Naqdi Broker: Is It Safe and Reliable?

Abstract:Is Naqdi Broker legit? We verify its licenses, trading conditions, and customer support in this full review.

Naqdi Broker appears to be a legitimately licensed multi‑asset broker, but traders should weigh its mixed client feedback, complex regulatory footprint, and offshore-style conditions before committing significant capital. The broker offers tight spreads, high leverage up to 1:500, and MetaTrader 5 access, yet some third‑party reviews flag concerns around withdrawals, hidden fees, and cross‑border licensing limits.

Naqdi Broker Review: Licensing And Safety

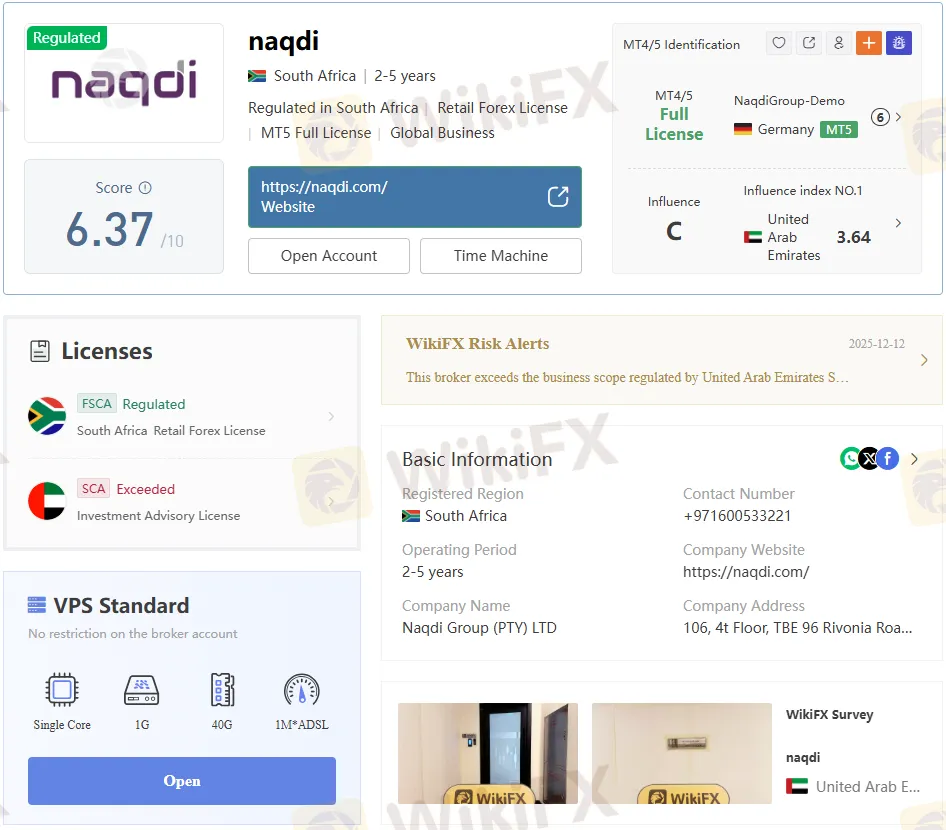

Naqdi Broker operates through group entities, including Naqdi Group Pty Ltd, which holds a Financial Sector Conduct Authority (FSCA) license in South Africa under FSP number 51598. This authorization allows the firm to offer derivatives and CFD trading under a recognized regulatory regime, with obligations around capital adequacy, segregation of client funds, and complaint handling.

In the UAE, Naqdi Securities and Currencies Brokers LLC has obtained a Securities and Commodities Authority (SCA) Category 5 license, placing it under one of the region‘s more stringent supervisory frameworks. However, external assessments note that some of Naqdi’s activities in the UAE and broader MENA region have at times exceeded local permissions, creating regulatory grey areas that traders should monitor.

Domain Registration And Corporate Background

The primary trading domain naqdi.com was registered on 9 July 2010 and shows a long operational history, which typically compares favorably to the short life span seen among many scam brokers. Domain records also show a multi‑year renewal horizon, suggesting an intention to remain active rather than a quick “hit‑and‑run” setup.

Naqdi positions itself as a global online broker offering forex, indices, shares, commodities, metals, and cryptocurrencies from offices and partners across Europe, Asia, and the Middle East. At the same time, the broker publicly restricts clients from some high‑risk jurisdictions such as the United States and certain sanctioned countries, aligning with standard compliance practice among regulated CFD providers.

Trading Platforms And Technology

Naqdi Broker centers its trading infrastructure on MetaTrader 5 (MT5), providing desktop, web, and mobile versions with support for Expert Advisors, algorithmic trading, and advanced charting tools. MT5 access is a strong point for algorithmic traders and those who rely on custom indicators, copy trading, or multi‑asset chart analysis.

In addition, Naqdi promotes a social trading app branded “Naqdi Social” on Android, allowing clients to link their trading accounts and mirror strategies from signal providers within the Naqdi ecosystem. This social offering aims to attract beginners who prefer following experienced traders rather than building discretionary systems from scratch.

Account Types, Leverage And Minimum Deposit

According to Naqdis public materials and independent Naqdi Broker review sources, the broker runs a tiered account structure built around Standard and Elite (or equivalent naming) profiles. The Standard account advertises no formal minimum deposit, zero commission, and leverage up to 1:500, targeting new and cost‑sensitive traders.

The Elite‑style accounts are designed for high‑volume or professional clients, featuring spreads from 0.0 pips on major forex pairs, offset by a per‑lot commission to maintain competitiveness for scalping and algorithmic strategies. Across both accounts, Naqdi claims a straight‑through‑processing (STP) model with no dealing‑desk intervention, which—if implemented as described—should reduce conflict of interest between broker and client.

Spreads, Fees, And Trading Costs

Naqdi Broker markets “unbeatable competitive fees and spreads” on forex majors, with the Standard account offering variable spreads that start low but may widen around news and off‑peak liquidity. Independent reviewers report typical spreads that are in line with other mid‑tier STP brokers, but not always as tight as top‑tier ECN competitors for high‑volume trading.

Elite or raw‑spread accounts offset 0.0‑pip pricing with a round‑turn commission, which advanced traders often prefer because the total cost becomes more predictable during volatile sessions. Non‑trading fees, such as deposit and withdrawal charges, appear mostly absorbed by Naqdi on popular methods, though some third‑party payment providers may pass on their own fees.

Instruments Available To Naqdi Clients

Naqdi Broker offers a broad instrument list spanning forex, global indices, share CFDs, commodities, metals, and selected cryptocurrencies. This lineup allows multi‑asset strategies, from currency hedging to equity‑index swing trading and gold‑based safe‑haven plays in the same account.[8][10]

Forex traders gain access to major, minor, and some exotic pairs, while commodity coverage includes energy products and soft commodities. Crypto and equity CFD availability can vary by jurisdiction and regulatory constraints, so clients should confirm local product schedules before committing strategies that rely on those markets.

Deposit, Withdrawal, And Payments

Naqdi supports multiple funding channels—including cards, e‑wallets, and bank transfers—with a focus on fast processing and automated back‑office handling. Marketing materials emphasize instant deposits for most electronic methods and same‑day withdrawals once internal verification is complete, although actual times depend on the payment provider and region.

Despite these claims, some external Naqdi Broker review sites and user comments flag issues such as delayed payouts and disputes over withdrawal eligibility when bonuses or high‑risk strategies are involved. These mixed experiences underline the need for traders to document their account activity, read bonus terms closely, and test withdrawals early with small amounts.

Customer Support And Reputation

Naqdi offers multilingual customer support via live chat, email, and phone, catering to its Middle Eastern and international client base. The broker also invests in IB and affiliate programs, which help expand its footprint but can sometimes introduce conflicts when third‑party marketers overstate benefits or underplay risks.

Reputation metrics are mixed: Trustpilot scores in the mid‑range suggest an “average” customer experience, with both positive reviews highlighting responsive service and negative reviews alleging platform issues or difficulties closing accounts. Specialist review sites give Naqdi a middling to good risk rating, citing valid regulation but also noting unresolved complaints and the “Exceeded” license status raised by some watchdogs.

