Dollar Flat, Eye on Pivotal Economic Data

Abstract:The Dollar Index retreated from resistance levels, as market participants applied profit-taking strategies ahead of crucial events. With attention shifting towards the pivotal Producer Price Index (PPI) and retail sales figures, investors seek insights into the economy's trajectory and potential interest rate adjustments by the Federal Reserve.

Dollar Flat, Eye on Pivotal Economic Data

Dollar Retreats Amid Profit-Taking: Eyes on PPI and Retail Sales Data

Gold Rebounds as Market Caution Prevails: A Look at Safe-Haven Assets Amidst Uncertainty

Crude Oil Surges on Inventory Data: Insights into Energy Markets Amid Economic Shifts

Market Summary

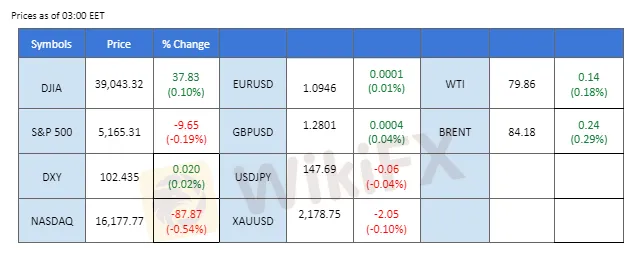

The Dollar Index retreated from resistance levels, as market participants applied profit-taking strategies ahead of crucial events. With attention shifting towards the pivotal Producer Price Index (PPI) and retail sales figures, investors seek insights into the economy's trajectory and potential interest rate adjustments by the Federal Reserve. Meanwhile, US equity markets experienced a slight pullback driven by profit-taking activities, despite hovering near record highs. While the S&P 500 and NASDAQ Composite recorded marginal declines, the Dow Jones Industrial Average demonstrated resilience, buoyed by gains in industrial heavyweight 3M Company. Amidst prevailing market caution, gold prices rebounded from support levels, extending their bullish trajectory as investors sought refuge in safe-haven assets amidst lingering risk aversion. Crude oil prices surged higher on the back of better-than-expected inventory reports, with US Crude oil inventories declining more than anticipated according to Energy Information Administration (EIA) data.

Current rate hike bets on 20th March Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95%) VS -25 bps (5%)

Market Overview

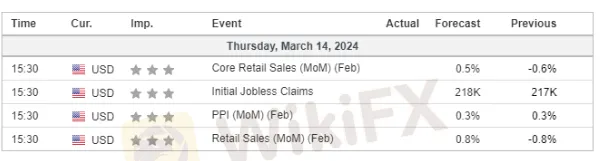

Economic Calendar

(MT4 System Time)

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index retreated from resistance levels as market participants absorbed higher-than-expected Consumer Price Inflation (CPI) data, prompting profit-taking strategies ahead of upcoming US economic releases. Attention noSw turns to pivotal Producer Price Index (PPI) and retail sales figures for insights into the economy's trajectory and potential interest rate adjustments.

The Dollar Index is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 40, suggesting the index might extend its losses since the RSI stays below the midline.

Resistance level: 103.05, 103.70

Support level:102.55, 102.10

XAU/USD, H4

Amidst prevailing market caution ahead of crucial US economic data releases, gold prices rebounded from support levels, extending their bullish trajectory. Lingering risk aversion prompted investors to seek refuge in safe-haven assets, contributing to heightened demand for gold.

Gold prices are trading higher following the prior rebound from the support level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 75, suggesting the commodity might experience technical correction since the RSI entered overbought territory.

Resistance level: 2235.00, 2350.00

Support level:2150.00, 2080.00

GBP/USD,H4

Pound Sterling saw a modest rebound post UK GDP data release, which met market expectations. According to the Office for National Statistics, the UK economy returned to expansion in January, rising by 0.20% after contracting 0.10% in December, which aligned with the market expectations. Despite returning to growth in January, Pound Sterling remained relatively subdued amidst ongoing volatility. Market participants await additional catalysts before taking decisive positions.

GBP/USD is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 52, suggesting the pair might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 1.2865, 1.2940

Support level: 1.2770, 1.2710

EUR/USD,H4

EUR/USD experienced modest gains, supported by US Dollar depreciation. However, market sentiment remains mixed as investors weigh macroeconomic outlooks in the Eurozone and the United States. Anticipation builds ahead of potential borrowing cost adjustments by the European Central Bank (ECB) and the Federal Reserve (Fed) in June.

EUR/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 61, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 1.0960, 1.1095

Support level: 1.0865, 1.0765

BTC/USD,H4

Bitcoin maintains its bullish trend, buoyed by analysts' optimistic forecasts and the SEC's approval of Bitcoin Spot ETFs. JMP Securities predicts further price surges driven by anticipated ETF inflows. However, caution is advised given the high-risk nature of cryptocurrencies, especially considering their inherent volatility.

BTC/USD is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 77, suggesting the crypto might enter overbought territory.

Resistance level: 78710.00, 80000.00

Support level: 64965.00, 54175.00

AUD/USD, H4

AUD/USD edged higher as markets anticipated a potential Federal Reserve interest rate cut in June, despite sticky inflation data. Contrastingly, the Reserve Bank of Australia (RBA) hints at potential rate hikes amidst elevated inflammation levels, signalling divergent monetary policies between the two central banks.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 63, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 0.6645, 0.6680

Support level: 0.6585, 0.6535

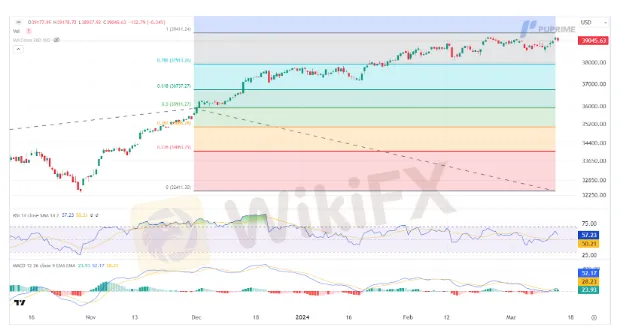

Dow Jones, H4

Despite lingering near record highs, US equity markets experienced a slight pullback fueled by profit-taking activities following a robust rally driven by enthusiasm over artificial intelligence. The S&P 500 and NASDAQ Composite recorded marginal declines, while the Dow Jones Industrial Average maintained resilience, supported by gains in industrial heavyweight 3M Company.

The Dow is trading flat while currently testing the resistance level. MACD has illustrated increasing bullish momentum, whale RSI is at 57, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 39400.00, 40000.00

Support level: 37915.00, 36735.00

CL OIL, H4

Crude oil prices climbed higher following better-than-expected inventory reports, with US Crude oil inventories declining more than anticipated according to Energy Information Administration (EIA) data. Investors await the International Energy Agency's monthly report for further insights into supply and demand dynamics, following OPEC's latest forecast.

Oil prices are trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 80.20, 84.10

Support level: 78.00, 75.95

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Rate Calc