OmegaPro Exposed- 5 Red Flags You Shouldn't Ignore

Abstract:If prominent regulators around the world issue warnings against a broker, you must take those warnings seriously and avoid such brokers. OmegaPro is one of the brokers that many regulators have warned about. In this article, we’ll show you the red flags of OmegaPro to give you a scam alert.

If prominent regulators around the world issue warnings against a broker, you must take those warnings seriously and avoid such brokers. OmegaPro is one of the brokers that many regulators have warned about. In this article, well show you the red flags of OmegaPro to give you a scam alert.

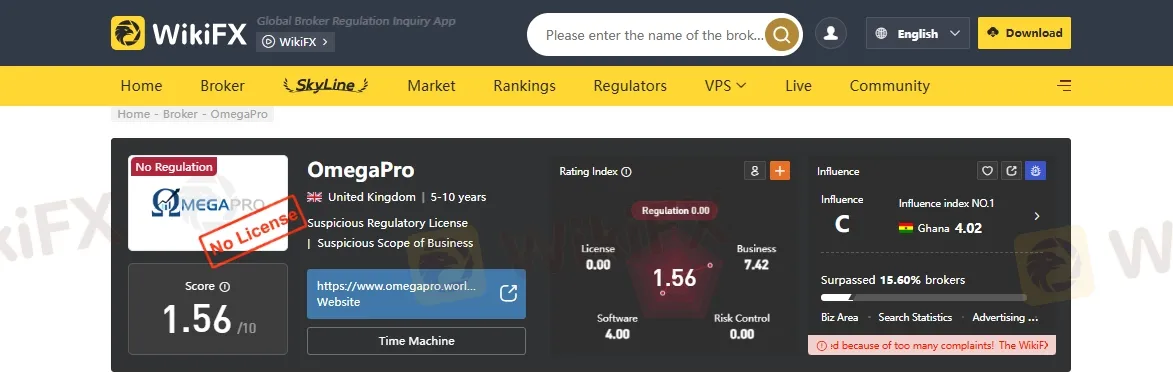

1. Low Score

OmegaPro has received a very low rating of just 1.56 out of 10 on WikiFX. This poor score raises serious doubts about how reliable and trustworthy the broker is. A rating this low can be a warning sign for traders, so its very important to do proper research before investing. If you're looking for a safe and dependable broker, it's better to choose one with a higher score and strong regulation.

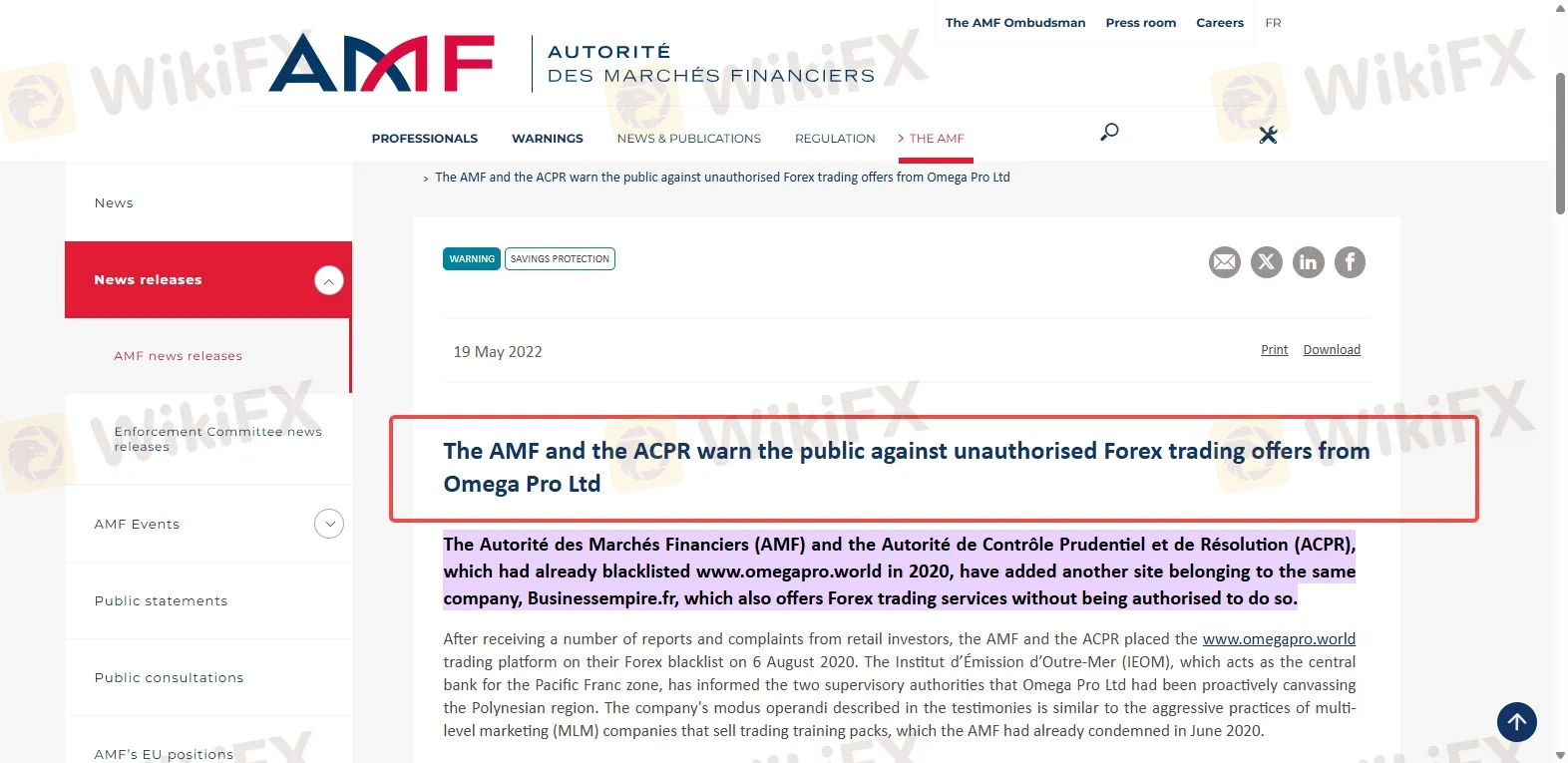

2. AMF warned against OmegaPro in 2020

According to The Autorité des Marchés Financiers (AMF) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR), both of which had already blacklisted the website www.omegapro.world back in 2020, they have now added another website, Businessempire.fr, to their blacklist. This new site is also operated by the same company and offers Forex trading services without proper authorization. These actions highlight ongoing concerns about the companys unauthorized financial activities and the risks involved for investors using these platforms.

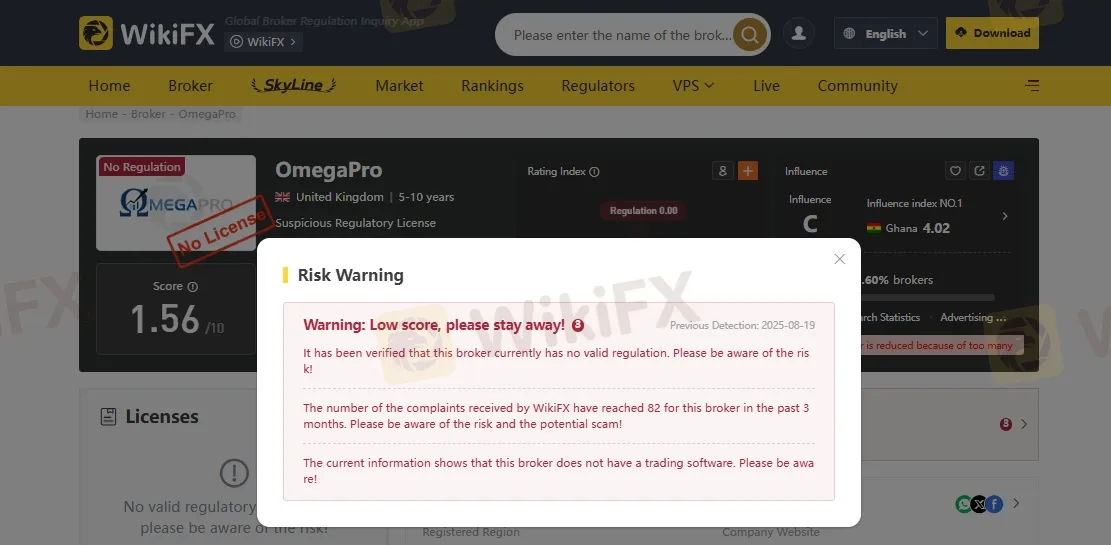

3. Warning from WikiFX

WikiFX has issued a clear warning about OmegaPro that should not be ignored. The platform says:

Warning: Low score, please stay away!

This broker has no valid regulation. Please be aware of the risk!

WikiFX is advising traders to be very careful and to think twice before opening an account or putting in money. These warnings are meant to protect investors from unsafe or untrustworthy brokers, so they should be taken seriously.

4. OmegaPro Co-Founder Arrested in $4B Crypto Scam

In July 2024, Turkish authorities arrested OmegaPro co-founder Andreas Szakacs in Istanbul. He was accused of leading a $4 billion cryptocurrency Ponzi scheme. The arrest came after an anonymous tip and statements from victims. During the raid, officials seized several crypto wallets and key documents linked to the case.

Do not miss these Important Articles- www.wikifx.com/en/newsdetail/202508195264246286.html

www.wikifx.com/en/newsdetail/202508194324626285.html

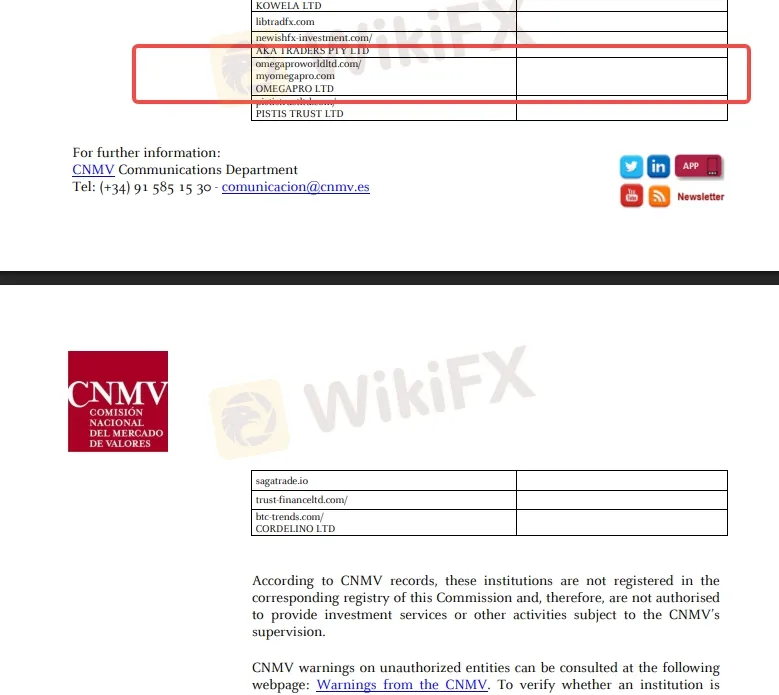

5. CNMV Warning in 2022

In March 2022, Spain's National Securities Market Commission (CNMV) officially issued a public warning regarding OmegaPro. The CNMV stated that OmegaPro was not licensed or authorized to provide investment services within Spain. This means that the company was operating without the necessary regulatory approval, which raises serious concerns about the safety and legitimacy of its services for Spanish investors.

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading — all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

The "Profit Deletion" Anomaly: Why ActivTrades Users Are Seeing Balances Vanish

While holding a reputation rooted in longevity, ActivTrades has recently become the subject of alarming reports regarding the sudden removal of trader profits. Our analysis of data ranging from late 2024 through 2025 reveals a specific pattern: traders generate returns, attempt to withdraw, and subsequently find their profits—and occasionally principal deposits—deducted without clear recourse.

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

MIFX Review: When Regulatory Badges Cannot Shield 'High Risk' Anomalies and Execution Failures

Despite holding legitimate regulatory statuses in Indonesia, the broker MIFX (PT. Monex Investindo Futures) has become the subject of intense scrutiny following a surge in trader complaints. Over the past three months alone, WikiFX has logged 15 formal complaints, painting a picture of a trading environment plagued by technical irregularities, unexplained order executions, and a deposit system that allegedly traps funds in a bureaucratic loop. This investigation delves into the disparity between MIFX’s regulatory paperwork and the jarring reality reported by its active users.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

WikiFX Broker

Latest News

The "Demo Trap": Why You Win Millions for Fun but Lose Your Rent in Real Life

Want to Trade with $100,000? The Truth About Prop Firms

Stop Bleeding Cash: Why Most Forex Rookies Get Crushed

The Silent Killer: Why Your Biggest Wins Often Precede Your Worst Crash

FAKE TRADES ALERT: How Long Candles Are Used to Mislead Retail Traders

Razor Markets Regulation Explained: Real User Reviews Exposed!!

Equiti Regulation: Compliance and Licensing Info

November's inflation report is the first to be released after the shutdown. Here's what to expect

Stop Chasing Green Candles: 3 Fatal Mistakes You’re Making in Trend Trading

Tradgrip Review 2025: Regulation Details, User Experiences & Complaints

Rate Calc