Acqua Trading Solutions

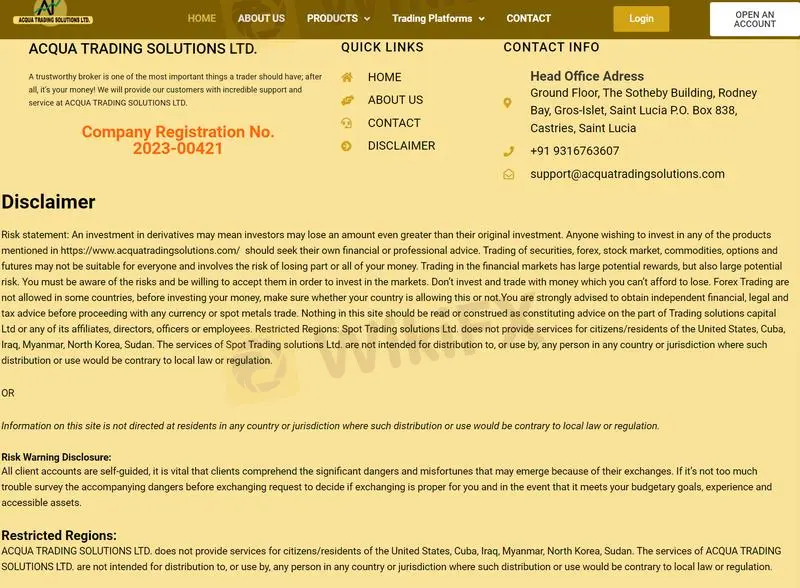

Abstract:Acqua Trading Solutions, founded in 2023 and registered in Saint Lucia, operates as an unregulated broker, which may raise concerns for potential traders. The firm offers its services through the popular MetaTrader 5 platform for desktop and PC, providing a robust trading environment. While specific commission details are not available, clients can reach customer support at +91 9316763607 for assistance.

| Broker Name | Acqua Trading Solutions |

| Founded in | 2023 |

| Registered in | Saint Lucia |

| Regulated by | Not regulated |

| Trading Platform | MetaTrader 5 Desktop/PC |

| Customer Support | +91 9316763607 |

Overview of Acqua Trading Solutions

Acqua Trading Solutions, founded in 2023 and registered in Saint Lucia, operates as an unregulated broker, which may raise concerns for potential traders. The firm offers its services through the popular MetaTrader 5 platform for desktop and PC, providing a robust trading environment. While specific commission details are not available, clients can reach customer support at +91 9316763607 for assistance.

Regulation

Acqua Trading Solutions operates without regulatory oversight, indicating a lack of formal authorization from recognized financial authorities. This absence of regulation raises potential concerns regarding investor protection and the firm's adherence to industry standards, making it essential for clients to exercise caution and conduct thorough due diligence before engaging with the company.

Pros & Cons

Acqua Trading Solutions offers notable advantages, including the use of the widely acclaimed MetaTrader 5 platform, which enhances the trading experience, and a strong focus on Forex trading. However, the company also presents several drawbacks, such as insufficient information regarding account types, the absence of regulatory oversight, which may expose traders to potential risks, and a lack of educational resources and transparency about company policies and procedures.

| Pros | Cons |

| • Utilizes the popular MetaTrader 5 platform | • Operates without regulatory oversight, potentially exposing traders to risks |

| • Forex Focus | • Lack of information about account types |

| • Lack of educational resources or transparency regarding company policies and procedures |

Market Instruments

Acqua Trading Solutions' services cater to forex traders, indicating their expertise in this specific market.

How to open an account

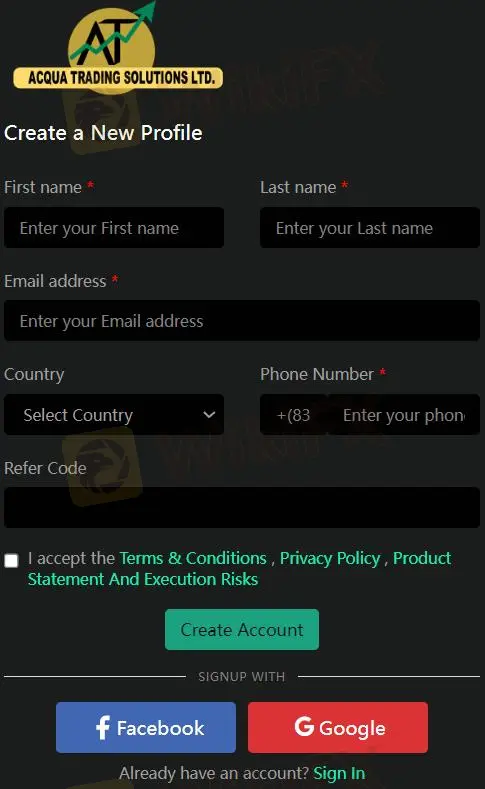

To open an account with Acqua Trading Solutions, follow these steps:

- Visit the Acqua Trading Solutions website and locate the “OPEN AN ACCOUNT” button.

