Olymptrade Review: Regulation and Risk

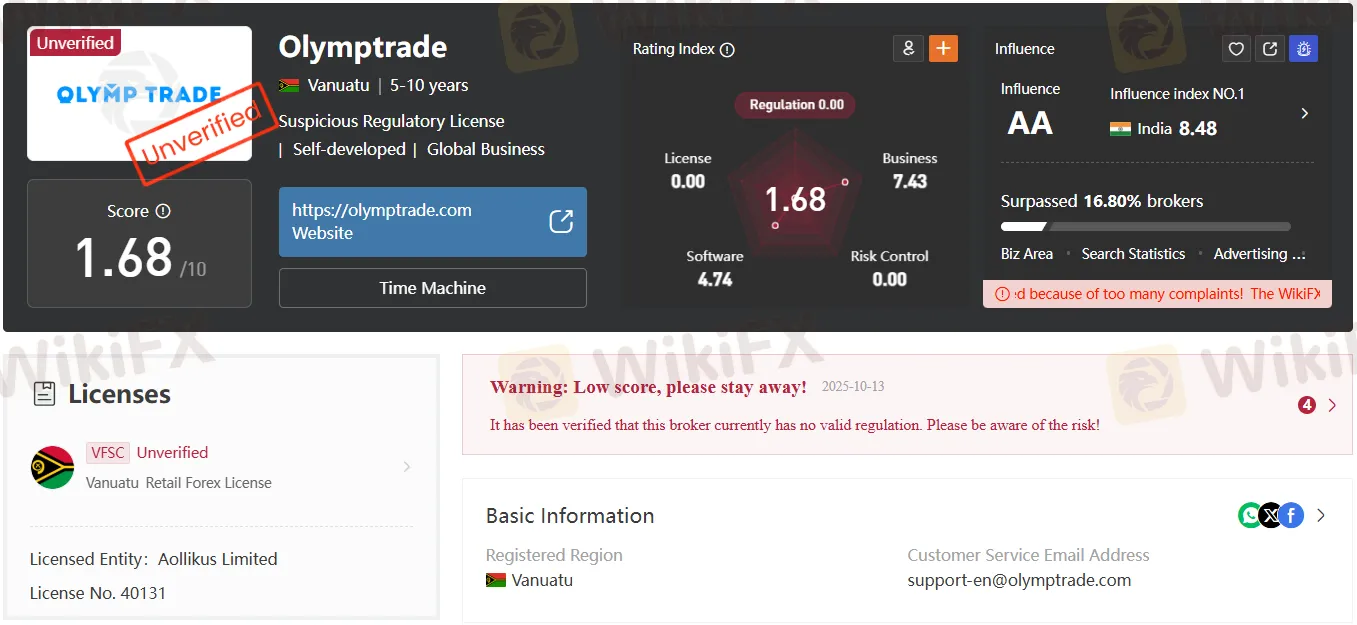

Abstract:Olymp Trade is an online broker claiming VFSC oversight, but registry checks show no valid license; traders face elevated regulatory and fraud risk.

Olymp Trade review: Is it regulated and safe?

Olymp Trade markets itself as a multi-asset broker with zero-commission stock entries and forex spreads from 0, but public registry checks and third‑party risk monitors indicate no currently valid regulation, placing users at heightened risk of unprotected losses and dispute difficulties.

Key findings

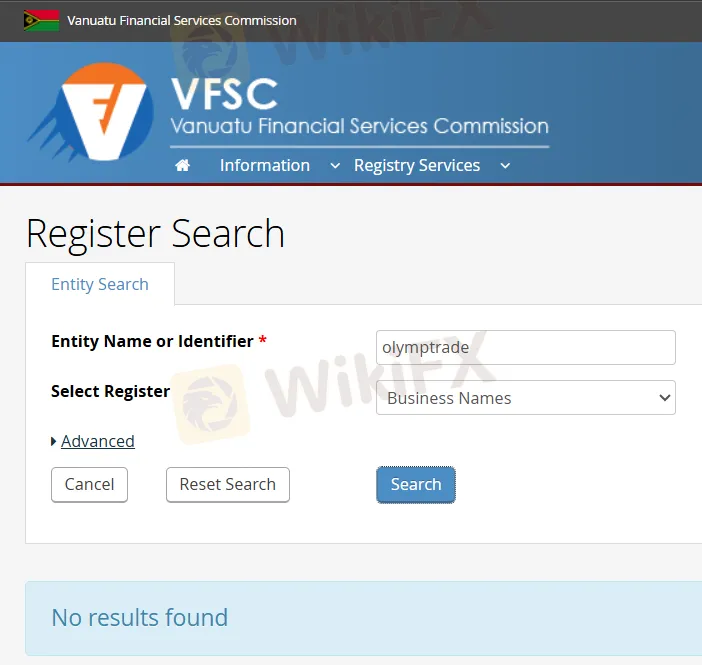

Olymp Trade states it is “licensed and regulated by the Vanuatu Financial Services Commission (VFSC)” and highlights client protections such as deposit insurance and a compensation fund, yet the brokers VFSC business‑name query returns no results and external monitors flag an unverified regulatory status.

Broker snapshot

- Brand and origin: Olymp Trade, established in 2014, registered in Vanuatu with a listed office at 1276, Govant Building, Kumul Highway, Port Vila.

- Trading offer: In‑house platform on desktop, mobile, and PWA; forex and select stocks; no MT4/MT5; minimum deposit of $/€10; demo and Islamic accounts available.

- Pricing claims: Forex from 0 spread with commissions from 0.6 pips; zero commission on stock order entry; inactivity fee $10 after 180 days of no activity.

