Excent Capital

Abstract:Excent Capital is a trading platform founded in 2021, registered in the United Kingdom. It is offshore regulated by The Seychelles Financial Services Authority. The platform offers access to a diverse range of market instruments, including forex, indices, ETFs, US stocks, and commodities. Excent Capital provides a proprietary trading platform. Traders can benefit from leverage of up to 1:150, with spreads starting at 1.1 pips (for EUR/USD). A demo account is available for practice trading, but details about the minimum deposit requirement are not provided.

| Excent CapitalReview Summary | |

| Founded | 2021 |

| Registered Country/Region | United Kingdom |

| Regulation | FSA (offshore) |

| Market Instruments | Forex, Indices, ETFs, US Stocks, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:150 |

| Spread | 1.1 pips (EUR/USD) |

| Trading Platform | Excent Capital platform |

| Minimum Deposit | / |

| Customer Support | Live Chat |

| Email: support@excent.capital | |

| Phone: +248 437 3651, +44 2038 403 680 | |

| Social Media: LinkedIn, YouTube, Twitter, Instagram, Facebook, Telegram | |

| Regional Restrictions | USA, Iran, Spain, North Korea |

Excent Capital Information

Excent Capital is a trading platform founded in 2021, registered in the United Kingdom. It is offshore regulated by The Seychelles Financial Services Authority. The platform offers access to a diverse range of market instruments, including forex, indices, ETFs, US stocks, and commodities. Excent Capital provides a proprietary trading platform. Traders can benefit from leverage of up to 1:150, with spreads starting at 1.1 pips (for EUR/USD). A demo account is available for practice trading, but details about the minimum deposit requirement are not provided.

