MHMarkets :MHM European Market

Abstract:On Thursday (April 20), spot gold shock slightly down during the Asian session and is currently trading near $1992.25 per ounce. A number of Fed officials have signaled further interest rate hikes this week, with Fed "number three" and New York Fed President Williams highlighting signals for further rate hikes on Thursday morning. Market expectations for the Fed to reduce interest rates during the year has cooled and continue to provide support to the dollar U.S. bond yields, which put pressure

Market Overview

On Thursday (April 20), spot gold shock slightly down during the Asian session and is currently trading near $1992.25 per ounce. A number of Fed officials have signaled further interest rate hikes this week, with Fed “number three” and New York Fed President Williams highlighting signals for further rate hikes on Thursday morning. Market expectations for the Fed to reduce interest rates during the year has cooled and continue to provide support to the dollar U.S. bond yields, which put pressure on gold prices.

U.S. crude oil traded near $78.84 per barrel; oil prices retreated more than 2% to a two-week low on Wednesday, despite a sharp decline in U.S. crude inventories, but gasoline stocks unexpectedly jumped due to disappointing demand dragged down oil prices; and a stronger dollar, the market fears that the Fed's looming interest rate hike may dampen demand.

Inflation remains high in countries like the Eurozone and the UK. Market expectations for further interest rate hikes in the Eurozone and the Bank of England have risen, also making gold bulls wary as central bank rate hikes will increase the opportunity cost of holding gold.

Technically, the 5-day SMA crossed below the 10-day SMA to form a dead cross at the daily level. Short-term bearish signals have strengthened and may further probe support near the 1,960 handle.

This trading day needs to focus on the U.S. initial jobless claims and the U.S. annualized home sales total for March. Watch for speeches from Fed Governor Waller, Fed Governor Bowman, Cleveland Fed President Meister, and Atlanta Fed President Bostic.

MHMarkets strategy is only for reference and not for investment advice. Please carefully read the statement at the end of the text. The following strategy will be updated at 15:00 on April 20, Beijing time.

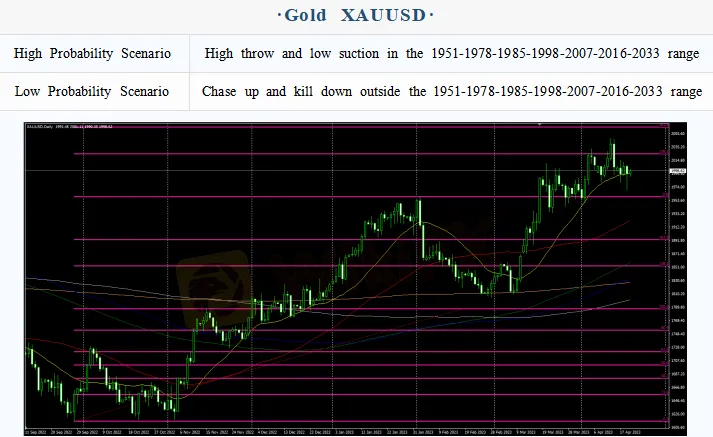

Intraday Oscillation Range: 1951-1978-1985-1998-2007-2016-2033

Overall Oscillation Range: 1730-1756-1780-1801-1817-1833-1856-1873-1889-1903-1911-1929-1937-1951-1978-1985-1998-2007-2016-2033-2046-2057-2066-2077-2089-2097-2100

In the subsequent period of spot gold, 1951-1978-1985-1998-2007-2016-2033 can be operated as the bull and bear range; High throw low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 20. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 23.9-24.5-25.3-26.1

Overall Oscillation Range: 19.7-20.1-20.6-21.5-22.3-23.1-23.9-24.5-25.3-26.1-26.6-27.3

In the subsequent period of spot silver, 23.9-24.5-25.3-26.1 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 20. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 77.9-78.5-79.9-80.7-82.3-83.5

Overall Oscillation Range: 62.1-63.7-64.5-65.8-66.9-67.3-68.9-70.1-71.2-72.3-73.1-73.8-75.1-77.9-78.5-79.9-80.7-82.3-83.5-85.3-87.3-89.1

In the subsequent period of spot silver, 77.9-78.5-79.9-80.7-82.3-83.5 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 20. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.0690-1.0755-1.0830-1.0950-1.1157

Overall Oscillation Range: 1.0290-1.0360-1.0460-1.0570-1.0690-1.0755-1.0830-1.0950-1.1157-1.1220-1.1303

In the subsequent period of EURUSD, 1.0690-1.0755-1.0830-1.0950-1.1157 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 20. This policy is a daytime policy. Please pay attention to the policy release time.

Intraday Oscillation Range: 1.2250-1.2375-1.2400-1.2470-1.2550

Overall Oscillation Range: 1.1610-1.1830-1.1920-1.2030-1.2135-1.2250-1.2375-1.2400-1.2470-1.2550-1.27000

In the subsequent period of GBPUSD, 1.2250-1.2375-1.2400-1.2470-1.2550 can be operated as the bull and bear range. High throw and low suction in the range, chase up and kill down outside the range!

Note: The above strategy was updated at 15:00 on April 20. This policy is a daytime policy. Please pay attention to the policy release time.

Read more

MHMarkets:2024.03.29 MHM European Time Analysis

Fed Governor Christopher Waller's recent comments have highlighted a cautious stance towards adjusting interest rates, marking a significant moment for the financial markets.

MHMarkets:2024.03.28 MHM European Time Analysis

In the forex market, stability was the theme for the U.S. dollar index, holding firm at 104.30. Minor fluctuations were observed across major currency pairs: the Euro slightly weakened against the dollar, closing at 1.0827

MHMarkets:2024.03.27 MHM European Time Analysis

In the latest market wrap focusing on the foreign exchange sector, the U.S. dollar index showed minimal movement, holding at 104.31.

MHMarkets:March 27, 2024 Economic Highlights

On Tuesday, due to February's US durable goods orders growth exceeding expectations and an optimistic economic growth outlook for the first quarter in the US, the US dollar index initially fell but then rose, briefly touching below the 104 mark before recovering during the US trading session, closing up 0.07% at 104.29.

WikiFX Broker

Latest News

PayPal reports slow growth in key margin figure even as earnings top estimates

5 Best Forex Brokers in Singapore for 2025

Trump's tariffs could soon bring higher food prices for some Americans, analysis finds

iFourX: So Many Red Flags You Can’t Ignore

Tom Lee's Granny Shots ETF rakes in $2 billion in AUM just 9 months after inception

Starbucks same-store sales fall again, but CEO Niccol says turnaround is ahead of schedule

Singapore holds monetary policy, flags slowdown in second half of the year

Top Forex Chart Patterns Every Trader Must Know

Adidas to raise prices as US tariffs cost €200m

Top 4 Forex Scam Tactics Fake Brokers Use to Trap Investors

Rate Calc