9X Markets Review: Is It Reliable?

Abstract:9X Markets Broker explained: explore account types, trading tools, and reliability. Our review helps you decide.

9X Markets Broker positions itself as a high-leverage, multi‑asset trading platform, but the details in its own profile and user feedback raise serious questions about transparency, regulation, and long‑term reliability.

9X Markets Broker Overview

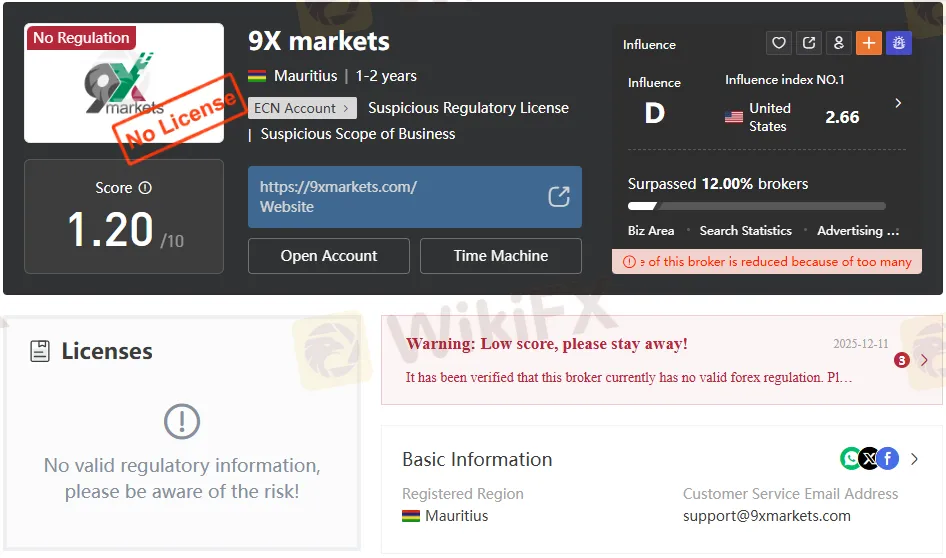

The 9X Markets Broker profile in the screenshot shows a relatively low rating score, a small number of reviews, and multiple risk flags highlighted on the page. The broker is presented as a multi‑asset platform with forex, CFDs, and crypto pairs, but important details such as licensing jurisdiction, legal entity name, and physical office address are either missing or not clearly disclosed.

9X Markets Review of Regulation

In the attached image, the regulation section does not list any recognized top‑tier regulator such as the FCA, ASIC, CySEC, MAS, or NFA, and instead indicates that the broker is “unregulated” or operating without confirmed oversight. The warning ribbon and risk tags visible near the top of the profile further emphasise that 9X Markets Broker may not hold a verifiable licence with a major authority, exposing clients to higher counterparty and withdrawal risk than brokers that are properly supervised.

Domain And Corporate Transparency

The image shows a broker information panel with domain details, including a recently registered website and a relatively short operational history, which is often a red flag when combined with the absence of clear regulatory backing. There is no obvious disclosure of the operating companys full legal name, registration number, or registered address, making it difficult for traders to confirm who stands behind 9X Markets Broker or what legal jurisdiction would handle disputes.

Trading Platforms And Tools

Screenshots submitted in the user reviews show what appears to be a proprietary web or mobile interface rather than a widely recognised platform like MetaTrader or cTrader. The charts, order tickets, and position windows look functional but basic, suggesting that 9X Markets Broker focuses on a lightweight, mobile‑first environment without the rich ecosystem of third‑party indicators and automated trading that established platforms provide.

Instruments And Market Coverage

User screenshots highlight forex majors, some minor FX pairs, crypto pairs such as BTC‑related contracts, and indices or commodities, indicating that 9X Markets Broker offers a CFD‑style multi‑asset line‑up rather than direct market access. However, the attached image does not clearly display a detailed product list, contract specifications, or margin tables, so traders may not know in advance which symbols, leverage tiers, and trading hours are available until after account registration.

Leverage, Spreads, And Costs

Several screenshots of open positions and order tickets show sizeable leverage in action, where relatively small account balances control large position sizes, implying that 9X Markets Broker promotes high‑leverage trading. At the same time, the image does not provide a transparent schedule of spreads, commissions, or overnight financing rates, so it is impossible to verify whether trading costs are competitive compared with established ECN or STP brokers.

Account Types And Minimum Deposits

The account panels visible in the image reference multiple account types, but the specific differences in spreads, leverage caps, and extra features are not clearly spelled out. Minimum deposit information also appears vague, with no prominent table that outlines thresholds for standard, VIP, or professional accounts, which is unusual when contrasted with leading brokers that publish full account specifications upfront.

Deposits, Withdrawals, And Funding Safety

User‑submitted screenshots show successful deposits, growing equity curves, and occasional withdrawal confirmations, suggesting that at least some clients have been able to move funds in and out of 9X Markets Broker accounts. Yet, given the lack of confirmed regulation and corporate information, traders cannot rely on segregated accounts, investor compensation schemes, or formal dispute‑resolution channels if a withdrawal is delayed or rejected.

9X Markets Broker User Feedback

Recent exposure cases filed on WikiFX paint a consistently negative picture of the 9X Markets Broker experience, with most complaints centering on spreads, slippage, execution, and fund safety. One trader reports that the broker promotes low spreads, but the spread frequently widens at key market moments, adding hidden costs and leading to significant capital losses.

Several users describe severe execution issues, including being unable to open or close positions because the platform showed the market as “closed” while prices were clearly moving, which they say caused heavy losses when they could not hedge or exit trades. Another case alleges that profitable trades booked after a market session were later removed from the account without prior notice or explanation, wiping out gains overnight.

