Trust Markets

Abstract:Founded in 2014, Trust Markets is an unregulated broker registered in St. Lucia, mainly offering trading in forex, commodities, shares, indices and cryptoscurrencies. It offers a demo account for practicing and requires no minimum deposit for live accounts on the advanced MT5 platform.

Note: Trust Markets's official website - https://www.trustmarkets.com/ is currently inaccessible normally.

| Trust Markets Review Summary | |

| Founded | 2014 |

| Registered Country/Region | St. Lucia |

| Regulation | No regulation |

| Market Instruments | 39+ forex, 12+ indices, 134+ stocks, 12+ commodities, 25+ cryptocurrencies |

| Demo Account | ✅ |

| EUR/USD Spread | From 1.0 pips (Standard account) |

| Leverage | Up to 1:1000 |

| Trading Platform | MT5 |

| Min Deposit | 0 |

| Customer Support | Live chat, contact form |

| Tel: +90 212 271 00 66 | |

| Email: support@trustmarkets.com | |

| Restricted Countries | North Korea, United States, Puerto Rico, Canada, Japan, Iran, Iraq, Lebanon, Turkey |

Trust Markets Information

Founded in 2014, Trust Markets is an unregulated broker registered in St. Lucia, mainly offering trading in forex, commodities, shares, indices and cryptoscurrencies. It offers a demo account for practicing and requires no minimum deposit for live accounts on the advanced MT5 platform.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | No regulation |

| Demo accounts | WikiFX complaints about withdrawal issues |

| Multiple account types | Restricted in some countries |

| Commission-free accounts offered | |

| MT5 platform | |

| No minimum deposit requirement | |

| Popular payment options | |

| Live chat support |

Is Trust Markets Legit?

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of Trust Markets, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on Trust Markets?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

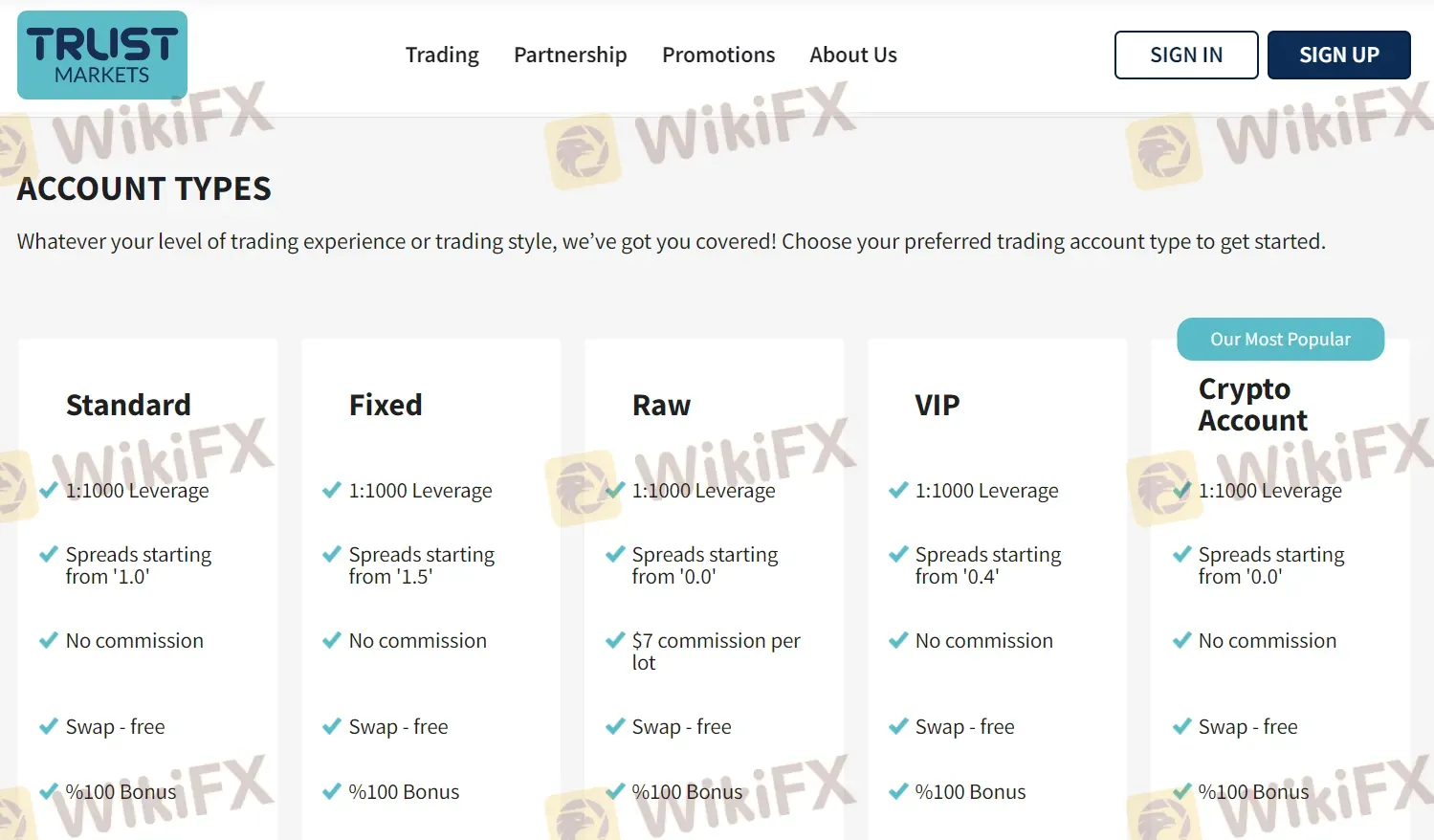

Account Type/Fees

| Account Type | Spread | Commission |

| Standard | From 1.0 pips | ❌ |

| Fixed | From 1.5 pips | ❌ |

| Raw | From 0.0 pips | $7 per lot |

| VIP | From 0.4 pips | ❌ |

| Crypto | From 0.0 pips | ❌ |

Leverage

Trust Markets offersa leverage level of up to 1:1000 for all account types, which means you can control a larger position of up to 1000 times of your initial deposit.

However, you should always be very prudent to use such tool since leverage not only amplify profits, but losses will be augmented at same level as well, especially for abnormal high leverage as 1:1000.

Trading Platform

The broker offers the industry-leading MetaTrader 5 platform, which is popular worldwide for its user-friendly interface, automated trade execution via Expert Advisor, advanced charting and analysis tools, etc.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Android, iOS | Experienced traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

Trust Markets mainly accept payments through Visa, Master Card, Bank Wire Transfer and more.

Read more

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

NPE Market Review: Why to Stay Away

NPE Market review shows blocked accounts, no regulation, and low trust—best to stay away.

ZarVista Community Feedback: What Users Really Think About This Broker

This article gives you a complete, fair look at ZarVista (now called Zarvista Capital Markets as of September 2024). We'll examine what users say, check the company's legal status, and investigate the biggest problems users report. Our goal is to give you clear, factual information so you can make a smart decision based on evidence, not just marketing promises. We'll look at both the good services they offer and the serious issues you need to think about carefully.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc