Titan Capital Markets: The "Token" Trap Hiding Behind a Forex Mask

Abstract:Titan Capital Markets presents itself as a sophisticated Australian Forex broker offering AI-driven trading. However, a deep dive into recent trader activity exposes a disturbing pivot: the forced conversion of liquid funds into illiquid "tokens," aggressive demands for "tax" payments to unlock withdrawals, and a severe regulatory blacklisting from the Philippines Securities and Exchange Commission (SEC). This report uncovers why funds deposited here may never come back.

Abstract

Titan Capital Markets presents itself as a sophisticated Australian Forex broker offering AI-driven trading. However, a deep dive into recent trader activity exposes a disturbing pivot: the forced conversion of liquid funds into illiquid “tokens,” aggressive demands for “tax” payments to unlock withdrawals, and a severe regulatory blacklisting from the Philippines Securities and Exchange Commission (SEC). This report uncovers why funds deposited here may never come back.

Important Disclosure

All trader testimonials cited in this article are based on verified records submitted to the WikiFX resolution center. While the specific details are factual, the identities of the traders have been anonymized to protect their privacy.

The “Bait and Switch”: From Forex to Crypto Tokens

Traders usually accept that the market involves risk. Prices go up and down. But what traders in our database are reporting is not a market loss—it is a structural trap.

Historically, Titan Capital Markets marketed itself as a platform for Forex copy trading. Investors were drawn in by promises of stable returns (ROI) and the simplicity of copying expert trades. However, a significant number of recent reports indicate a sudden, unilateral change in the company's business model that has left traders stranded.

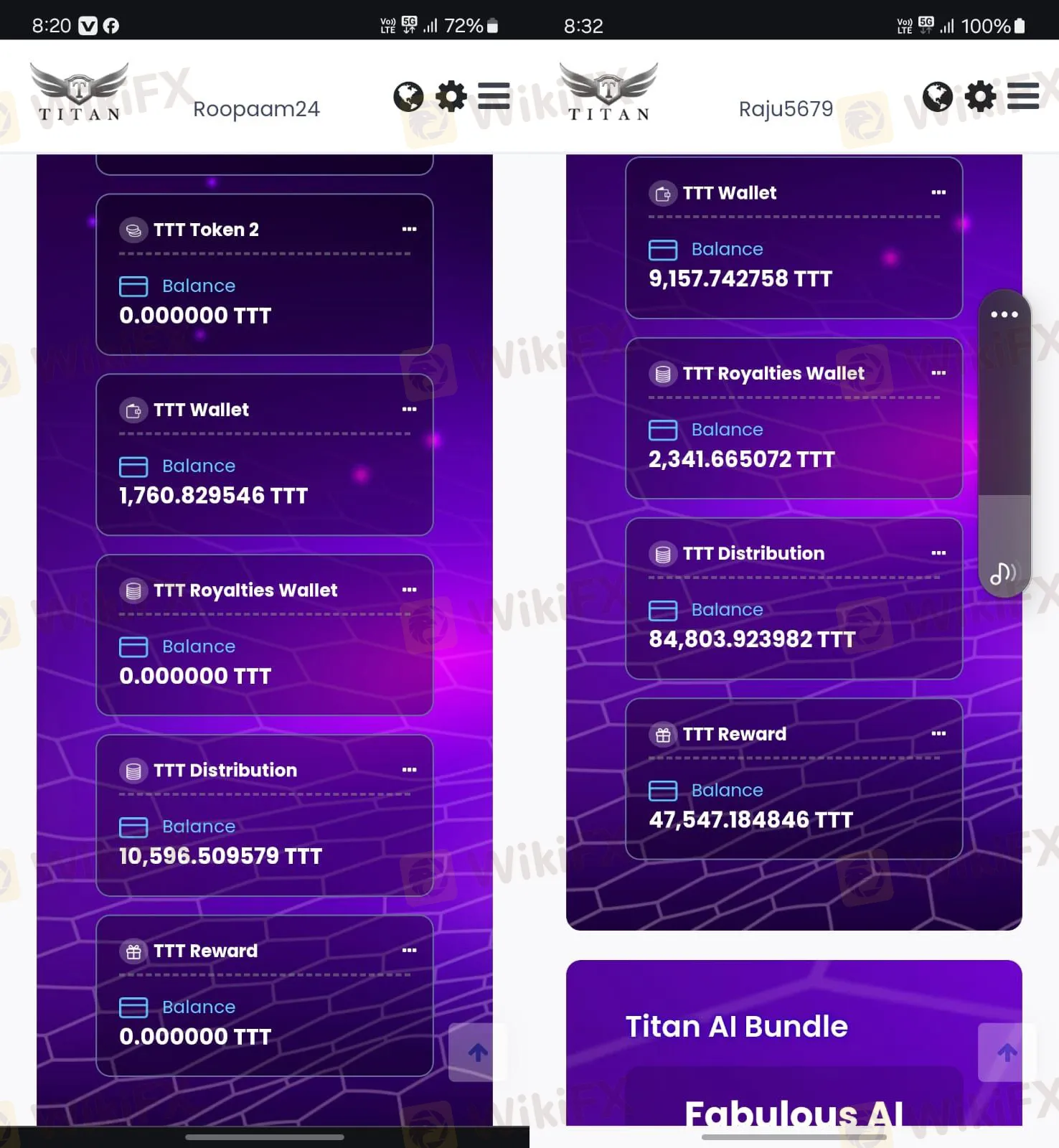

According to multiple inputs from 2024 and 2025, the broker allegedly shut down its standard copy trading operations and forced investors into a new ecosystem involving a proprietary token, often referred to as “TTT”.

The mechanism of the trap appears to be:

- Forced Conversion: Investors who deposited US Dollars or stablecoins expected to withdraw the same. Instead, their balances were converted or “vested” into TTT tokens without explicit consent.

- The “Vesting” Freeze: Once funds were converted, traders were told their capital was “locked” for a contract period (often 90 to 180 days).

- Devaluation: Traders report that the internal value of these tokens plummeted, effectively wiping out their principal before it could ever be withdrawn.

One trader noted, “They forcibly kept the investor's dollars... to introduce new tokens... without permission.” Another investor from the Maldives described investing 8,000 USDT, only to find they could not withdraw from the “distribution wallet” because the TTT rate had been manipulated to near zero.

(Evidence: Traders report forced retention of funds to support new token launches.)

Regulatory Audit: The Disconnect Between Claims and Reality

Titan Capital Markets claims headquarters in Australia, a jurisdiction known for high financial standards. However, our internal data auditing reveals a stark contrast between their marketing and their actual legal standing.

While they may hold a registration, the critical detail lies in the scope of that license. Furthermore, international regulators have already sounded the alarm, identifying the broker's operations as exhibiting “Ponzi” characteristics.

Titan Capital Markets Regulatory Status Table

| Regulator Name | License Type | Current Status | Notes |

|---|---|---|---|

| ASIC (Australia) | Appointed Representative | Exceeded | The broker is operating outside the permitted scope of this license. It effectively offers no protection for the activities described by traders. |

| SEC (Philippines) | Regulatory Disclosure | Blacklisted / Warning | The SEC explicitly flagged “Titan Capital Markets Pty Ltd” for operating an unauthorized investment scheme with “Ponzi” characteristics. |

The “Ponzi” Warning

The Philippines SEC did not mince words in their official disclosure. They warned the public that the scheme employed by Titan Capital Markets involves using new investor money to pay “fake profits” to earlier investors. The regulator noted that such models are “fraudulent and unsustainable.” This is a critical red flag for any trader: when a government body uses the word “Ponzi,” the risk level is absolute.

The “Tax” Extortion Loop

A secondary, highly concerning pattern has emerged in 2024 involving direct demands for more cash. This is a classic hallmark of high-risk recovery scams, yet it is occurring directly on the platform.

We have documented cases where users attempting to withdraw their remaining funds were met with a new hurdle: a requirement to pay “tax” upfront. In legitimate trading, taxes are rarely, if ever, collected by the broker as a condition for withdrawal; they are usually deducted or reported by the trader to their local authority.

The “Bottomless Pit” Scenario:

One distressing case involves a trader who had $2,800 stuck on the platform. When they attempted to withdraw, support claimed they needed to pay a $566 “tax.” Desperate to retrieve their capital, the trader paid the amount.

- The Result: The withdrawal was not processed.

- The Escalation: The broker then claimed the trader had “traded too many times in a single day,” froze the account, and demanded another $500 for “inspection fees.”

This cycle—demanding fees to release funds, then finding a new excuse to demand more—is a tactic designed to drain the last remaining liquidity from a victim before communication is cut off entirely.

(Evidence: User chat logs showing demands for tax payments and subsequent account freezing.)

Silence and Account Blocks

When the “token vesting” excuses and “tax” demands run out, the final stage reported by traders is silence.

Recent reports from 2024 and 2025 highlight a wave of account suspensions. One trader, identified as Jasbir, reported being blocked without notice. “They didn't give me a warning or ask me about issues... they just blocked my ID.” This user was waiting for a 100% withdrawal of their principal for over four months before accessing their account was revoked.

This behavior suggests the broker is potentially in a “exit” phase, where they are systematically cutting off users who complain or demand withdrawals to minimize noise while they retain the funds. The transition from “Titan” to other entities (some users noted a name change to “Yun Shang Hui Xin Limited”) further complicates the recovery process, creating a labyrinth of names to confuse investors.

(Evidence: Users reporting sudden account blocks after requesting withdrawals.)

The evidence surrounding Titan Capital Markets paints a picture of a failed investment scheme actively working to withhold client funds.

- The “Tokenization” of funds verified by user reports confirms a shift away from liquid Forex markets.

- The “Tax” demands indicate predatory behavior.

- The Regulatory blacklisting by the SEC confirms the “Ponzi” nature of the operations.

We strongly advise all traders to cease depositing funds into Titan Capital Markets immediately. The likelihood of recovering capital through standard withdrawal requests is currently assessed as critically low.

WikiFX Risk Warning

Forex and CFD trading involve significant risk and are not suitable for all investors. The information in this specific article is based on the current regulatory status and complaints regarding “Titan Capital Markets” as of 2025. Regulatory statuses can change; always check the live WikiFX app for the most up-to-date broker profiles before trading.

Read more

FIBOGROUP Investigation: When Revoked Licenses Meet Malicious Liquidation

In the high-stakes world of forex trading, regulatory status and execution quality are the bedrock of trust. However, our latest investigation into FIBOGROUP reveals a troubling disconnect between their marketing claims and the reality faced by traders. With key licenses from the UK’s FCA and Cyprus’s CySEC currently listed as Revoked, and a surge in complaints regarding malicious liquidations and vanishing withdrawal options, the safety of client funds is in question. This report dissects the evidence to determine if FIBOGROUP remains a viable option for investors.

The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

MIFX Review: When Regulatory Badges Cannot Shield 'High Risk' Anomalies and Execution Failures

Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFX’s regulatory paperwork and the jarring reality reported by its active users.

WikiFX Broker

Latest News

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

JRJR Review: Why a "Valid" License Can't Hide the Withdrawal Nightmare

ZarVista Review 2025: A Complete Look at Its High-Risk Profile

Voices of the Golden Insight Award Jury | Greg Matwejev, Chief Market Strategist of BCR

EC Markets Opens New Marketing Hub in Central Limassol

London Capital Group – Regulation & Genuine User Reviews

Why Do You Always Lose When Trading?

Rate Calc