Weltrade Review: Assessing the Critical Risks Behind the "A" Influence Rank

Abstract:Our investigation into Weltrade exposes a critical safety score of 2.42 and a revoked license in Belarus, severely undermining its claim of being a trusted global broker. With over 40 recent complaints detailing systematic withdrawal denials and artificial slippage, we issue an urgent warning to all traders.

By WikiFX Special Investigator

The disparity between a broker's marketing power and its actual regulatory standing is often the most dangerous trap for retail traders. Our latest investigation into Weltrade uncovers a platform with a high “Influence Rank” of A, yet a dismal WikiFX Score of 2.42. While the broker Weltrade promotes itself aggressively across Southeast Asia and South America, the internal data tells a story of revoked licenses and desperate users.

The Hook: When “Under Review” Means “Funds Withheld”

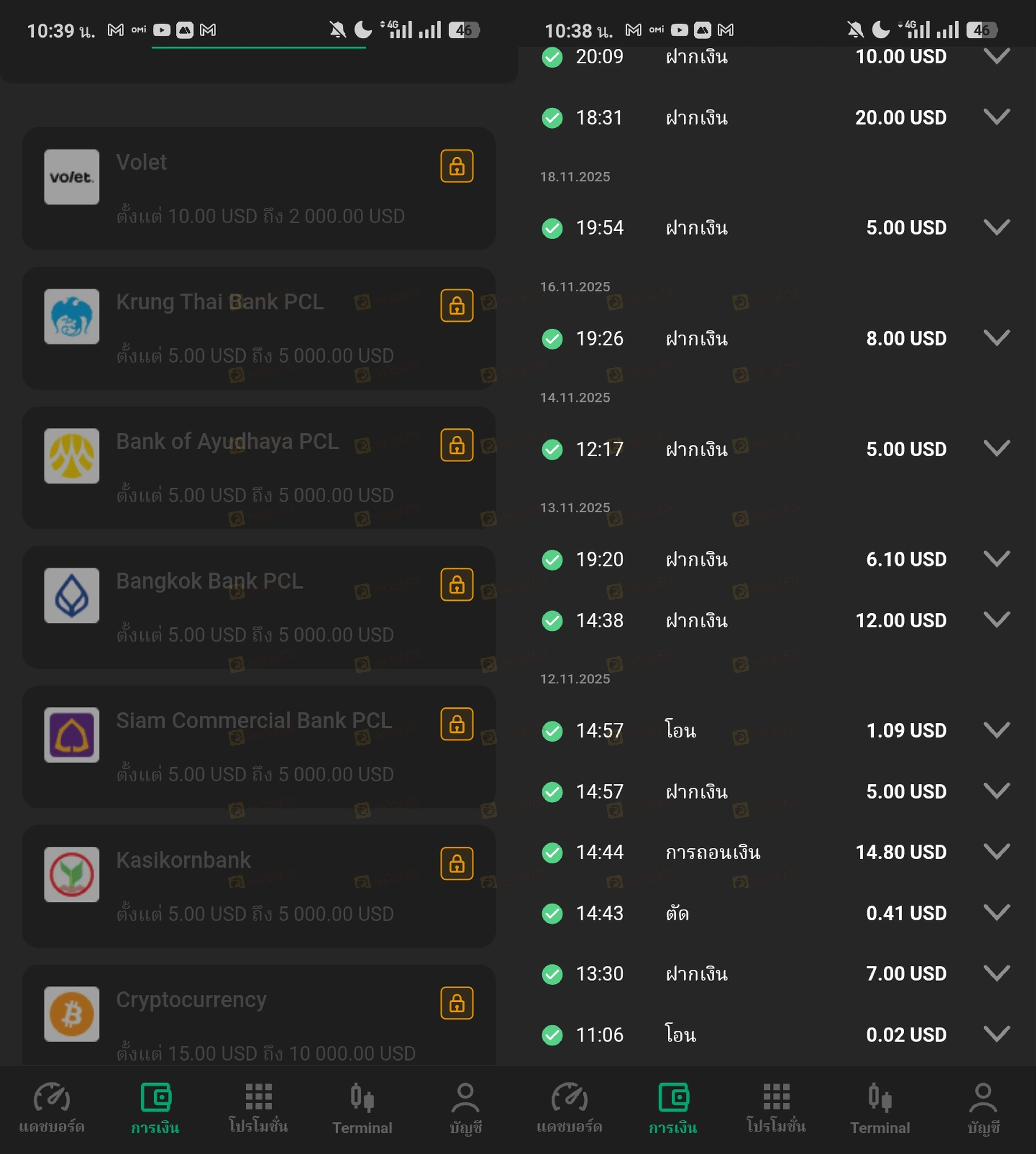

For many users, the nightmare begins not with a trading loss, but with a trading win. In our latest Weltrade review file, a Malaysian trader (Case 3) reports a harrowing experience where a withdrawal request remained unprocessed for three weeks.

