NPE Market Review: Why to Stay Away

Abstract:NPE Market review shows blocked accounts, no regulation, and low trust—best to stay away.

Introduction: A Broker Under Scrutiny

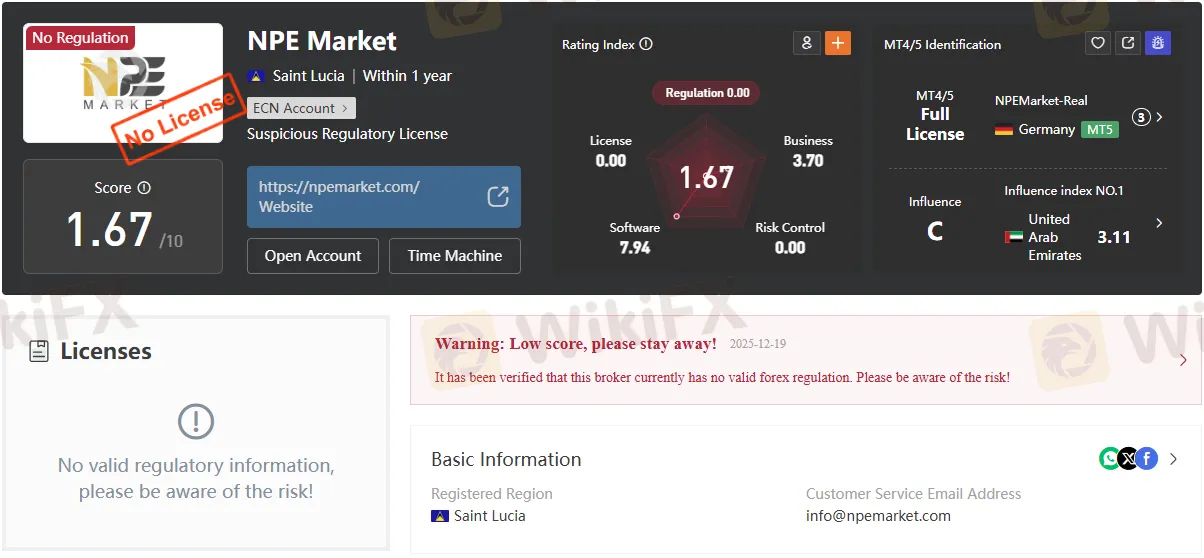

Trust in a broker begins with regulation and transparency. In this NPE Market Review, the evidence from the attached file reveals a troubling picture: NPE Market operates without valid oversight, carries a low trust score, and has documented cases of blocked accounts. Despite its polished marketing promises, the reality is far more concerning.

NPE Market Regulation Status

The brokers regulatory standing is clear: NPE Market is unregulated. Registered in Saint Lucia, it has no valid license from any recognized financial authority.

- WikiFX Score: 1.67/10

- Regulatory Score: 0.00

- Claimed Licenses: Suspicious and unverifiable

- Domain: npemarket.com

- Warning Issued: December 19, 2025

Awareness Point: An unregulated broker means traders have no legal protection if funds are lost or accounts are frozen. Regulatory oversight is not a formality—it is the backbone of trader safety.

Reported Case: Blocked Account Incident

One user report stands out as a cautionary tale. After opening an account in November 2025 and growing it to $23,000, the traders account was suddenly blocked without warning or explanation. No email, no communication—just a suspension.

Eye Opener: If a broker can freeze an account without notice, traders risk losing not only profits but also their initial deposits. This is a hallmark of unregulated operations.

Trading Platforms and Execution

NPE Market advertises access to MetaTrader 4/5 (MT4/5), with one MT5 server listed: NPEMarket‑Real.

- Execution Speed: 216 ms average

- Server Location: Germany

- Ping: 174 ms

While MT5 is a legitimate platform, the infrastructure is minimal. The claim of “perfect” MT5 service is contradicted by the absence of regulatory backing and limited server presence.

Awareness Point: A strong platform does not guarantee safety. Without regulation, even the best technology cannot protect traders from broker misconduct.

Account Types and Conditions

NPE Market promotes four account types: Cent, ECN, ECN Pro, and Standard.

| Account Type | Minimum Deposit | Leverage | Spread | Commission |

| Cent | $10 | 1:3000 | From 1.8 | Zero |

| ECN | $300 | 1:500 | From 0.2 | $5 per lot |

| ECN Pro | $5000 | 1:500 | From 0.0 | $5 per lot |

| Standard | $50 | 1:3000 | From 1.2 | Zero |

Key Observations:

- Extremely high leverage (up to 1:3000) is risky and often banned by regulators.

- Minimum deposits vary widely, suggesting inconsistent targeting of retail traders.

- Withdrawal methods are unspecified, leaving traders uncertain about fund accessibility.

Eye Opener: High leverage may look attractive, but it magnifies losses as much as gains. Regulators often cap leverage to protect retail traders from catastrophic losses.

Trading Instruments and Features

The broker claims to offer 280+ instruments, including forex and crypto. However, the absence of detailed product listings and withdrawal transparency undermines credibility.

Awareness Point: A wide product range means little if traders cannot withdraw profits or verify the brokers legitimacy.

Pros and Cons of NPE Market

Pros:

- Access to the MT5 trading platform

- Multiple account types with low entry deposits

- High leverage options for aggressive strategies

Cons:

- No valid regulation or license

- Extremely low trust score (1.67/10)

- Reported cases of blocked accounts

- Lack of transparency on withdrawals and deposits

- Suspicious claims of “full license” without verification

Bottom Line: Stay Away

This NPE Market Review makes one conclusion clear: NPE Market is not a safe broker. With no regulation, a low trust score, and documented cases of account suspension, the risks outweigh any potential benefits.

Final Awareness Statement: Marketing promises of transparency and empowerment mean nothing without regulatory proof. Traders should treat unregulated brokers as high‑risk entities. NPE Markets lack of accountability and suspicious practices make it a broker best avoided.

Final Verdict: NPE Market is unregulated, unreliable, and unsafe. Traders are strongly advised to stay away.

Read more

WikiFX Alert: Three Well-Known Brokers Targeted by Impersonation Websites

WikiFX issues a warning over unlicensed trading sites posing as established brokers, highlighting the lack of regulatory safeguards and growing risks of fraud and investor losses.

Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Beware Weltrade: Scam Reports Surge in One Month

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

PU Prime Launches “The Grind” to Empower Traders

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

WikiFX Broker

Latest News

Consumer Credit Smashes All Estimates As Monthly Credit Card Debt Unexpectedly Surges By Most In 2 Years

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

Eurozone Economy Stalls as Demand Evaporates

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Rate Calc