Banxso Review: Why Traders Should Avoid Banxso

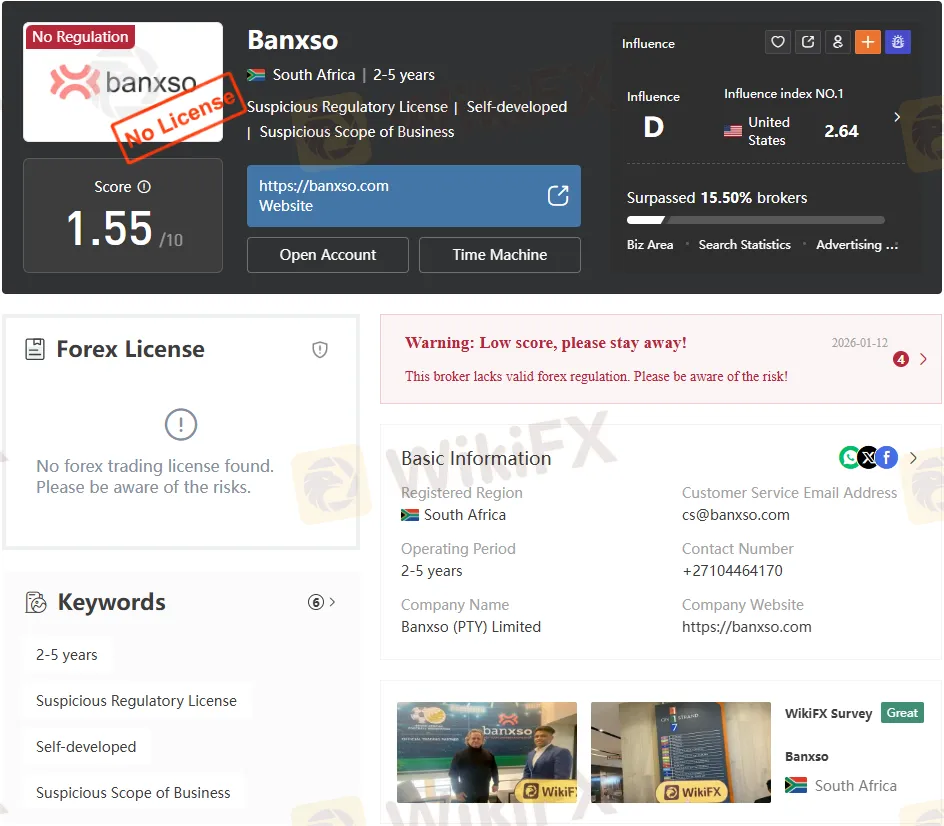

Abstract:Banxso review highlights revoked regulation, suspicious clone licenses, and unsafe trading. Learn why Banxso is not legit.

Introduction: A Broker Under Scrutiny

Banxso presents itself as a modern multi-asset trading platform based in South Africa, offering access to Forex, indices, commodities, cryptocurrencies, and stocks. On the surface, it markets advanced tools, demo accounts, and compatibility with MT5 alongside its proprietary Banxso X app. Yet beneath the polished branding lies a troubling reality: Banxso Regulation is revoked, its licenses are suspicious clones, and its legitimacy is highly questionable.

This investigative review examines Banxsos regulatory failures, operational inconsistencies, and trading risks. The findings reveal why traders should exercise extreme caution before committing funds to this broker.

Banxso Regulation: Revoked and Suspicious

The most critical red flag is Banxsos regulatory standing.

- South Africa (FSCA): Banxso (PTY) Limited once held license number 37699 under the Financial Sector Conduct Authority. That license has been revoked, stripping the firm of any legal authority to operate financial services in the country.

- Cyprus (CySEC): Banxso claims ties to Nova Securities Ltd under license 413/22. However, this is flagged as a suspicious clone, meaning Banxso is misrepresenting another entitys credentials.

- Australia (ASIC): A supposed license under ALTUS INVESTIUM LTD (000458097) is also marked as revoked and suspicious, further undermining credibility.

Without valid oversight, Banxso cannot be considered a legitimate broker. Regulation is the cornerstone of trader protection, and Banxsos revoked and cloned licenses expose clients to significant risk.

Company Background and Domain Transparency

Banxso was founded in 2022 and operates under Banxso (PTY) Limited in South Africa. The companys website is https://banxso.com, with domain records pointing to servers in the United States.

The broker advertises itself as “not your grandfathers bank,” but the lack of regulatory legitimacy makes this slogan hollow. Traders should note that flashy branding does not substitute for compliance. Competitor brokers with valid FSCA or CySEC licenses provide far greater transparency and security.

Office Location: Cape Town Presence

A field survey conducted in 2023 confirmed Banxsos office at 123 Strand Street, Cape Town, Western Cape, South Africa. While the physical presence may reassure some, it does not compensate for revoked licenses. Many unregulated brokers maintain offices to project legitimacy, but without regulatory backing, such addresses offer little protection to clients.

Trading Instruments: Wide Range, Questionable Safety

Banxso claims to provide access to:

- Forex

- Commodities

- Indices

- Stocks

- Cryptocurrencies

- Bonds, options, funds, ETFs

While the product range appears comprehensive, the absence of valid regulation makes these offerings unsafe. Competitor brokers with proper oversight deliver similar instruments but within a secure framework. Banxsos instruments, by contrast, expose traders to unmonitored risks.

Account Types: High Deposits, Risky Conditions

Banxso offers multiple account tiers, each requiring substantial deposits:

- Classic Tier: Minimum deposit $300, spreads from 1.6 pips.

- Platinum Tier: Deposits from $10,000 to $100,000, spreads from 1.2 pips.

