With BlackRock, BUX Will Provide An ETF Savings Plan Across Europe

Abstract:BUX, a financial technology firm, and neobroker have collaborated with BlackRock, a prominent investment provider, to establish an ETF (exchange-traded fund) savings plan in Europe. The product gives European customers a straightforward method to invest in a diverse portfolio of ETFs managed by iShares, a BlackRock affiliate.

In Europe, BUX and BlackRock have joined forces.

Users may build portfolios using iShares ETFs, which give wide exposure to bonds and equities across global markets. The BUX Savings Plan may be tailored by selecting from a wide range of iShares ETFs, such as equities, bonds, themes, sectors, factors, and sustainable ETFs.

“The desire to begin investing exists, but the knowledge is inadequate, creating a barrier for those who want to begin investing but lack expertise. We have established a suitable solution for customers who are overwhelmed by the number of goods and don't know how and when to start investing by collaborating with Blackrock, a famous specialist in financial markets and products” BUX's CEO, Yorick Naeff, said.

“By working together, BUX and BlackRock can have a significant influence on how Europeans invest and plan for their financial future.”

Investments begin at €10 per ETF every month, with a €1 commission cost per portfolio transaction. The BUX ETF savings plan seeks to assist participants to achieve a more secure financial future by providing a greater knowledge of financial markets and diversification.

Meanwhile

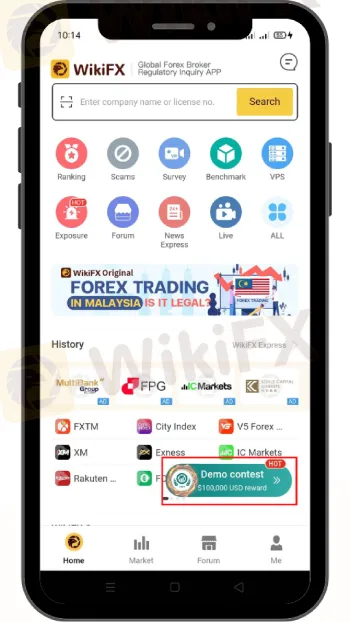

WikiFX has launched “The First Ever Demo Forex Trading World Cup 2023” and win as much as “$100,000”.

How To Join!

Download and install the WikiFX App on your smartphone through the link https://bit.ly/3wL2KqJ or from the App Store or Google Play Store.

Once installed tap the “Demo Contest” button that appears on the screen

Create an account by “Signing Up” or “Register”

Once all is done, click on the “Trade Button”

You should see the trading platform and may select trading instruments you wanted to trade

Good luck and enjoy your trading experience!

Concentrating on Passive Investing

According to a BUX poll, a lack of understanding is a big barrier to investing, with 42% of respondents identifying it as a reason for not investing. Despite the fact that long-term investing is critical for establishing a secure financial future, many individuals feel frightened by the investment process.

Picking individual stocks for a stock market portfolio is challenging and needs a great deal of expertise and experience. As a result, the business wishes to promote a savings strategy based on passive investing via ETFs.

“Millions of investors turn to iShares ETFs as instruments to develop investment portfolios and attain financial well-being as investing becomes more affordable and accessible. We are thrilled to be collaborating with BUX; this collaboration provides an efficient way for investors throughout Europe to gain the benefits of ETFs and investing in global markets in a simple, accessible, and cost-effective format ” BlackRock's Head of Digital Distribution Continental Europe, Christian Bimueller, stated.

BUX performed a study to investigate investor behavior in the Netherlands, Italy, and Germany. The most essential thing for everyone is to save and accumulate money over time in order to give security to their family.

Neobroker has completed its active year.

Over the last year, the European mobile brokerage business located in the Netherlands has set its eyes on aggressive expansion. Finance Magnates recently reported on new licenses, staff changes, and product modifications.

BUX gained its Digital Asset Service Provider (DASP) license from the Autorité des Marchés Financiers (AMF) in December and purchased Ninety Nine, the retail brokerage branch of the Spanish neobroker. With these developments, the corporation expanded into new European markets and clientele.

The platform opted to rename its CFD product to Stryk in July, largely to distinguish its various offerings. The platform, formerly known as BUX X, was released in 2014 and provided services similar to BUX Zero, the company's zero-fee trading software.

BUX named Salim Sebbata, the Chief Executive Officer of its United Kingdom branch, as the Managing Director of Stryk a few months after rebranding.

Install the WikiFX App on your smartphone to keep up to speed on current events.

Link to the download: https://www.wikifx.com/en/download.html?source=fma3

Read more

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

According to the report, Doo Group, a prominent Singapore-based online brokerage firm, has strengthened its global presence by securing new offshore licenses for its brokerage brand, Doo Financial. The company recently announced that entities under the Doo Financial umbrella have been granted licenses by two key offshore regulatory bodies: the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

Why is there so much exposure against PrimeX Capital?

In recent months, PrimeX Capital, a Forex and CFD broker established in 2022, has become a subject of concern in the trading community. However, despite these enticing features, the broker's reputation has been severely tarnished by multiple complaints and a troubling lack of regulatory oversight.

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

Forex broker scams continue to evolve, employing new tactics to appear credible and mislead unsuspecting traders. Identifying these fraudulent schemes requires vigilance and strategies beyond the usual advice. Here are five effective methods to help traders assess the legitimacy of a forex broker and avoid potential pitfalls.

Doo Financial Obtains Licenses in BVI and Cayman Islands

Doo Financial, a subsidiary of Singapore-based Doo Group, has expanded its regulatory footprint by securing new offshore licenses from the British Virgin Islands Financial Services Commission (BVI FSC) and the Cayman Islands Monetary Authority (CIMA).

WikiFX Broker

Latest News

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

AIMS Broker Review

The Hidden Checklist: Five Unconventional Steps to Vet Your Broker

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

YAMARKETS' Jingle Bells Christmas Offer!

Doo Financial Expands Regulatory Reach with Offshore Licenses in BVI and Cayman Islands

Why is there so much exposure against PrimeX Capital?

Russia to Fully Ban Crypto Mining in 10 Regions Starting January 1, 2025

Rate Calc