- Regulatory red flags: VFSC search shows no matching entity; third‑party rating labels the license “unverified” with a low score and warns of too many complaints.

Regulation status

Olymp Trades materials reference a VFSC “Retail Forex License” No. 40131 for Aollikus Limited with an effective date of 2023‑01‑06, but the status is marked “Unverified,” and a VFSC registry search for “olymptrade” returns “No results found,” which conflicts with a clean, active authorization.

Risk assessment

- No valid, verifiable oversight means clients may lack recourse to a statutory complaints scheme, segregated client money audits, and capital adequacy controls commonly mandated by tier‑1 regulators.

- A third‑party monitor assigns a 1.68/10 score, calls the license “unverified/suspicious,” and explicitly warns to stay away due to complaints, indicating elevated operational and conduct risk.

- Marketing emphasis on a compensation fund and deposit insurance is not backed by a regulator listing in the VFSC public search results, increasing the risk that promised protections cannot be enforced.

Products and platforms

Olymp Trade focuses on spot forex and a limited selection of stocks, with over 100 assets cited broadly across majors, minors, and exotics, but it does not support cryptocurrencies, commodities, indices, ETFs, bonds, options, or futures in the current specification.

Its proprietary platform covers desktop, mobile, and a web PWA, targeting beginners; industry‑standard terminals MT4/MT5 are not supported, which limits third‑party tooling and independent order‑execution analytics.

Accounts, deposits, and fees

Account information is sparse in official summaries, beyond a $/€10 minimum and availability of demo and Islamic accounts, suggesting limited transparency versus multi‑tier account structures used by established brokers.

Deposits are accepted via bank cards, e‑payments, and crypto; withdrawals require submitting a request from the account area with a minimum of $/€10, but processing times and payout channels are not detailed in the overview.

A $10 monthly inactivity fee applies after 180 days without funding or trading, and forex pricing is presented as “zero spread with commissions from 0.6 pips,” while stock opening trades cite zero commission with commission assessed on closing profitable trades.

Pros and cons

- Pros: Low entry threshold at $/€10, demo access for practice, 24/7 support, and simple in‑house platform UX for first‑time traders.

- Cons: Unverified regulation, no MT4/MT5, limited instruments beyond basic forex and some stocks, and incomplete public detail on account tiers and execution policies.

Independent checks and signals

A domain record shows olymptrade.com registered on 2014‑04‑14 with renewal to 2026‑04‑14, consistent with the brands 2014 launch narrative, but this does not substitute for regulatory validation.

The risk monitors “VFSC Unverified” tag tied to Aollikus Limited (License No. 40131) and its explicit 2025‑10‑13 warning strengthen the case that regulatory coverage is currently absent or not recognized by the cited authorities.

Expert view and user awareness

From a compliance perspective, a broker that cannot be located in the VFSCs business‑name registry and is flagged unverified by an industry monitor presents a high‑risk profile for custody and best‑execution outcomes.

For beginners attracted by $10 entry and slick apps, the central trade‑off is convenience versus the absence of a regulator capable of auditing client‑fund segregation, leverage controls, negative‑balance protection, and dispute resolution under administrative law.

Safety checklist

- Verify any claimed license directly in the stated regulators public registry rather than relying on badges or images within marketing material.

- Avoid funding accounts with significant sums until regulator listings, legal entity names, and license numbers match across public sources.

- Prefer brokers with transparent execution statistics, published best‑execution reports, and support for independent platforms that allow third‑party analytics.

Bottom line

Olymp Trade offers a low‑cost, beginner‑friendly platform and minimal entry requirements, but the lack of a verifiable, current license in the VFSC search and unverified ratings create a material consumer‑protection gap that overshadows its pricing and UX claims.

Until a valid authorization can be confirmed in the regulators registry, traders should treat the broker as unregulated and consider safer alternatives with recognized oversight.

Read more

24option Review: Is it Legit or a Scam? Find Out in This In-depth Investigation

Contemplating 24option as your forex trading companion? Want to explore its trading platforms? We appreciate your interest! But how about knowing the Hong Kong-based forex broker and its different aspects, such as withdrawals and deposits. More specifically, if we have to say, what’s the feedback of traders concerning 24option? Are they happy trading with the broker? From a healthy collection of over 200 reviews, the broker is found to be a SCAM! Many traders have expressed concerns over the illegitimate trading approach adopted by the broker. In the 24option review article, we have explored many complaints against the broker.

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Did your forex trading experience with FXNovus become bad after a short profitable spell on small trades? Did you make tax payments on your failed withdrawal request, as the funds did not arrive? Did the customer support team fail to return your hard-earned profits on the FXNovus trading platform? Feel that the South Africa-based forex broker debited illegitimate fees from your trading account? You are not alone! Many traders have voiced these trading concerns while sharing the FXNovus review. In this article, we have highlighted these concerns in greater detail. Read on!

Capital.com Expands into Kenya with Local Licence

Capital.com secures a Kenyan CMA licence and appoints Samwel Kiraka as CEO, marking a major step in its Africa expansion strategy.

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

Nearly 400 investors have urged the Labuan FSA to take stricter measures against a company accused of running an illegal forex trading scheme, which has reportedly caused losses exceeding RM104 million.

WikiFX Broker

Latest News

Fed

Geopolitical Risk Returns: Iran Threatens 'Unforgettable Lesson' as Tensions Mount

TrioMarkets Launches TrioFunded as Brokers Continue to Expand Into Prop Trading

War Risk Premium Explosions: Gold Hits

FCA Warns on Complex ETP Sales Practices

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

A major development in Trump's Fed feud is set to happen next week in the Supreme Court

Forex 101: Welcome to the $7.5 Trillion Beast

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Rate Calc