The pattern is specific and alarming. After depositing and trading profitable “Forex” positions, the user was hit with infinite delays. Support cited “finance department reviews” and demanded endless verification—IDs, bank statements, utility bills, and selfies—only to reject them and ask for more. When the user complied, Weltrade allegedly pivoted to accusing them of “unusual trading activity,” retrospectively banning their hedging strategy to freeze the account.

This is not an isolated incident. A Thai user (Case 1) describes a similar sensation of being bullied: despite submitting all documents for identity verification, the broker simply refused to process the withdrawal, leaving the user struck by a wall of silence.

Weltrade Regulation: A Reality Check

To understand why these grievances go unresolved, we must audit the Weltrade regulation framework. A broker's license is the only shield a trader has.

Our investigation reveals a fractured regulatory status. While they hold a license in South Africa, their European-adjacent license in Belarus has been revoked, and major Asian regulators have blacklisted them.

| Regulator | License Type | REAL STATUS |

|---|---|---|

| FSCA (South Africa) | Financial Service Provider | Regulated |

| NBRB (Belarus) | Retail Forex | Revoked |

| BAPPEBTI (Indonesia) | Futures Trading | Unauthorized / Blocked |

| SCM (Malaysia) | Capital Markets | Investor Alert List (Unauthorized) |

The Red Flag: The revocation of the NBRB license is a critical warning sign. furthermore, being placed on the Investor Alert List by the Securities Commission Malaysia (SCM) and blocked by Indonesia's BAPPEBTI confirms that Weltrade is operating without valid authorization in key regions where it aggressively acquires clients.

Weltrade Login and Platform Instability Exposed

Regulatory gaps often bleed into technical performance. Our data indicates serious concerns regarding platform access and stability, specifically regarding Weltrade login issues during critical market moments.

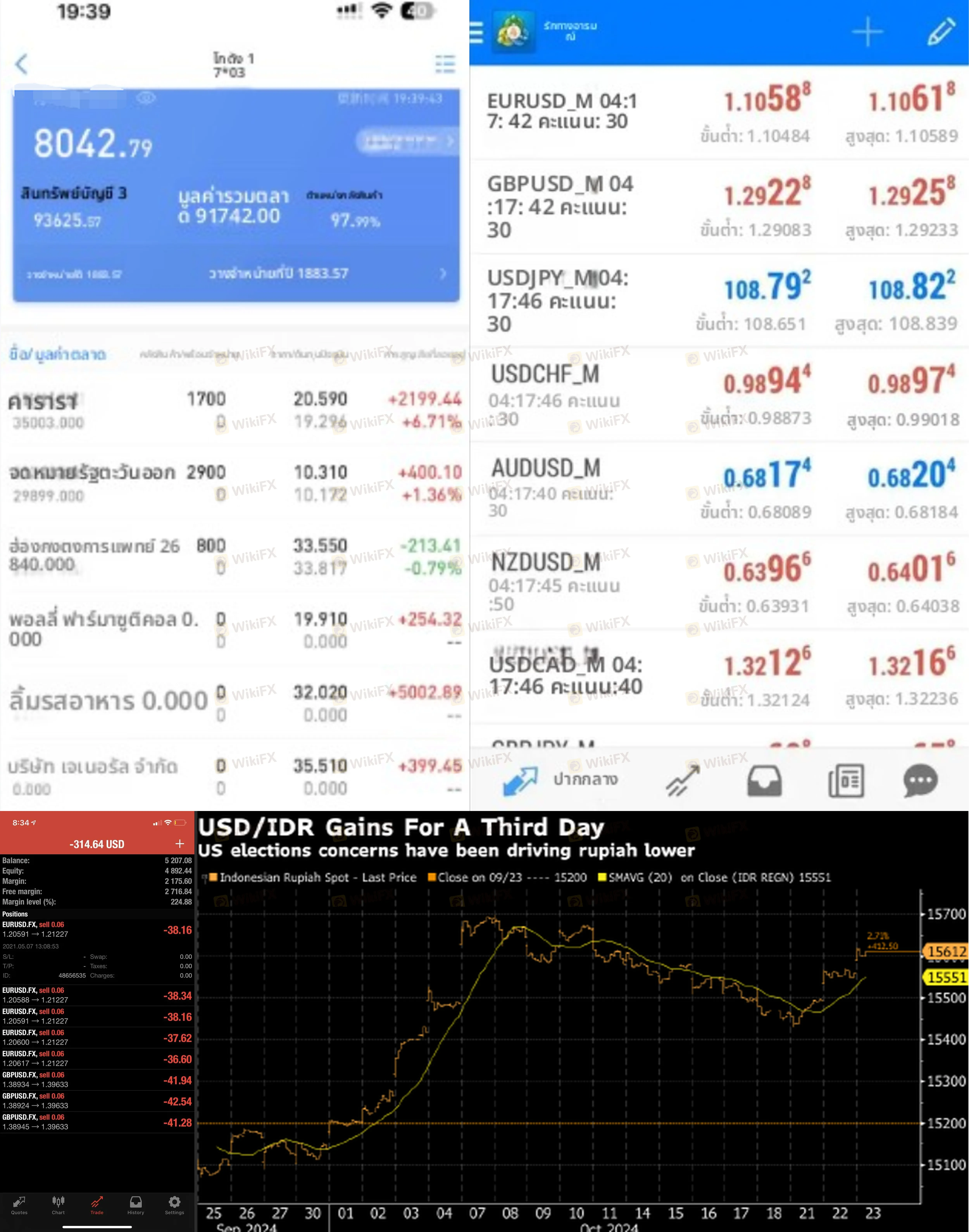

- Case 11 (Malaysia): A user reported that after making a profit of RM15,000 on a USD/CAD trade, they “suddenly couldn't log in.” By the time access was restored or support was contacted, the profitable momentum was gone, or withdrawal access was restricted.

- Case 4 (Thailand): A trader attempting to place a buy order on GBP/THB faced a “Order transmission failed” error. The platform froze for 10 minutes. When it reconnected, the price had moved, resulting in a loss of opportunity worth 64,500 THB. Support blamed the user's internet, despite the user having high-speed fiber optics.

If you face Weltrade login failures during high volatility, realize that the provided data suggests this may be a systemic feature rather than a bug.

The “Forex” Trap: Slippage and Data Manipulation

Traders flock to Weltrade Forex offerings for the promise of profit, but the investigation suggests the game may be rigged via data manipulation.

- Artificial Slippage: In Case 12 and 14, an Indonesian investor reported losing 95 million IDR due to “market delay.” During a Federal Reserve meeting, the platform displayed a price differing by 70 to 80 points from the market execution price. Stop-losses were ignored or triggered at disastrous levels due to this artificial lag.

- The Zero-Negative Slippage Anomaly: Analysis from Case 21 claims that Weltrade manipulates slippage distribution. The user noted that positive slippage (getting a better price) occurred 0% of the time, while negative slippage (getting a worse price) happened nearly 24% of the time. This statistical impossibility suggests the Forex Weltrade engine may be programmed to disadvantage the client.

Key Red Flags Detected

- License Revoked: The NBRB (Belarus) license is no longer valid.

- Withdrawal Walls: Multiple reports of withdrawals being stalled by “tax” demands (Case 20) or endless verification loops.

- Regulatory Blacklists: Officially warned against by Malaysian and Indonesian authorities.

- Platform unstable: Reports of freezing and login denials during profitable periods.

Verdict

The evidence is overwhelming. While broker Weltrade maintains a high influence rank through marketing, its operational conduct is riddled with danger. The combination of a revoked primary license, documented Weltrade login denials, and aggressive withholding of funds makes this platform a severe risk.

We advise all traders to prioritize the preservation of capital over the promise of bonuses or high leverage. The regulatory safety net here is broken. Use extreme caution.

WikiFX Broker

Latest News

AI Revolutionizes Modern Medicine and Diagnostics

Geopolitics meets Liquidity: EU Freezes Trade Talks as Trump 'Greenland' Gambit Rattles Alliance

De-Dollarization Reality: Gold Overtakes Treasuries in Central Bank Reserves

Pocket Option Review: The Offshore Mirage Luring Traders into a Withdrawal Abyss

Markets Rally as Trump Suspends EU Tariffs on 'Greenland Framework'

Weltrade Review: Assessing the Critical Risks Behind the "A" Influence Rank

iq option Review 2026: Is this Forex Broker Legit or a Scam?

JGB Meltdown: Japan's Debt Crisis Deepens as Snap Election Stirs Fiscal Panic

Oil Markets Boxed In: Supply Glut Overpowers Geopolitical Floor

JGB Market Turmoil: Volatility Spikes as BOJ Ownership Dips Below 50%

Rate Calc