MIFX Regulation, Is This Indonesian Broker Safe?

Abstract:MIFX is a regulated Indonesian broker with STP licenses from BAPPEBTI, JFX, and ICDX. Learn how its oversight protects traders and ensures compliance.

MIFX, the retail brand of PT Monex Investindo Futures, is a fully licensed Indonesian forex and commodities broker with multi‑exchange memberships, competitive spreads, and a mobile‑first trading experience, but it also faces mixed user reviews and a relatively narrow product universe compared with global multi‑asset platforms. For traders prioritizing local regulation, rupiah accounts, and straightforward account options, MIFX presents a credible option, provided that clients understand the fee structure and the limits of its offering.

MIFX Regulation And Safety

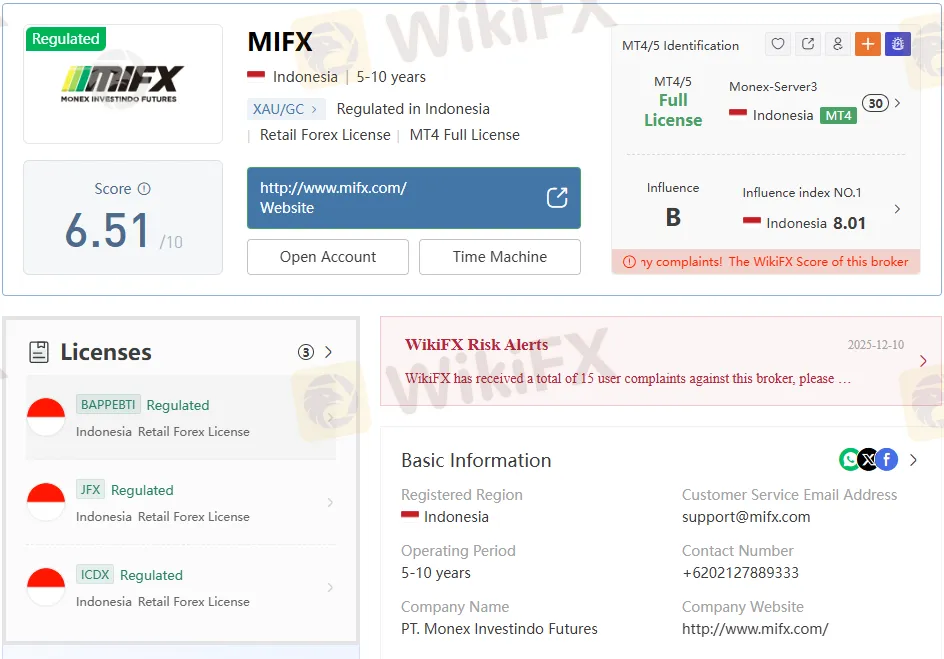

MIFX operates under PT Monex Investindo Futures, which holds a futures broker license from Indonesias Commodity Futures Trading Regulatory Agency (BAPPEBTI) and is supervised for certain products by Bank Indonesia and the Financial Services Authority (OJK). The firm is also a member of the Jakarta Futures Exchange (BBJ), the Indonesian Commodity and Derivatives Exchange (ICDX), and clearing houses KBI and Indonesia Clearing House, which means client transactions pass through regulated exchanges and central counterparties.

Client funds are held in segregated bank accounts, in line with Indonesian futures regulations designed to separate company operating capital from customer margin deposits. The MIFX platform additionally promotes ISO 27001 information‑security certification, signalling a structured approach to data protection and operational risk management.

Domain, Brand, And Corporate Profile

The official trading domain for MIFX is mifx.com, which hosts the retail platform, product descriptions, and account‑opening funnels. MIFX presents itself as Indonesias largest local forex broker, backed by more than two decades of operation under the Monex Investindo Futures brand.

Corporate communications describe MIFX as a pioneer trading application that focuses on simplifying access to forex, commodities, and index futures for Indonesian clients, with a strong emphasis on mobile functionality and education. Public profiles indicate a firm size in hundreds of employees, aligning with its positioning as a large domestic brokerage rather than a boutique operation.

