Is Adam Capitals Safe? A Complete Look at Risks, Rules, and User Worries

Abstract:This article gives you a detailed Adam Capitals safety review to answer one important question: Can you trust this broker? To be honest, our research shows that Adam Capitals has a high risk level. The main reason for this judgment is that it's an unregulated broker working from an offshore location, specifically Saint Lucia. This one fact is more important than all other parts of its service. This lack of government oversight is a serious problem that puts client money in danger. Industry ratings show this reality, giving the broker poor scores consistently. Throughout this report, we will carefully break down the proof supporting this conclusion. We will look at its regulatory status (or lack of it), study how it operates, and include real-world user worries to give you a complete understanding of the risks involved when trading through Adam Capitals.

Your Main Safety Question Answered

This article gives you a detailed Adam Capitals safety review to answer one important question: Can you trust this broker? To be honest, our research shows that Adam Capitals has a high risk level. The main reason for this judgment is that it's an unregulated broker working from an offshore location, specifically Saint Lucia. This one fact is more important than all other parts of its service.

This lack of government oversight is a serious problem that puts client money in danger. Industry ratings show this reality, giving the broker poor scores consistently. Throughout this report, we will carefully break down the proof supporting this conclusion. We will look at its regulatory status (or lack of it), study how it operates, and include real-world user worries to give you a complete understanding of the risks involved when trading through Adam Capitals.

Breaking Down Regulatory Warning Signs

The most important factor in any broker safety review is regulation. Good financial oversight is the foundation of trader protection, making sure that a broker follows strict standards of behavior, financial strength, and openness. In the case of Adam Capitals, our investigation into its regulatory standing shows significant reasons for concern.

What No Regulation Means

Our analysis confirms that, as of our latest review in 2025, Adam Capitals has no valid regulatory licenses from any respected, top-level financial authority. This is not a small detail; it is the main part of our risk assessment.

Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), enforce rules that are crucial for client safety. These rules typically require:

· Separated Client Funds: Brokers must keep client capital in accounts separate from the company's operating funds. This protects client capital if the broker goes bankrupt.

· Negative Balance Protection: This ensures that traders cannot lose more than they have put in their accounts.

· Investor Compensation Plans: If a regulated broker fails, these plans can provide some compensation to affected clients, up to a certain limit.

· Fair Practice and Dispute Resolution: Regulators provide a formal way for traders to file complaints and resolve disputes, holding brokers responsible for their actions.

By operating without such a license, Adam Capitals provides none of these basic protections. Traders' funds are not guaranteed to be separated, and there is no official, independent body to turn to for help in case of withdrawal problems, trade disputes, or complete firm failure.

Offshore Registration vs Regulation

Adam Capitals is registered in Saint Lucia. It is important for traders to understand the critical difference between company registration and financial regulation.

> Registering a company in a location like Saint Lucia is a simple paperwork process that creates a legal entity. It does not, in any way, equal being regulated for financial services. The Financial Services Authority (FSA) of Saint Lucia has publicly and clearly stated that it does not regulate, monitor, supervise, or license forex trading or brokerage businesses.

This means the Saint Lucia address—Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia—provides a legal shell and a mailing address, but zero financial oversight. This location is well-known as a haven for offshore companies wanting to operate with minimal checking, which is a major red flag for any financial services provider.

Suspicious License Warnings

The broker is connected with a “Suspicious Regulatory License” warning. This label is used when a broker makes misleading claims about its regulatory status or is linked to a “regulator” that has no actual authority or is not recognized within the global financial industry. This further strengthens the assessment that the broker is not operating under any meaningful oversight. The presence of such a warning indicates a potential attempt to create a false sense of security, reinforcing the high-risk classification. To get a complete and up-to-date understanding of their regulatory status and any new warnings, we advise traders to check the Adam Capitals profile on WikiFX for themselves.

A Framework-Based Review

While the lack of regulation is the most critical issue, a comprehensive Adam Capitals safety assessment requires a deeper look into its operational parts. We will now evaluate its trading platform, company transparency, and stated trading conditions to build a complete risk profile. This framework allows us to see how different aspects of the broker's operations either reduce or increase the primary risk of being unregulated.

The MT5 Double-Edged Sword

Adam Capitals offers its clients the MetaTrader 5 (MT5) platform, and our analysis confirms it operates a full license for this software. On the surface, this appears to be a positive feature. MT5 is a globally recognized, powerful, and stable trading platform known for its advanced charting tools, support for automated trading via Expert Advisors (EAs), and reliable execution. A full license suggests the broker has invested in legitimate technology and has access to proper server support from the platform's developer, MetaQuotes.

However, this is a classic double-edged sword. A sophisticated platform is only as trustworthy as the broker that controls it. While the MT5 technology itself is sound, an unregulated broker has administrative control over the server. This means it could potentially manipulate price feeds, interfere with trades, or, most critically, deny withdrawal requests. The best trading software in the world offers zero protection if the entity holding your funds operates without oversight and accountability. Therefore, the presence of MT5, while a technical positive, does not in any way guarantee the safety of your capital.

Transparency and Background Check

A broker's transparency regarding its operations and history is a key indicator of its trustworthiness. Here, Adam Capitals displays several significant information gaps.

| Attribute | Details | Risk Implication |

| Registered Region | Saint Lucia | High-risk location with no forex regulation. |

| Operating Period | 2-5 years | Relatively short track record; not enough to establish long-term trust. |

| Company Address | Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia | A known address for offshore registrations, likely a virtual office. |

| Payment Methods | Information not provided | A major transparency failure and a critical red flag for traders. |

The most obvious omission is the complete lack of information on deposit and withdrawal methods. Legitimate brokers are upfront about how clients can fund their accounts and, more importantly, how they can access their capital. This absence is a severe red flag, as it leaves traders in the dark about processing times, potential fees, and the viability of withdrawal channels.

Furthermore, the broker's operating period of “2-5 years” (founded in 2021) is relatively short in the financial industry. It has not weathered multiple market cycles or established a long-term reputation for reliability. Its physical address, Rodney Bay, is a well-known building that houses many international business companies. This strongly suggests it is a virtual office or a registration agent's address, not a substantial operational headquarters with actual staff. This lack of a verifiable physical presence further undermines its credibility.

Analyzing Trading Condition Risks

Unregulated brokers often use the appeal of highly attractive trading conditions to draw in clients, and Adam Capitals is no exception. However, a closer look reveals potential differences and significant embedded risks.

The broker offers leverage up to 1:500 across all its account types. While high leverage can amplify profits, it equally magnifies losses and is a hallmark of offshore brokers. Reputable regulators in major locations (such as Europe, the UK, and Australia) have capped leverage for retail clients at much lower levels (typically 1:30) precisely to protect them from the catastrophic risks associated with such high exposure. Offering 1:500 leverage is a strategy to attract risk-seeking traders, but it dramatically increases the probability of a quick account wipeout.

There is also a notable difference in its marketing around spreads. The company summary advertises “ultra-low spreads below 0.2 pips.” However, the account type details present a different picture:

| Account Type | Minimum Deposit | Leverage | Spread |

| Standard | $100 | 1:500 | 1.5 pips |

| Trader | $500 | 1:500 | 0.8 pips |

| Fresher | $10 | 1:500 | 2.0 pips |

Analyzing Community Concerns

The analytical risks we have identified are not just theoretical. They are reflected in the questions and experiences shared by the trading community. Examining this user feedback provides real-world validation of our safety assessment.

The Lack of a Demo Account

A significant drawback highlighted by user 'QM Trader' is the absence of a demo account. He noted, *“Since they don't have a demo account, I couldn't try their platform risk-free. This was a downside because I prefer to test before trading live.”*

This is a critical point. A demo account is a fundamental risk-management tool. It allows new traders to learn the platform and experienced traders to test strategies without committing real capital. For any broker, its absence is a user-unfriendly practice. For a high-risk, unregulated broker like Adam Capitals, it is particularly concerning. It forces traders to deposit real money (with a minimum of $1005 for a Standard account) just to experience the platform, putting their funds at immediate risk.

Community Questions on Legitimacy

The most common question from potential users revolves around the core issue of safety. User 'Tomas' asked directly, *“Is Adam Capitals safe and legit?”* The response provided by another community member was telling: *“Honestly, given the absence of regulation and limited public information, I wouldn't classify Adam Capitals as very safe or fully legitimate...without official oversight, I'm wary of trusting them with my money.”*

This exchange perfectly captures the central thesis of our review. Experienced traders in the community correctly identify the lack of regulation as the primary disqualifying factor. It shows that the risk-aware segment of the market understands that attractive trading conditions are meaningless without the foundational guarantee of regulatory protection.

Confusion Over Trading Conditions

Questions from users like 'zack18' and 'seejay' about spreads and account types highlight another issue: ambiguity. While the broker provides some basic information, the difference between advertised spreads and actual account spreads creates confusion. The community's focus on these operational details underscores the need for a clear, top-down risk assessment. Traders can get lost in the details comparing pips and leverage, but these details are secondary to the overwhelming primary risk of being unregulated. The fact that users are asking these basic questions suggests the broker's own materials are not sufficiently clear or transparent.

Final Verdict on Risk

After a comprehensive analysis of Adam Capitals' regulatory status, operational framework, and user-reported concerns, our final verdict is clear and unequivocal.

We assess Adam Capitals as an extremely high-risk broker.

This conclusion is based on the combined effect of multiple severe red flags:

1. No Valid Regulation: The broker operates without oversight from any reputable financial authority, removing all fundamental protections for client funds.

2. Offshore Location: Its registration in Saint Lucia offers a legal shield but no financial supervision.

3. Lack of Transparency: Critical information, such as deposit and withdrawal methods, is missing, and its corporate presence appears to be virtual.

4. High-Risk Trading Conditions: The offering of 1:500 leverage and potentially misleading marketing on spreads are characteristic of brokers that do not prioritize client protection.

Features, such as the MT5 platform or claims of low spreads, are rendered irrelevant by the profound lack of regulatory safety. Without the guarantee of separate funds and a legal framework for dispute resolution, there is no assurance that clients will be able to withdraw their profits or even their initial deposit. The “Warning: Low score, please stay away!” associated with this broker is advice that should be taken seriously.

For the most current safety score and to review any new exposure reports submitted by users, it is prudent to check the Adam Capitals page on WikiFX before taking any action. We strongly advise traders to prioritize regulatory security above all else and to seek brokers licensed by top-tier authorities.

---

*Disclaimer: Please note that the information presented in this article is based on data available as of our last update in 2025 and is intended for informational and educational purposes only. Financial markets and broker statuses can change. We strongly advise all traders to conduct their own comprehensive due diligence before investing any funds.*

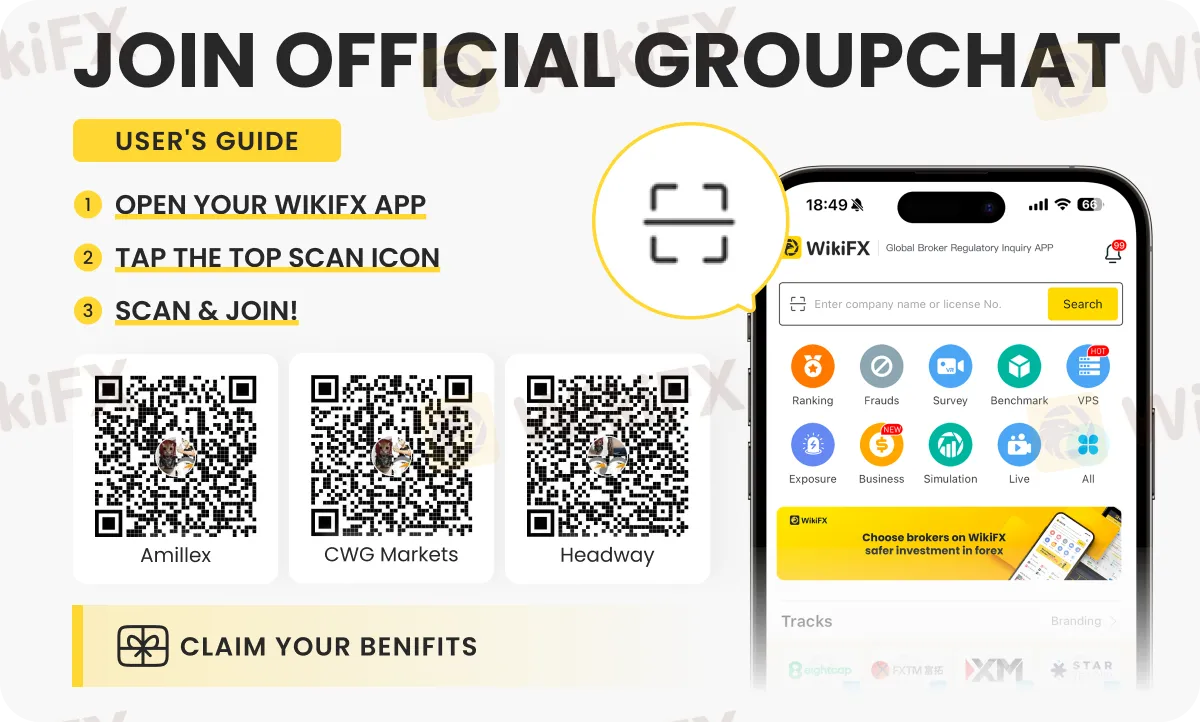

Want to be part of a group/s to learn insightful forex trading tips? Join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G)

Read more

NSFX Forex Broker Review and Regulation Updates

NSFX Forex broker review covering regulation, licenses, and compliance. Learn about NSFX broker's Malta license and revoked FCA authorization.

Adam Capitals Regulation: A Complete Guide to Its Licensing and Safety Claims

When choosing a broker, every trader needs to ask one key question: Is my capital safe, and is this company legitimate? The question of Adam Capitals regulation is at the heart of this safety check. Based on public records from 2025, the clear answer is that Adam Capitals does not have a valid financial license from any major, trusted regulatory authority. The company, called AdamFxCapitals Ltd, is registered as an International Business Company (IBC) in Saint Vincent and the Grenadines (SVG). However, this registration is not equivalent to financial regulation. As a result, the broker is classified as "High potential risk" and receives low trust scores from industry verification services. This guide will break down the broker's regulatory claims, look at how it operates and what platform it uses, and explain the risks for potential investors. The goal is to give you clear, fact-based information to help you decide if your capital would be safe with them.

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

Thailand has intensified its fight against regional scam networks, seizing more than $318 million in assets and issuing 42 arrest warrants in one of the country’s most sweeping anti-fraud operations to date, authorities announced on Wednesday.

Community Limited-Time New Year Wishes Event

Dear friends, 2025 is coming to a close, filled with stories, while 2026 approaches with infinite possibilities. Thank you for another year of companionship. The community has specially launched this New Year Wishing Pool for you.

WikiFX Broker

Latest News

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

Plus500 Allegations Exposed in Real Trader Cases

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

The "Balance Correction" Trap: Uncovering the Disappearing Funds at Vittaverse

HEADWAY: The Fast Track to Financial Dead-Ends?

NordFX.com Review Reveals its Hidden Negative Side- Must-Read Before You Trade

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

Rate Calc