Multiple reviewers complain that spreads and slippage spike sharply and unpredictably, with one user noting that the spread “jumped” from profit into loss, and others stating that slippage and widening spreads make it “impossible” to earn consistently with 9X Markets Broker. A trader named Abdul Razak reports more than 100 USD in losses attributed to spreads “adding up” and slippage driving prices away from comparable market quotes seen at other brokers.

Concerns are not limited to trading conditions; several complaints focus on deposits, withdrawals, and KYC handling. One user states that after a successful deposit, the trading balance remained at zero and customer support did not respond, while another says a withdrawal request was blocked with repeated “Error upload KYC” messages, followed by the account balance dropping to zero and transaction history allegedly disappearing.

Taken together, these user feedback cases suggest a pattern of operational and trust‑related issues at 9X Markets Broker, including opaque spread behavior, unstable execution, unresolved deposit discrepancies, and blocked withdrawals linked to KYC errors. For prospective clients, these allegations underscore the importance of testing the platform with minimal funds, monitoring execution and slippage closely, and considering brokers with stronger regulatory oversight and cleaner user‑review records.

Cons Of 9X Markets Broker

- No verifiable oversight from a tier‑one or tier‑two financial regulator, which significantly increases legal and counterparty risk for clients holding balances on the platform.

- Limited disclosure on domain registration, corporate entity, and physical address makes it difficult to check the brokers history or pursue formal recourse in the event of disputes.

- Sparse product specifications, unclear fee structure, and reliance on a proprietary platform, while more established competitors offer detailed contract data, stable third‑party platforms, and audited financial transparency.

- Repeated complaints about spreads widening sharply at crucial moments, contradicting the brokers marketing around “low spreads” and resulting in cumulative hidden costs and unexpected losses for traders.

- Numerous user reports of severe slippage, where prices allegedly “jump” from profit into loss, raise questions about how trade execution and price feeds are being managed on the platform.

- Cases where clients claim they could not open or close positions because the system showed “market closed” while prices were moving, preventing hedging or exiting trades and leading to forced losses.

- Allegations that profitable trades were removed or profits reversed without prior notification or a clear rationale, with users waking up to see gains wiped from their accounts.

- Complaints of deposits showing as successful on the funding side but not appearing in the trading balance, combined with a lack of timely response from customer support to resolve the discrepancy.

- Reports of blocked withdrawals tied to repeated KYC error messages, followed by account balances dropping to zero and transaction histories allegedly disappearing from the client portal.

How 9X Markets Compares

Compared with long‑standing, fully regulated forex and CFD brokers that publish licence numbers, audited financials, and negative balance protection policies, 9X Markets Broker appears less transparent and carries higher structural risk. Traders who value strict regulatory protection, clear fee schedules, and independent platform technology will typically gravitate towards brokers supervised in major jurisdictions rather than one with the opaque profile seen in the screenshot.

Bottom Line On 9X Markets Broker

The available evidence in the attached image paints 9X Markets Broker as a high‑risk, lightly documented platform that prioritises marketing and aggressive growth stories over full regulatory and corporate transparency. Traders considering this broker should treat it as a speculative option, commit only capital they can afford to lose, and seriously weigh the benefits of choosing a fully regulated alternative with verifiable oversight and a longer track record.

Read more

IQ Option Review: Real User Experiences

IQ Option broker review: See what users say about trading experience, withdrawals, and platform support.

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

WisunoFX is a trading company that lets you trade different types of investments. It has been running for 5 to 10 years and is registered in Seychelles. The broker lets you trade currencies (Forex), stock indexes, commodities like gold and oil, individual stocks, and cryptocurrencies. It offers itself as a good choice for traders around the world by providing the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. This review gives you an honest look at what WisunoFX offers. We will examine how it is regulated by two different authorities, compare the different account types you can choose from, and look at trading costs, including spreads and its very high leverage options. We will also check how well its platforms work and what real users say about it. This will help you decide if this broker is right for your trading goals.

Classic Global Ltd Review: Can You Trust This Broker or Are There Warning Signs?

When choosing an online broker, the most important thing for any investor is safety. The internet presents numerous opportunities, but it also poses significant risks. This brings us to Classic Global Ltd, a forex and CFD broker that has gotten attention recently. Potential investors are asking a crucial question: Is Classic Global Ltd. trustworthy? To answer this, you can't just rely on what the broker says about itself. You need to carefully look at whether it's properly regulated, its company history, and what real users say about it. This article gives you a complete, fact-based analysis designed to cut through the confusion. Our goal isn't to make a quick judgment but to show you the proven facts, so you can make a smart decision about the safety of your money. Doing your homework is the foundation of successful investing, and this review is an important part of that process for anyone thinking about Classic Global Ltd.

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

Deriv stands as a colossal figure in the retail trading landscape, recognized for its extensive global footprint and a multi-jurisdictional regulatory framework that spans from Europe to Southeast Asia. With a WikiFX score of 7.04, the broker commands significant influence, particularly in regions like the UAE, Australia, and parts of South America. Established in its current form in 2019, Deriv markets itself as a flexible, tech-forward broker offering access to diverse markets via the MetaTrader 5 (MT5) ecosystem. However, recent data suggests a growing dichotomy between its high-level regulatory status and the ground-level friction reported by traders, particularly regarding capital accessibility and sudden policy shifts.

WikiFX Broker

Latest News

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

Inside Darwinex Broker Review: Regulation Explained & Authentic User Complaints

B2CORE Update Enhances Forex Broker Operations and CRM Systems

MIFX Regulation, Is This Indonesian Broker Safe?

CommSec Regulation, Login Information & User Review : A Comprehensive Review

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

FCA Waning list of Unauthorised firms

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

Rate Calc