Vida Markets Regulation and Broker Review

Abstract:Vida Markets regulation exceeded under FSCA. Broker review covers accounts, platforms, and risk considerations.

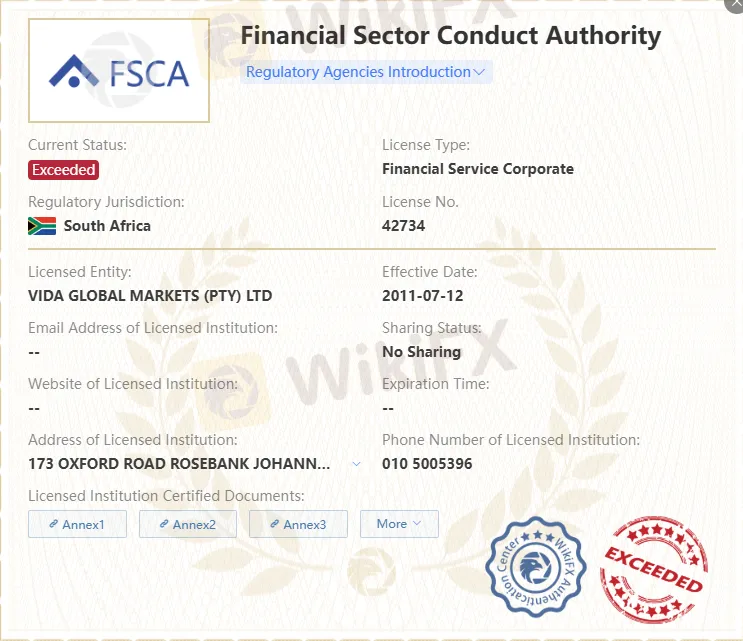

Vida Markets Regulation: FSCA Oversight and Exceeded Status

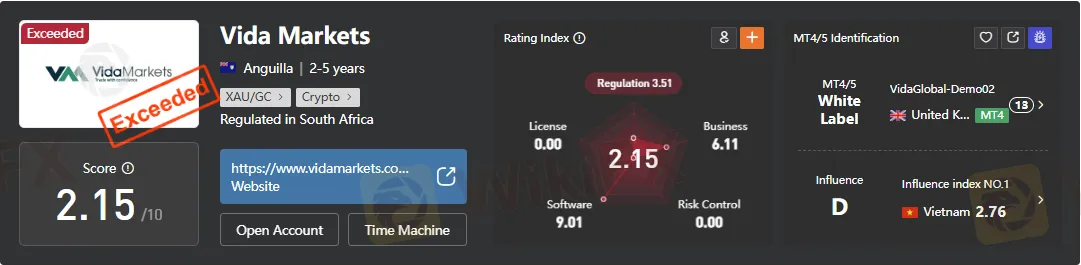

Vida Markets operates under the Financial Sector Conduct Authority (FSCA) in South Africa, with license number 42734 issued to Vida Global Markets (Pty) Ltd. The license was effective from July 12, 2011, yet its current status is marked as “Exceeded.”

In regulatory parlance, “Exceeded” signals that the broker has gone beyond its authorized scope or failed to maintain compliance standards. This raises questions about the brokers long-term credibility and investor protection. While Vida Markets presents itself as a regulated entity, the exceeded status diminishes the strength of its regulatory shield.

Transparency issues are evident: the brokers listed office address in Rosebank, Johannesburg, was flagged by WikiFX investigators as “No Office Found,” suggesting inconsistencies between registered details and physical presence.

Vida Markets Broker Profile and Domain Registration

According to the attached documentation, Vida Markets Limited is registered in Anguilla (2022) and operates globally with a declared presence in South Africa. The company website is https://www.vidamarkets.com/en/, and customer support is offered via support@vidamarkets.com.

The dual registration—Anguilla and South Africa—creates jurisdictional ambiguity. Competitor brokers such as Tickmill or Pepperstone typically emphasize clear, singular regulatory frameworks (FCA, ASIC, CySEC), whereas Vida Markets layered registrations complicate its compliance narrative.

