FCX Review 2025: Institutional Audit & Risk Assessment

Abstract:Based on a comprehensive audit of current regulatory filings and trader feedback, FCX (FCX Trade) operates as a high-risk, unregulated entity. Despite claims of a UK presence, the broker holds no authorization from the Financial Conduct Authority (FCA) or any other Tier-1 regulatory body. The platform has been flagged by multiple offshore authorities for operating without a license and, significantly, for utilizing forged corporate documents. With a WikiFX score of 1.47, FCX fails to meet the minimum standards for solvency, transparency, and client protection. We classify this entity as a critical risk to capital.

Executive Summary

WikiFX Score:1.47 / 10

Regulatory Status:Unregulated (Multiple Regulatory Warnings)

Based on a comprehensive audit of current regulatory filings and trader feedback, FCX (FCX Trade) operates as a high-risk, unregulated entity. Despite claims of a UK presence, the broker holds no authorization from the Financial Conduct Authority (FCA) or any other Tier-1 regulatory body. The platform has been flagged by multiple offshore authorities for operating without a license and, significantly, for utilizing forged corporate documents. With a WikiFX score of 1.47, FCX fails to meet the minimum standards for solvency, transparency, and client protection. We classify this entity as a critical risk to capital.

Quick Take: Pros and Cons

The following checklist synthesizes the operational strengths and weaknesses of FCX based on available filings and user data:

Pros

- ✅ Online Customer Support (Nominal availability via email).

Cons

- ❌ Severe Regulation Warning: Official warnings issued by Belize FSC and St. Vincent FSA.

- ❌ Unregulated Status: No valid license to offer financial services in any jurisdiction.

- ❌ Forgery Allegations: Regulators have confirmed the use of fraudulent incorporation certificates.

- ❌ Withdrawal Failures: Multiple reports of account freezing upon profit generation.

- ❌ Opaque Infrastructure: No transparency regarding trading software (MT4/MT5) or liquidity providers.

- ❌ Low Trust Score: A 1.47/10 rating indicates a high probability of distress or scam operations.

Regulatory Compliance & Safety Profile

License Verification: Null

A formal audit of FCX's legal standing reveals a complete absence of regulatory oversight. While the brokers summary data mentions a UK establishment year of 2021, a cross-reference with the UK FCA register (implied by the lack of license data) confirms that FCX is not authorized to hold client funds or offer speculative investment products in the United Kingdom.

Legitimate UK-based brokers are required to adhere to strict capital adequacy rules and participate in the Financial Services Compensation Scheme (FSCS). FCX provides none of these safeguards.

Risk Warning: Active Regulatory Actions

The most critical finding in this audit is the existence of specific, active warnings from offshore regulators. These are not merely administrative lapses; they indicate potential fraudulent intent.

- Belize Financial Services Commission (FSC) Warning (September 2024):

The Belize FSC issued a “Cease and Desist” order against FCX Trade. The regulator explicitly stated that the entity is unlicensed and unauthorized. The warning highlights that dealing with this entity is done at the trader's “own risk,” marking the firm as a confirmed danger to the public.

- St. Vincent and the Grenadines (FSA) Warning:

In a severe disclosure, the FSA stated that FCX-Trade LLC presented documents claiming to be incorporated and licensed in St. Vincent. The FSA clarified that these documents are false and forged. Furthermore, the FSA reiterated that it does not issue “Forex Brokerage licenses.” The use of forged government documents is a primary indicator of a scam operation rather than a legitimate business.

Analyst Implication:

The combination of operating without a license and the documented use of forged certificates suggests that FCX is not a functioning financial intermediary but likely a boiler room operation. There is zero segregation of funds, meaning client deposits are likely commingled with the company's operational accounts and at immediate risk of misappropriation.

Market Sentiment: User Complaints

A review of recent client activity, specifically from the Indian market region in 2025, reveals a consistent pattern of unethical behavior. These cases highlight significant liquidity risks and operational malpractice.

