Dana -Some important Details about This Broker

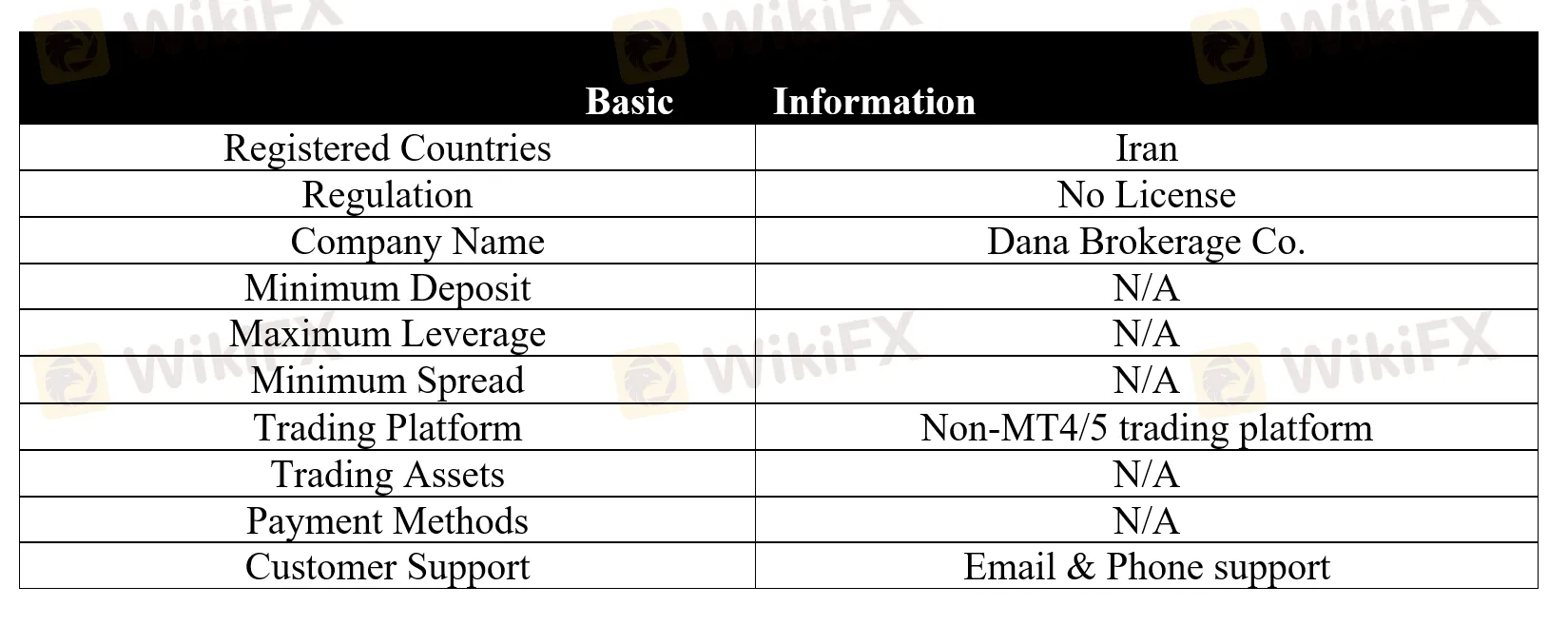

Abstract:Dana Brokerage Co. (short for “Dana”) is an Iran-based brokerage firm founded in 2005, providing clients access to the currency and stock markets.

General Information

Dana Brokerage Co. (short for “Dana”) is an Iran-based brokerage firm founded in 2005, providing clients access to the currency and stock markets.

According to this brokerage firm, Exchange Licenses it holds include the following:

License to operate in Tehran Stock Exchange

OTC license to operate in Iran

Online Trading License

Admission Consultant License

However, there is no official regulatory license showing this broker legally operates.

Market Instruments

With the Dana Brokerage Co. platform, investors can get access to various financial markets, including Foreign Exchange, Stocks, Options, and more.

Trading Channels

Trading the stock market can be done in three ways:

Face to face orders: You can complete the purchase or sales form in the acceptance section and the person in charge of accepting your order informs the traders.

Online Orders: You can register your buying and selling orders through the website of the brokerage without visiting the brokerage in person. After registration, the person in charge of the online reception department informs the traders after seeing these orders.

Online transactions: In both cases mentioned above, you only place orders through traders, but in online transactions, you register purchase and sales orders directly in the core of the transactions, which means you become your own trader.

Trading Platform

What Dana Brokerage Co. offers is not the MT4 or MT5 trading platform, its proprietary trading platform instead.

Deposit Options

There are three channels for clients to deposit money to the brokerage account to buy securities:

1. Through online access and the instant deposit section (the limit of the deposit amount for daily purchases from each bank care is 50 million Tomans).

2. Direct purchase from a bank account (this method can only be done for Bank Mellat and Bank Saman account holders)

3. You can also deposit funds to the bank accounts of the brokerage through branches or internet Bank.

Two working days after the sales of each share and at your request, the brokerage will deposit the amount of the sales shares into your account.

Educational Resources

Dana Brokerage Co. also provides access to some educational resources, including Stock Exchange, Stock Portfolios, Futures, Options Trading, as well as teaching how to use the option trading system, etc.

Customer Support

Traders with any questions or concerns they may have about their accounts or their trading can reach out to Dana Brokerage Co. through its two branches:

Jordan Branch

Telephone: 021 79408, 02126291522, 02178301000

Address: Tehran, Nelson Mandela Street (Jordan), Kaj Abadi Street, No. 27

Phone: 051370557603

Fax: 05137672291

Address: Mashhad, Janbaz Blvd., Page Complex, Block E 13th Floor, Unit 9

Or you can also follow this company on some social media platforms, such as Linkedin, Instagram, Youtube and Facebook.

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

Read more

Ringgit hits five-year high against US dollar in holiday trade

The Malaysian ringgit extended its rally, reaching a five-year high against the US dollar, trading in a narrow range of RM4.04-RM4.05.

AMarkets Updated Review: Is This Established Broker Still a Good Choice in 2025?

In a competitive online trading space, few companies can claim a history as long as AMarkets. Started in 2007, this broker has helped over three million clients and built a strong presence, especially in CIS, Asian, and Latin American markets. What makes it appealing is clear right away: very high leverage, many different account types, and an excellent 4.8-star rating on Trustpilot based on reviews from over 3,000 users so far. These features show a popular and seemingly trustworthy trading partner. However, a closer look shows a basic problem that traders may face. Behind the attractive features and positive user opinions lies a major concern: AMarkets works only under offshore regulation. It doesn't have licenses from any top-level regulatory bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). This AMarkets Review 2025 aims to break down this contradiction. We will provide a complete analysis based on verified facts, looking at the broker's safety measures, trading condi

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

ZarVista Community Feedback: What Users Really Think About This Broker

This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

WikiFX Broker

Latest News

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

FX Markets: Dollar Holds Firm at 98.00; Euro and Kiwi Breach Key Technical Levels

“Elites’ View in Arab Region” Event Successfully Concludes

Bond Markets Signal 'Hawkish' Risk: The Era of Cheap Money is Officially Over

FP Markets Marks 20 Years of Global Trading

GivTrade Secures UAE SCA Category 5 Licence

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

Common Questions About GLOBAL GOLD & CURRENCY CORPORATION: Safety, Fees, and Risks (2025)

What Is a Liquid Broker and How Does It Work?

Rate Calc