Pros & Cons

| Pros | Cons |

| Demo account available | Offshore regulation risks |

| Commission-free | Limited account info |

| Multiple tradable products | Regional restriction |

| Transparent spreads | Limited payment options |

| Live chat support |

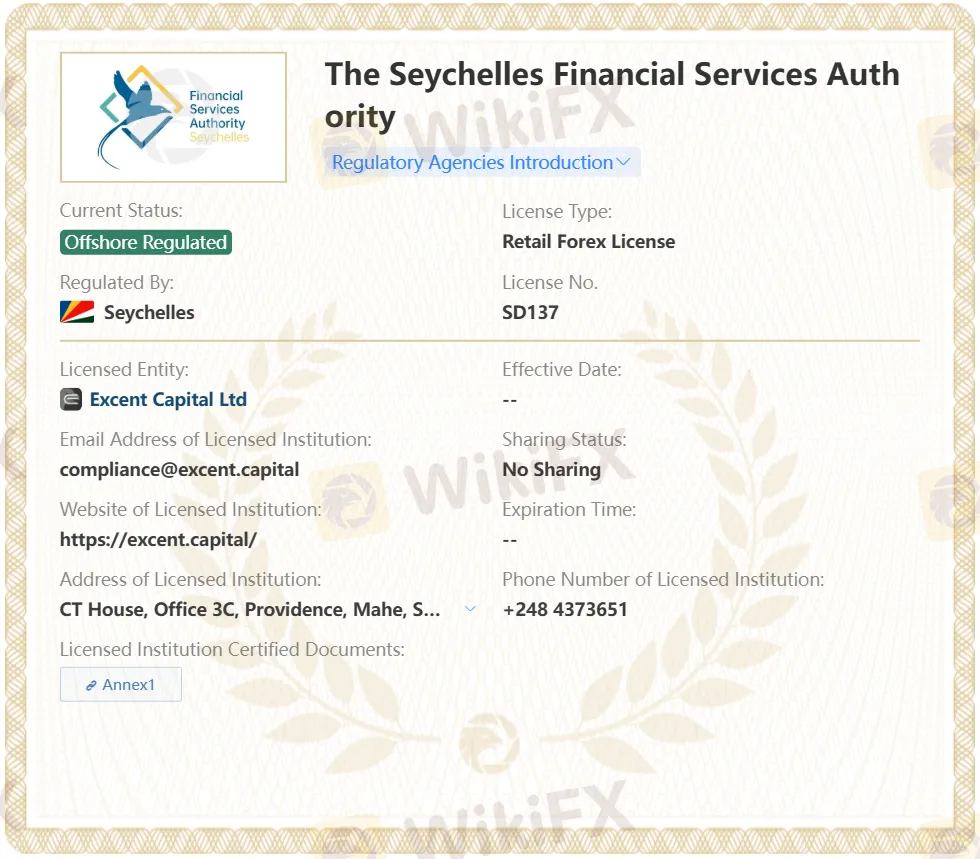

Is Excent Capital Legit?

Excent Capital is Offshore Regulated by the Seychelles Financial Services Authority, holding a retail forex license (SD137). You still need to be cautious, since offshore regulation may pose potential risks.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Seychelles | The Seychelles Financial Services Authority (FSA) | Offshore Regulated | Excent Capital Ltd | Retail Forex License | SD137 |

