Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Abstract:For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

Executive Summary: The Answer Upfront

For traders asking, “Is ZarVista legit?”, the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved.

Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

The Bottom Line on ZarVista

ZarVista presents a high-risk profile for traders due to several critical concerns. Before considering this broker, you must be aware of the following red flags:

· Weak Overseas Regulation: The broker's licenses are from the Comoros Union and Mauritius. These places offer very little oversight and lack the strong protections provided by top-tier financial authorities such as the UK's FCA or Australia's ASIC.

· Severe Withdrawal Issues: A consistent pattern of user complaints across multiple review platforms highlights significant delays, unresponsiveness, and outright denial of withdrawal requests. This is the most pressing operational risk.

· Legal & Regulatory Problems: The entity, under its former name ZaraFX, faced a direct investigation and asset freeze by India's Enforcement Directorate for alleged illegal forex trading operations.

· Lack of Investor Protection: Due to its offshore status, ZarVista is not part of any investor compensation fund. If the company becomes bankrupt, clients have no safety net or clear way to recover their deposits.

Breaking Down ZarVista's License

A broker's license is the foundation of its legitimacy. It determines the rules it must follow, the oversight it faces, and the level of protection a trader can expect. ZarVista claims licenses from two offshore places, which we will examine critically.

Claimed License 1: Comoros Union (MISA)

ZarVista holds a license from the Mwali International Services Authority (MISA) in the Comoros Union. This is a popular choice for brokers seeking light regulation.

MISA is known for its low money requirements, minimal reporting duties, and a hands-off approach to oversight. For traders, this means a very low level of protection. Solving disputes with a MISA-regulated entity is extremely difficult, and the license holds little to no weight with major international financial bodies. It is, for all practical purposes, a convenience flag that offers the appearance of regulation without client protection.

Claimed License 2: Mauritius (FSC)

The broker also claims a license from the Financial Services Commission (FSC) of Mauritius. While the FSC is generally considered a step up from Comoros, it is still an offshore regulator and has a significant, critical flaw.

According to warnings from industry watchdogs like BrokersView, the Mauritius FSC does not publicly share the domain names of its licensees. This transparency gap creates a major risk of identity fraud. A fraudulent entity can easily “copy” a legitimate company's license number and claim it as its own, and traders have no official way to verify if the website they are using (e.g., zarvistacm.com) is genuinely connected to the licensed entity. This makes the FSC license an unreliable indicator of safety.

ZarVista's Regulatory Profile

The combination of an extremely weak license and another with a critical verification flaw leaves traders dangerously exposed. There is no top-tier regulation, no separation of client funds enforced by a reputable authority, and no access to an investor compensation scheme.

| Regulatory Body | License Number | Regulatory Standing | Key Concern for Traders |

| MISA (Comoros) | T2023293 / HY00623401 | Offshore / Low | Extremely weak investor protection; low international credibility. |

| FSC (Mauritius) | GB23202450 | Offshore / Medium-Low | High risk of identity fraud; domain verification is not possible. |

Major Red Flags: Legal Troubles

Beyond the weak regulatory framework, ZarVista's operational history contains significant red flags that any potential client must consider. These issues move from theoretical risk to documented, real-world problems.

Red Flag #1: India Investigation

In August 2025, India's Enforcement Directorate (ED), a specialized financial investigation agency, conducted raids on four locations associated with the broker, which was then operating as ZaraFX.

The investigation centered on allegations of illegal forex trading operations and violations of India's currency regulations. The direct consequence of this action was the freezing of bank accounts containing approximately ₹39 million (around USD 445,000). The ED also started an investigation into the company's CEO, Jamsheer Thazhe Veettil. While ZarVista has stated that it does not operate in India or market to its residents, the existence of such a severe regulatory action by a national authority is a major blow to the company's credibility and a significant reputation risk.

Red Flag #2: Withdrawal Complaints

The most common and alarming feedback from ZarVista users relates to the withdrawal process. Across platforms, such as Trustpilot and WikiFX, a clear and disturbing pattern emerges. The core problem is that traders report extreme difficulty in accessing their funds, particularly their profits.

Common complaints include:

· Long Delays: Withdrawal requests are frequently reported as remaining in a “pending” or “pending check” status for weeks, and in some cases, months, far exceeding the broker's stated processing times.

· Unresponsive Customer Service: When users ask about their delayed withdrawals, they often receive repetitive and unhelpful responses from support staff, such as “the relevant team is processing it,” with no resolution or clear timeline.

· Denied Profits and Blocked Accounts: There are numerous reports of traders who, after making profits, have their accounts flagged for alleged rule violations, such as using certain Expert Advisors (EAs). This often leads to the cancellation of profits and a refusal to process withdrawal requests for the earned funds. One widely cited case involves a user unable to withdraw approximately $9,000, with the platform alleging prohibited EA usage, a claim the user denied.

