Bower Trading

Abstract:Bower Trading is a commodities-focused trading firm founded in 1996, registered in the United States. Despite its long-standing experience in the commodities market (over 60 years), it is unregulated, which poses potential risks for investors.

| Bower TradingReview Summary | |

| Founded | 1996 |

| Registered Country/Region | United States |

| Regulation | No Regulation |

| Market Instruments | Commodities |

| Demo Account | \ |

| Leverage | \ |

| Spread | \ |

| Trading Platform | \ |

| Minimum Deposit | $5,000 |

| Customer Support | Email: Jim@bowertrading.com |

| Phone: (765) 423-4484; (800) 533-8045 | |

| Address: 324 Main Street, Ste. APO Box 415 (47902) Lafayette, IN 47901 | |

Bower Trading Information

Bower Trading is a commodities-focused trading firm founded in 1996, registered in the United States. Despite its long-standing experience in the commodities market (over 60 years), it is unregulated, which poses potential risks for investors.

Pros & Cons

| Pros | Cons |

| Experienced firm | No regulation |

| High minimum deposit | |

| Lack of account and fee details | |

| Limited trading products |

Is Bower Trading Legit?

Bower Trading does not currently have valid regulatory information and is an unregulated company. In this case, investors should be extremely cautious when using its services, fully assess the potential risks, and try to choose a regulated financial service provider to ensure the safety of funds and legitimate interests.

What Can I Trade on Bower Trading?

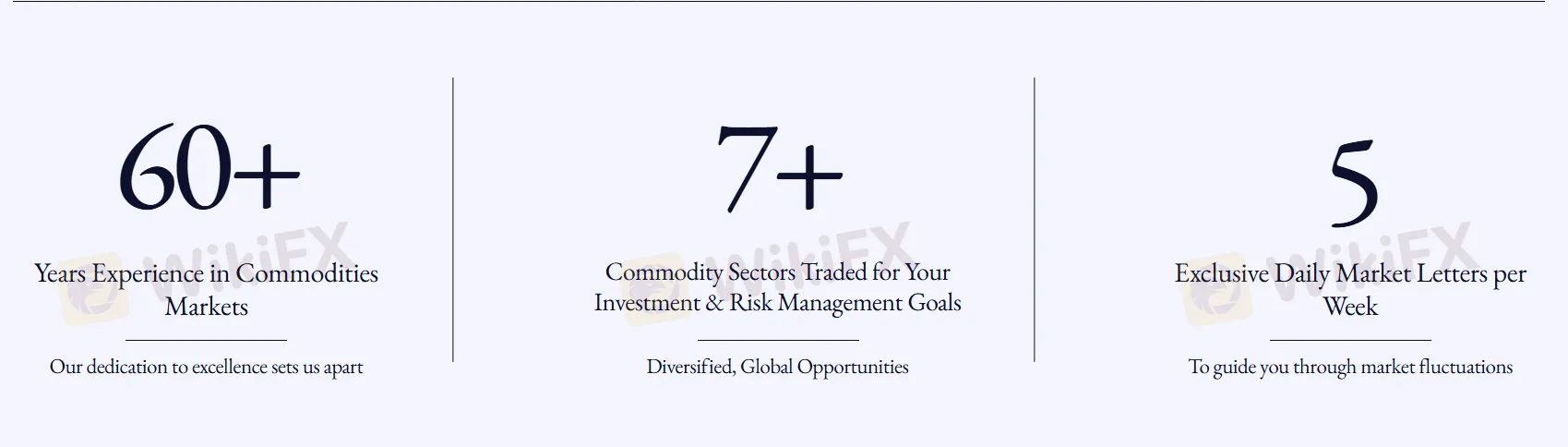

Bower Trading focuses on the commodities market and offers trading services in commodities. The firm has more than 60 years of experience in the commodities market and covers more than 7 commodity industry sectors for investment and risk management objectives, providing clients with diversified global investment opportunities.

| Tradable Instruments | Available |

| Commodities | ✔ |

| Forex | ❌ |

| Futures | ❌ |

| Indices | ❌ |

| Bonds | ❌ |

| Stocks /Shares | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| Funds | ❌ |

| ETFs | ❌ |

Fees

The minimum deposit at Bower Trading is $5,000.00.

Read more

SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

Zeven Global Review: WikiFX Risk Warning and Key Investor Considerations

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

FP Markets Marks 20 Years of Global Trading

FP Markets celebrates 20 years of innovation, global expansion, and award-winning service, reinforcing its role as a trusted multi-asset broker.

GivTrade Secures UAE SCA Category 5 Licence

GivTrade gains UAE SCA Category 5 licence, enabling advisory, arrangement, and consulting services under strict regulatory oversight.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

2025 Global Economic Year in Review: How Tariffs and AI Rewrote the Playbook

Yen in Peril: Wall Street Eyes 160 as Structural Outflows Persist

RM238,000 Lost to a Fake Stock Scheme | Don't Be The Next Victim!

What Is a Forex Expert Advisor and How Does It Work?

Is 9X markets Legit or a Scam? 5 Key Questions Answered (2025)

What Is a Liquid Broker and How Does It Work?

“Elites’ View in Arab Region” Event Successfully Concludes

Commodities Wrap: Copper Surges on ‘Green Squeeze’ Fears; Oil Dips on Peace Hopes

GivTrade Secures UAE SCA Category 5 Licence

Rate Calc