SEVEN STAR FX Exposure: Do Traders Face Account Blocks & Withdrawal Denials?

Abstract:Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker‘s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the companys operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

SEVEN STAR FX Profile: Trading Instruments & Account Types

From the information available on SEVEN STAR FXs website, the company was founded in 2004 with a view to making trading accessible to all. It is a multi-asset trading platform that allows trading opportunities across a wide range of instruments such as currency, CFD futures, cryptocurrency, soft commodities, energies, metals, global indices, etc. With multiple platforms, such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), Web Trader and MultiTrader, SEVEN STAR FX promises to offer an interactive and insight-based trading experience to traders with varied experience and capital in hand.

The broker offers three types of accounts - Standard, VIP and ECN - with minimum deposits of $50, $25,000 and $5,000, respectively. While ECN and VIP accounts offer the maximum leverage of 1:500, the maximum leverage in the Standard account remains 1:1000.

A Look at the Top Forex Trading Complaints Against SEVEN STAR FX

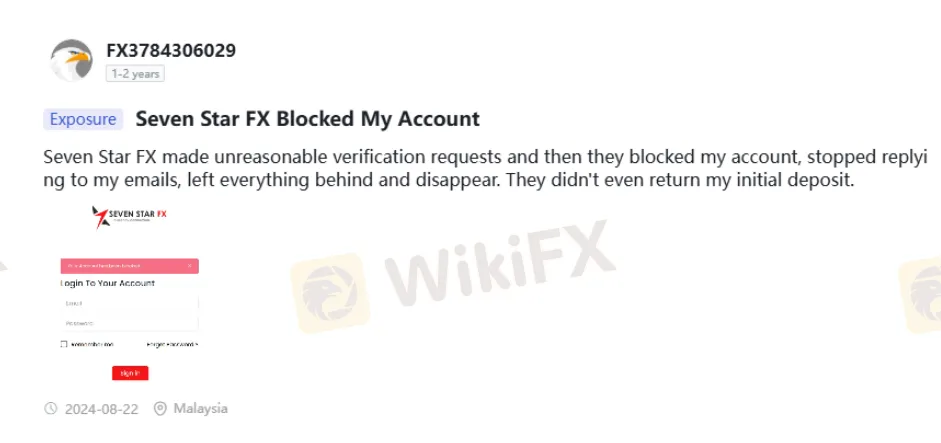

The Illegitimate Verification Notification and Subsequent Account Block Accusation

A Malaysia-based trader hit out at the broker for unreasonable account verification requests. Subsequently, SEVEN STAR FX blocked the trading account, to which the trader contacted the customer support team through email. However, the trader alleged that the team did not respond to any of the emails and disappeared, trapping even his initial deposit. Find out the entire accusation in this SEVEN STAR FX review.

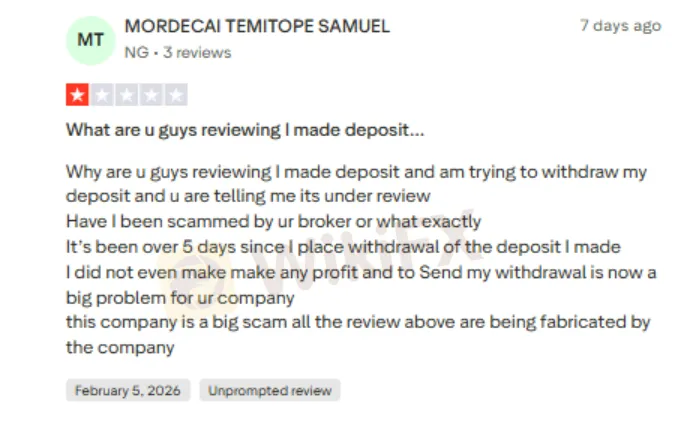

User Alleges Deposit Return Delays and Possible Scam

A trader claimed to have requested a withdrawal of the initial funds deposited on the SEVEN STAR FX platform. As per the traders admission, there was no profit when trading through the broker. However, the withdrawal has reportedly been under “review” for over five days with no clear resolution. The complainant expressed frustration over the delay, questioning the legitimacy of the broker and suggesting the possibility of a scam. The trader also alleged that positive reviews about the company may have been fabricated. To know more, read this complaint.

