Elite FX-Some important Details about This Broker

Abstract:Elite FX is registered in the United Kingdom and appears to be a fraudulent broker without any credible regulation, with a history of no more than 5 years. Unfortunately, we could not find any more detailed information about this broker on the internet. Therefore, we recommend that you do not deal with such a low-information broker right off the bat and always consult WikiFX to get at least a basic understanding of a broker.

Note: At this time, we only have a cursory look at Elite FX as the company's official website (https://elite-fx.biz/ ) does not open properly.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

General Information

| Elite FX Review Summary in 10 Points | |

| Founded | N/A |

| Registered Country/Region | United Kingdom |

| Regulation | No license |

| Market Instruments | N/A |

| Demo Account | N/A |

| Leverage | 1:500 |

| EUR/USD Spread | Fixed from 3.0 pips |

| Trading Platforms | MT4 |

| Minimum deposit | N/A |

| Customer Support | |

What is Elite FX?

Elite FX is registered in the United Kingdom and appears to be a fraudulent broker without any credible regulation, with a history of no more than 5 years. Unfortunately, we could not find any more detailed information about this broker on the internet. Therefore, we recommend that you do not deal with such a low-information broker right off the bat and always consult WikiFX to get at least a basic understanding of a broker.

When choosing a forex broker, you should know that a regulatory license does not necessarily guarantee the reliability of a broker as it may be an expired or cloned regulatory license, but a broker without any regulatory license has a high probability of being unreliable.

Pros & Cons

| Pros | Cons |

| • Multiple account types offered | • No regulatory license |

| • Leverage up to 1:500 for all account types | • No segregated accounts |

| • Supports MT4 trading platform | • Website is unavailable |

| • Islamic (swap-free) accounts available | • Scam exposures from their users |

| • Wide fixed spreads (3 pips) | |

| • Limited payment options (only Bank Transfers) | |

| • High minimum deposit requirement for some account types |

Elite FX Alternative Brokers

AvaTrade - a reliable broker with competitive trading conditions and a wide range of markets and trading platforms;

Swissquote - a well-regulated broker with a solid reputation and a wide range of trading products and innovative technologies;

HotForex - a popular broker that offers low spreads, multiple account types, and a wide range of trading instruments.

There are many alternative brokers to Elite FX depending on the specific needs and preferences of the trader. Some popular options include:

Is Elite FX Safe or Scam?

Elite FX does not have a regulatory license, does not offer segregated accounts, and there are scam exposures from their users. Additionally, their website is currently unavailable. These factors raise concerns about the safety and legitimacy of Elite FX. Without proper regulation and security measures, there is a higher risk of fraud and financial loss. Therefore, it is advisable to exercise caution and consider alternative brokers with a better reputation for safety and reliability.

Market Instruments

As the website of Elite FX is currently unavailable, it is not possible to provide specific information about the market instruments offered by the broker. However, it is common for brokers to offer a range of financial instruments for trading, including forex, commodities, indices, and shares. As Elite FX offers trading through the MT4 platform, it is likely that clients are able to trade a variety of financial instruments through this platform. However, without access to their website or further information, it is not possible to provide a more detailed analysis of Elite FXs market instruments.

Accounts

Elite FX offers three account types - Micro, Mini and Standard. The minimum deposit for the Micro account type is unknown, while the Mini account requires a minimum deposit of $2,000 and the Standard account requires a minimum deposit of $5,000. The broker also offers swap-free (Islamic) accounts for those who follow Shariah law. The availability of multiple account types allows traders to choose an account that best suits their trading needs and budget. However, the lack of information regarding the minimum deposit for the Micro account type may be a concern for some traders.

Leverage

Elite FX offers a maximum leverage of 1:500 for all account types. This high leverage can be attractive to traders looking to amplify their potential profits, as it allows them to control a larger position with a relatively small amount of capital. However, it also increases the risk of large losses, especially for inexperienced traders. It is important for traders to understand the risks associated with high leverage and to use it judiciously.