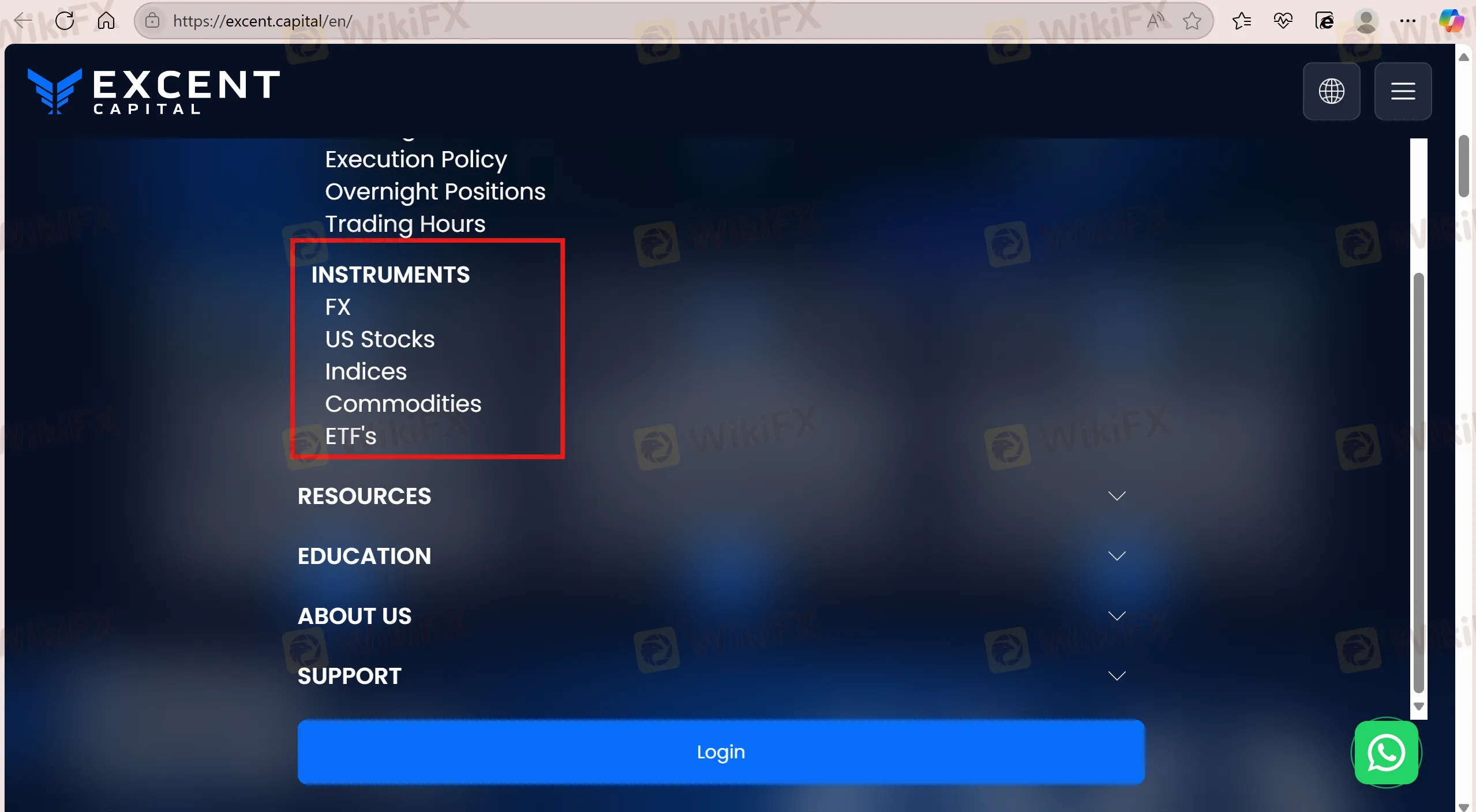

What Can I Trade on Excent Capital?

Traders on Excent Capital get access to market instruments like forex, ETFs, commodities, US stocks, and indices.

| Tradable Instruments | Supported |

| forex | ✔ |

| ETFs | ✔ |

| commodities | ✔ |

| stocks | ✔ |

| indices | ✔ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| futures | ❌ |

Account Types

A demo account is available on this platform. However, there is minimal information regarding live accounts.

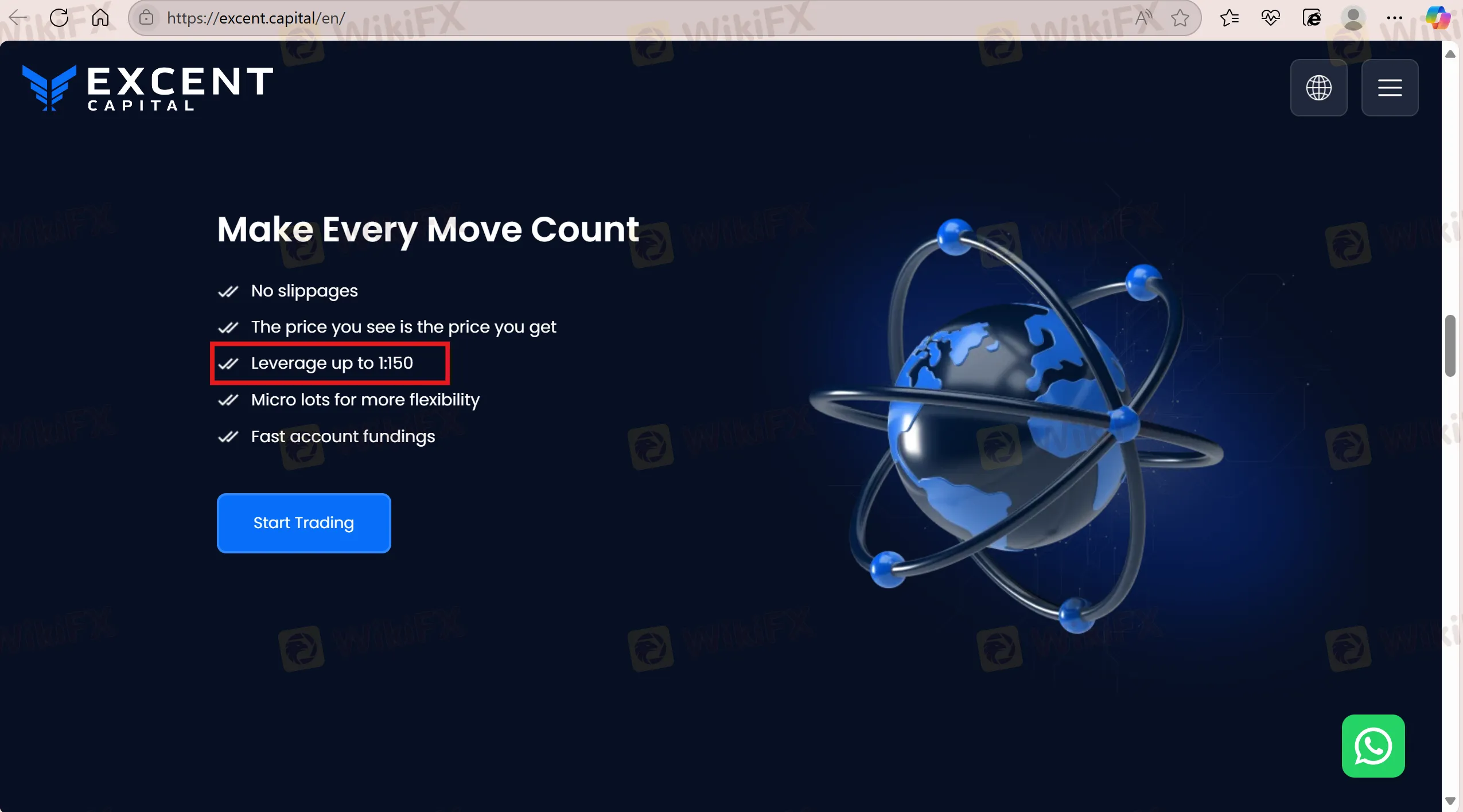

Leverage

Excent Capital offers leverage up to 1:150 on this platform.

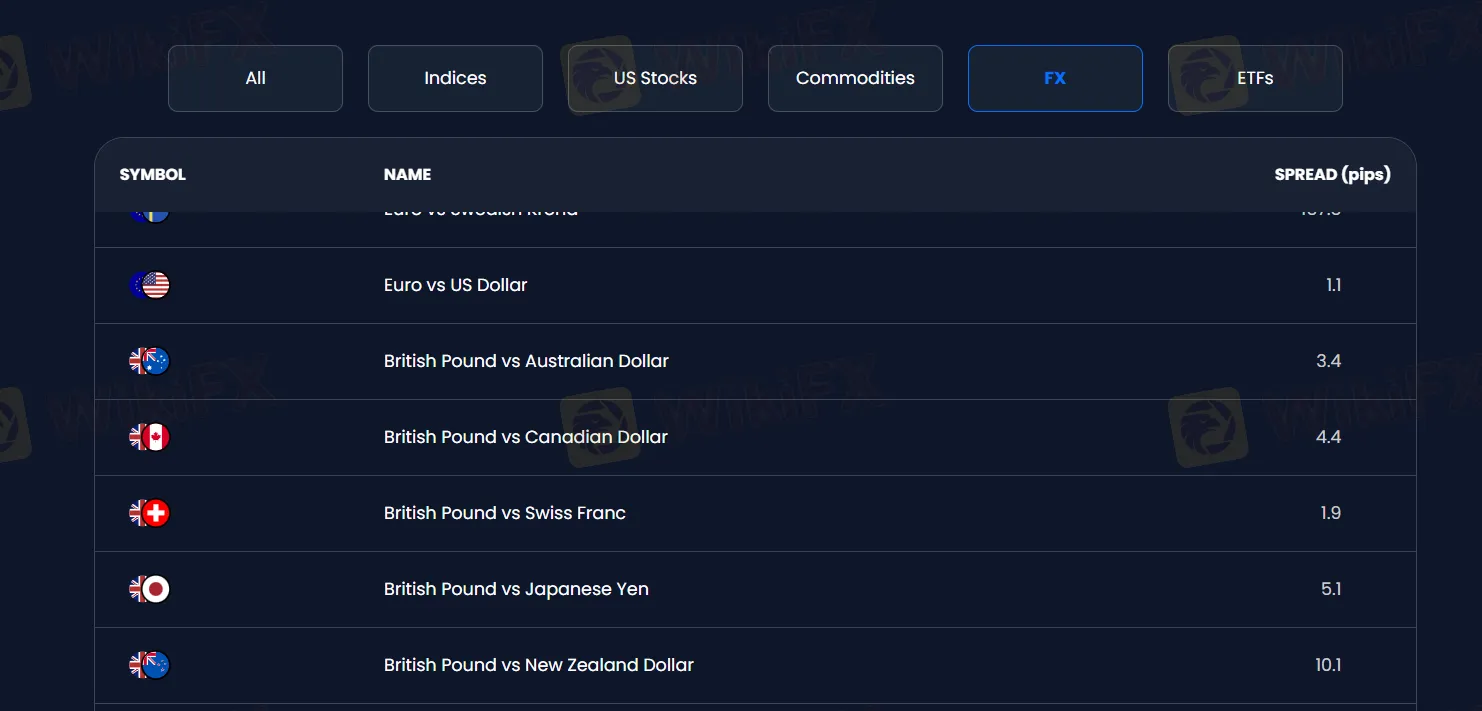

Fees

Excent Capital offers a transparent breakdown of spreads for each asset type and various currency pairs. For instance, in the forex category, the EUR/USD spread is 1.1 pips. In terms of fees, Excent Capital claims to prioritize transparency and fairness, offering a commission-free trading experience.

