ActiveX Markets

Abstract:ActiveX Markets is a broker. The tradable instruments with a maximum leverage of 1:500 include forex and commodities markets, indices, Cryptocurrencies, and US stocks. The broker also provides a demo account for novices. The minimum spread is from 0.0 pips and the minimum deposit is $100. ActiveX Markets is still risky due to its unregulated status, high leverage, and the official website cannot be opened.

| ActiveX Markets Review Summary | |

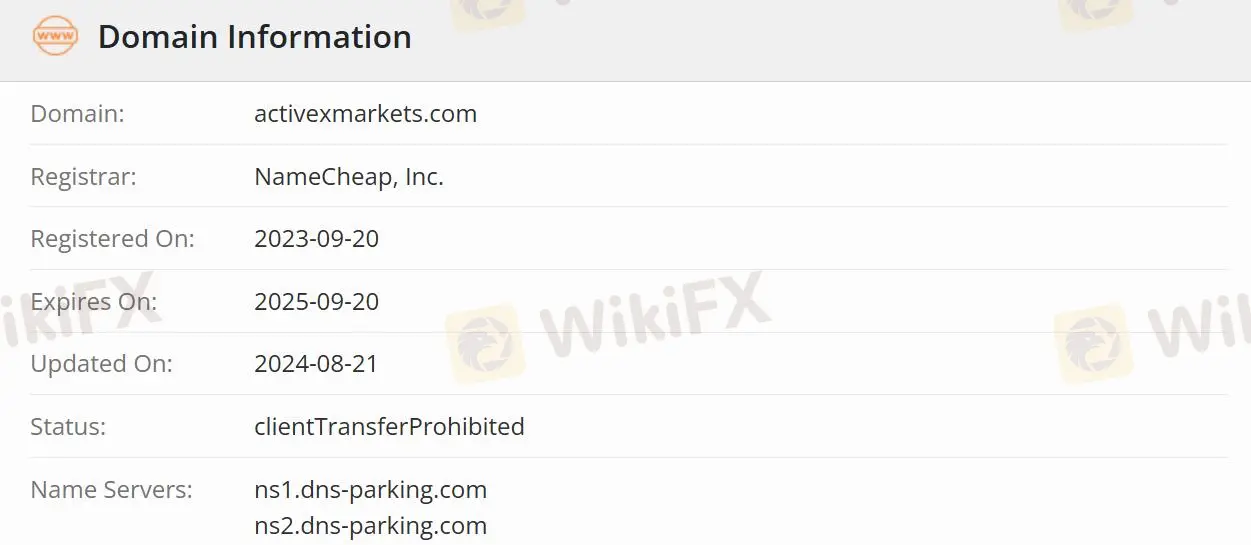

| Founded | 2023-09-20 |

| Registered Country/Region | Saint Lucia |

| Regulation | Unregulated |

| Market Instruments | Forex/Commodities Markets/Indices/Coyptocuencles/US stocks |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | Not mentioned |

| Min Deposit | $100 |

| Customer Support | 24/5 client support |

ActiveX Markets Information

ActiveX Markets is a broker. The tradable instruments with a maximum leverage of 1:500 include forex and commodities markets, indices, Cryptocurrencies, and US stocks. The broker also provides a demo account for novices. The minimum spread is from 0.0 pips and the minimum deposit is $100. ActiveX Markets is still risky due to its unregulated status, high leverage, and the official website cannot be opened.

Pros and Cons

| Pros | Cons |

| Leverage up to 1:500 | Unregulated |

| Spread as low as 0.0 pips | Missing contact information |

| Various trading instruments | Inaccessible official website |

Is ActiveX Markets Legit?

ActiveX Markets is not regulated, which makes it less safe than regulated brokers.

What Can I Trade on ActiveX Markets?

Traders can choose different investment directions because the broker provides forex and commodities markets, indices, Cryptocurrencies, and US stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| US stocks | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