Trading Instruments On MIFX

The broker focuses on leveraged trading in forex pairs, precious metals, energy, commodities, and index contracts for difference or futures, depending on the underlying exchange. Major, minor, and selected exotic forex pairs are offered, together with gold and silver, key energy contracts such as oil, and a range of indices tracking major global equity benchmarks.

MIFX positions its product lineup squarely at short‑term traders: instruments are margin‑based, marked‑to‑market daily, and designed for intraday or swing strategies rather than long‑term investing or cash equities. Compared with international multi‑asset brokers offering stocks, ETFs, and options, MIFXs universe is narrower but more focused on the local futures framework.

MIFX Account Types And Key Conditions

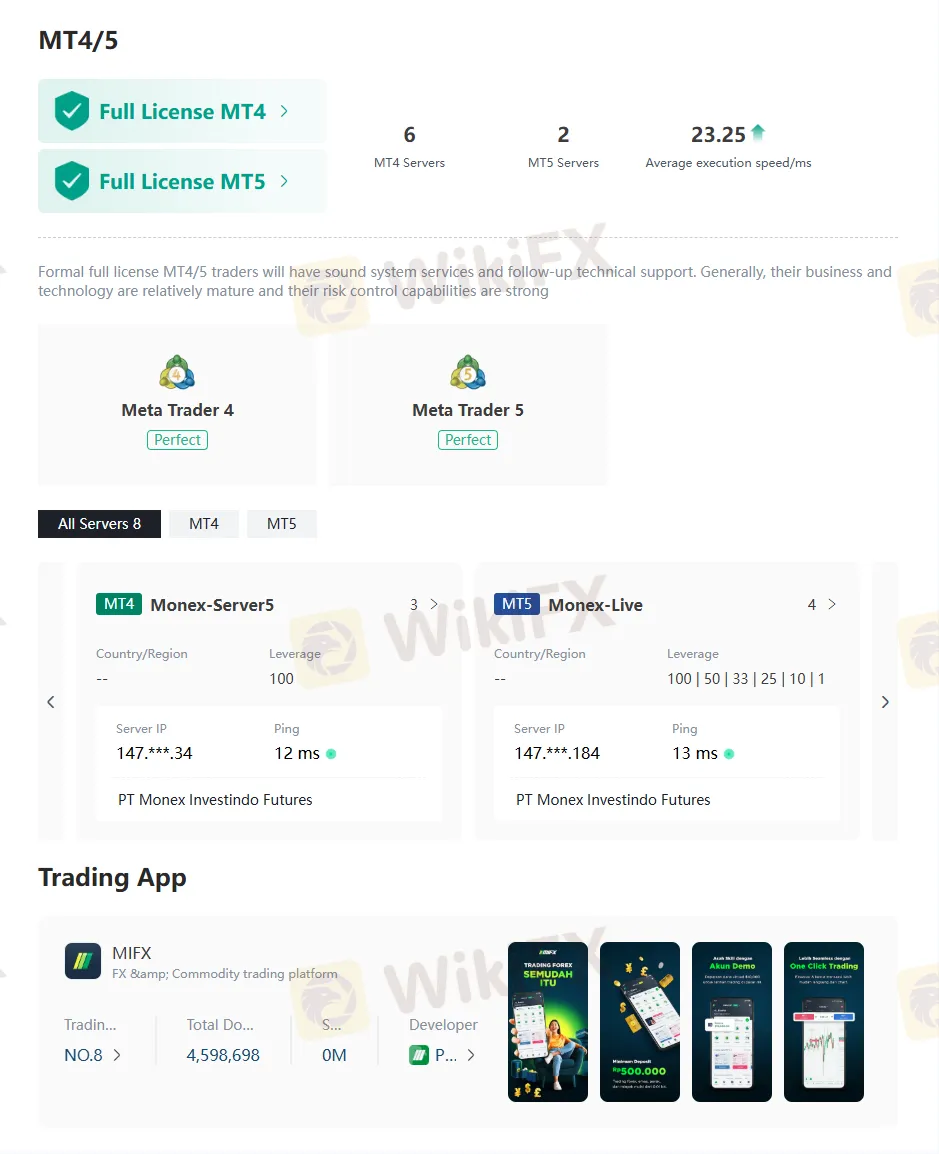

MIFX offers several account configurations tailored to different capital sizes and trading styles: Ultra Low, Standard, Pro, Pro Rebate, and Multilateral. All accounts share a minimum trade size of 0.01 lot, leverage up to 1:100, and access to MetaTrader platforms, with the MIFX mobile app supporting trading, deposits, and withdrawals on most accounts.

Account comparison

| Feature / Account Type | Ultra Low | Standard | Pro | Pro Rebate | Multilateral |

| Feature / Account type | Ultra Low | Standard | Pro | Pro Rebate | Multilateral |

| Minimum first deposit | IDR 500,000 | IDR 500,000 | IDR 100,000,000 | IDR 100,000,000 | IDR 1,000,000 |

| Typical spread (from) | 0.3 pips | 1.8 pips | 0.3 pips | 1.8 pips | 0.6 pips |

| Commission per lot | 10 USD | 1 USD | 5 USD | 1 USD | from 20 USD |

| Leverage | 1:100 | 1:100 | 1:100 | 1:100 | 1:100 |

| Platforms | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT4/MT5 | MT5 |

| MIFX app features | Trade, deposit, withdraw, overbook | Trade, deposit, withdraw, overbook | Trade, deposit, withdraw, overbook | Trade, deposit, withdraw, overbook | Deposit, withdraw, overbook |

| Swap‑free option | Available on request | Available on request | Available on request | Available on request | Not offered |

| Trading tools & education | Signals, tools, full education | Signals, tools, full education | Signals, tools, full education | Signals, tools, full education | Education and news access |

Data in the table reflects the brokers own product comparison as of 2025 and may change; prospective clients should verify current trading conditions before funding. The tiered structure makes it possible to start with a low‑deposit Standard or Ultra Low account and later migrate to Pro or Pro Rebate when trading volume justifies higher capital.