| Currency Pairs | Spread (pips) |

| Euro vs Japanese Yen | 2.5 |

| Euro vs Norwegian Krone | 23.1 |

| Euro vs New Zealand Dollar | 2.8 |

| Euro vs Polish Zloty | 50.3 |

| Euro vs Swedish Krona | 157.5 |

| Euro vs US Dollar | 1.1 |

| British Pound vs Australian Dollar | 3.4 |

| British Pound vs Canadian Dollar | 4.4 |

| British Pound vs Swiss Franc | 1.9 |

Trading Platform

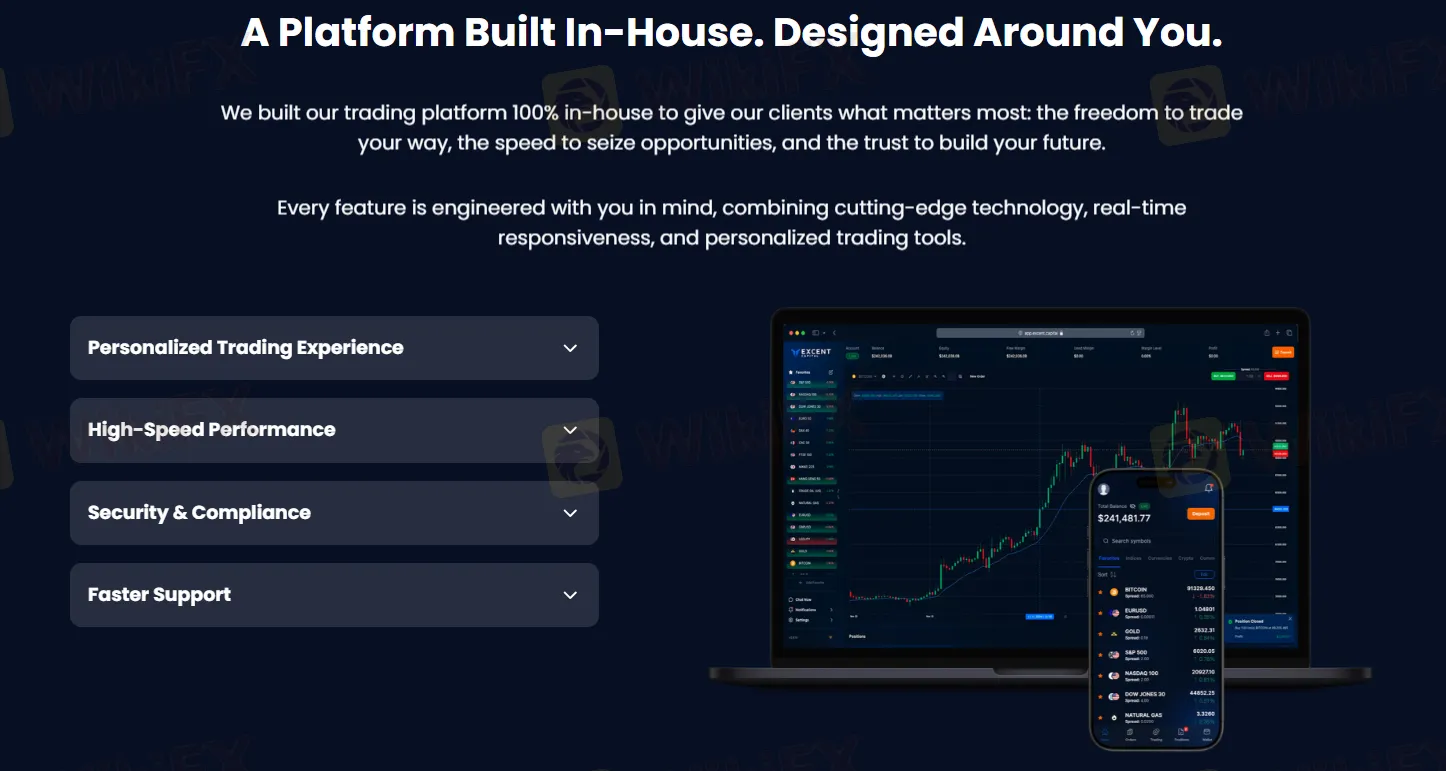

Excent Capital claims to provide a 100% in-house platform. It is said to have features like Personalized Trading Experience, High-Speed Performance, Security & Compliance, and Faster Support.

| Trading Platform | Supported | Available Devices | Suitable for |

| Excent Capital platform | ✔ | Desktop, Mobile | / |

| MT5 | ❌ | / | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Traders on Excent Capital get access to two payment options:

Credit/Debit Cards: Use a major credit or debit card for an immediate deposit.

Bank Transfers:

- Equals Money: Directly transfer funds from your local bank to Excent Capitals custodian bank in London, UK.

- Local Payment Partners: Use trusted local payment agents for easier local transactions, especially if international transfers are unfamiliar.

Read more

Spec Trading Blocks Withdrawals on Big Profits

Spec Trading blocks profit withdrawals and traps funds. Victims face denied payouts—avoid Spec FX, read reviews, protect money now!

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

Received a withdrawal notification from GFS, but the amount could not be credited to your wallet despite numerous follow-ups with the Australia-based forex broker? Did you witness massive slippage in your stop-loss settings or pay high transaction fees charged by the broker? Did the broker delete and deactivate your trading account without any explanation? The Internet is flooded with negative GFS reviews for these and many more alleged trading activities by the broker. Let’s begin examining all of these in this article.

Multibank Group UAE & Azerbaijan Scam Case – LATEST

Multibank Group forex scam cases reveal denied $70K+ withdrawals in the UAE & Azerbaijan. Stay alert with the WikiFX App and avoid risky forex brokers.

Ingot Broker Victims: $3K/$3200 Profits Stolen LATEST

Ingot Broker scam alert: Kenya victim lost $3K profit ($600 dep); Pakistan $3,200→$179 ($250 dep); HK halted post-2018. Avoid fraud—check WikiFX cases now!

WikiFX Broker

Latest News

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

BitPania Review 2026: Is this Broker Safe?

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

XTB Analysis Report

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Five key takeaways from the Supreme Court's landmark decision against Trump's tariffs

Rate Calc