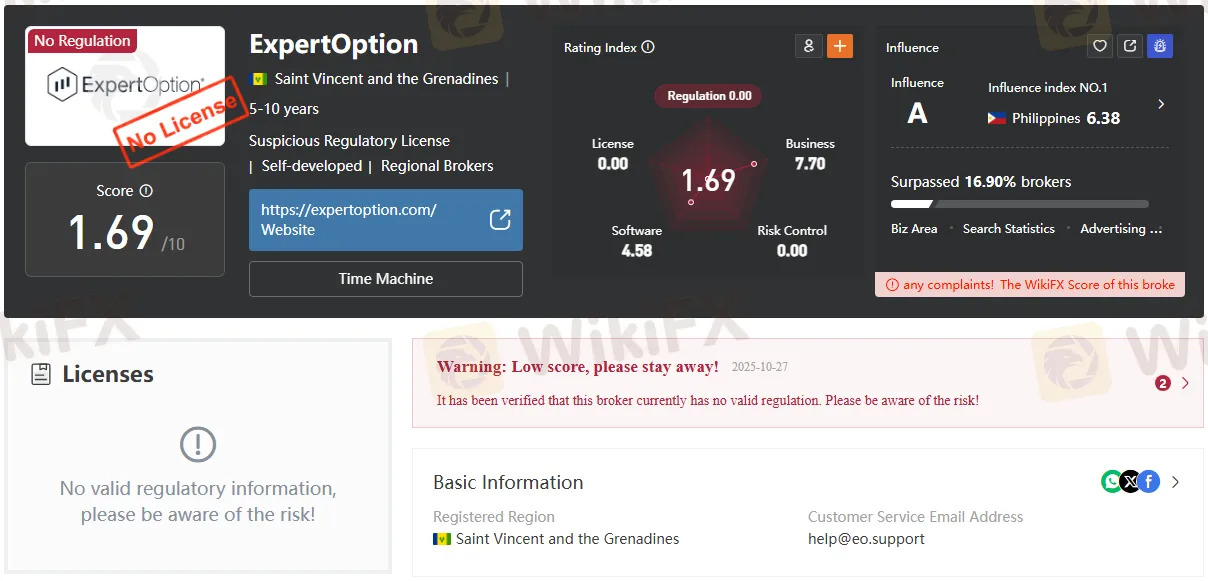

Expert Option Review – Is It Really Regulated?

Abstract:Expert Option is not regulated by any major authority. It operates offshore with only Financial Commission membership, not full broker regulation.

Introduction

Expert Option has positioned itself as a global trading platform offering access to more than 100 assets, including stocks, commodities, indices, and cryptocurrencies. The broker claims to serve millions of clients worldwide, with a minimum deposit of just $10 and trade sizes starting at $1. While the platform highlights accessibility, fast execution, and social trading features, its regulatory status raises important questions for traders seeking security and transparency.

This review examines Expert Option in detail, focusing on its regulatory framework, account types, trading conditions, and overall credibility. The goal is to provide a clear picture of what traders can expect before committing funds.

Expert Option Regulation Status

One of the most critical aspects of any broker is its regulatory oversight. According to the companys own disclosures, Expert Option is operated by EOLabs LLC, registered in St. Vincent and the Grenadines. This jurisdiction is known for its light-touch financial supervision, and the broker is not licensed or regulated by any recognized financial authority such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia).

Instead, Expert Option highlights its membership with The Financial Commission, an independent dispute resolution body. Membership provides access to a compensation fund of up to €20,000 per client in case of disputes. While this offers some reassurance, it is not equivalent to full regulatory oversight. Traders should understand that the Financial Commission is not a government regulator but a private organization.

Company Background and Restrictions

Expert Option was established in 2014 and claims more than 70 million clients globally. However, the broker explicitly restricts services in numerous countries, including the United States, Canada, the European Union, the United Kingdom, and others. This exclusion list covers most major regulated markets, leaving the platform primarily available in regions with less stringent financial oversight.

The companys registered address is in Kingstown, St. Vincent and the Grenadines, a common base for offshore brokers. While this does not automatically imply malpractice, it does mean that clients have limited legal recourse in case of disputes.

Trading Platform and Features

Expert Option provides a proprietary trading platform available on desktop, mobile (iOS and Android), and web browsers. The platform emphasizes simplicity and accessibility, with features such as:

- Over 100 tradable assets, including stocks like Apple, Tesla, and Google, as well as commodities, indices, and ETFs.

- Social trading tools that allow users to follow and copy top-performing traders in real time.

- Technical analysis features, including charts, indicators, and news-based trading options.

- Cross-device compatibility, supporting Windows, MacOS, Android, and iOS.

The platform is designed for beginner-friendly use, but advanced traders may find the tools limited compared to MetaTrader 4 or 5.

Account Types and Minimum Deposits

Expert Option offers a tiered account structure, starting with a Micro account requiring just $10. Higher-tier accounts unlock additional benefits:

- Basic Account – from $50

- Silver Account – from $500

- Gold Account – from $2,500

- Platinum Account – from $5,000

- Exclusive Account – invitation only

Benefits vary by account type, with higher tiers offering features such as daily market reviews, financial research, and priority withdrawals. However, the maximum trade size and number of open deals are capped at lower levels for smaller accounts.

