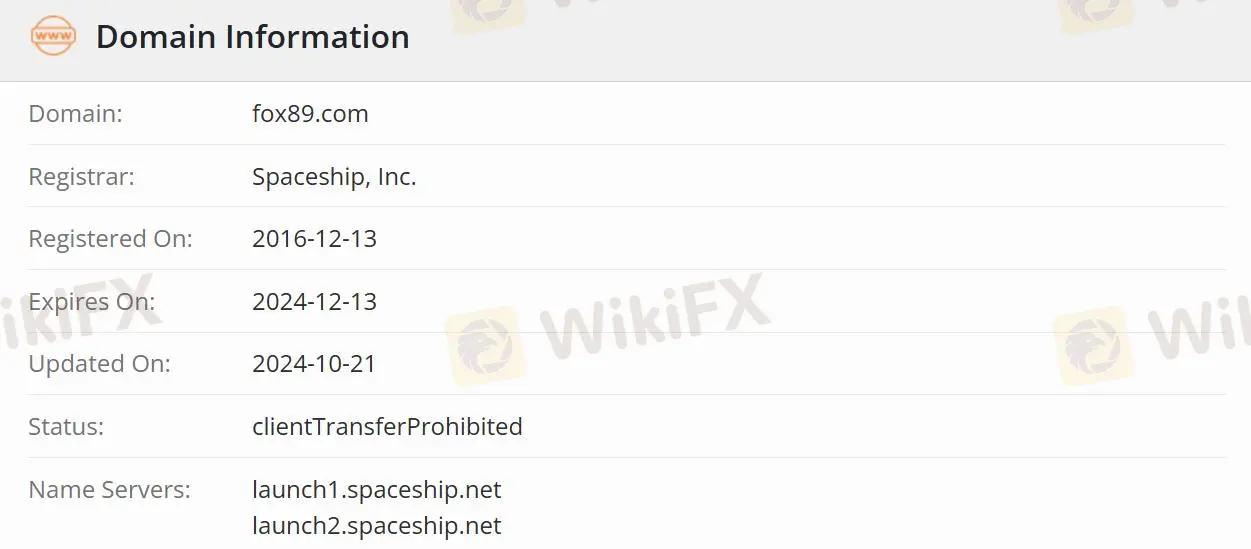

Note: SD GLOBAL's official website: https://www.fox89.com/ is currently inaccessible normally.

SD GLOBAL Information

SD GLOBAL is an unregulated brokerage company registered in Belize. While the broker's official website has been closed, so traders cannot obtain more security information.

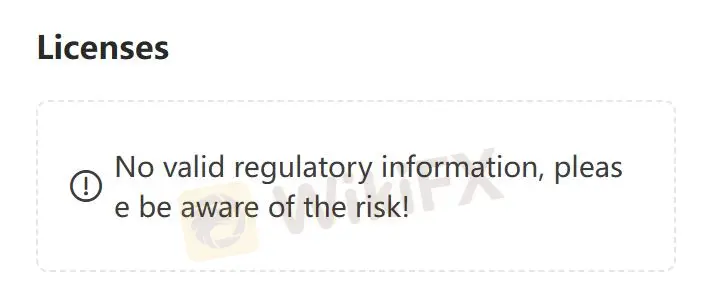

Is SD GLOBAL Legit?

SD GLOBAL is not regulated, which will increase trading non-compliance and reduce traders investment security. Caution is advised when dealing with SD GLOBAL.

Downsides of SD GLOBAL

- Unavailable Website

SD GLOBAL's official website is currently inaccessible, raising concerns about its reliability and accessibility.

- Lack of Transparency

Since SD GLOBAL does not explain more transaction information, especially regarding fees and services, this will bring huge risks and reduce transaction security.

- Regulatory Concerns

SD GLOBAL is not regulated, which is less safe than a regulated one.

Conclusion

SD GLOBAL Since the official website cannot be opened, traders cannot get more information about security services. In addition, the unregulated status indicates that this brokers trading risks are high. It is advisable to choose regulated brokers with transparent operations to ensure the safety of your investments and compliance with legal standards. Traders can learn more about other brokers through WikiFX. Information improves transaction security.

Wiki โบรกเกอร์

ข่าวล่าสุด

ศาลสั่งจำคุก 2 ปี 9 เดือน “มนัส บุญจำนงค์” คดีฉ้อโกงโควตาหวย บทเรียนราคาแพงของอดีตฮีโร่

เสียงจากคณะกรรมการรางวัล Golden Insight Award | เดนนิส เยห์ หัวหน้าภูมิภาคเอเชียแปซิฟิก แห่ง Taurex

ฝันร้ายหลักหมื่นล้าน! ย้อนรอยคดีแฮกคริปโตครั้งประวัติศาสตร์ 25,000 BTC ที่ไม่มีวันได้คืน

เทรดกำไรแต่พอร์ตพัง? ปัญหาที่แท้จริงอาจอยู่ที่ Margin Level

ใช้ EA เทรด Forex ดีไหม สำหรับมือใหม่ หรือเหมาะกับคนมีประสบการณ์มากกว่า

Day Trade vs Swing Trade ต่างกันตรงไหน และแบบไหนเหมาะกับคุณ

โบรกเกอร์ดีวัดจากอะไร? มองการเลือกโบรกเกอร์ในมุมเทรดเดอร์อาชีพ

กำไรล้านแรกของ Day Trader ไม่ได้มาจากความเก่ง แล้วมาจากอะไรต้องอ่าน!

แฮกเกอร์เกาหลีเหนือโกยคริปโทฯ 2 พันล้านดอลลาร์ในปีเดียว! ความเสี่ยงที่นักเทรดมักประมาท

กลยุทธ์มาก่อน อินดิเคเตอร์มาทีหลัง—กฎเหล็กของการเทรดที่คนมองข้าม

คำนวณอัตราแลกเปลี่ยน