Risk Factors Disclosed by Users:

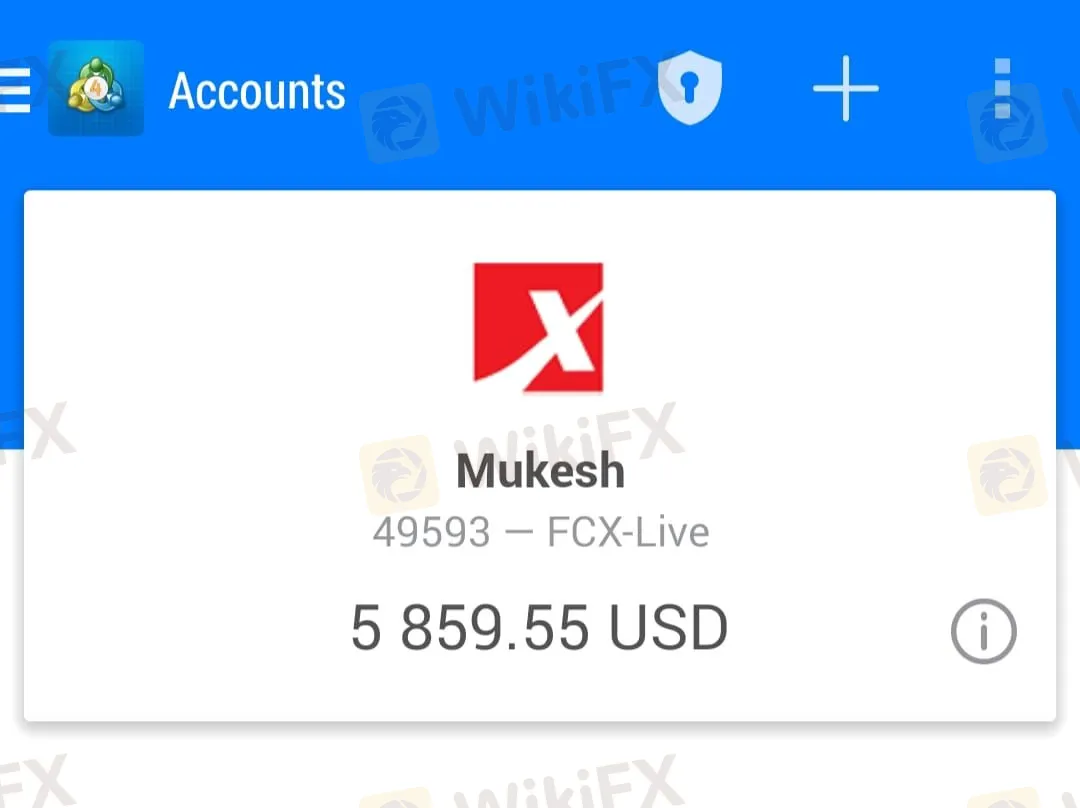

- Profit-Based Account Locking: Multiple users report that their accounts functioned normally during the deposit phase but were blocked immediately after generating profits.

- Arbitrary Freezing: Accounts are frozen without prior notice or compliance justification.

- Total Loss of Capital: Users report cases where balances were wiped to zero or funds became irretrievable due to a lack of communication.

Evidence of Disputes:

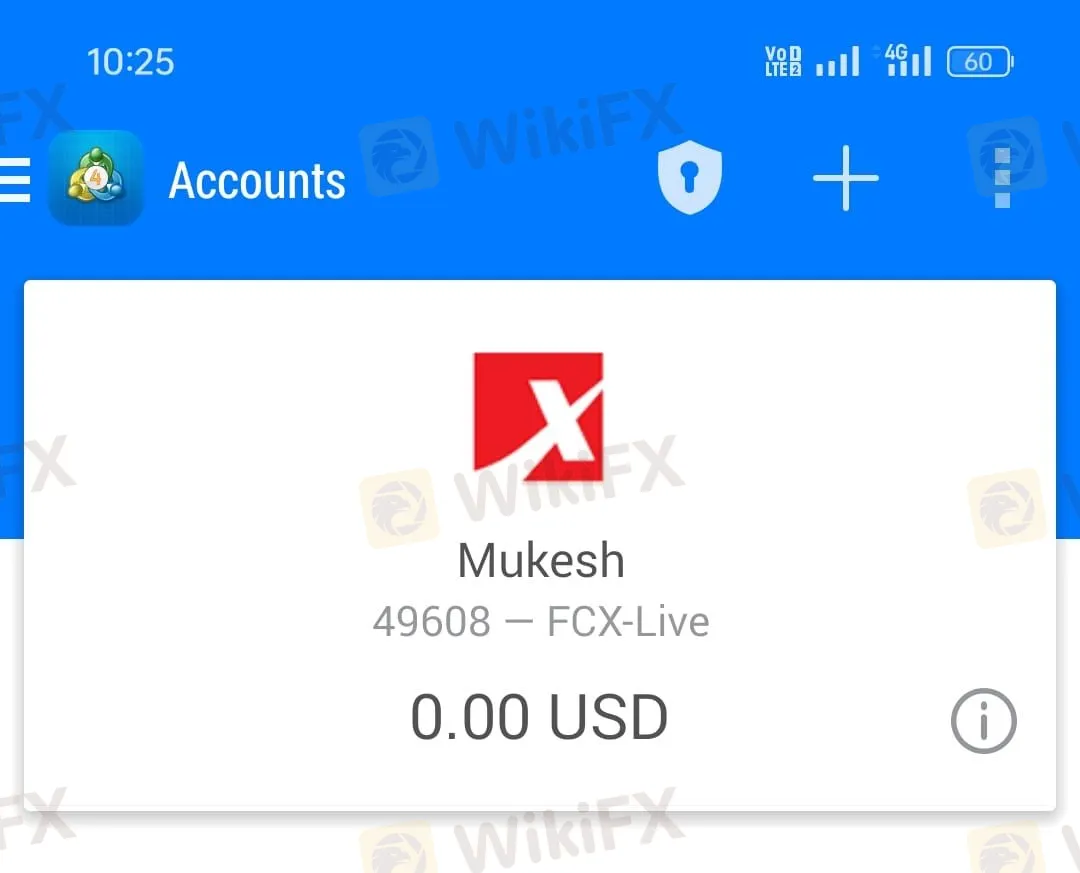

- Case 1 (July 2025): A user reported, “Once account grew with good profit they didn't give withdrawals and also blocked account.”

Case 2 (March 2025): A trader stated their account was blocked while in profit, with deposited funds withheld and the balance showing zero.

Case 3 (March 2025): A report of an account freeze without notice, leaving all funds stuck.

Analyst Note: The recurring theme of “blocking accounts upon profit” is characteristic of a “B-Book” execution model where the broker acts as the sole counterparty. In such setups, a client's profit is the broker's direct loss. The inability to pay out profits suggests FCX lacks the liquidity to hedge trades or simply refuses to honor profitable positions.

Final Verdict

The audit of FCX reveals an entity that presents an imminent threat to investor capital. The platform displays all standard red flags associated with fraudulent financial schemes: it is unregulated, has been publicly denounced by authorities for document forgery, and exhibits a documented history of confiscating client funds upon withdrawal requests.

Key Findings:

- WikiFX Score: 1.47 (Critical Risk).

- Regulatory Standing: Non-existent; confirmed illicit activity by Belize and SVG authorities.

- Operational Risk: High probability of inability to withdraw funds.

Recommendation:

Investors are strongly advised to avoid FCX entirely. The confirmation of forged certificates makes this entity a “Do Not Trade” platform. Traders should seek brokers with verified Tier-1 regulation (FCA, ASIC, or ASIC) where capital protection statutes are legally enforceable.

For the most current regulatory certificates and real-time blocklisting status, verify FCX on the WikiFX App.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Rate Calc