Red Flag #3: No Safety Net

Reputable brokers in top-tier places are typically members of an investor compensation scheme. Examples include the Financial Services Compensation Scheme (FSCS) in the UK, which protects client funds up to £85,000, or the Investor Compensation Fund (ICF) in Cyprus.

ZarVista, due to its offshore regulation in Comoros and Mauritius, is not part of any such scheme. This has a critical implication for traders: if the broker were to become bankrupt or cease operations, there is no established mechanism to protect or recover client deposits. The money is simply at risk, with no third-party guarantee.

An Inside Look at Offerings

To provide a complete picture, it is necessary to review the products and services ZarVista offers. However, these features must be viewed through the lens of the significant risks already discussed. An attractive spread or a high leverage ratio is meaningless if you cannot withdraw your funds.

Account Types and Conditions

ZarVista offers a tiered account structure designed to cater to different deposit levels. The minimum deposit is relatively low, starting at $50, making it accessible to beginners. However, the trading conditions, particularly the spreads on lower-tier accounts, are not particularly competitive compared to leading brokers.

| Account Type | Min. Deposit | Spreads From | Commission | Max. Leverage |

| Starter | $50 | 1.5 pips | None | 1:500 |

| Professional | $250 | 1 pip | None | 1:500 |

| VIP | $500 | 0.0 pip | $5 per lot | 1:500 |

The broker provides access to over 350 assets, including forex, metals, indices, and cryptocurrencies, but notably lacks stock CFDs. It operates on a mixed Market Maker, STP, and ECN model.

Platforms and Tools

ZarVista's primary platform offering is strong, centered on the industry-standard MetaTrader suite.

· MetaTrader 5 (MT5): The main platform, offering advanced charting, a wide range of indicators, and support for automated trading.

· Social Trading Platform: The broker has an in-house copy trading system for users who wish to follow the strategies of others.

Additionally, ZarVista integrated AnalysisIQ, an AI-driven market analysis tool from Acuity Trading, in late 2024 to provide clients with market sentiment and technical insights.

Deposits and Withdrawals

The broker provides a wide array of funding methods, which makes depositing funds a simple process. These include bank wires, credit/debit cards, e-wallets like Skrill and Neteller, and various cryptocurrencies.

However, this is a two-sided coin. While depositing is easy, withdrawing is where the primary risk lies.

· Official Policy: ZarVista's website states that withdrawals are processed within 24 hours.

· The Reality Check: These official timelines strongly contrast with the numerous, detailed user reports of extreme delays, non-responsive support, and outright refusal of withdrawals. This difference represents the single biggest risk when dealing with this broker and calls the integrity of its financial operations into question.

The Ultimate Authenticity Check

The case of ZarVista serves as a powerful lesson for all traders. Checking a broker is the most critical step you can take to protect your capital. Here is a simple but effective process you can use to evaluate any broker.

A 3-Step Checking Process

1. Go Beyond the Broker's Website: Never take a broker's claims of regulation or safety at face value. A broker's website is a marketing tool designed to attract clients, not an objective source of information.

2. Check the Regulator's Public Registry: For any license a broker claims, find the official website of that financial regulator. Use its public search function to look up the company by name or license number. If you cannot find a matching, active entry, consider it a major red flag.

3. Use Independent Verification Platforms: Use specialized third-party services that gather regulatory data, user reviews, and expert analysis. These platforms do the heavy lifting of due diligence for you.

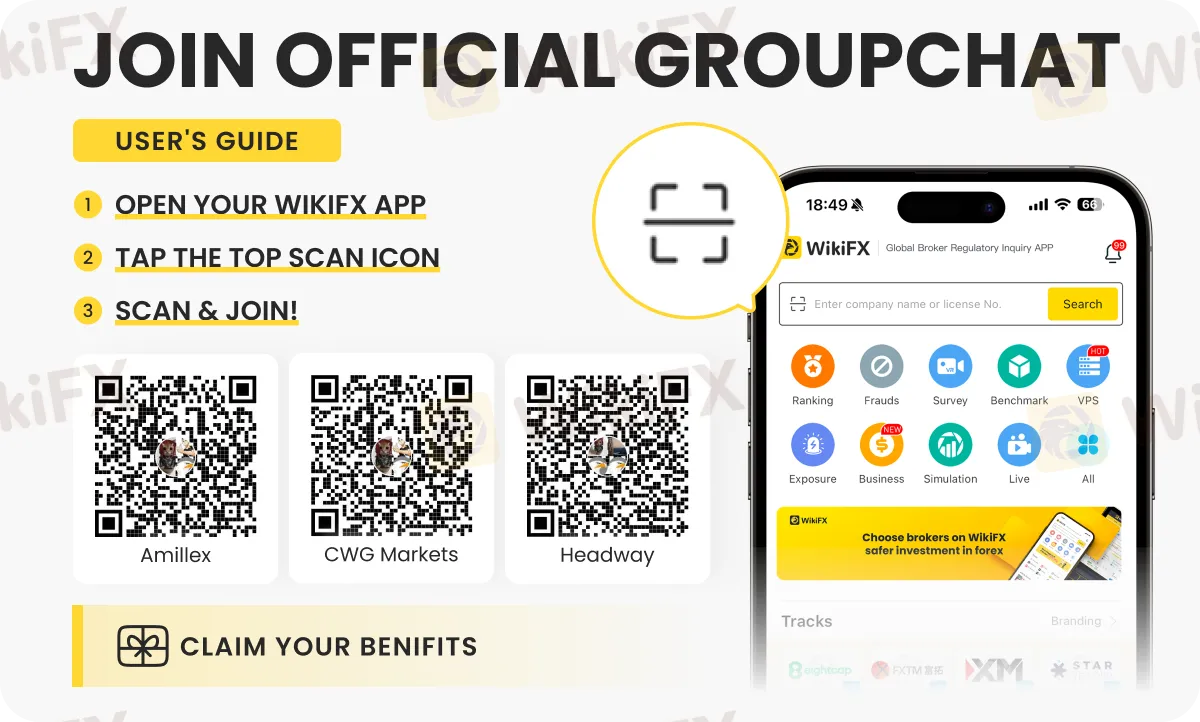

Our Recommendation: Use WikiFX

For comprehensive due diligence, we strongly recommend using a platform like WikiFX.

WikiFX is a global forex broker regulatory inquiry platform. It brings together crucial information into an easy-to-understand format. On WikiFX, you can find a broker's safety score, details on its regulatory status (including any warnings), and, most importantly, a collection of real user reviews. This allows you to see if other traders are experiencing issues, especially concerning withdrawals, which is often the first sign of a problem broker.

Before considering depositing funds with ZarVista or any other broker, we strongly urge you to search for them on WikiFX. This simple step can provide critical insights and help you avoid potentially devastating financial losses.

Final Verdict: Is ZarVista a Legit Broker?

After a thorough review of its licenses, legal history, and user feedback, our final verdict on the question “Is ZarVista legit?” is clear. While the company is a registered entity, it operates with a risk profile that is unacceptably high for any trader who prioritizes the safety of their capital.

Weighing the Evidence

The attractive features offered by ZarVista—such as high leverage, a low minimum deposit, and the MT5 platform—are completely overshadowed by the fundamental and severe weaknesses in its operational and regulatory integrity. The combination of weak offshore licenses that offer no real protection, a documented history of legal action from a state financial authority, and a widespread pattern of user complaints regarding fund withdrawals paints a picture of a broker that should be approached with extreme caution.

The documented risks associated with fund security and withdrawals are too significant to ignore. We strongly advise traders to prioritize safety and choose brokers regulated by reputable, top-tier authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). Always verify before you invest. Your capital deserves no less.

Check the latest forex updates seamlessly on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G.

Read more

FIBOGROUP Investigation: When Revoked Licenses Meet Malicious Liquidation

In the high-stakes world of forex trading, regulatory status and execution quality are the bedrock of trust. However, our latest investigation into FIBOGROUP reveals a troubling disconnect between their marketing claims and the reality faced by traders. With key licenses from the UK’s FCA and Cyprus’s CySEC currently listed as Revoked, and a surge in complaints regarding malicious liquidations and vanishing withdrawal options, the safety of client funds is in question. This report dissects the evidence to determine if FIBOGROUP remains a viable option for investors.

Titan Capital Markets: The "Token" Trap Hiding Behind a Forex Mask

Titan Capital Markets presents itself as a sophisticated Australian Forex broker offering AI-driven trading. However, a deep dive into recent trader activity exposes a disturbing pivot: the forced conversion of liquid funds into illiquid "tokens," aggressive demands for "tax" payments to unlock withdrawals, and a severe regulatory blacklisting from the Philippines Securities and Exchange Commission (SEC). This report uncovers why funds deposited here may never come back.

The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

WikiFX Broker

Latest News

JRJR Review: Why a "Valid" License Can't Hide the Withdrawal Nightmare

ZarVista Review 2025: A Complete Look at Its High-Risk Profile

Voices of the Golden Insight Award Jury | Greg Matwejev, Chief Market Strategist of BCR

EC Markets Opens New Marketing Hub in Central Limassol

London Capital Group – Regulation & Genuine User Reviews

Why Do You Always Lose When Trading?

Coinbase Expands Into Stocks and Tokenized Assets

Titan Capital Markets: The "Token" Trap Hiding Behind a Forex Mask

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Rate Calc