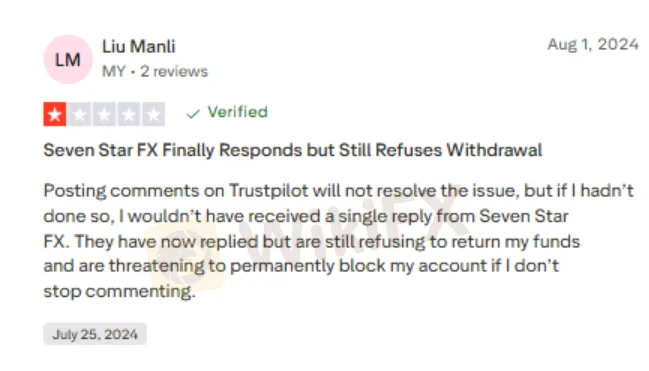

A Late Customer Support Response, But Still No Withdrawals Possible

While the SEVEN STAR FX customer support team responded to the queries raised by the trader, it did not ensure access to withdrawals even at that time. The trader even accused the broker of threatening to block the trading account. Look at this negative, SEVEN STAR FX review for clarification.

Legal Assistance Sought for Fund Recoveries

Aggrieved by the fund loss, a US-based trader sought assistance from a legal firm to recover the stuck funds. The trader appreciated the firm for handling the entire process efficiently. Check out this user review.

What Does SEVEN STAR FX Say About Its Regulatory Status?

On its official website, SEVEN STAR FX claims to have a license number - GB23202165 - from the Financial Services Commission (FSC), which actually works as an offshore regulator in regions such as Mauritius, where the broker has a registered office with this address - Level 5 The Core Building, Cybercity, Ebene, Republic of Mauritius. The offshore regulation cannot be compared with top regulations from authorities such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). The protection levels ensured by top regulators cannot be matched by entities regulated by offshore regulators such as the FSC.

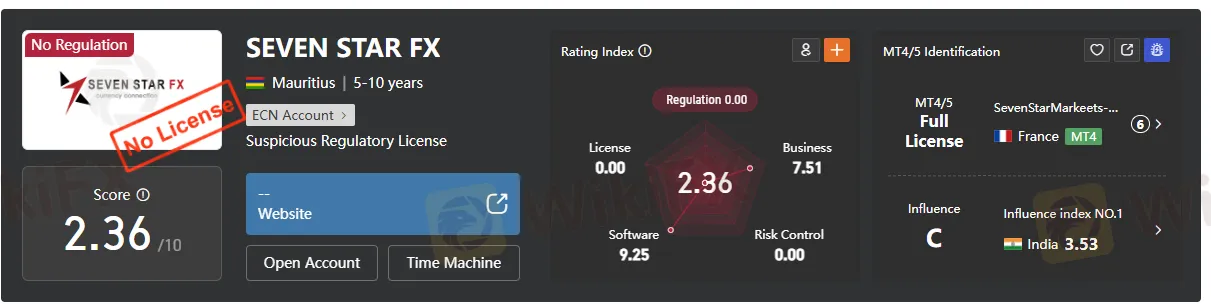

SEVEN STAR FX Review by WikiFX: The Exact Regulatory Status & Score

The investigation conducted by WikiFX, a renowned broker regulation inquiry app, did not find a license for SEVEN STAR FX. No license status inevitably raises trading risks for investors. Keeping this in mind, the WikiFX team gave it a score of only 2.36 out of 10.

Read more

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

The question "Is ZarVista legit?" is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations. To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informe

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc