Stonefort Broker Review 2025: Legit or Risky? A Complete Analysis

Abstract:When choosing a new broker, the most important question every trader must ask is: “Is this broker safe and trustworthy?” This question becomes especially crucial when discussing Stonefort, a name that has recently gained attention in trading communities. Many traders are seeking a clear answer about “Stonefort Broker Legit” status before investing their money.

When choosing a new broker, the most important question every trader must ask is: “Is this broker safe and trustworthy?”

This question becomes especially crucial when discussing Stonefort, a name that has recently gained attention in trading communities. Many traders are seeking a clear answer about “Stonefort Broker Legit” status before investing their money.

This article provides an objective and in-depth analysis of Stonefort. We dont rely on claims — we focus on facts, covering regulation status, security scores, trading conditions, and user feedback. The goal is to give you a complete, factual foundation to make an informed decision.

Our initial findings already raise red flags concerning licensing and low safety scores, indicating significant risks that potential investors must be aware of. Lets explore each aspect in detail.

Broker Profile and Identity

Understanding who stands behind a trading platform is the first critical step. Structured company information helps form a baseline for evaluating legitimacy.

Company Details

| Information | Description |

| Company Name | Stonefort Securities Limited / Stonefort Securities LLC |

| Registered Jurisdiction | Saint Lucia |

| Operating Period | Estimated 1–2 years |

| Registered Address | 11th floor, Bramer House, Hotel Avenue, Ebene, Cybercity, Mauritius |

| Contact Email | support@stonefortsecurities.com |

| Phone Number | +971 43656600 (UAE country code) |

One concerning observation is the geographical inconsistency — registered in Saint Lucia, physical address in Mauritius, and phone number from the UAE. Such discrepancies highlight the importance of verifying every corporate claim independently. To confirm official company data, traders should check verified broker analysis databases.

Regulatory and Licensing Analysis

Regulation and licensing are the most crucial factors in determining whether a broker is trustworthy — they serve as the primary protection for traders funds. Unfortunately, this is where Stonefort shows its most fundamental weakness.

Low Safety Rating and Warnings

Overall, the broker has received an extremely low safety score, accompanied by a clear warning:

⚠️Warning: Low score — stay away!

Such a strong alert is rarely issued without solid justification. It indicates serious issues in Stonefort‘s operational or compliance structure that could threaten clients’ funds.

License Investigation

According to available records, Stonefort Securities LLC is listed as holding a license from the Securities and Commodities Authority (SCA) of the United Arab Emirates, license number 20200000226, valid until November 4, 2025. At first glance, having a license from the SCA might seem reassuring — but the details tell a very different story.

Operating Beyond Licensed Scope

The key issue lies in the type of license: Stonefort holds an Investment Advisory License, not a brokerage license. This distinction is critical. An Investment Advisory License allows a company to provide financial and investment advice, but it does not authorize the company to: Accept or manage client funds for trading Offer leveraged trading Act as a counterparty in forex or CFD transactions . In short, Stonefort operates outside the scope of its approved license, offering forex and CFD services without proper authorization — a serious compliance breach.

Do Not Miss this Article- Stonefort No Deposit Bonus: What Traders Must Know Before Signing Up- www.wikifx.com/en/newsdetail/202511063864366869.html

What This Means for Traders

The implications are serious and practical:

No Regulatory Protection:

Since Stonefort‘s forex operations fall outside SCA’s licensed scope, client funds are not covered by compensation or investor protection schemes. You are effectively trading in an unregulated environment.

No Oversight of Trading Practices:

Regulators do not monitor Stoneforts trade execution or client fund handling, leaving the door open to unfair practices or even fraud — with no authority to hold the broker accountable.

Legal Complexity:

If disputes arise, pursuing legal action will be extremely difficult and costly, given Stoneforts multi-jurisdiction setup (registered in Saint Lucia, licensed in UAE, operating from Mauritius).