Deposits and Withdrawals

The broker supports more than 20 payment systems, including Visa, Mastercard, Maestro, UnionPay, Neteller, Skrill, and Binance Pay. Deposits are instant, and withdrawals are processed with no stated commission. However, priority withdrawals are reserved for Gold, Platinum, and Exclusive accounts.

While the payment options are diverse, the absence of regulation means that clients rely solely on the brokers internal policies for fund security. This is a significant risk factor compared to regulated brokers that must adhere to strict client fund segregation rules.

Social Trading and Community Features

Expert Option promotes itself as a leader in social trading. The platform allows users to view trades made by others in real time, follow top investors, and even compete in country-based rankings. This gamified approach appeals to beginners but also carries risks, as following other traders does not guarantee profitability.

The broker also maintains active social media channels on Facebook, Twitter, Instagram, and YouTube, where it shares updates and promotional content.

Awards and Recognition

Expert Option highlights its award as “Best Trading Platform” at the China Trading Expo in Shenzhen (2017). While this recognition adds some credibility, traders should note that industry awards are not a substitute for regulatory licensing.

Risk Warnings and Legal Disclaimers

The broker includes standard risk warnings, emphasizing that trading involves a significant risk of loss and may not be suitable for all investors. It advises clients not to invest funds they cannot afford to lose and to seek independent financial advice if uncertain.

Importantly, the company acknowledges that it is not supervised by the Japanese Financial Services Agency (JFSA) and does not target residents of Japan. Similar disclaimers apply to other restricted jurisdictions.

Strengths of Expert Option

- Low minimum deposit ($10) and trade size ($1).

- Proprietary platform with a simple interface.

- Wide range of assets across multiple classes.

- Social trading features for beginners.

- Membership with The Financial Commission and access to dispute resolution.

Weaknesses of Expert Option

- Unregulated and unlicensed by any major financial authority.

- Offshore registration in St. Vincent and the Grenadines.

- Restricted in major markets including the US, UK, EU, and Canada.

- Limited advanced trading tools compared to MetaTrader platforms.

- Priority withdrawals only for higher-tier accounts.

Is Expert Option Safe?

The safety of Expert Option depends largely on a trader‘s risk tolerance. While the platform offers user-friendly features, multiple account types, and a wide asset selection, the lack of recognized regulation is a major drawback. Traders have limited protection in case of disputes, aside from the Financial Commission’s compensation fund.

For beginners seeking a low-cost entry into trading, Expert Option may appear attractive. However, experienced traders and those prioritizing fund security may prefer brokers regulated by authorities such as the FCA, ASIC, or CySEC.

Conclusion

Expert Option markets itself as a global trading platform with millions of users, low entry requirements, and innovative social trading features. Yet, its offshore registration and lack of recognized regulation remain significant concerns. While the brokers membership with The Financial Commission provides some dispute resolution mechanisms, it does not replace the protections offered by licensed regulators.

Traders considering Expert Option should weigh the convenience of its platform against the risks of trading with an unregulated broker. As always, due diligence and risk management are essential before committing funds.

Read more

FXPIG Exposed: Traders Report Withdrawal Denials, Fund Scams & Regulatory Flags

Do you face massive losses due to astonishing spreads at FXPIG? Have you witnessed multiple trade executions by the Georgia-based forex broker even though you wanted to execute a single order? Has this piled on losses for you? Is the FXPIG withdrawal too slow? Maybe your trading issues resonate with some of your fellow traders. In this FXPIG review article, we have shared these issues so that you can introspect them thoroughly before deciding on the best forex trader.

Does WealthFX Generate Wealth or Losses for Traders? Find Out in This Review

The name WealthFX sounds appealing for all those wishing for a rewarding forex journey. However, behind the aspiring name are multiple complaints against the Comoros-based forex broker. These trading complaints dampen the broker’s reputation in the forex community. In this WealthFX review article, we have shared some of these complaints here. Take a look!

FXPrimus Review: Is FXPrimus Regulated and Reliable for 2025?

FXPrimus is a CySEC-regulated forex broker offering MT4, MT5, and WebTrader with flexible leverage and diverse trading instruments since 2009.

IG Japan to Halt Crypto ETF CFDs as FSA Tightens Rules

IG Japan will end cryptocurrency ETF CFDs after new FSA guidance, forcing traders to close positions by January 31, 2026, under stricter crypto rules.

WikiFX Broker

Latest News

150 Years Of Data Destroy Democrat Dogma On Tariffs: Fed Study Finds They Lower, Not Raise, Inflation

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Amillex Withdrawal Problems

IEXS Review 2025: A Complete Expert Analysis

IEXS Regulation: A Complete Guide to Its Licenses and Safety Warnings

Oil and gas giant Wood plc sold to Dubai engineering firm

FONDEX Review: Do Traders Really Face Inflated Spreads & Withdrawal Issues?

Rate Calc