Spreads & Commissions

Based on the information provided, Elite FX offers fixed spreads starting from 3 pips on EUR/USD pair for all account types. It is important to note that while fixed spreads may provide traders with predictability, they may also be wider than variable spreads. Elite FX does not provide information on commission charges, which could impact the overall cost of trading. It is recommended that traders carefully review all fee structures before opening an account with Elite FX.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Elite FX | 3 pips | N/A |

| AvaTrade | 0.9 pips | None |

| Swissquote | 1.4 pips | None |

| HotForex | 1.2 pips | None |

Note: Spreads and commissions may vary depending on the account type, trading platform, and market conditions.

Trading Platforms

Elite FX supports the popular MetaTrader 4 (MT4) trading platform, which is widely used by traders worldwide. MT4 is known for its user-friendly interface, advanced charting capabilities, and wide range of trading tools and indicators. The platform also offers the ability to create and use automated trading strategies through the use of expert advisors (EAs). MT4 is available for download on desktop and mobile devices, allowing traders to access their accounts and trade on-the-go. Overall, MT4 is a reliable and robust trading platform that provides traders with a comprehensive trading experience.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| Elite FX | MetaTrader 4 |

| AvaTrade | MetaTrader 4, AvaTradeGo, DupliTrade, ZuluTrade |

| Swissquote | MetaTrader 4, Advanced Trader, WebTrader |

| HotForex | MetaTrader 4, MetaTrader 5, HotForex WebTrader |

Note: Some brokers may offer additional trading platforms that are not listed above. The table above only lists the main trading platforms offered by each broker.

Deposits & Withdrawals

Elite FX offers limited deposit and withdrawal options, as the broker only supports Bank Transfer. Unfortunately, there is no information available about the minimum deposit requirement or the fees associated with deposits and withdrawals. It is recommended to contact Elite FX's customer support team for more details before making any transactions.

Elite FX minimum deposit vs other brokers

| Elite FX | Most other | |

| Minimum Deposit | N/A | $100 |

Customer Service

Based on the information available, Elite FX appears to only offer email (info@elite-fx.biz) support for their clients, which may not be sufficient for traders who require timely and efficient support. The lack of other support channels such as phone or live chat may also be a disadvantage for clients who need urgent assistance. It is important to note that the quality and responsiveness of the email support cannot be determined without further information or personal experience.

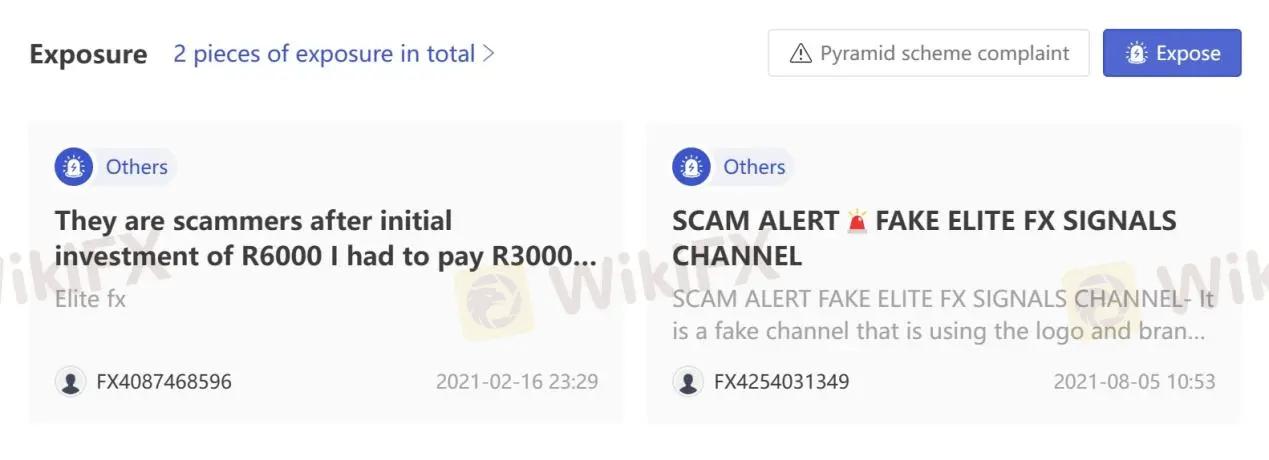

User Exposure

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Conclusion

In a word, it is difficult to recommend Elite FX as a reliable and trustworthy broker due to the lack of regulatory oversight, no information on market instruments, unavailable website, and negative reviews from users. While Elite FX does offer a variety of account types and high trading leverage, the lack of transparency and security measures raises red flags. It is important to thoroughly research and consider a broker's reputation and regulation before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is Elite FX regulated? |

| A 1: | No, it is currently not effectively regulated and you are advised to be aware of its potential risks. |

| Q 2: | Does Elite FX offer the industry-standard MT4 & MT5? |

| A 2: | Yes. Elite FX supports MT4. |

| Q 3: | Is Elite FX a good broker for beginners? |

| A 3: | No. Elite FX is not a good choice for beginners. Not only because of its unregulated condition, but also because of its inaccessible website. |

Read more

ehamarkets exposed: Is Withdrawing Profits Impossible for Traders? Let’s Find Out!

ehamarkets is the focus of many traders on broker review platforms for all the negative reasons. Among the many complaints against the Malaysia-based forex broker, the withdrawal issue and the utter helplessness of the trader in recovering their funds stood out. The broker is accused of denying traders their funds using numerous excuses. So, if you were planning to invest in this forex broker, do not miss reading this ehamarkets review article. Take a look!

Bull Market Review: Reports of Withdrawal Blocks, Server Downtime & Capital Scam Allegations

Witnessed a complete halt on your Bull Market trading platform after a good run? Did you receive a poor response from the broker’s official upon the trading halt enquiry? Failed to receive withdrawals despite undergoing numerous checks by the forex broker? Is your Bull Market withdrawal application pending for months? Did you have to encounter massive trading fees on the Bull Market platform? These issues have become rampant here, and we have highlighted them in this Bull Market review article.

BitForex Review: What Traders are Saying About Fund Scams and Withdrawal Issues

Earned profits on the BitForex platform, but could not withdraw because of tax payment and other liabilities? Does the forex broker even flag your account with fake money laundering charges? Do you consistently face login issues when using the BitForex trading platform? Is your deposited capital directed to the wrong address by the forex broker? All these have become very typical of the way the broker goes about the business. Many traders have opposed the broker on several review platforms online. It’s time to check their comments in this BitForex review article.

FXPN Complete Review: Understanding the High-Risk Warnings and Trading Rules

For traders asking the important question, "Is FXPN safe and worth trying?", our research gives a clear and warning answer. After looking closely at its legal status, how it operates, and what users say, FXPN shows a high-risk situation that needs extreme care. We have gathered a quick summary to give you an immediate answer before you read the detailed results. The proof shows major warning signs that potential investors cannot ignore.

WikiFX Broker

Latest News

US Trade Deficit Collapses In October: Structural Shifts In Global Trade Revealed

Big Boss Review 2025: Safety Warning and Regulatory Analysis

EURUSD Fails to Make New Highs

Situation In Venezuela Adds To Dollar Uncertainty

TP ICAP Expands Global Reach with Acquisition of Vantage Capital Markets

Dollar Dives and Metals Surge: Powell Investigation Sparks Institutional Crisis

Dollar on Edge: Supreme Court Tariff Ruling and Deficit Warnings Collide

Silver Markets Face 'Liquidity Squeeze' Risk, Warns Goldman Sachs

Top Forex Brokers Offering Free Demo Accounts

Dollar Reigns Supreme: Economic Resilience Eclipses Political Noise Ahead of

Rate Calc