Amillex Withdrawal Problems

Abstract:Issues with Amillex withdrawal problems have become a major talking point for traders in 2025. People are reporting delays, frozen accounts, and withdrawal requests that aren't being processed. This has created a need for a clear, fact-based review. This article will take a detailed look at these reported problems, investigate what's causing them, and provide helpful advice for current and future Amillex traders. Our goal is to break down the facts, showing both what users are claiming and how the broker has officially responded, so you have the information you need to handle the platform's money transfer processes successfully.

Issues with Amillex withdrawal problems have become a major talking point for traders in 2025. People are reporting delays, frozen accounts, and withdrawal requests that aren't being processed. This has created a need for a clear, fact-based review. This article will take a detailed look at these reported problems, investigate what's causing them, and provide helpful advice for current and future Amillex traders. Our goal is to break down the facts, showing both what users are claiming and how the broker has officially responded, so you have the information you need to handle the platform's money transfer processes successfully.

A Deep Dive into Cases

To understand what's really happening with the reported Amillex withdrawal problems, we need to look at specific cases that have been made public. These examples, submitted by users, give us insight into the conflicts that can happen between a trader and a broker. We'll present these cases in an organized way, showing both what the user claims happened and the official response from Amillex. It's important to remember that these are reports submitted by users and the broker's replies, presented here to give you a clear view of the situation.

Case Study 1: The Currency Conflict

One major complaint shows a complicated issue involving different currencies for deposits and withdrawals.

User Claim:

A user, known as `FX2618573357`, reported that after making a deposit, one of their bank cards was frozen. After that, a withdrawal request made in USDT was not processed by the platform. The user claimed that customer service stopped responding and that their account was eventually blocked. The report also mentions that the broker asked the user to complete a video verification process.

Amillex's Official Reply:

In response, Amillex confirmed that the user's money was safe in their trading account. The broker said that the main issue came from breaking Anti-Money Laundering (AML) rules: the user put money in using Chinese Yuan (CNY) but tried to take it out in USDT. Amillex's reply noted that the original deposit was being investigated by legal authorities. To move forward, the user needed to complete identity verification (KYC). The broker explained that once this verification was successfully completed, the user would be able to withdraw their money in the original deposit currency (CNY) to their personal bank account.

Case Study 2: Freezing and Banning

The same user made another complaint, making broader claims about the platform's withdrawal practices.

User Claim:

The user claimed that Amillex “doesn't allow withdrawals” and “keeps freezing” accounts. They also said that their account was banned after bringing in a “master” to help with operating the account.

Amillex's Official Reply:

Amillex repeated that the main problem was the AML/KYC compliance issue, specifically trying to deposit in CNY and withdraw in USDT. The broker's official statement explained that the user had not responded to multiple emails or submitted the required verification documents needed to resolve the compliance check. They stressed that as a regulated company, the platform must follow these financial security rules and cannot process the withdrawal without the user's compliance. Amillex promised that the account would be fully restored for both trading and withdrawal (in CNY) as soon as the identity verification was completed.

We present these summaries for clarity, but traders can review the full details of these user interactions and the official replies on platforms that collect broker information to form their own opinions.

The Other Side of the Story

While the negative reports are serious and need attention, they don't represent all user feedback. A balanced view requires recognizing the positive experiences shared by other traders. According to several unverified user reviews, many clients have had smooth and efficient experiences with Amillex's payment systems.

Positive Feedback Highlights:

• Users praise the platform for fast and convenient withdrawals, with one review stating, “Withdrawals are processed quickly.”

• Customer service has been described as responsive and quick in handling issues.

• The overall deposit and withdrawal process is frequently described as being “very smooth” and “very convenient.”

• Some traders also praise the platform for its excellent trading environment.

These positive accounts suggest that the withdrawal system can work effectively, supporting the idea that specific circumstances, such as compliance checks, may be the main causes of the reported problems.

Understanding The Root Cause

The most common connection between the documented Amillex withdrawal problems is following global financial regulations, specifically Anti-Money Laundering (AML) and Know Your Customer (KYC) policies. Understanding these rules isn't just about Amillex; it's important for anyone trading with a regulated broker worldwide. This knowledge turns a complaint from a simple “problem” into a learning opportunity about how the financial industry protects itself and its clients.