- Click on the button to access the account registration page.

- Provide the required personal information, including your name, email address, and phone number.

- Complete the registration form and submit it.

- Your account will be registered once your application is reviewed and approved.

Trading Platform

Acqua Trading Solutions provides traders with access to the MetaTrader 5 (MT5) trading platform, a powerful and versatile tool for analyzing and executing trades across various financial markets. The platform is developed and supported by Acqua Trading Solutions Ltd., ensuring seamless operation and access to the latest features.

Key Features of MT5 Trading Platform:

- Comprehensive Charting Tools: MT5 offers a wide array of charting tools for in-depth market analysis, including various chart types, technical indicators, and drawing objects.

- Automated Trading: Traders can automate their trading strategies using Expert Advisors (EAs) and other algorithmic tools, enabling more disciplined and consistent trading.

- Market Depth Analysis: MT5 provides real-time market depth information, allowing traders to assess order liquidity and potential price movements.

- Fundamental Analysis Tools: Access fundamental news and data feeds to stay informed about market-moving events and make informed trading decisions.

Customer Support

Acqua Trading Solutions offers customer support through various channels, including a dedicated phone line at +91 9316763607. While the availability of direct communication may facilitate client inquiries, it is advisable for users to assess the responsiveness and effectiveness of the support provided to ensure a satisfactory experience.

Conclusion

Acqua Trading Solutions offers the popular MT5 platform and caters to forex traders. However, the lack of regulation and transparency are significant concerns. Consider well-regulated brokers for stronger security and trust.

User comment

Acqua Trading Solutions uses the MT5 platform, which is good. They seem to focus on forex, but double-check everything as there's not much info available. Especially about fees and account types.

FAQs

Is Acqua Trading Solutions regulated?

No, Acqua Trading Solutions is not regulated by any financial authority.

What platform does Acqua Trading Solutions use?

Acqua Trading Solutions offers the MetaTrader 5 (MT5) platform.

What instruments can I trade with Acqua Trading Solutions?

Based on the available information, Acqua Trading Solutions appears to focus on forex trading.

Risk Warning

Trading online carries inherent risks, including the potential loss of your entire investment. It's essential to recognize that online trading may not be suitable for everyone, and individuals should carefully consider their risk tolerance before participating. Additionally, please be aware that the details provided in this review are subject to change as companies update their services and policies. Therefore, it's advisable to verify the most up-to-date information directly with the company before making any trading decisions. Ultimately, the responsibility for utilizing the information in this review lies solely with the reader.

Read more

Equiti Regulation: Compliance and Licensing Info

Equiti regulation includes CySEC, Cyprus, FCA UK, and FSA Seychelles. Review broker accounts, leverage, and platforms.

GMI Markets Announces Global Closure After 16 Years of Operation

GMI Markets, an FCA‑regulated forex broker, will cease global operations on Dec 31, 2025. Clients must withdraw funds by January 31, 2026.

TrueFX Review: Traders Report Inaccurate Forex Signals & Regulatory Issues

Losing trades due to misleading forex signals on the TrueFX platform? Followed all the instructions, yet you received losses? Have you been lured into trading with TrueFX because of the NFA-registered claim on its website? Many have reported these trading concerns online. In this TrueFX review article, we have discussed these complaints. Take a look!

SquaredFinancial Ends CySEC CIF License Operations

Cyprus broker SquaredFinancial winds down CySEC CIF license, shifting FX broker and CFDs clients amid regulatory transition.

WikiFX Broker

Latest News

The "Broker Group" Abyss: How OmegaPro Trapped Thousands in a Digital Dead End

FXORO Under the Microscope: Revoked Licenses and The "Advisory" Trap

XXLMARKETS Review: Regulatory Status and Trading Conditions

IUX Review 2025: Regulatory Status and Withdrawal Complaints

Saxo Bank Review 2025: Regulatory Status and Safety Score

AmariFX Review: Traders Annoyed by Slippage, Login & Withdrawal Issues

Vida Markets Regulation and Broker Review

Headway Broker Regulation and User Reviews

MBFX Review: Withdrawal Denials, Fund Scams & Poor Customer Support Service

Show This to Your Elderly Loved Ones | Online Scams Are Emptying Seniors’ Life Savings

Rate Calc