WIKIFX REPORT: M4MARKETS PARTS WAYS WITH MARKETING HEAD THEMIS CHRISTOU

Abstract:Seychelles-regulated brokerage firm M4Markets firm has parted ways with Themis Christou who held several marketing roles for nearly two years.

Mr Christou, whose career in the FX industry spans more than 13 years, has served most recently as Group Head of Marketing. Prior to M4Markets, he spent more than four years at London-based brokerage firm, Tickmill.

During this long stint, he worked his way up through several senior roles with the firm, culminating with the position of interim chief marketing officer (CMO). Christou‘s career also encompasses other stops at forex broker Orbex where he served as the group’s senior marketing executive.

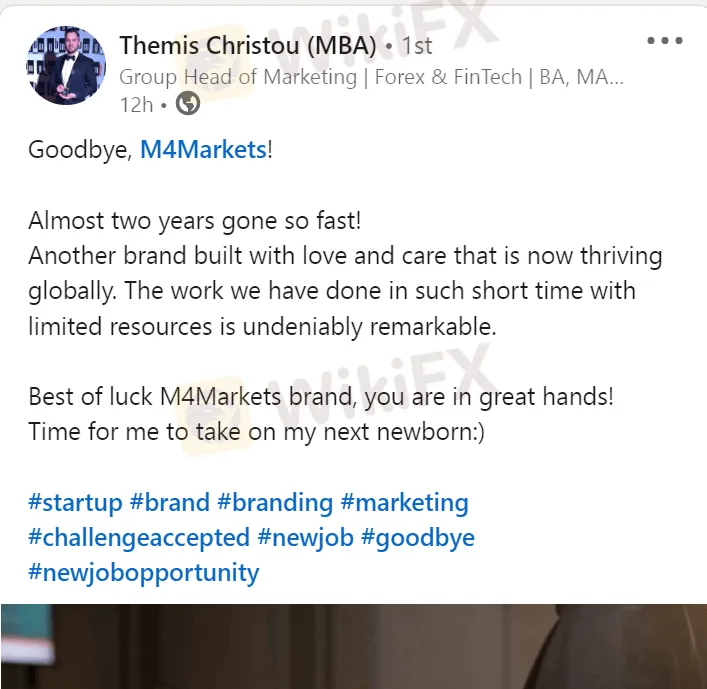

Without revealing his next destination, Themis confirmed in a Linkedin post that he is leaving M4Markets on good terms.

Established in 2019, M4Markets is the trading name of Trinota Markets Global Limited. The broker maintains its head office in the Seychelles and is licensed by the countrys Financial Services Authority (FSA).

The firm was in the news recently after it picked up some investment from Cyprus and Dubai based investors in a new funding round that it will be using to grow its business.

The lesser-known platform has not shared any details about the capital injection amount. M4Markets also didnt disclose the identity of the investors participating in the financing round, though it says they acquired a significant stake.

The new funds will go towards product development and will allow M4Markets to continue its expansion plans by penetrating new markets. The company also intends to use the new capital to further develop its platform, accelerate growth and launch into new regions in line with its plans to become a global brokerage house.

Read more

MH Markets Broker Review

In this review, we take a closer look at MH Markets, a forex broker that has been attracting attention in the online trading community. We’ll analyze the broker based on evaluating several key factors such as regulatory status, trading platform, customer service, account types, spreads, and overall reliability.

xChief Broker Review 2025: Trustworthy or Risky?

Explore our 2025 review of xChief, a Comoros-based forex and CFD broker. Assess its regulation, trading environment, user feedback, and risks to determine if it’s a reliable choice for traders.

Use Leverage Like a Pro | Avoid the Mistakes That Wipe Traders Out

In the high-stakes world of financial trading, leverage is a potent instrument that enables traders to punch well above their financial weight. By allowing market participants to control larger positions with a relatively small outlay of capital, leverage opens the door to potentially outsized returns. But it is not without peril as amplified gains also come with amplified losses, and understanding how leverage works is crucial for anyone stepping into leveraged markets.

CWG Markets’ 10% Deposit Bonus Campaign With Rewards Up to $5,000

CWG Markets, a global online trading platform, has announced a new deposit bonus campaign running now for a limited time. Both new and existing clients are eligible to receive a 10% deposit bonus, with a maximum reward of up to USD 5,000 per account.

WikiFX Broker

Latest News

Robinhood Launches Free Desktop Trading Platform for UK Investors

UK Unveils Crypto Regulation Plan: FCA and Bank of England Target Stablecoins and Custody

ALERT! 98% of Indian Finfluencers Are NOT SEBI-Registered!

PAY ATTENTION!! WARNING ALERT — MAY 29, 2025- CHECKOUT THE LIST

IronFX UK 2024 Revenue Doubles to $1.44 Million

Capital.com Reports Strong Growth and Leadership Changes

India GDP: Growth at 7.4% faster than expected in fourth quarter

NinjaTrader Fined $250,000 for Anti-Money Laundering Lapses

OANDA Fined $600K by NFA Over Rule Breaches and Crypto Claims

Key Figure Behind $230 Million Crypto Fraud Arrested After Two Years on the Run

Rate Calc