Capex Review 2025: Is This Forex Broker Safe?

Abstract:Capex receives a WikiFX Score of 5.30, holding a regulated status with CySEC (Cyprus) and FSA (Seychelles). While the broker offers MT5 and multiple account types, it is heavily burdened by numerous user complaints regarding withdrawal denials and platform instability. Notably, users have reported difficulties with the Capex login process, citing prolonged access failures. This review analyzes the safety, regulatory validity, and trading conditions of Capex.

Capex is a Forex broker established in 2016, currently holding a WikiFX Score of 5.30. The broker operates under a mixed regulatory framework, holding a license from the Cyprus Securities and Exchange Commission (CySEC) and an offshore license from the Seychelles Financial Services Authority (FSA). While the score suggests a moderate level of credibility, the broker's reputation is challenged by conflicting regulatory statuses in other regions and a significant volume of investor complaints.

Pros and Cons of Capex

- ✅ Regulated Entity: Valid licenses held with CySEC (Cyprus) and FSA (Seychelles).

- ✅ Platform Options: Offers the industry-standard MT5 trading platform and a proprietary web trader.

- ✅ Account Variety: Three distinct account tiers (Essential, Original, Signature) to suit different trader levels.

- ❌ High Entry Barrier: The “Essential” account requires a minimum deposit of $1,000, which is significantly higher than the industry average.

- ❌ Withdrawal Complaints: severe allegations regarding the inability to withdraw funds and pressure to deposit more capital.

- ❌ Unverified Licenses: The regulatory status with the FSCA (South Africa) is listed as unverified.

Capex Regulation and License Safety

The regulatory environment of Capex is a mix of high-tier European oversight and offshore authorizations.

Cyprus Securities and Exchange Commission (CySEC)

Capex is regulated by CySEC under license number 292/16. This is a Tier-2 regulatory body that provides significant protection, including the separation of client funds and participation in the Investor Compensation Fund (ICF). This adds a layer of safety for clients falling under this specific jurisdiction.

Seychelles Financial Services Authority (FSA)

The broker also holds an offshore license (SD020) with the FSA in Seychelles. Offshore regulation generally allows for higher leverage and fewer restrictions but offers less stringent client protection compared to European standards.

Risk Warning: Unverified Statutes

It is crucial to note that while the CySEC and FSA licenses appear valid, Capex's status with the Financial Sector Conduct Authority (FSCA) in South Africa is currently flagged as “Unverified”. Traders should be cautious, as operating without a verified license in specific jurisdictions can pose risks regarding dispute resolution.

Real User Feedback and Complaints

The user feedback for Capex is concerning, with WikiFX receiving multiple complaints within the last three months. The primary issues revolve around severe withdrawal blocks and aggressive sales tactics.

Common issues reported:

- Withdrawal Denials: Multiple users from Mexico and Ecuador reported being unable to withdraw their funds (e.g., Case 1, Case 2, Case 4). Advisors allegedly invent excuses, such as requiring “bonus completions” or demanding effective turnover before releasing funds.

- Aggressive Deposit Pressure: Traders claim advisors pressure them to inject more capital to “save” positions or “unlock” withdrawals (Case 3, Case 6).

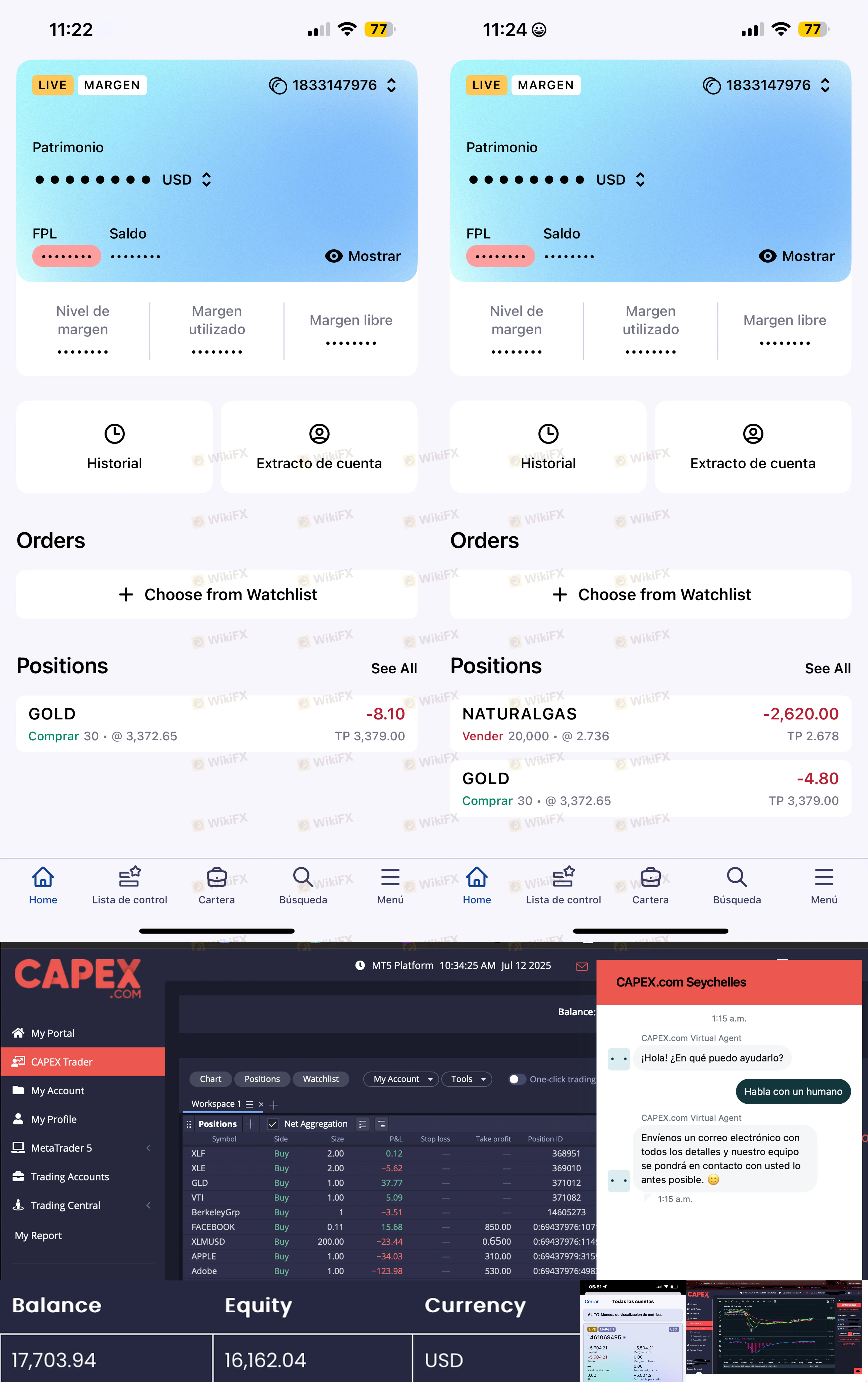

- System Failures: Technical stability has also been called into question. Users have reported difficulties with the Capex login process, with one specific case (Case 5) stating the web platform was inaccessible for several days and the Android app had not functioned for two months.

Evidence:

Capex Forex Trading Conditions and Fees

Capex provides a structured trading environment heavily accessible via the MetaTrader 5 (MT5) platform and their proprietary web interface.

Account Types and Minimum Deposits

The broker imposes high entry requirements compared to competitors:

- Essential Account: Requires a $1,000 deposit.

- Original Account: Requires a $5,000 deposit.

- Signature Account: Requires a $25,000 deposit.

Platforms

Traders can choose between a proprietary WebTrader and MT5. The availability of MT5 is a positive feature, offering advanced charting and automated trading capabilities. However, the absence of support for other third-party applications or lower-barrier entry accounts limits flexibility for casual traders.

Leverage and Spreads

While specific leverage caps aren't detailed in the provided data, regulation by CySEC typically enforces a max leverage of 1:30 for retail clients, whereas the FSA offshore entity may offer higher ratios. Spreads vary by account type but are not explicitly transparent in the standard summary.

Final Verdict

Capex presents a complex profile. On paper, it is a regulated Forex broker with a valid CySEC license, which provides a degree of safety. However, the high number of complaints regarding funds being withheld, combined with technical issues, severely impacts its trust rating. The entry requirement of $1,000 is also restrictive for beginners.

Traders should weigh the valid European regulation against the serious user allegations of withdrawal obstruction.

To stay safe and view the latest regulatory certificates, check Capex on the WikiFX App.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Rate Calc