Why Currency Mismatches Are Blocked

The practice of putting money in using one currency (like CNY via bank transfer) and trying to take it out in another (like USDT cryptocurrency) is a major warning sign for financial institutions and regulators. This activity, known as currency switching, can be used to hide where money comes from and is a classic money laundering technique. To fight this, regulated brokers are legally required to enforce a “return to source” policy. This means that whenever possible, money must be returned using the same method and in the same currency as the original deposit. This isn't an arbitrary rule set by Amillex but a standard, non-negotiable industry practice.

The Role of Identity Verification

Know Your Customer (KYC) is the process through which a broker verifies the identity of its clients. This typically involves submitting official documents like a government-issued ID and proof of address (such as a utility bill). When a transaction is flagged for potential AML risk—like the currency mismatch in the case studies—brokers are required to perform enhanced due diligence. This explains Amillex's request for video verification. The broker must confirm, with certainty, that the person requesting the withdrawal is the same person who owns the account and made the deposit. Failure to complete this step gives the broker no choice but to freeze the funds until compliance is met.

A Guide to Smooth Withdrawals

Based on the documented issues and the broker's official policies, traders can take several proactive steps to avoid Amillex withdrawal problems and ensure a smooth process. Following this checklist can significantly reduce the risk of delays and account restrictions.

1. Complete Your Identity Verification (KYC) First: Don't wait until you want to make a withdrawal. Complete the full KYC process immediately after opening your account. Submitting and getting your documents approved beforehand removes a major potential roadblock.

2. Ensure Currency Consistency: This is the most important step. Always request a withdrawal in the same currency you used for your deposit. If you deposited USD via Bank Transfer, you must withdraw USD via Bank Transfer. If you deposited USDT, withdraw USDT. Don't try to switch currencies between deposit and withdrawal.

3. Understand Processing Times: A “delay” is often just the standard processing time. While many methods are instant, Bank Transfers can take up to 5 working days. Learn the official timeline for your chosen method to set realistic expectations.

4. Use the Correct Channels: Start all withdrawal requests through the official client portal on the Amillex website. Don't use third-party methods or informal communication channels. Follow the platform's step-by-step procedure.

5. Communicate with Customer Support: If a real delay occurs (meaning the processing time has exceeded the official timeframe), contact customer support through official channels like email (`support@amillex.com`) or the live chat feature. Provide your account number and transaction details clearly to help get a quick resolution.

Official Methods and Timelines

To manage expectations, it's essential to know Amillex's official payment system. The broker offers various methods, each with its own processing time. The perception of a “delay” can often be traced back to misunderstanding these timelines, particularly with traditional banking methods.

Amillex Payment Methods Overview

| Payment Method | Min. Transaction | Processing Time | Key Consideration |

| USDT (ERC-20/TRC-20) | 50 USD | Instant | Subject to strict AML rules if deposit currency was different. |

| E-Wallet | 50 USD | Within 24 hours | A relatively fast and convenient option. |

| Bank Transfer | 50 USD | Up to 5 Working Days | This is the longest official processing time and a likely source of perceived “delays”. |

| Other Methods (Help2Pay, etc.) | 50 USD | Instant | Availability may vary depending on the trader's region. |

Assessing Overall Trustworthiness

A final assessment of Amillex's reliability requires looking at its regulatory standing and the associated risks. The broker operates under a dual-license structure, which presents both strengths and weaknesses that traders must consider.

The Tale of Two Licenses

Amillex holds licenses from two different regulatory bodies:

• ASIC (Australia): The broker has an Institution Forex License (STP) from the Australian Securities and Investments Commission. ASIC is widely regarded as a top-tier regulator, known for its strict enforcement and strong investor protection frameworks.

• FSC (Mauritius): The broker also holds a Retail Forex License (No. GB24203163) from the Financial Services Commission of Mauritius. This is an offshore regulation. A specific risk warning is associated with this license, highlighting that offshore oversight is typically less strict and may offer weaker investor protection compared to top-tier regulators like ASIC.

The dual-license setup means that the level of protection you receive may depend on the specific entity your account is registered with. The existence of the ASIC license is a positive sign of institutional credibility, while the FSC offshore license presents a known risk that traders must be comfortable with. To better understand the protections offered, traders can verify the current status of these licenses and view any associated risk warnings directly on comprehensive review platforms.