Spreads, Commissions, And Other Fees

On Ultra Low and Pro accounts, headline spreads from 0.3 pips cater to spread‑sensitive strategies, but this comes with a higher commission per lot, while Standard and Pro Rebate accounts carry wider spreads from 1.8 pips with lower per‑lot commissions. This trade‑off means effective trading costs depend heavily on instrument choice and turnover, so active traders need to calculate all‑in costs rather than focusing on raw spreads alone.

All account types use a maximum leverage of 1:100, a level that limits margin‑call risk compared with offshore brokers offering 1:500 or more, but still amplifies market moves significantly. MIFX also promotes a swap‑free option on most accounts, subject to terms and conditions that typically restrict eligible products or holding periods.

Platforms, Tools, And User Experience

MIFX supports MetaTrader 4 and MetaTrader 5, offering charting, algorithmic trading, and order‑management tools familiar to global forex traders. The proprietary MIFX application integrates account opening, trading, funding, and educational content into a single mobile interface, emphasizing ease of use for domestic clients who prefer app‑based trading.

The platform stack is complemented by trading signals and a suite of analytical tools—such as pattern recognition and alert services—aimed at assisting less experienced traders in identifying setups. Education and news content are embedded directly into the platform, reflecting the brokers marketing focus on guided learning for new traders entering the futures and forex markets.

Deposits, Withdrawals, And Support

Minimum first deposits start from IDR 500,000 on Standard and Ultra Low accounts, which places MIFX within reach of entry‑level Indonesian traders. Higher‑tier accounts, such as Pro and Pro Rebate, require deposits of IDR 100 million, targeting more serious or professional clients.

Deposits and withdrawals are processed via local banking channels, with the MIFX app supporting instant funding, overbooking between accounts, and requests for withdrawals from within the interface. The broker advertises one‑day withdrawal processing in many client testimonials, although independent user reviews show a mix of positive experiences and occasional complaints about delays or administrative checks.