Naqdi Broker Versus Competitor Brokers

The table below places Naqdi Broker alongside two well‑known competitors frequently used as benchmarks in third‑party reviews.

| Feature | Naqdi Broker | Typical Top‑Tier ECN Broker | Typical Market‑Maker Broker |

| Core regulation | FSCA (South Africa), SCA (UAE cat‑5) | FCA, ASIC, CySEC (single or multiple) | Often offshore or single mid‑tier license |

| Platform | MT5, proprietary social app | MT4/MT5, cTrader, proprietary | MT4/MT5 or web‑only |

| Account types | Standard (no‑min, zero commission), Elite (0.0‑pip + commission) | ECN / Raw spread accounts with commission | Standard fixed/variable spread accounts |

| Max leverage | Up to 1:500 | Often 1:30–1:500 depending on regulator | Often 1:200–1:1000 offshore |

| Reputation | Mixed user reviews, moderate risk ratings | Generally strong trust metrics for leading brands | Varies widely; many complaints for weaker brands |

This comparison shows Naqdi attempting to straddle the line between tightly regulated brokers and high‑leverage offshore firms, pairing formal licenses with aggressive trading conditions. For some traders, this balance is attractive, but risk‑averse investors may still prefer brokers domiciled under Tier‑1 regulators such as the FCA or ASIC.

Pros And Cons Of Naqdi Broker

Pros of Naqdi Broker include its dual‑entity regulatory structure, wide instrument range, and access to MT5 plus social trading tools. The zero‑minimum Standard account and 0.0‑pip Elite account provide flexibility for both beginners and seasoned traders, while multi‑channel funding and partnerships cater to a global audience.

On the downside, leverage up to 1:500 significantly amplifies market risk, particularly for inexperienced clients operating on margin. Mixed external reviews—covering withdrawal disputes, perceived hidden fees, and license “exceeded” notes—also indicate that Naqdi is not without controversy and must be approached with appropriate due diligence.

Bottom Line: Is Naqdi Broker Safe And Reliable?

Naqdi Broker is not an anonymous or short‑lived operation; it has over a decade of domain history and holds recognized licenses in South Africa and the UAE, which sets it apart from unregulated offshore brokers. That said, the brokers risk profile is not negligible, given its high leverage, mixed client feedback, and questions about the scope of its activities versus regulatory permissions.

For traders prepared to monitor their risk carefully, test withdrawals early, and keep position sizing moderate, Naqdi can offer competitive spreads and a modern MT5‑based trading environment. Conservative investors or those prioritizing the strongest possible regulatory protection may be better served by Tier‑1‑supervised competitors, using this Naqdi Broker review as a framework for comparing licenses, conditions, and real‑world user experiences across multiple providers.

Read more

EPlanet Brokers Exposed: Traders’ Take on Price Manipulation, Slow Order Execution & Withdrawal Issu

Have you been constantly dealing with slow trade order execution at EPlanet Brokers? Does the trading app freeze during live trades and make it difficult for you to execute at the right price? Do you have to constantly deal with high slippage? Does the broker deny you withdrawals when you make profits? These issues have become increasingly common for traders here. Some of them have highlighted these issues while sharing the EPlanet Brokers review online.

ThinkMarkets Hit By Chaos Ransomware In Major Data Breach

Australian broker ThinkMarkets suffers a Chaos ransomware attack; 512GB of sensitive company and client data leaked online.

ATFX Partners with KX to Enhance Real-Time Trading Solutions

ATFX partners with KX to boost real-time data analytics, AI integration, and trading efficiency for global clients through advanced fintech innovation.

Interactive Brokers Opens Access to Brazil’s B3 Exchange

Interactive Brokers adds Brazil’s B3 Exchange, giving investors worldwide seamless access to trade Brazilian equities and expand emerging market opportunities.

WikiFX Broker

Latest News

Is Deriv Safe? A Deep Dive into Regulatory Claims vs. Withdrawal Nightmares

Inside Darwinex Broker Review: Regulation Explained & Authentic User Complaints

MIFX Regulation, Is This Indonesian Broker Safe?

BLITZ finance Review 2025: Is It a Scam? License and Safety Evaluation

The "Invalid Profit" Trap & The Withdrawal Maze: A Deep Dive into MultiBank Group

B2CORE Update Enhances Forex Broker Operations and CRM Systems

WisunoFX Review 2025: A Complete Look at Costs, Trading Platforms, and Safety

9X Markets Review: Is It Reliable?

IQ Option Review: Real User Experiences

Bessent to propose major overhaul of regulatory body created from financial crisis

Rate Calc