Conclusion: Navigating with Confidence

While the keyword “Amillex withdrawal problems” points to a valid area of concern backed by user reports, the available evidence suggests that many of these issues are rooted in non-compliance with standard, industry-wide AML and KYC procedures. The conflict between deposit and withdrawal currencies appears to be the primary trigger for the most severe complaints of frozen funds and blocked accounts.

For traders, the path to a smooth withdrawal experience is built on compliance. By completing KYC verification early, ensuring currency consistency, and understanding official processing times, users can reduce the most common risks.

Ultimately, the decision to trade with Amillex requires weighing its offerings—such as multiple account types and a diverse range of assets—against the documented withdrawal disputes and the inherent risks associated with its offshore FSC regulation. For a complete and up-to-date overview of Amillex's regulatory status, user feedback, and operational details, traders are encouraged to conduct their own thorough research on a comprehensive platform before committing funds.

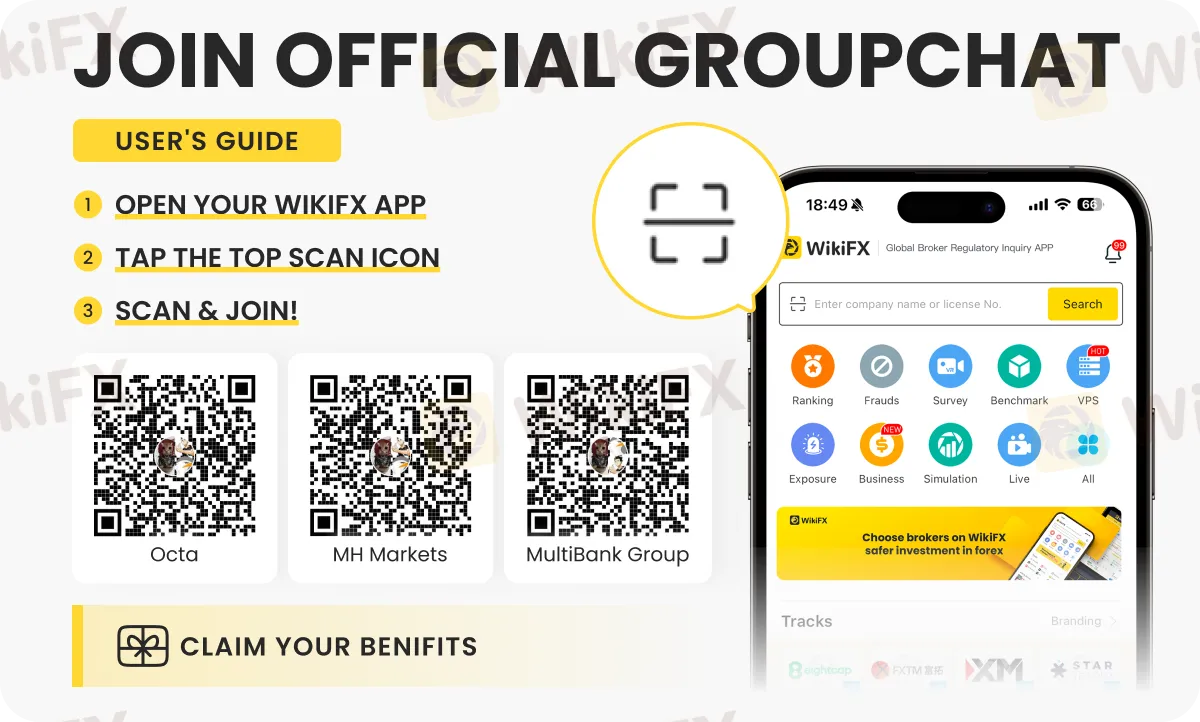

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

WikiFX Broker

Latest News

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Netflix Confirms 2025 Stock Split, FxPro Issues Update

XM Broker Launches $150K Partners Rising League

The Hidden Reason Malaysian Traders Lose Money And How Timing Can Fix It

FXCL Review: Broker License Revoked, No Regulation

Is WinproFx Safe or a Scam? A 2025 Simple Safety Review

Rate Calc