Independent Reviews And Reputation

User‑generated review sites and forums present MIFX in a mixed light: some traders highlight fast withdrawals, responsive staff, and stable platforms, while others raise concerns about slippage, account issues, or the quality of customer support. Crowd‑sourced ratings on specialist broker‑review portals similarly place MIFX in the middle of the pack, indicating a broker with both satisfied and dissatisfied segments rather than an outlier at either extreme.

It is important to distinguish regulatory safety from user satisfaction: MIFXs BAPPEBTI‑regulated status and exchange memberships address legal legitimacy, but they do not guarantee flawless execution or service quality in every case. Traders should therefore treat online reviews as one input among many, cross‑checking them against personal testing on a demo or small live account.

MIFX Versus Key Competitors

In the Indonesian market, MIFX competes primarily with other BAPPEBTI‑licensed futures brokers and, indirectly, with offshore CFD platforms that accept Indonesian residents. Domestic competitors may offer similar leverage and regulatory profiles but differ in spreads, promotions, and mobile‑app sophistication, while global brokers often provide broader asset classes at the cost of weaker local investor protections.

From a cost and features perspective, MIFXs combination of 0.01‑lot minimums, low minimum deposits, and comprehensive education content positions it as an accessible starting point for local traders who value a regulated environment more than ultra‑high leverage or very niche instruments. However, high‑volume or multi‑asset traders might find better pricing or broader markets at international brokers, provided they accept the jurisdictional trade‑offs.

Pros And Cons Of MIFX

Pros

- Fully licensed under BAPPEBTI with memberships in major Indonesian futures exchanges and clearing houses, enhancing legal transparency.

- Low entry threshold on Standard and Ultra Low accounts, with minimum deposits from IDR 500,000 and 0.01‑lot trade sizes.

- Strong mobile‑first offering with the MIFX app integrating trading, funding, education, and reward programs.

- Choice of MT4 and MT5 platforms plus trading tools and signals designed to support various experience levels.

Cons

- The product range focuses on forex and derivatives, lacking direct access to cash equities or global ETFs found at many international brokers.

- The commission structure on Ultra Low and Multilateral accounts can be expensive for smaller traders despite tight spreads.

- User reviews on independent platforms reveal inconsistent experiences with support and account administration.

- Maximum leverage of 1:100 may feel restrictive to traders accustomed to higher ratios at offshore brokers, though it also lowers risk.

Bottom Line On MIFX Regulation And Value

MIFX stands out as a domestically regulated forex and commodities broker operating under PT Monex Investindo Futures, combining BAPPEBTI oversight, exchange memberships, and ISO‑aligned security practices to deliver a legally robust trading environment. For Indonesian traders who prioritise local supervision, rupiah funding, and a polished mobile platform, the broker offers a compelling mix of accessibility, structured education, and tiered account options, albeit with a focused product set and mixed user feedback that warrant careful, small‑scale testing before committing substantial capital.

Read more

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

Is NaFa Markets Legit? A Complete Investigation

Our research into NaFa Markets gives us a clear and urgent answer. For anyone asking, "Is NaFa Markets legit?", the answer is definitely no. This platform shows all the typical signs of a fake operation created to steal funds from people who don't know better. We strongly recommend that all traders stay completely away from this platform.

Capitalix Review: Revealing the Latest Fund Scam Allegations Against the Broker

Has Capitalix imposed a fine on your trading inactivity? Did you still lose your capital despite paying the fine amount? Have you had multiple instances of fund scams at Capitalix? Does your forex trading account balance often become negative? Failed to receive a response to the Capitalix withdrawal application? Did you face a prolonged drawdown issue on the broker’s trading platform? You are not alone! Many traders have reported these issues on broker review platforms such as WikiFX. We have uncovered all these alleged trading activities in this Capitalix review article. Take a look!

WikiFX Broker

Latest News

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Rate Calc