Understanding license scope and legal coverage is essential — always examine a brokers regulatory details before committing funds.

Trading Conditions and Platform

While regulation remains the biggest red flag, it‘s still important to objectively review Stonefort’s trading environment to understand what traders might encounter.

Account Types and Requirements

| Feature | Starter Account | Advanced Account | Elite Account |

| Minimum Deposit | $10,000 | Not available | Not available |

| Maximum Leverage | 1:200 | Not available | Not available |

| Minimum Spread | From 0.1 pips | Not available | Not available |

| Commission | $7 per lot | Not available | Not available |

A minimum deposit of $10,000 for a “Starter” account is extremely high compared with most regulated brokers, many of which offer accounts starting from $10–$500. Combined with regulatory risks, this steep entry barrier adds further concern.

Trading Platform: MetaTrader 5

Stonefort uses the MetaTrader 5 (MT5) platform with a Full License, not a white label. A full license indicates the broker has its own infrastructure and MT5 server access, typically providing better stability, internal control, and direct MetaQuotes technical support. The use of MT5 is indeed a positive note, as its an advanced and widely trusted platform.

Server Information and Connectivity

Technical data show two main servers:

StonefortSecurities-Server — Mauritius

StonefortSecurities-Demo — Mauritius / Singapore

These locations suggest regional hosting for performance optimization. Actual latency, however, will depend on the traders own network conditions.

Deposit and Withdrawal Methods

Unfortunately, no public details are provided about deposit or withdrawal methods. Both fields appear as “--” in official data — a major transparency issue.

Lack of payment information is a critical red flag. Traders must know exactly how to deposit and withdraw funds before investing. Its strongly advised to request clarification from Stonefort directly before making any deposit.

Reputation and User Reviews

After assessing technical and regulatory data, the next step is user experience. However, this must be interpreted with caution.

Summary of User Reviews

There are 12 user reviews available for Stonefort — all of them positive, with no neutral or negative reviews recorded.

Common Praise Themes

Withdrawal Process:

Many users highlight smooth and fast withdrawals — a major concern for most traders.

Customer Support:

Feedback describes the support team as responsive and professional. Specific names like Hassan and Jack are mentioned for their guidance and helpfulness.

Platform and Execution:

Users praise the MT5 platforms user-friendliness and quick trade execution.

IB Program:

One review mentions the Introducing Broker (IB) program as transparent and reliable, with fast commission payments. One Indonesian reviewer even stated:

“So far most broker problems are withdrawal problems, and so far Stonefort has been very smooth in withdrawals.”

If true, such testimonials are appealing — but they must be treated carefully.

Critical Context: “Unverified” Status

All these reviews are marked as Unverified — meaning no evidence confirms theyre from real traders using real accounts. They could easily be affiliate-generated or part of a marketing campaign. Hence, basing investment decisions on unverifiable testimonials is highly risky. Objective data — regulation, licensing, and transparency — should always outweigh anecdotal claims.

Conclusion: Final Verdict

After examining Stoneforts regulation, trading conditions, and reputation, we can now answer the key question: Is Stonefort Broker Legit?

Summary of Findings

Potential Advantages (with caveats):

Full MT5 license — technically solid trading infrastructure Positive user reviews — mainly highlighting withdrawal speed and support (but unverified)

Major Drawbacks (High Risk):

Extremely low safety score and strong public warnings Operating outside licensed scope — SCA license does not authorize forex/CFD trading Very high minimum deposit ($10,000)

Fragmented company data across Saint Lucia, Mauritius, and UAE Lack of transparency regarding deposit/withdrawal methods

Our Final Recommendation

Based on comprehensive analysis, the answer to “Is Stonefort Broker Legit?” is clear: Investing with this broker carries extremely high risk. The fundamental regulatory problem — operating without a proper forex license — outweighs all potential benefits. Even a strong MT5 platform or positive testimonials cannot compensate for the absence of legal fund protection.

We strongly advise traders — both beginners and professionals — to exercise extreme caution. Always choose brokers with clear, valid, and relevant regulation matching the services they offer. Before investing, verify every detail and review the brokers latest rating and license status to safeguard your funds.

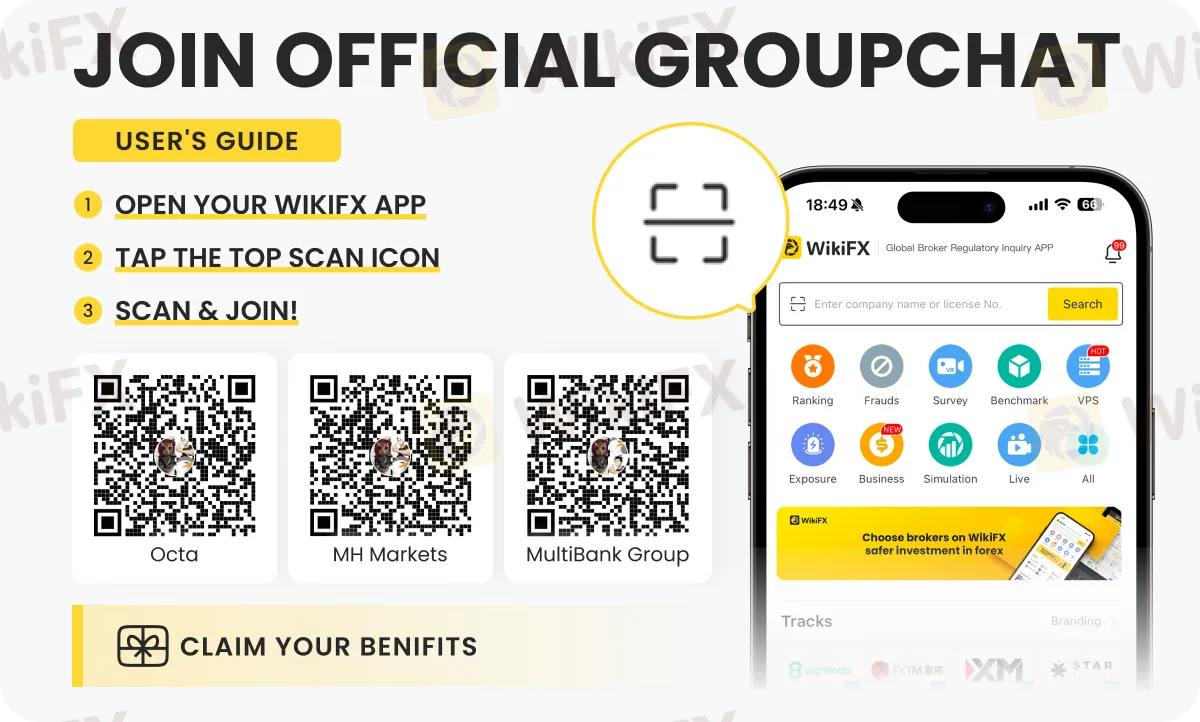

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

Private payrolls rose 42,000 in October, more than expected and countering labor market fears, ADP says

Yields Rise, Rate-Cut Odds Slide As ISM Services Survey Signal Inflation Fears

Op-ed: The fuel for the AI boom driving the markets is advertising. It is also an existential risk.

Stonefort Broker Review 2025: Legit or Risky? A Complete Analysis

The United States Outgrows All Its Major Peers

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

PINAKINE Broker Review: A Complete Look at Its Services and Risks

Voices of the Golden Insight Award Jury - Simon So, Chief Experience Officer of Hantec Financial

Seychelles FSA Flags Clone Website Impersonating Admiral Markets

Canary Wharf Address Scam Resurfaces: FCA Exposes 20+ Clone Template Forex Platforms

Rate Calc