- VIP Account: Minimum deposit $250,000, spreads from 0.8 pips, leverage up to 1:200.

These deposit requirements are significantly higher than many regulated competitors, which often allow entry with $50–$100. The high thresholds combined with revoked regulations amplify the risk of unrecoverable losses.

Trading Platforms: MT5 and Banxso X

Banxso provides access to two platforms:

- Banxso X App: Proprietary software with hedging, customizable watchlists, alerts, and AI analysis.

- MetaTrader 5 (MT5): A globally recognized platform offering algorithmic trading, advanced charting, and multi-asset support.

While MT5 is a legitimate platform, Banxsos integration does not guarantee safety. Regulation ensures platform integrity, and without it, even MT5 access cannot protect traders from broker misconduct.

Fees and Leverage: Hidden Dangers

- Leverage: Up to 1:200 across all accounts. While leverage can magnify profits, it equally magnifies losses. Unregulated brokers often exploit high leverage to encourage risky trading.

- Spreads: Starting from 0.8 pips but varying by account type. The lack of transparency raises concerns about hidden fees or manipulated spreads.

Competitor brokers under FSCA or CySEC typically provide clearer fee structures and capped leverage to protect retail traders. Banxsos model prioritizes risk over safety.

Deposit and Withdrawal Methods

Banxso accepts payments via:

- Debit/Credit Card (Visa, Mastercard)

- Bitcoin

- Bank Wire Transfer

The inclusion of cryptocurrency deposits is another red flag. Unregulated brokers often use Bitcoin to bypass financial oversight, making fund recovery nearly impossible in disputes.

Pros and Cons

Pros

- Access to MT5 and proprietary Banxso X app

- Demo accounts available

- Wide range of trading instruments

Cons

- No valid regulation

- Revoked FSCA license and suspicious clone claims under CySEC and ASIC

- High minimum deposits compared to competitors

- Risky leverage up to 1:200

- Cryptocurrency deposits with limited recovery options

Competitor Comparison

To contextualize Banxsos shortcomings, consider regulated competitors:

- AvaTrade (FSCA, ASIC regulated): Minimum deposit $100, transparent spreads, strong oversight.

- XM (CySEC regulated): Minimum deposit $5, capped leverage, investor compensation schemes.

- IG Group (FCA regulated): Global reputation, strict compliance, and robust client protections.

Compared to these brokers, Banxsos revoked regulation and high deposit requirements make it a poor choice for traders seeking safety and transparency.

Reported Cases and Suspicious Activity

The brokers regulatory record includes revoked licenses and suspicious clone warnings. These are not minor infractions but serious breaches of trust. Traders should interpret such findings as clear evidence of risk.

Bottom Line: Banxso Is Not Legit

Banxsos revoked FSCA license, suspicious clone claims under CySEC and ASIC, and reliance on high deposits and risky leverage paint a clear picture: Banxso is not a legitimate broker.

While it offers access to MT5 and a proprietary app, these features cannot offset the dangers of trading with an unregulated entity. Competitor brokers provide similar tools within a secure, regulated environment.

For traders prioritizing safety, transparency, and regulatory protection, Banxso should be avoided. The risks far outweigh the benefits, and the lack of valid oversight makes this broker unsuitable for serious investors.

Read more

ehamarkets exposed: Is Withdrawing Profits Impossible for Traders? Let’s Find Out!

ehamarkets is the focus of many traders on broker review platforms for all the negative reasons. Among the many complaints against the Malaysia-based forex broker, the withdrawal issue and the utter helplessness of the trader in recovering their funds stood out. The broker is accused of denying traders their funds using numerous excuses. So, if you were planning to invest in this forex broker, do not miss reading this ehamarkets review article. Take a look!

Bull Market Review: Reports of Withdrawal Blocks, Server Downtime & Capital Scam Allegations

Witnessed a complete halt on your Bull Market trading platform after a good run? Did you receive a poor response from the broker’s official upon the trading halt enquiry? Failed to receive withdrawals despite undergoing numerous checks by the forex broker? Is your Bull Market withdrawal application pending for months? Did you have to encounter massive trading fees on the Bull Market platform? These issues have become rampant here, and we have highlighted them in this Bull Market review article.

BitForex Review: What Traders are Saying About Fund Scams and Withdrawal Issues

Earned profits on the BitForex platform, but could not withdraw because of tax payment and other liabilities? Does the forex broker even flag your account with fake money laundering charges? Do you consistently face login issues when using the BitForex trading platform? Is your deposited capital directed to the wrong address by the forex broker? All these have become very typical of the way the broker goes about the business. Many traders have opposed the broker on several review platforms online. It’s time to check their comments in this BitForex review article.

FXPN Complete Review: Understanding the High-Risk Warnings and Trading Rules

For traders asking the important question, "Is FXPN safe and worth trying?", our research gives a clear and warning answer. After looking closely at its legal status, how it operates, and what users say, FXPN shows a high-risk situation that needs extreme care. We have gathered a quick summary to give you an immediate answer before you read the detailed results. The proof shows major warning signs that potential investors cannot ignore.

WikiFX Broker

Latest News

US Trade Deficit Collapses In October: Structural Shifts In Global Trade Revealed

Situation In Venezuela Adds To Dollar Uncertainty

EURUSD Fails to Make New Highs

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

RM2.95 Million Gone: Terengganu Director Falls for ‘High-Return’ Scam

Trade War Crossroads: Supreme Court Ruling and Tariff Maze Threaten Economic Stability

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

The 'Just-in-Case' Era: Strategic Hoarding Ignites Commodity Supercycle

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Rate Calc