FX-EXCHANGE247

Abstract:FX-EXCHANGE247 is allegedly a forex broker registered in the United States via three different investment plans.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No regulation |

| Market Instrument | Forex, cryptocurrencies |

| Account Type | Silver, Gold and Premium |

| Demo Account | N/A |

| Maximum Leverage | N/A |

| Spread | N/A |

| Commission | N/A |

| Trading Platform | N/A |

| Minimum Deposit | $500 |

| Deposit & Withdrawal Method | N/A |

FX-EXCHANGE247 is allegedly a forex broker registered in the United States via three different investment plans. Here is the home page of this brokers official site:

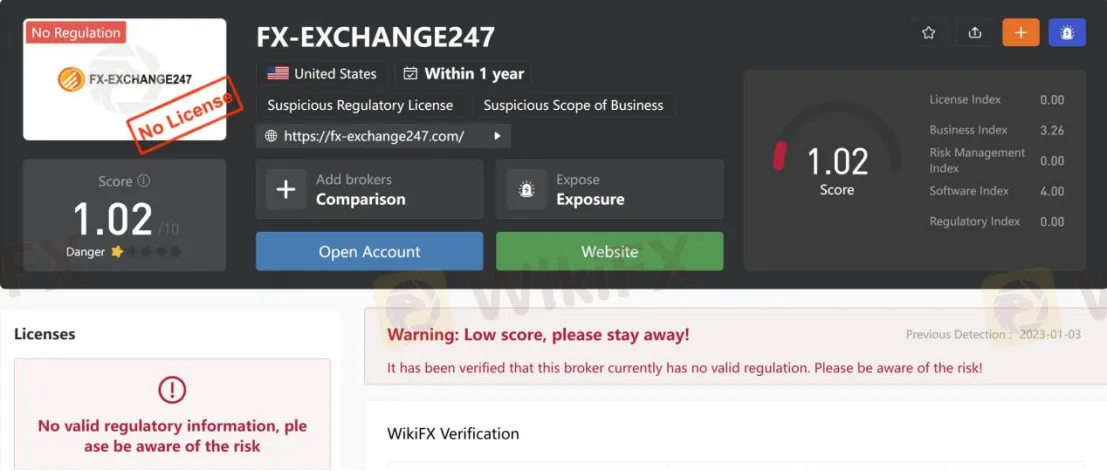

As for regulation, it has been verified that FX-EXCHANGE247 currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.02/10. Please be aware of the risk.

Market Instruments

FX-EXCHANGE247 advertises that it is a forex broker that mainly offers forex and cryptocurrency trading.

Investment Plans

FX-EXCHANGE247 claims to offer three types of investment plans, namely Silver, Gold and Premium, with minimum initial deposit requirements of $500, $5,000 and $10,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Deposit & Withdrawal

The minimum initial deposit requirement at FX-EXCHANGE247 is $500. However, the broker says nothing about the deposit and withdrawal methods.

Customer Support

FX-EXCHANGE247‘s customer support can be reached by email: support@fx-exchange247.com. Company address: 3238 Doctors Drive, Los Angeles, California, 90017 USA. However, this broker doesn’t disclose other more direct contact information like telephone numbers that most transparent brokers offer.

Pros & Cons

| Pros | Cons |

| N/A | • No regulation |

| • Lack of transparency | |

| • High minimum deposit ($500) |

Frequently Asked Questions (FAQs)

| Q 1: | Is FX-EXCHANGE24 regulated? |

| A 1: | No. It has been verified that FX-EXCHANGE24 currently has no valid regulation. |

| Q 2: | What is the minimum deposit for FX-EXCHANGE24? |

| A 2: | The minimum initial deposit at FX-EXCHANGE24 to open the most basic account is $500. |

| Q 3: | Is FX-EXCHANGE24 a good broker for beginners? |

| A 3: | No. FX-EXCHANGE24 is not a good choice for beginners. Not only because of its unregulated condition, but also because of its lack of transparency and high initial deposit. |

Read more

SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

Zeven Global Review: WikiFX Risk Warning and Key Investor Considerations

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

As the new year begins, WikiFX extends our sincere gratitude to traders worldwide, our industry partners, and all users who have consistently supported us.

Become a Broker Reviewer: Your Experience is Worth Its Weight in Gold

Dear Forex Traders, When choosing a forex broker, have you ever faced these dilemmas? Dozens of broker advertisements, but unsure which one is truly reliable? Online reviews are either promotional content or outdated/incomplete? Want to learn about real users’ deposit/withdrawal experiences but can’t find firsthand accounts? Now, your experience can help thousands of traders and earn you generous rewards! The campaign is long-term and you can join anytime.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

US Dollar on Edge: Fed Minutes and Trump Attacks Rattling Central Bank Independence

Gold and Silver Plummet from Record Highs as Profit-Taking Sweeps the Market

WM Markets Review (2025): Is this Broker Safe or a Scam?

It’s a Scam, Not Romance: How This Woman Lost US$1 Million

Crude Oil Surges as US Strikes Venezuela Facility and Ukraine Talks Stall

He Thought He Was Investing BUT US$500,000 Disappeared!

Forex Daily: USD/JPY and AUD/USD Falter as Year-End Liquidity Thins

Fed Watch: Powell Sounds Alarm on "Excessive" Valuations

Rate Calc