Uniglobe Markets Review 2025: A Safe Broker or a High-Risk Scam?

Abstract:When looking at a broker, the most important question is always about safety: "Is Uniglobe Markets Safe Or Scam?" After carefully studying how it operates and its regulatory status, the answer is clear. Uniglobe Markets works without any proper financial regulation from a trusted authority. This fact alone is the biggest warning sign for any potential investor. This lack of oversight gets worse when you add the multiple official warnings from financial regulators across Europe and a pattern of serious problems reported by users, especially with withdrawals. This review will give you a detailed, fact-based look at these important points, breaking down what the broker offers and the risks involved to help you make a smart decision.

Answering the Main Question

When looking at a broker, the most important question is always about safety: “Is Uniglobe Markets Safe Or Scam?” After carefully studying how it operates and its regulatory status, the answer is clear. Uniglobe Markets works without any proper financial regulation from a trusted authority. This fact alone is the biggest warning sign for any potential investor. This lack of oversight gets worse when you add the multiple official warnings from financial regulators across Europe and a pattern of serious problems reported by users, especially with withdrawals. This review will give you a detailed, fact-based look at these important points, breaking down what the broker offers and the risks involved to help you make a smart decision.

Company Profile and Regulation

To understand the risks with Uniglobe Markets, we need to first look at how the company is set up and, most importantly, its regulatory standing. This section shows the basic facts about the broker's identity and the official attention it has received.

Broker Overview

Looking at the broker's details gives us context of how it operates. The following information has been put together for a clear overview.

· Company Name: Uniglobe Markets Ltd

· Founded: 2014 (Operating for 5-10 years)

· Registered Region: United Kingdom (Note: Registration is not the same as regulation)

· Stated Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia.

The Major Regulatory Problem

Uniglobe Markets does not have a valid regulatory license from any major, recognized financial authority. For a trader, this means there is no safety net. The absence of regulation means:

· No access to investor compensation funds if the broker goes bankrupt.

· No required oversight of the broker's business practices, including keeping client funds separate.

· No formal, legally binding dispute resolution process if you have problems.

Working with an unregulated broker creates a high risk to your capital, as you are trusting your funds to a company that operates outside the established system of financial protection.

Official Authority Warnings

The lack of regulation is not just a passive problem; Uniglobe Markets has been actively flagged by several global financial authorities. These official warnings serve as direct advice to the public about the risks of dealing with this company.

· Spain (CNMV): On February 10, 2020, the Comisión Nacional del Mercado de Valores (CNMV) issued a public warning against Uniglobe Markets for providing investment services without the necessary authorization.

· France (AMF): On February 27, 2020, the Autorité des Marchés Financiers (AMF) added Uniglobe Markets to its blacklist of unauthorized companies and websites offering forex investments.

· Cyprus (CYSEC): The Cyprus Securities and Exchange Commission (CYSEC) has included the broker in public warnings about unregulated entities on at least two occasions: October 26, 2023, and August 14, 2025.

These repeated warnings from different national regulators form a clear and consistent pattern, strengthening the conclusion that this broker operates outside of legal financial frameworks.

Trading Conditions Offered

Despite the serious regulatory concerns, it is useful to objectively review what Uniglobe Markets offers. Understanding the platform's features, account structure, and available instruments helps explain what might attract traders, allowing for a balanced assessment against the documented risks.

Accounts and Minimum Deposits

The broker offers a tiered account structure, catering to different deposit levels. While this provides flexibility, the minimum deposits for ECN accounts are relatively standard for the industry.

| Account Type | Minimum Deposit | Maximum Leverage |

| Micro | $100 | 1:500 |

| Uniglobe Premium | $500 | 1:300 |

| ECN | $1,000 | 1:200 |

| ECN Elite | $10,000 | 1:100 |

| Uniglobe VIP | $50,000 | 1:100 |

Leverage and Associated Risks

Uniglobe Markets offers high leverage, reaching up to 1:500 on its Micro account. While this can be a powerful tool for increasing potential gains, it carries an equal, if not greater, potential to increase losses. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favor and against you. Regulated brokers in major areas, such as the EU, UK and Australia, are typically restricted from offering such high leverage to retail clients due to the inherent risks.

Tradable Instruments

The broker provides access to a conventional range of CFD instruments. However, it notably lacks offerings in some popular modern asset classes. The following information on available instruments is for reference purposes.

· Available: Forex, Stock CFDs, Indices, Metals, Commodities, Cryptocurrencies

· Not Available: Bonds, Options, ETFs.

Trading Platforms

A significant positive feature is the broker's support for the industry-standard MetaTrader platforms.

· MT4 (MetaTrader 4): Widely regarded for its user-friendly interface and extensive ecosystem of automated trading tools (Expert Advisors), it is a favorite among beginner and intermediate traders.

· MT5 (MetaTrader 5): The successor to MT4, offering more advanced charting tools, additional timeframes, and access to a wider range of markets, though the instrument list at Uniglobe Markets remains limited.

The availability of these trusted third-party platforms means traders have access to a reliable and familiar trading environment, separate from the broker's questionable operational integrity.

Analysis of Red Flags

Beyond the primary issue of non-regulation, a deeper analysis reveals a cluster of red flags and user-reported problems. This section brings together these concerns to provide a complete view of the operational risks and real-world consequences reported by those who have used the platform.

User Complaint Summary

Many reports from traders paint a troubling picture of the broker's practices. These are not isolated incidents but recurring themes that point to systematic problems. The most common complaints include:

· Withdrawal Denials: This is the most frequently cited and most serious issue. Traders report that when they attempt to withdraw funds, especially profits, they are met with a variety of excuses, long delays, or outright refusal.

· High Slippage: Users have reported experiencing consistent and significant slippage on their trades. Slippage is the difference between the expected price of a trade and the price at which the trade is actually executed. While some slippage is normal in volatile markets, consistently negative slippage can systematically drain profits and equity.

· Account Blockage: Some traders have claimed their accounts were blocked or frozen without clear justification, preventing them from accessing their funds or closing positions.

These recurring problems have led many traders to conclude that the platform's operational model may be designed to keep client funds unfairly.

Associated Company Red Flag

An investigation into the company's structure reveals a connection to an entity named UNI SMART SOLUTIONS LTD, registered in the United Kingdom. Public records show that this related company's status is “Deregistered.” A deregistered or dissolved associated company is a significant warning sign. It raises serious questions about the overall financial stability, longevity, and legitimacy of the entire operation connected to Uniglobe Markets.

Aggressive Bonus Promotions

Uniglobe Markets heavily promotes a variety of aggressive bonus schemes, including a “100% Deposit Bonus,” a “200% Deposit Bonus,” and a “Refer a Friend” program. While these offers seem attractive on the surface, they are a classic tactic used by unregulated brokers. These complex bonus terms often come with strict, difficult-to-meet trading volume requirements that effectively lock client funds into the platform, making withdrawals nearly impossible until the conditions are met. Such promotions are designed to encourage larger initial deposits and prevent traders from pulling out their capital. For the most current alerts and user feedback on broker promotions and practices, it's always wise to check for detailed profiles on a comprehensive platform such as WikiFX.

Deposits and Support

Understanding the practical logistics of funding an account and seeking assistance is important for any trader. This section provides a factual overview of the payment methods and customer support channels offered by Uniglobe Markets.

Payment Methods and Fees

The broker supports a range of common online payment processors, offering convenience for deposits. The listed methods include:

· Neteller

· Skrill

· Bank Wire

· VISA

· Cashiu

· OK Pay

· Perfect Money

The company claims that it does not charge any fees for deposits or withdrawals. However, given the user-reported issues with withdrawals, this claim should be treated with caution. Traders should always verify potential hidden fees or stringent conditions associated with payments.