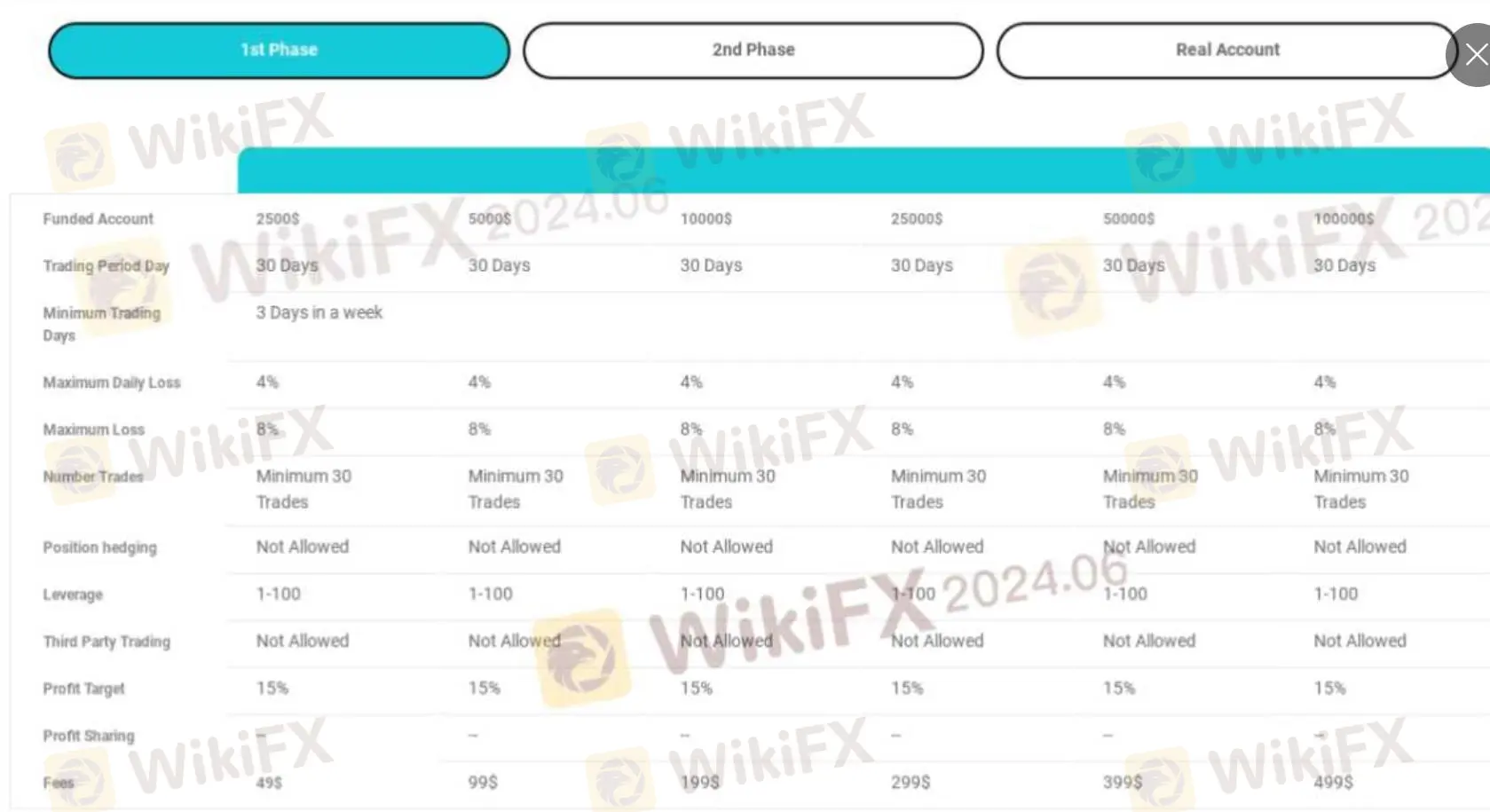

Account Type

ActiveX Markets provides demo and real accounts divided into different capital accounts. The funded account of 1st phase starts at $2500 and the fees are from $49.

ActiveX Markets Fees

The spread starts from 0.0 pips and the commission is free.

Leverage

The maximum leverage is 1:500 meaning that profits and losses are magnified 500 times.

Deposit and Withdrawal

The minimum deposit is $100. However, the official website is inaccessible, payment methods and associated fees are unknown.

Customer Support Options

ActiveX Markets provides 24/5 personal client support.

Read more

OlympTrade Review 2025: Trading Accounts, Demo Account, and Withdrawal to Explore

OlympTrade is a relatively young online broker registered in Saint Vincent and the Grenadines, a shady spot with a booming of unlicensed entities. Tradable assets on the OlymTrade are not extensive, and this broker does not tell many essential trading conditions. As for trading platforms, I found trades can only operated on a simple web-based trading platform, no Metatrader platform at all.

T4Trade Review 2025: Live & Demo Accounts, Withdrawal to Explore

T4Trade, established in 2021 and regulated by the FSA in the Seychelles, allows trading on a modest portfolio of over 300 instruments, spanning forex, metals, indices, commodities, futures, and shares, all accessible via the popular MetaTrader 4 and their proprietary WebTrader platforms. Notably, T4Trade offers a zero-commissions pricing model where both floating and fixed spreads are offered on its MetaTrader—flexible leverage up to 1000:1 to increase trading flexibility. T4Trade also introduces a copy trading service called “TradeCopier”, which enables traders who lack experience or time to join in the markets by copying the trades of seasoned professionals.

Swissquote Review 2025: Live and Demo Account to Explore

Swissquote is a unique online broker with a solid banking background in Switzerland. As a forex-focused platform, it provides one of the most respective range in the industry, over 80 currency pairs in major, minor and exotic. Notably, Swissquote offers different trading conditions for traders from Switzerland, Europe, Middle East, Hong Kong, South Africa, and other regions, and traders at Swissquote can enjoy the benefit of trading with its well-regulated brand and entities. Besides, Swissquote offers excellent research offerings along with its product offerings.

Webull: A Comprehensive Review from Accounts to Withdrawal 2025

Webull Financial stands as a digital trading platform founded in 2017, offering commission-free trading across multiple asset classes including stocks, options, ETFs, cryptocurrencies, and forex. The platform targets primarily intermediate traders seeking a balance of analytical tools and straightforward execution capabilities. While Webull provides robust charting tools and an intuitive mobile experience, its forex offering remains at industry average levels with certain limitations in currency pair selection compared to some other forex brokers.

WikiFX Broker

Latest News

How Do You Make Money in the Forex Market in March 2025

Europe’s High-Stakes Gamble: Can It Bridge the U.S.-Ukraine Divide?

Crypto Trading: New Trend among Indian Youth

Botbro Creator, Lavish Chaudhary Unveils New Project

Is TUOTENDA a cryptocurrency scam primarily targeting men over the age of 50?

Canada to Enforce Retaliatory Tariffs if U.S. Duties Persist

Unbelievable! Is the Yen Really Gaining Strength?

Malaysia’s EPF Declares Highest Dividend Since 2017 Amid Market Resilience

First UK Criminal Conviction for Unregistered Crypto ATMs Involves Over £2.5 Million

Consob Exercises MICAR Authority for the First Time, Shutting Down Unregistered Crypto Website

Rate Calc