Trading Instruments Offered by Vida Markets Broker

Vida Markets provides access to a wide range of instruments:

- Forex (major, minor, and exotic pairs)

- Equities (global shares)

- Indices (major stock market benchmarks)

- Commodities (gold, silver, oil)

- Cryptocurrencies (popular digital assets)

- ETFs, Bonds, and Mutual Funds

This breadth of instruments positions Vida Markets competitively against mid-tier brokers. However, the exceeded FSCA regulation status undermines confidence in the safety of these offerings.

Account Types and Trading Conditions

Vida Markets offers two primary account types:

| Feature | STP Account | RAW Account |

| Spreads | 1.2 pips | 0.1 pips |

| Commission | None | From $5/€5/£5 per lot |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Minimum Trade Size | 0.01 lots | 0.01 lots |

Additionally, a Swap-Free account is available for traders in Indonesia, Malaysia, and the MENA region.

The leverage ceiling of 1:1000 is significantly higher than industry norms. For comparison, FCA-regulated brokers cap leverage at 1:30 for retail clients. While high leverage appeals to aggressive traders, it magnifies risk exposure and potential losses.

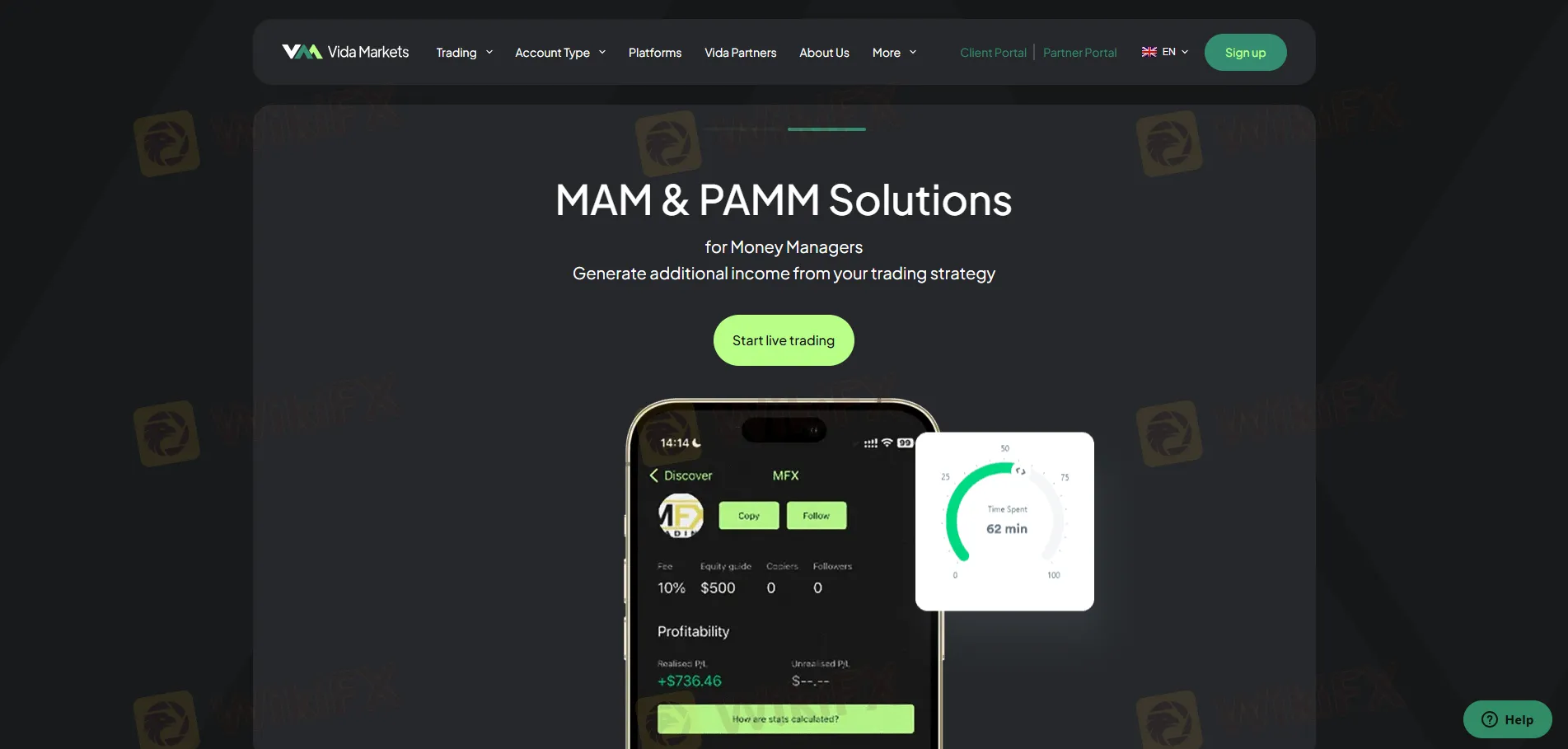

Platforms: MT4, MT5, and Proprietary Solutions

Vida Markets supports:

- MetaTrader 4 (MT4) – suited for beginners

- MetaTrader 5 (MT5) – advanced features for experienced traders

- VIDA PAMM – money manager accounts

- VM Social – mobile-based social trading

Execution speeds average 164–177 ms, with multiple live and demo servers listed. While the infrastructure appears robust, the reliance on white-label MT4/MT5 servers suggests limited proprietary development compared to brokers like IC Markets or XM, which operate full-license servers with stronger risk control systems.

Fees, Spreads, and Commission Structure

- STP Account: Fixed spread of 1.2 pips, no commission.

- RAW Account: Spreads as low as 0.1 pips, commission from $5 per lot.

This dual structure mirrors industry practices, yet the lack of transparency around additional fees (withdrawal charges, inactivity fees) is a concern. Competitor brokers often publish detailed fee schedules, whereas Vida Markets documentation remains partially opaque.

Pros and Cons of Vida Markets Broker

Pros

- Wide range of trading instruments (forex, equities, indices, commodities, cryptos).

- Support for PAMM/MAM accounts.

- Swap-free accounts available.

- 24/7 customer support.

- Spreads starting from 0.1 pips.

- MT4 and MT5 platforms supported.

Cons

- Exceeding FSCA regulation undermines legitimacy.

- Regional restrictions (United States, North Korea).

- High leverage increases risk exposure.

- Office address inconsistencies flagged by WikiFX.

- Limited transparency on fees.

- Reports of blocked accounts and unresolved deposits from users.

User Complaints and Exposure Cases

The attached file highlights multiple user exposure cases:

- Accounts blocked without warning, with funds withheld under alleged fraud suspicions.

- Deposits are pending for several days without resolution.

- MT4 accounts are inaccessible due to server issues, with vague responses from support.

These complaints, combined with the exceeded regulatory status, raise red flags about operational reliability. In contrast, brokers with strong regulatory oversight (e.g., FCA, ASIC) rarely face such systemic complaints.

Competitor Comparison

- Pepperstone (ASIC, FCA): Transparent fee structure, leverage capped at 1:30 for retail.

- XM (CySEC, ASIC): Strong educational resources, multiple account types, clear regulatory backing.

- Vida Markets: High leverage, exceeded FSCA license, inconsistent office presence.

Vida Markets offerings are attractive on paper but fall short in regulatory credibility compared to established competitors.

Bottom Line: Vida Markets Regulation and Broker Value

Vida Markets presents itself as a multi-asset broker with competitive spreads, high leverage, and modern trading platforms. However, the exceeded FSCA regulation status, ambiguous jurisdictional registration, and unresolved user complaints cast significant doubt on its legitimacy.

For traders seeking security, brokers with active FCA, ASIC, or CySEC licenses provide stronger safeguards. Vida Markets may appeal to risk-tolerant traders attracted by high leverage and social trading features, but caution is warranted.

Verdict: Vida Markets Broker offers breadth but lacks depth in regulatory assurance. The exceeded FSCA regulation is a critical weakness that overshadows its trading advantages.

Read more

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc