WikiFX Broker Assessment Series | Is Land Prime Reliable?

Abstract: In this article, we'll look in-depth at Land Prime, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at Land Prime, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

About Land Prime

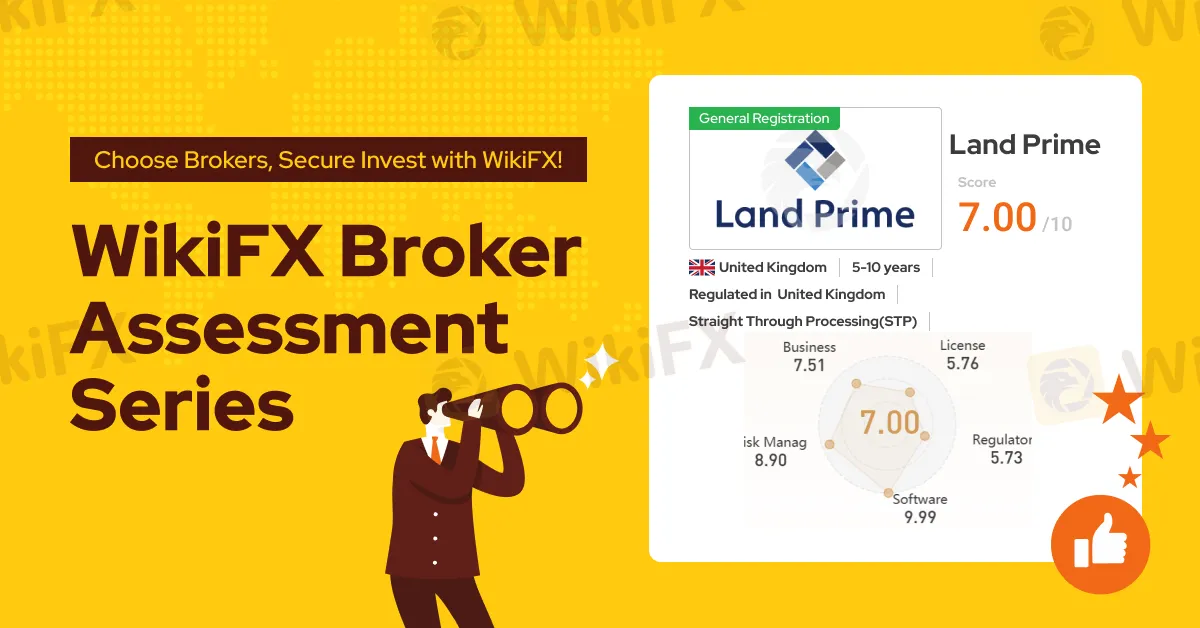

Land Prime offers a series of trading instruments, including Forex, Commodities, and Indices. This allows traders to access multiple markets and asset classes and diversify their portfolios. Land Prime is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. As such, it can offer faster order execution speed, tighter spreads, and greater flexibility regarding the leverage offered. However, this also means that Land Prime has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. WikiFX has rated this broker a decent score of 7.00/10.

Is Land Prime Legit?

Land Prime is a regulated broker. The Financial Conduct Authority regulates Land Prime with license number 709866.

Trading Platform

Land Prime offers its clients access to the popular MT4 and MT5 trading platforms. These platforms are well-known in the industry and provide traders with access to advanced charting tools, technical analysis features, and automated trading capabilities. Additionally, the MT4 and MT5 platforms are available as mobile apps for Android and iOS devices, allowing traders to stay connected and manage their trades. While these platforms offer a user-friendly interface, they have limited customization options and a limited selection of add-ons and plugins. Moreover, Land Prime does not offer a proprietary trading platform, and its social trading features are limited.

Account Types & Minimum Deposit

Land Prime offers four different account types to cater to different trading needs. The standard account has a low minimum deposit requirement of $10 and a low spread of 0.9 pips, making it accessible for beginners. The prime account has a higher minimum deposit of $300 but offers a lower spread of 0.5 pips. The ECN account, with a minimum deposit of $1000, has a spread as low as 0.0 pips and offers a high leverage of 1:1000. The swap-free account is also available for traders who require it. Three account types have zero commission fees and unlimited leverage, making them cost-efficient and accessible for traders. However, accounts become inactive if no transactions are made in a month. The ECN account also has a high minimum deposit requirement, making it less accessible for beginners.

Leverage

Land Prime offers a variety of leverage options across its different account types, with a maximum leverage of 1:1000 on its ECN account and unlimited leverage for other accounts. Traders can choose the leverage level that best suits their trading style and goals, and have the ability to adjust it as necessary. While high leverage can increase the potential for profits, it can also lead to higher risks and losses, especially for inexperienced traders.

Spreads and commissions

Land Prime offers a competitive range of spreads and zero commission across their four primary account types: Standard, Prime, ECN, and Swap-free account. The lowest spread is available on the ECN account, starting at 0.0 pips, while the Standard and Prime accounts offer spreads starting from 0.9 and 0.5 pips respectively, with zero commission on all accounts. The Swap-free account is available for those who need to adhere to Islamic finance principles, with a commission of 0.3 pip/lot.

Conclusion

As a regulated broker with a high Wiki score, Land Prime maybe a considerable choice if you want to enhance your trading journey. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to help me make an informed decision.

Read more

1Prime options Review: Examining Fund Scam & Trade Manipulation Allegations

Did you find trading with 1Prime options fraudulent? Were your funds scammed while trading on the broker’s platform? Did you witness unfair spreads and non-transparent fees on the platform? Was your forex trading account blocked by the broker despite successful verification? These are some issues that make the traders’ experience not-so memorable. In this 1Prime options review article, we have investigated the broker in light of several complaints. Keep reading!

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

This EXTREDE Review serves an important purpose: to examine the big differences between what the broker advertises and what we can actually prove. For any trader thinking about using this platform, the main question is about safety and whether it's legitimate. We will give you a clear answer right away. Our independent research, backed up by third-party information, shows that EXTREDE operates without proper regulation, creating a high-risk situation for all investors. The main focus of this investigation is the absolutely important need to check a broker's claims before investing. A broker's website is a marketing tool; it cannot replace doing your own research. The information that EXTREDE presents contains contradictions that every potential user must know about. A quick way to see these warnings gathered together is by checking the broker's live profile on verification platforms. For example, the EXTREDE page on WikiFX brings together regulatory status, user feedback and expert ri

Eurotrader Review: Safe Broker or Risky Choice?

Eurotrader is regulated by CYSEC & FSCA, offering MT4/5 with forex and CFDs. Safe broker or risky choice? Review facts and decide now via the WikiFX App.

NEWTON GLOBAL Deposit and Withdrawal Methods: A Complete 2026 Review

When traders look at a broker, they care most about how well its payment system works and what options it offers. You are probably looking for information about NEWTON GLOBAL deposit and withdrawal methods to see if they work for you. The broker says it has many modern payment options and promises fast processing times. However, a good review needs to look at more than just what it advertises. We need to check how safe your capital really is with this broker. One important factor that affects the safety of every transaction is whether the broker is properly regulated. Our research shows that NEWTON GLOBAL does not have any valid financial regulation from a trusted authority. This fact, along with a very low trust score, completely changes the situation. The question changes from "How can I withdraw?" to "Is it safe to invest here?" This background information is essential for protecting your capital.

WikiFX Broker

Latest News

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

BP PRIME Review: Safe Broker or Risky Broker

EXTREDE Review (2026): A Complete Look at the Serious Warning Signs

Promised 30% Returns, Lost RM630,000 Instead

You Keep Blowing Accounts Because Nobody Taught You This

HTFX Review: Safety, Regulation & Forex Trading Details

Effective Stop Loss Trading Strategies

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Hits Q4 Growth

Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

Pepperstone Review: Regulation, Licences and WikiScore Analysis

Rate Calc