Customer Support Channels

Uniglobe Markets offers multiple ways for customer contact, operating on a 24/5 basis, which is standard for the forex industry. The availability of multiple channels assures a professional support structure.

· Support Availability: 24/5

· Methods: Live Chat, Contact Form

· Phone: +44 2035040120

· Email: info@uniglobemarkets.com

· Social Media: The broker maintains a presence on Facebook, LinkedIn, Twitter, WhatsApp, Threads, YouTube, and Telegram.

While the presence of these channels is noted, their effectiveness in resolving serious issues, such as withdrawal denials, is highly questionable based on user reports.

Final Verdict on Safety

So, is Uniglobe Markets a safe choice for traders in 2025? After weighing the evidence, the conclusion is clear.

On one hand, the broker presents an attractive facade. It offers a wide range of account types, access to the popular MT4 and MT5 platforms, and the appeal of high leverage. These are features designed to appeal to both new and experienced traders looking for flexibility and powerful trading tools.

However, these offerings are completely overshadowed by an overwhelming amount of evidence pointing to extreme risk. To make an informed decision, consider these unavoidable facts:

· Fact: The broker holds no valid regulatory license from any reputable financial authority. This is the most critical factor and a non-negotiable red flag for safety.

· Fact: It has been officially blacklisted and warned against by financial regulators in Spain, France, and Cyprus.

· Fact: A related corporate entity, UNI SMART SOLUTIONS LTD, is officially “Deregistered,” indicating potential instability and a lack of corporate legitimacy.

· Reports: There is a significant volume of user complaints centered on fundamental operational failures, most notably the denial of withdrawal requests.

While Uniglobe Markets operates a functional trading platform, it does so with a level of risk that is exceptionally high. The combination of no regulation, official government warnings, and widespread user complaints about fund withdrawals means it exhibits the primary characteristics of an unsafe and potentially fraudulent operation. The risks associated with depositing funds far outweigh the benefits of its trading features.

*Disclaimer: The information presented in this article is for informational purposes only and is based on data available at the time of writing. Financial markets and broker statuses can change. We are not providing financial advice.*

Before making any financial decisions, we strongly encourage traders to conduct their own due diligence. This can include reviewing up-to-date broker information and user reviews on independent platforms, such as WikiFX, to get the most updated broker's status.

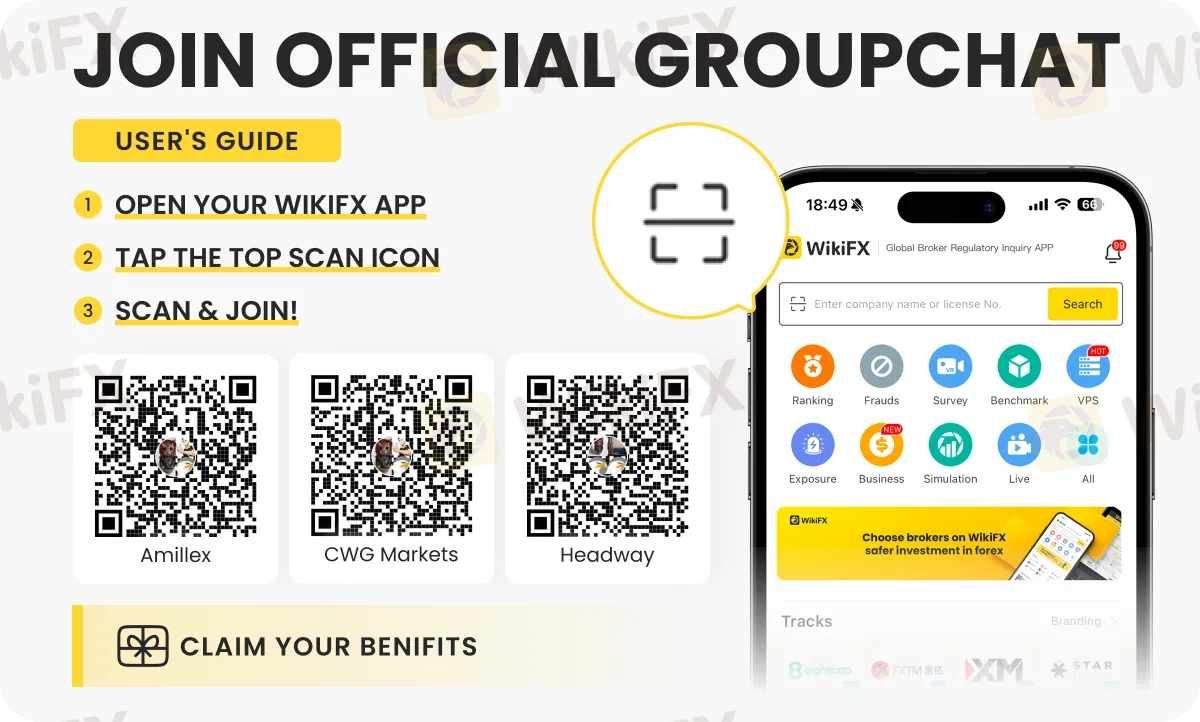

To know the latest on Uniglobe Markets and other forex brokers, we have dedicated chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join any of these by following the instructions shown in the image below.

Read more

CMS Prime Review: Traders Report Withdrawal Blocks, Fund Scams & Unprofessional Support

Is your CMS Prime forex trading experience financially distressing? Does the broker constantly deny you to withdraw your funds? Has the broker defaulted on swap charges? Has the CMS Prime scammed you at every stage of your forex journey with it? Do you also have to witness unprofessional behavior from the broker officials? Well, these trading issues have become headlines on the CMS Prime broker’s review platforms. We have shared some complaints in this CMS Prime review article. Read on!

BingX Review: Traders Angry Over Withdrawal Denials, Account Blocks & More

Are BingX officials with you when you lose your trade? Do these officials apply restrictions on withdrawals as you earn profits? Do you lose access to BingX com login after earning profits? Does the US-based forex broker block your trading account in such situations? Failing to get key trading data access from the broker? These issues have been affecting many traders at BingX. In this BingX review article, we have shared some complaints. Take a look!

TD Markets Exposed: Price Manipulation, Withdrawal Issues & False Promises Hurt Traders

Is your winning trade converted into a loss upon closing it at TD Markets due to heavy price manipulation? Is withdrawing funds too much of a hassle at this South Africa-based forex broker? Does even the customer support fail to respond to your withdrawal requests? Have you been defrauded on the promise of zero commission upon withdrawal? Have you failed to close the trade due to the systemic issue at TD Markets? You are not alone! Many traders have commented while sharing the negative TD Markets review. We have shared some of them in this article. Take a look!

B2PRIME Retail Brings Pro-Level Trading to Everyone

B2PRIME unveils B2PRIME Retail, delivering pro-level execution and transparent pricing to retail traders with institutional-grade tech and multi-asset offerings.

WikiFX Broker

Latest News

Private payrolls rose 42,000 in October, more than expected and countering labor market fears, ADP says

Yields Rise, Rate-Cut Odds Slide As ISM Services Survey Signal Inflation Fears

Op-ed: The fuel for the AI boom driving the markets is advertising. It is also an existential risk.

Stonefort Broker Review 2025: Legit or Risky? A Complete Analysis

The United States Outgrows All Its Major Peers

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

PINAKINE Broker Review: A Complete Look at Its Services and Risks

Voices of the Golden Insight Award Jury - Simon So, Chief Experience Officer of Hantec Financial

Seychelles FSA Flags Clone Website Impersonating Admiral Markets

Canary Wharf Address Scam Resurfaces: FCA Exposes 20+ Clone Template Forex Platforms

Rate Calc